It is unusual for a mobile phone launch to draw the attention of national security experts globally, but upon its big reveal at an event in September 2023, Huawei’s new Mate60 Pro had analysts scratching their heads. After over a year of controls limiting the flow of semiconductors and related manufacturing equipment to China, the chips in the phone were not supposed to exist.

Semiconductors are the modern-day battleground for global digital supremacy, with the development of bleeding-edge technologies almost entirely reliant on cutting-edge chips. The wide-ranging export controls placed on China, mostly by the US, have been designed to limit China’s access to new technology as it is increasingly viewed by the West as a strategic adversary.

“Following the US restrictions, the importance of domestic equipment suppliers in China has gradually increased,” says Lucy Chen, Vice President at technology consulting firm Isaiah Research. “China can avoid being further constrained by US policies in the future only by accelerating the establishment of its domestic supply chain.”

The Mate60 Pro, for example, is said by analysts to use an unexpectedly advanced 7 nanometer chip designed by Huawei subsidiary HiSilicon and manufactured by the country’s largest chipmaker, Semiconductor Manufacturing International Corp. (SMIC). What’s more, the phone now also contains 47% China-made components, up from 29% in the previous model, showing a surprising growth in China’s tech manufacturing capabilities.

Chips are simply too important for the future of the country’s economy to fall by the wayside. And China, the world’s largest semiconductor market, is spending an enormous amount of money to bring its domestic manufacturers closer to the cutting-edge. Take for example, SMIC’s 2023 budget, which rose 18% year-on-year to $7.5 billion. But will that be enough?

Chips with everything

Semiconductors are the backbone of the Internet of Things (IoT) and the wider digital transformation of industry, and indeed life, across the world. They act as the decision-making center of every electronic device or system, from smart fridges to data centers. A single electric vehicle (EV) can contain over 1,000 chips, each responsible for running a different operation.

Chips vary in classification, with the density of transistors on each chip denoted by a nanometer (nm) measurement. At the time of writing, chips around 3nm are considered state-of-the-art, while legacy chips are typically considered those made with 28nm equipment or above, which is now a decade-old technology. Apple’s iPhone 15 runs on a 3nm chip.

The most advanced chips available are used in AI R&D and quantum computing, and will be key to any major future breakthroughs. According to Precedence Research, the global semiconductor industry was worth $591.8 billion in 2022, and is expected to pass the $1 trillion mark in 2027.

The largest semiconductor company globally is Taiwan Semiconductor Manufacturing Company (TSMC). According to The Economist, Taiwan produces around 60% of the world’s semiconductors and over 90% of the most advanced chips, with TSMC making the lion’s share. Other major global players include Intel, Nvidia and Samsung, but TSMC’s production capacity of the top chips overshadows the rest.

The other key component of the global semiconductor supply chain are the companies that produce chip manufacturing equipment. The leading player here is Dutch firm ASML, which produces some of the most advanced photolithography machines that are an integral part of advanced semiconductor manufacturing.

