Now that the world has reopened, Trip.com Group is looking to return to previous heights

More than a year after China’s border reopened for international travel, parts of Shanghai’s Pudong Airport still feel like a ghost town. The aftermath of COVID was so strong that in 2024 the airport has still not moved back into the top 10 busiest airports in the world for international travel, a reflection of the slow recovery of cross-border trips in China.

Prior to the pandemic, the country’s travel and tourism spending had been among the highest in the world and had been rising steadily for years. But today, outbound tourism has only recovered to around 40% of pre-COVID levels. Travel businesses everywhere suffered a massive drop in turnover, but those in China have suffered the longest due to prolonged restrictions.

Trip.com Group, China’s most popular online travel company, is one of those. In order to survive during the worst of the pandemic, the company, like many others, had to adapt. It digitalized rapidly and swiftly shifted its focus to the domestic market and seeking out untapped consumer demand. The company appears to have made it through the toughest of times, but the shadow of the pandemic has not completely disappeared.

“The travel industry in China had to find ways to survive, reduce costs and find new business,” says Oliver Sedlinger, CEO of specialized tourism consultancy Sedlinger & Associates. “It was a very difficult time, especially since no one knew when and how business could restart.”

What a trip!

Co-founded as Ctrip in 1999 by four Chinese entrepreneurs, the company is now arguably China’s best known online travel agency. It listed on NASDAQ in 2003. Ctrip then acquired other online travel agencies Trip.com, Qunar and Skyscanner, all of which offer the ability to compare and book travel tickets and accommodation, and rebranded as Trip.com Group in 2019. In 2021, the company completed a secondary listing on the Hong Kong Stock Exchange.

The company’s various subsidiaries offer a multitude of travel-related services for both the China and international markets, including flight, tour and hotel bookings as well as car rental and complete vacation packages. It also has a huge network of affiliate businesses across China and around the world, from travel agents to luxury hotel chains, which provide consumers with access to special offers and unique products.

“What the company did, particularly in the decade before the pandemic, was increase not just its international branding and marketing, but also its partnership with international tourism companies, destinations and tourist boards,” says Gary Bowerman, Director of Check-in Asia, a tourism intelligence & strategic marketing firm.

Internationally, the company competes with well-known online travel agencies (OTAs) such as Booking.com and Expedia, while at home there is a vast array of competition, from smaller OTAs to subsidiaries of the country’s internet giants such as Alibaba’s Fliggy and Meituan.

Trip.com Group’s annual revenue was showing consistent growth prior to the pandemic, and the company pulled in $5.12 billion in 2019 with a net income of just over $1 billion. After an almost 50% drop in 2020 in revenues, the company is yet to return to such heights and the last few years have been somewhat rocky. In 2022, company revenues were still only $2.9 billion.

Much of this income comes from four main revenue streams: accommodation reservations, transportation ticketing, package tours and corporate travel, in particular for outbound travelers from China.

“A lot of how Trip.com Group developed was done with the intention of increasing outbound Chinese tourism,” says Bowerman. And the pandemic forced the company to turn the premise on which it was built on its head, forcing it to think on its feet and pivot into new areas of opportunity.

Holidaying at home

China’s pandemic-related travel restrictions far outlasted those in other parts of the world. In early 2020, while its borders were closed and international travel was all but impossible, domestic movement was relatively uninhibited after the initial lockdown—as a result, China maintained its status as the world’s second-largest air market throughout the pandemic. For Trip specifically, this meant a major strategic shift away from its erstwhile focus on outbound travel.

“They had hired a lot of people whose focus was entirely outside of the country, and when the borders closed, they had to turn these into domestic positions, which requires a completely different skillset,” says Bowerman. “They had to completely restructure what they do in a very competitive market, with companies all targeting the same people with largely the same offerings.”

The first major financial hit to the company came in the form of refunds for the upcoming Chinese New Year holiday in 2020, which came just after pandemic travel restrictions were put in place. But it was also an opportunity for Trip.com Group to build goodwill with customers and partners.

