Keeping Food Competitive

KFC entered the China market in 1987 with the opening of their first store in Beijing, and as the core brand of fast-food restaurant company Yum China, KFC has since become the leading fast food brand in the country. In 2015, Yum’s China business accounted for more than 50% of its global revenue and as a result shareholders demanded that Yum’s China business be split off and re-listed as its own entity. The next year, Yum formally divested its China operations, including KFC and Pizza Hut, and placed them under the Yum China banner.

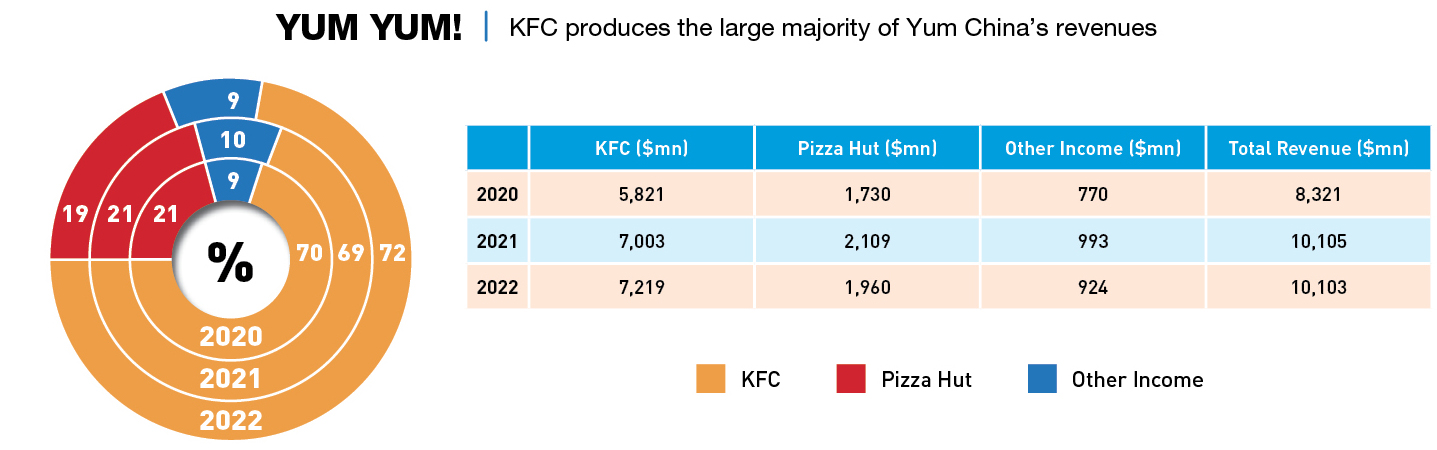

The company, which now has about 13,000 restaurants under seven different brands across China, brought in revenues of $9.57 billion in 2022, surpassing the parent, Yum! Brands’ $6.84 billion in revenues from the rest of the world. KFC China’s development has played a major role in this success, with 2022 revenues of RMB 48.6 billion ($6.84 billion), nearly 72% of Yum China’s, and reaching 9,094 stores across China—far outstripping McDonald’s’ 4,978.

Finding the recipe

The development of KFC in the Chinese market has gone through three stages. In the first stage, between entering the market and around 2000, KFC built on a brand image of “foreign fast food.” The classic combination of fried chicken, fries and a Coke, and the American fast food culture it represented, was very attractive to Chinese consumers. The price and brand positioning of the products at the time were relatively high.

In the second stage, after 2000, KFC began to make adjustments to their offerings and introduced some products that were closer to traditional Chinese tastes, such as Old Beijing chicken rolls, Chinese doughnuts and other Chinese fast food. Behind the scenes, KFC also did a lot of work on localizing its supply chain, cultivating local suppliers and building its own logistics system. At the same time, due to the gradual saturation of stores in first- and second-tier cities, KFC began to expand to third- and fourth-tier cities, with the KFC brand also moving from high-end to affordable.