A semi-full plate

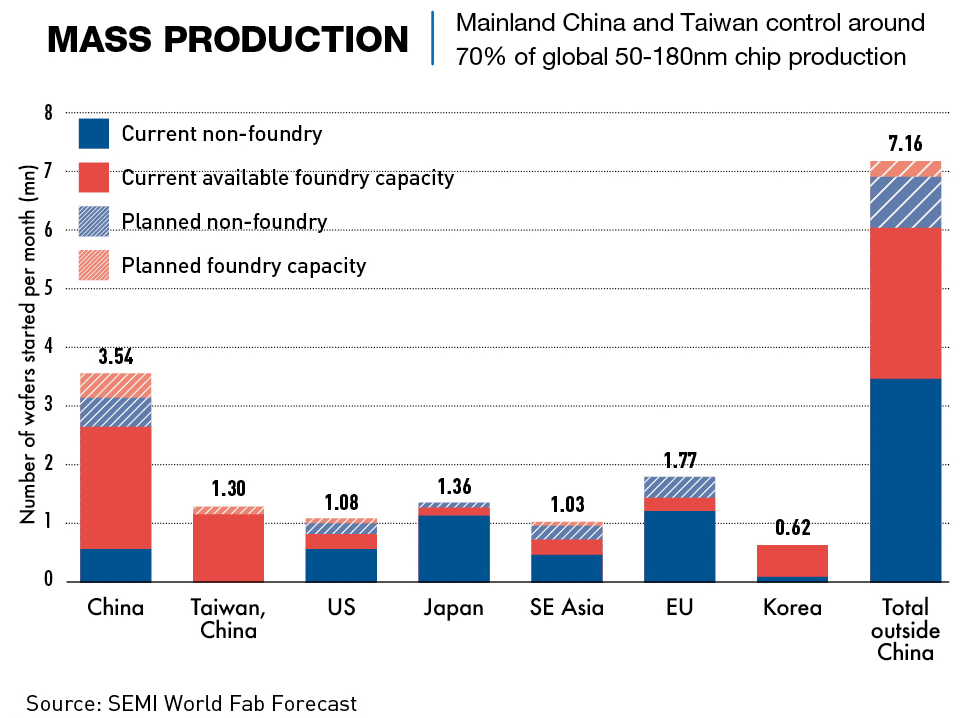

As with many industries today, semiconductor production has a truly global supply chain. Chinese chipmakers have established themselves as competent mass producers of legacy chips, with multiple foundries able to meet the demand from the country’s domestic manufacturers of simple technologies.

“China is already a big player in terms of lower-tech chips, and it’s made real strides in the past couple of years in catching up in certain spheres,” says Chris Miller, author of Chip War: The Fight for the World’s Most Critical Technology. “It’s still quite reliant on others overall, but in certain aspects of the chip industry it has, to some extent, caught up.”

China’s largest and most advanced chip company is the partially state-owned foundry SMIC. The company produces logic chips, which process information, rather than memory chips which store information.

But even prior to US trade restrictions, SMIC was not yet at the cutting-edge of chip manufacturing. “Most people would probably consider 7nm chips as being at the lagging-edge globally,” says Jacob Feldgoise, Analyst at Georgetown’s Center for Security and Emerging Technology (CSET). “They are a couple of generations behind.”

Other major players behind SMIC are Yangtze Memory Technologies Corp. (YMTC), a company founded in 2016 as part of the country’s drive to reduce dependence on foreign firms; and UNISOC, China’s largest mobile phone chip designer. Also of note is Naura Technology Group, which is the country’s largest chip production equipment manufacturer and the power behind the companies in China that perform Integrated Circuit (IC) packaging and testing.

There is also smartphone chipset manufacturer HiSilicon, a wholly-owned subsidiary of Huawei, that boasted a 16% share of the global market in Q2 2020, with revenues outstripping even SMIC. Due to Huawei’s struggles in recent years, that market share dropped to almost 0% in Q3 2022, but similar to Huawei, HiSilicon was back on an upward trajectory in 2023.

But homegrown producers cannot fully meet the needs of China’s rapidly-developing manufacturing sector. “In the view of global, and even domestic competitiveness, they do not meet demand,” says Ben Bajarin, CEO and Principal Analyst at tech consultancy Creative Strategies. “Chips being designed and made by local Chinese companies are not competitive compared to counterparts from outside of China, but any needs at the trailing edge are more easily met than at the leading edge.”

For the most part, China remains behind in the global race, and remains dependent on sourcing advanced chips and manufacturing equipment from the major international players.

According to market research firm IC Insights, China sourced only 16% of its semiconductors domestically in 2020, and the figure is only 6% after excluding foreign companies with facilities in China, such as TSMC and Samsung. While Chinese authorities put the domestic share of supply at around 30%, it still fell short of the “Made in China 2025” interim target of 40% by 2020. The target for 2025 is 70%.

Codes of conduct

For the Chinese semiconductor industry, times are getting increasingly difficult, due in part to the US government limiting companies’ ability to expand capacity in China as well as export chips and equipment to the country. In recent years, many Chinese firms have been added to the US Entity List, limiting their access to a variety of key technologies, but the signing into law of the CHIPS Act in August 2022, and the updates to export controls in October 2023, saw a more specific focus on the semiconductor industry.

While the impetus behind the CHIPS act is to strengthen the US’ own chip industry by providing subsidies for domestic development, there are also conditions designed to curb China’s ability to make further progress in the sector. As part of the act, research collaborations are limited and companies receiving money from the US for chip development are no longer able to expand their production capacity in China.