“We tried to build trust with consumers through the billions of ticket refunds we processed in the early months of the pandemic,” says a Trip.com Group spokesperson. “We also set up a ¥1 billion partnership fund to ease the cashflow worries of our small- and medium-sized partners.”

In general, it was a positive move, but due to massive short-term liquidity demands, some customers were left waiting for refunds. “I was stuck in Shanghai and cancelled my flight tickets in early March, but I didn’t actually receive the money in my bank account until later in April,” says Helen Fu, a 33-year-old Shanghai resident. “The communication with the company was quite good in that even though they couldn’t give me a date for the refund, because they had no idea when the money would be released by the airline, they were open about not knowing.”

In June 2020, the company announced “Travel On,” a range of initiatives aimed at reinvigorating travel. This included waiving change fees for bookings, providing customers with discounts of up to 60% on flexible advance reservations to a number of hotels across the world and providing continued access to funding for its global partners.

To make domestic travel as seamless as possible, Trip.com Group, along with other OTAs began to focus on a few key areas, in particular accelerating the mobile-first nature of services during the pandemic. By 2022, Trip.com Group reported that 90% of its bookings were made via mobile devices.

The bookings themselves also came from a new audience in the country’s lower-tier cities, residents of which make up 70% of the country’s urban population and were expressly targeted by OTAs, having been previously underserved by travel companies.

“Lower-tier cities were a captive market during the pandemic because it was functionally a closed market,” says Bowerman. “It also helped that they could initially focus on small-basket travel purchases rather than expensive trips.”

Self-driven road trips, given their lower level of risk and greater control compared to public transport also became popular, as well as shorter trips and local destinations for similar reasons.

For international travel, the key focus for the company was to stimulate continued interest in travel for customers despite the lack of international travel opportunities, while also maintaining the interest of its overseas partners in attracting future Chinese tourists.

In conjunction with international partners such as the Metropolitan Opera in New York and London’s National Theatre, the company promoted livestreams of shows performed from the home of actors and musicians, as well as tours of world-famous museums, art galleries and zoos. Both co-founder James Liang and CEO Jane Sun also ran personal livestreams, promoting and selling products.

The “Travel On” initiative in late 2020, also included steep discounts through their subsidy fund for bookings to countries such as Singapore. The bookings were low-cost and highly flexible, but kept user and partner interest high.

Fight or flight?

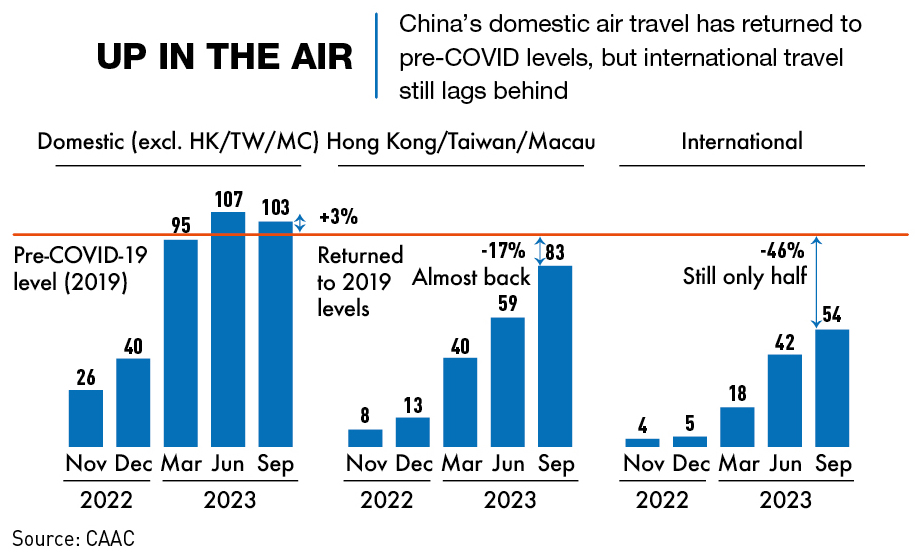

Chinese travellers have been slowly returning to the rest of the world since January 2023, when the country’s borders were reopened for international travel, but international flight capacity had only reached 50% of pre-pandemic levels by mid-2023. Bookings are also starting to show signs of recovery, and in Q2 2023, Trip’s outbound hotel and air reservations reached 60% of pre-pandemic levels, surpassing the industry-wide recovery rate of 37% in terms of international air passenger volume for the same period.