The third stage began around 2013-2014, when KFC found themselves facing three main issues. The first generation of customers had entered middle age and their enthusiasm for the product was waning, a new generation of consumers felt that there was no real novelty to KFC compared to other products and the emergence of a new swathe of fast food brands made market competition increasingly fierce. These issues, along with rising costs, particularly in first- and second-tier cities, and the impact of food safety incidents in the industry as a whole, resulted in declining profits for the company. Something needed to change.

Deciding on digital

KFC China management identified two directions for company transformation. They realized that they needed to consolidate KFC’s core strengths and to optimize outlets, products, services and communications. They also understood that these changes would facilitate the second transformation, using digital transformation to empower KFC’s business.

In order to do this, it was agreed that KFC China’s existing IT department wasn’t capable of successfully conducting the required digital transformation, thus the System Review Board (SRB) was set up to research new technologies and lead the company in upgrading its network infrastructure as well as introducing and developing software. Additionally, with social media becoming more popular, the Yum China marketing team focused on learning new non-traditional digital marketing methods.

When it came to consolidating its core strengths, the company focused on youth and individuality, adopting a development strategy that encouraged people to “eat, drink and play, all in one place.” KFC focused on creating a warm, casual and stylish atmosphere through its restaurant designs, making them suitable not only for Western-style fast food, but also for things like afternoon tea.

Products-wise, the company stuck to its positioning as a “fried chicken expert,” while at the same time developing more localized products and consistently updating its menu. To improve service and communication, KFC tracks the interests of younger people online, creating new channels to interact with these potential customers, making full use of cooperation opportunities with games, sports, entertainment, culture and other industries. For example, KFC cooperated with popular mobile game Glory of Kings to create a themed restaurant, as well as cross-over co-branding with popular games such as Pokémon.

For its digital transformation, KFC sought to integrate technology across the customer decision journey to enhance the brand experience, creating a robust member database to generate private domain traffic. In order to do this, KFC conducted in-depth research on customer behavior and the entire customer journey, including pre- and post-meal, to identify pain points and look for digital solutions through innovation.

Digital direction

Through various media, KFC now provides a wealth of product and campaign information to attract and inform consumers. Stores provide purchase access as well as offer coupons for repurchase or communication that supports users in having positive experiences through the purchase, use and sharing phases of the consumer journey.

The key part of KFC’s success, however, has been the building and curation of its own private online domain through its app and other media and e-commerce platforms, transferring offline customers into online users. The company applies a series of AI algorithms to analyze user data related to behavior, using product reviews, among other things, to understand consumer preferences. This improves decision-making efficiency and provides more opportunities for product innovation.

This development has been achieved through work in three areas:

1: The role of the business

The main goal of digital transformation for brands is to attract consumers from the public domain to their private domain and keep them there. Public domain marketing, represented by advertising, aims to expand publicity and increase sales; while private domain marketing, which aims to maintain long-term relationships with customers, includes things like point rewards given directly to customers to increase the benefits of membership.

For KFC China, the public domain is an important way to engage consumers through paid advertising, key opinion leaders (KOLs) and social media. The company also has stores on almost all third-party platforms such as ele.me and Meituan and continues to utilize traditional advertising channels, for example, placing outdoor advertisements on subways, buses and roadways.

In terms of the brand’s private domain, the KFC business center is concerned with operating its four functional modules: online community, online store, offline media and offline stores.

KFC China has its own online media and its own e-commerce, with its own official website and microblog, as well as mini-programs on WeChat and Alipay that function similarly to the main app. In addition to ordinary chain stores, KFC has music-themed restaurants, movie-themed restaurants, future concept stores and so on, and also builds special delivery channels at gas stations, railway stations and universities. For offline media, KFC makes full use of its own catalogues and touch screen advertisements in offline stores to interact with customers.

2: The app

A brand’s mobile application should easily facilitate customers’ decision making and shopping. It provides easy access to the brand’s marketing through digital content and online store options, as well as personalized information services to customers at any time, attracting their attention and increasing customer loyalty and conversion rate.