“It’s basically a contract that says, whether you are a foreign or US semiconductor company, if you are going to receive money from the US government, then we are going to place conditions on you because we don’t want to give you a subsidy as part of the new program and then have you turn around and build a giant fab in China,” says Feldgoise.

The US has also introduced export rules that target China’s access to equipment and technology for advanced semiconductors, including license requirements for items destined for Chinese production facilities capable of fabricating advanced chips as well as components for the production of advanced chip manufacturing equipment. These export rules can also impact non-US entities. For example, the legislation gives Washington the right to restrict the export of ASML’s machines if they contain any US parts. Several Dutch lawmakers have since challenged the US’ unilateral imposition of such rules.

According to US Commerce Secretary Gina Raimondo in a call with reporters in October 2023, the importance of chips for technological development and their potential military applications, that is at the heart of the US’ recent attempts to limit China’s ability to produce cutting-edge semiconductors or purchase both chips and chip-making equipment.

The impact of the controls is already beginning to show in the form of slower growth. A report from media outlet Semiconductor Industry Observation cited by Wei Shaojun of the China Semiconductor Industry Association (CSIA), noted that China’s integrated circuit (IC) design industry’s total revenue was up 8% in 2023, roughly half of the growth of the previous year. Wei also noted at a November 2023 forum that many of the enterprises were not in good shape.

It may prove hard to measure the full impact of the restrictions in China, particularly given the lack of transparency in the country, especially in relation to military technologies. “The biggest impact will be the limitations on advanced computing for the government and the cloud hyper-scalers like Tencent and Baidu,” says Bajarin. “They need access to the latest computing technology from Nvidia, Intel and AMD etc. to stay competitive in the global AI race.”

In the short term, the US restrictions will have an impact due to the clear link between China’s cutting-edge chip manufacturing and US IP. “In every facility that’s remotely close to the cutting edge, you can find US intellectual property, tools and software,” says Miller. “The entire industry is dependent on US inputs.”

“The single biggest thing the trade limitations have caused is the need for China to develop domestic sources of these capabilities, which is extremely difficult and not something any nation can really achieve on its own,” says Bajarin.

From the perspective of the manufacturing processes for end products, it appears that mid-to-high-end mobile application processors (APs) are currently experiencing the most significant impact. Many of these processors are manufactured using advanced processes with chips at 6-7nm or below, which are the nodes most affected by the US restrictions.

“The products for AI-related applications, such as GPUs, may also experience significant impacts, whether they are purchased from Nvidia, AMD, Intel, or designed by Chinese local IC designers like Shanghai Biren Intelligent Technology,” says Lucy Chen. “All of these products are heavily constrained by US restrictions.”

On the other hand, manufacturing processes for products such as CIS (CMOS Image Sensors) and ISP (Image Signal Processors) typically use chips at 40-55nm or higher, and therefore, are less likely to be affected by the restrictions.

“The big question is how China produces chips at more advanced nodes than 7nm and that is much more difficult with the current limitations on imports of ingredient technology,” says Bajarin. “It will not only be difficult to produce the chips, but even if they do, I’m not sure they will compete on all performance benchmarks.”

Out of the frying pan…

The US controls have been a shock to China’s semiconductor system, but also act as an impetus to bring forward an already inevitable shift. “The controls definitely have a degree of influence,” says Bajarin. “But I remain convinced China would have gone down the self-sufficiency path anyway due to their desire to not be reliant at all on the rest of the world for semiconductor-related needs.”

According to Chen, China’s semiconductor strengths lie in its massive consumer market scale, a pool of promising technical talent and government subsidies. In 2014, the Chinese government set up the National Integrated Circuit Industry Investment Fund, now widely known as the “Big Fund.” The fund raised ¥139 billion and ¥200 billion respectively in its first two funding rounds, but is currently struggling to meet the ¥300 billion ($41 billion) target in its third.

“Eventually they will get the third fund set up,” says Linghao Bao, Senior Analyst at Trivium China. “There is certainly enough political will to get it done, and the knock to business confidence if it doesn’t happen would be too great to risk.” In the first two fundraising rounds for the “Big Fund,” the country’s finance ministry was the largest contributor, adding 44% and 15% of the funds, respectively.