“Chinese outbound tourism is mostly being driven by ‘revenge tourism’—the pent-up desire to travel after three years of restricted mobility,” says Eduardo Santander, Executive Director of the European Travel Commission (ETC). “Though numbers are still well below 2019 levels, the lifting of travel restrictions unleashed a sizable amount of suppressed wanderlust.”

Despite the slow business uptick, there are still a number of hurdles to overcome. Domestically, China is facing geopolitical and economic headwinds that have compounded problems, and dented consumer confidence and spending has affected willingness and ability to travel.

“Even though I’ve always had an interest in travelling, the last few years of the pandemic and a tough time finding a good job has meant that money is quite tight at the moment,” says Helen Fu. “I’ll travel when I can afford to, but there aren’t any big trips on the itinerary at the moment.”

China’s world-beating high-speed rail system and self-driving holidays are still proving popular, and have mostly returned to pre-pandemic capacity. But the number of flights into, out of and around the country remains on the lower end, partly because the utilization of planes and crew numbers were cut during the pandemic. For many airlines in China, international flights, particularly to Southeast Asia, used to be the big money spinners, and the financial impact incurred by the loss of these flights was significant.

“International flight capacity continues to ramp up, but is yet to recover to pre-pandemic levels,” says a Trip.com Group spokesperson. “It will take some more time for airline and hotel partners to recover their staffing levels and build up the infrastructure needed to facilitate this demand level to cater to tourists.”

The centrally-planned nature of the Chinese economy is also a constricting factor for travel businesses. “China controlled its reopening very carefully in 2023,” says Bowerman. “There were constraints on travel companies, how they could operate internationally and how airlines were able to renew international routes as well as licences to fly overseas again.”

Geopolitical tensions with the West have also had a negative impact on outbound travel, particularly on flights to the US, which have dropped from 340 a week in 2019 to only around 70 a week in November 2023. But also, and more acutely, they have had an effect on inbound travel, and most visits to China are now business-related.

The leisure market remains slow for a number of reasons. General sentiment towards China, particularly in the West, is negative and this is compounded by concerns around safety and the high financial and time costs associated with the visa process for visitors. China has announced periods of visa-free travel between a number of countries including Thailand and several European nations, but recovery is expected to remain slow.

Looking at outbound travel, there were hopes from popular destinations such as Southeast Asia that visitor numbers would quickly bounce back, but that has not been the case. A lack of flight capacity remains on top of the economic and geopolitical issues present, and industry experts don’t expect to see the number of available seats for international travel returning to normal until at least 2025.

For travel to Europe, according to the ETC, high costs are the biggest concern for tourists when considering a trip to the continent. “Air capacity between China and Europe is still well below pre-pandemic levels and since Russian airspace was closed to European carriers at the start of the war in Ukraine, flight times between Europe and East Asia have significantly increased, leading to inflated prices for consumers,” says Santander.

Tentative steps

Trip.com Group has clearly learned from the pandemic period and is digitalizing their approaches to both marketing and customer support, as well as maintaining strong connections to domestic and international partners. China’s consumers are a notoriously discerning group and they are also very active online, and Trip.com Group has capitalized on this through both their sales livestreams and also their promotion of user-generated content (UGC).

“We have tried to enhance engagement between travelers and partners through the use of content marketing, and a lot of this is UGC,” says the Trip.com Group spokesperson. “There is a community travel sharing space on Ctrip and Trip Moments on Trip.com, which both showcase trips and ideas from users.”