The functionality and design of KFC China Super App supports the above objectives. First, by giving away new user benefits and coupons, KFC encourages customers to sign up for membership through many channels such as store codes, WeChat, Alipay or Tmall, etc. KFC especially encourages customers to download the KFC app and sign up for membership to attract offline customers to become online users. After becoming a member, customers will immediately receive points and exclusive coupons, and they will also receive more points after ordering and spending. Users also have the option to sign-in, like and forward things to others, to enhance user activity and app usage time.

The various parts of the app, as well as these rewards, are designed to give the consumer a feeling of exclusivity and satisfaction.

3: Data Center

The concept of users being assets is deeply rooted in the approach of the digital team at Yum China. By the end of 2022, KFC China had accumulated 380 million registered members. Such performance is not only far better than KFC China’s domestic competitors, such as McDonald’s China, but also superior to KFC USA. Yum! Brands has not publicly released membership figures, but third-party agency data puts active membership of KFC’s US app at just 10 million.

The use of such large quantities of data means that the picture of users created by the company’s data team is increasingly accurate and the delivery of personalized smart marketing services will be more successful.

There are many examples of this in KFC’s case: First, through intelligent advertising pushes, coupon distribution and other methods, the maximum scope for attracting customers will expand and improve customer repurchase rates. Second, it also allows for increasing customer unit purchase prices through offers such as coupons with a certain minimum spending threshold. Third, accurate pushing and precise marketing through data analysis can reduce marketing costs and improve marketing efficiency. Fourth, KFC can expand its business scope and develop new sources of profit growth: for example, when consumers place orders online, they will not only buy the meal itself, but also buy KFC’s services, and customers pay for membership cards to get more professional services.

With this level of digital infrastructure already in place, KFC China is expected to be well positioned to carry out a further digital transformation into the Web 3.0 era.

Secret blend = success?

In terms of cost reduction, sales and marketing expenses as a percentage of operating revenue have decreased year-by-year, from 4.76% in 2014 to 3.78% in 2021. With the improvement of cost control, Yum China’s gross sales margin and net sales margin have also improved by different degrees after 2014, although the COVID-19 pandemic did lead to drops in 2020-2021.

In terms of revenue growth, both EBIT (earnings before interest and taxes) and EBITDA (earnings before interest, taxes, depreciation and amortization) are growing steadily after the implementation of the ongoing digital transformation in 2014. KFC’s net sales margin was almost zero in 2013 and the company even lost money in 2014, but steadily recovered in 2015-2021, reaching a level of 10% in 2020. In terms of improving efficiency, the total asset turnover ratio decreased from 2.1 in 2015 to 0.9 in 2021; sales per employee increased from ¥112,200 in 2015 to ¥139,600 in 2021, and net profit per employee increased from ¥5,200 in 2015 to ¥14,000 in 2021.

The three-year long pandemic caused a large number of restaurant companies to see their revenues and profits decline, but Yum China was not hit as hard as some of their competitors. The contribution of the company’s digital transformation is clear: 89% of revenue from KFC and Pizza Hut restaurants in 2022 was generated through digital ordering, and, as a percentage of its total sales, KFC China’s 380 million community members contribute about 62%.

Due to its investment in technology and the number of new technological innovations it has tried, KFC is sometimes even referred to as a technology company that sells fried chicken. Beyond the content of this case study, which focuses on the outward facing digitalization of the company, areas such as supply chain, logistics and inventory management have also seen great strides in their digitalization. In 2021, Yum China opened digital R&D centers in Shanghai, Nanjing and Xi’an, which utilize a wide range of technologies to develop new solutions and services to further drive the company’s end-to-end digitalization.

For Yum China, digital transformation is a key part of the enhanced competitiveness of the company. Joey Wat, CEO of Yum China, said, “We use digital to continuously strengthen the company’s core competencies and widen and deepen our moat to forge a stronger business model to drive long-term growth.” Their investment in digitalization has proven to be well worth it.

Dean’s Distinguished Chair Professor of Marketing at CKGSB, Huang Xi, MBA student at CKGSB and Yan Min, Researcher at the CKGSB Case Center