Other recent policies introduced by the government include a 20% subsidy for domestic semiconductor foundries that purchase locally-produced equipment.

The main barrier to China moving forward is the lack of semiconductor technology in the country. “China now needs to expend greater efforts or make more significant concessions to acquire technology or collaborate with international giants,” says Chen. “Adapting to closed environments and acquiring new technology based on existing experience will be a major challenge.”

“The US actually banned the export of some extreme ultraviolet lithography (EUV) machines to China in 2019, so many of the people working at places like SMIC have never even seen one,” says Bao. “The issue here is that it’s much easier to reverse engineer something if you have it in front of you, but having no knowledge of it makes it much harder. This means that the Huawei chip might be the best they can make for a while.”

The grace period on the greater import restrictions ended in January 2024. And although there appeared to be a last-ditch effort by China to import advanced equipment from ASML prior to the deadline, the company was forced to cancel a number of shipments to China after pressure from the US government.

With this option now closed to China, there is a need for domestic companies to step up.

“From the equipment we have seen, China has shown promising performance in domestic alternatives provided by companies like AMEC, Naura and Piotech, but they are still not quite at the cutting edge,” says Chen. “In the field of lithography, SMEE is actively working on the development of domestic photolithography equipment. At the same time, both SMIC and HHG have established their own integrated circuit R&D centers to develop localized product lines for domestic tools and equipment.”

Companies like SMIC also have the benefit of almost unlimited demand from its home market. The company generated 84% of its 2023 Q3 revenue from China, up 75% year-on-year.

And although the controls obviously are a barrier, China’s history of innovative thinking and its established business ecosystems could prove a boon in circumventing its current predicament. “All indications are that we should expect SMIC to roll out a 5nm node,” says Feldgoise. “It may not be for a few years, and the yield will likely be sub-par, but because some of China’s best chip designers have now been cut off from using foreign fabs, there are very strong incentives for those designers to help SMIC improve its domestic fabrication processes.”

One major advantage China does have in the race for global semiconductor development is the sourcing and control of rare-earth metal supplies. Rare-earth elements play an integral role in the manufacturing of most electronic devices, semiconductors included. In 2022, China accounted for 70% of global mine production of rare earths and is home to 85% of global processing capacity.

The US’ reliance on Chinese rare-earth exports is declining but from a high starting point—between 2018 and 2021 the country sourced 74% of its rare-earth imports from China. This is also where China has chosen to levy tariffs on the US. In July 2023 the country introduced a requirement for export permits for gallium and germanium products used in chips, following this up with similar rules for graphite in October.

Maintaining control over these supplies is a boon for China’s chipmaking industry, particularly in the short term. But manufacturers elsewhere are already looking for alternatives to rare earths to mitigate the massive environmental burden that rare-earth mining and processing causes, as well as the clear supply chain risks.

“Rare-earth metal controls seem to be the go-to response for China in the hopes of deterring more export controls,” says Bao. “It’s one of the few bits of leverage China has, for now.”

…into the fire

It is clear that in the short- and medium-term China has a mountain to climb in order to solidify its chip industry and secure its ability to work at the cutting-edge of research, technology and product development. Given the speed of development in sectors such as AI, for example, falling behind at this stage could lead to a growing gap between China and other world-leading countries.

But looking at the long-term there is less certainty as to the efficacy of the US controls. Forcing China to innovate on its own has, in the past, led to the country leap-frogging competitors in a number of sectors such as green technologies and EVs, and this could also be the case for things like semiconductor equipment.

“It is entirely possible that five or 10 years from now there is a far more developed indigenous ecosystem for Chinese chip equipment suppliers than we have today,” says Feldgoise. “So from that perspective, and of course with the caveat that we don’t know exactly how it will play out, it might be that some of the US controls actually help accelerate China’s development in certain parts of the supply chain.”

Looking even further ahead, given the exponential improvement of chip technology, as aptly predicted by Gordon Moore decades ago, there is a chance that the semiconductor challenges as we know them now, cease even to be an issue in the long-term.

“While we’re not there yet, we are certainly getting closer to the potential end of Moore’s Law,” says Feldgoise. “It is entirely possible that we get to a point in the next 30 years where there will be increasing pressures for a complete change in direction of this technology, and that could be an opportunity for Chinese companies to define the next generation of semiconductor design and manufacturing.”