The company has also introduced more customizable options for customers seeking less traditional and more ‘authentic’ experiences. The company promotes real-time-updated trends, deals and popular options across its online presence.

In July 2023, Trip.com Group also jumped on the growing popularity of AI, launching an AI-powered assistant called TripGenie which is incorporated into the mobile app for users around the world. The tool uses large language model (LLM) technologies, similar to those behind ChatGPT, to help craft travel itineraries, provide booking information and shorten the overall booking process.

A month later, the company signed an MOU with Amazon Web Services (AWS) to build a joint innovation lab with the aim of improving their AI, cloud technologies and flight, hotel and international business sectors.

Going global

Prior to the pandemic, Trip.com Group was working on entering and building its presence in markets across the globe. During the pandemic, attempts to keep marketing and other partnerships active through livestreams and pre-booking were successful to some extent, but in 2023 the company was faced with the challenge of restarting many international partnerships.

“They have pretty much returned to the 2019 plan, which did work at the time, and have said that they also see additional new opportunities for inbound travel growth into China,” says Bowerman. “We are now in a new era, and analysts and investors are worried about how difficult it will be for them to grow their global marketing sales, because relying heavily on outbound Chinese travel isn’t going to work in the near future.”

The company has its own content channels through which it promotes partners and offers, something that is unmatched by other OTAs, and this appeals to travel partners around the world who often have to use third-party applications. Additionally, it supports the UGC model that Trip is increasingly utilizing and allows for purchases at every touchpoint for consumers on what is designed to be a seamless journey from idea to purchase.

But, whatever the technological offerings, for partnerships to be successful, they need to be supported by demand, and demand from Chinese consumers has shifted. There are still some pre-pandemic parallels, with continued interest in group tours, for example, albeit on a smaller scale. But the travel preferences of younger generations in particular are changing as they are looking for new, experimental and different experiences.

“These are long-term trends that will persist and only grow stronger, since these constitute fundamental lifestyle and consumption changes,” says Sedlinger.

The major change is that the booking window—the time between the booking and the trip itself—has become significantly shorter. This causes issues for partners in predicting and preparing for demand, particularly given the slow rate of recovery. But while this can partly be attributed to the general feeling of uncertainty in Chinese society at the moment, it is also a symptom of the on-demand nature of Chinese consumerism in general.

Once again, livestreams and flash sales are a large part of the company’s approach to stimulating demand. In early 2023 they launched a “Super World Travel” livestream series in collaboration with destination partners such as Singapore, Thailand and South Korea, which showcased the destinations and offered related deals.

“We also run flash sales in almost every local market in APAC for customers in the country,” says the spokesperson. “We’ve been doing it bi-monthly since 2022 in Singapore and Malaysia and recently we had our first Indonesian sale.”

Delays and cancellations

Thanks to its strong position prior to the pandemic, quick adaptations and diverse investments, Trip.com Group has seemingly ridden out the biggest period of pandemic-related turbulence and is on the road to recovery.

But challenges remain and the company had a slip-up domestically when they released their 2023 H1 results, commenting that the business travel market was consistent with an economy that wasn’t doing as well as expected, leading to a significant hit to its share price.

Internationally, and somewhat out of the company’s control, there is also the issue of how China is viewed by the rest of the world. The perception of China, particularly in the West is a hindrance for businesses across a wide range of sectors and for tourism it affects interest in travel and business collaboration opportunities.

It remains unclear as to how and when demand, capacity and the previous intensity of travel to and from China will return to pre-pandemic levels. And for Trip.com Group and the entirety of the Chinese market, 2023 has been a year of learning, working to understand new behaviors, trends and attitudes and working out how to cater to them properly in 2024.

But with what is likely to be the worst of times behind them, and numbers slowly rising again, thanks to innovative strategies and a dynamic business approach, the company looks set to take off.

“They have to drive demand, and although that can be tricky, I think we’re going to see some kind of acquisition or global move that puts them in a stronger position,” says Bowerman. “What that will be is hard to say, but what we have seen in the past is that Trip have always met their challenges head on.”