Transforming Industry

Sustained R&D spending has given SANY a strong history of innovation and should help in the shift to more digitalized production

In July 2022, the first excavator rolled off the production line of SANY’s new robot-dominated manufacturing plant on the outskirts of the Indonesian capital of Jakarta. The KIM Industrial Plant is the first Chinese “Industry 4.0” production base outside of China in the excavator industry, boasting a 5:1 ratio of robots to humans, but it certainly will not be the last.

SANY has gained its position by stressing robotic digital production more than any other producer globally. It now has 40 of these robot-dominated plants mostly in China, which embrace the latest manufacturing technologies, from proprietary intellectual property to the Industrial Internet of Things (IIoT). Such factories can supply a considerable competitive advantage, which SANY needs as it charges toward becoming the largest construction equipment manufacturer globally.

SANY also boasts two World Economic Forum-certified “Lighthouse Factories,” which take technological adoption to a higher level, the only two such factories in the heavy equipment manufacturing industry globally. The use of robots and technology has allowed the SANY plant in the central Chinese city of Changsha, to double its productivity when compared to standard plants and reduce unit manufacturing costs by 29%.

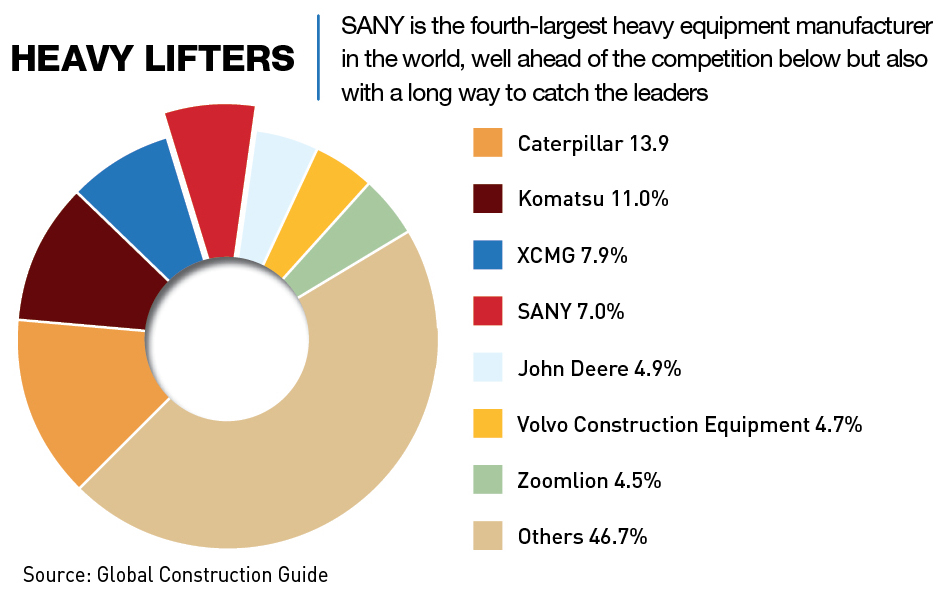

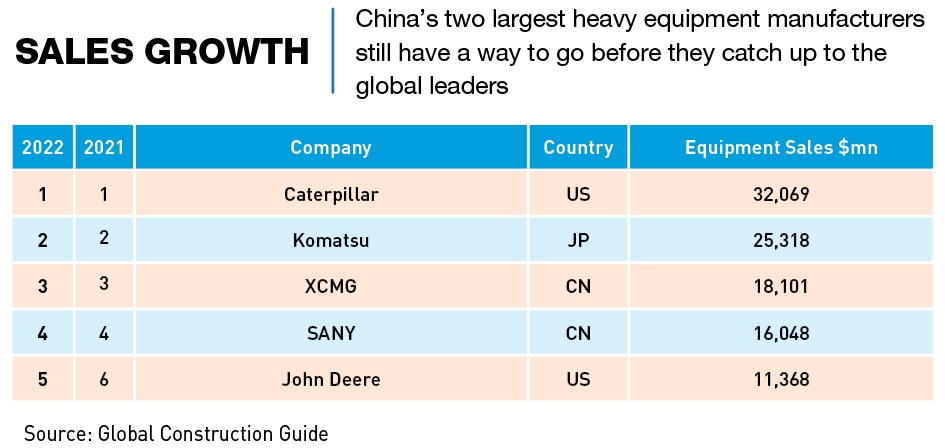

SANY currently sits in fourth place in the global construction equipment manufacturer rankings behind Caterpillar and Komatsu and Chinese state-owned XCMG but the company’s ambitions are clear. “SANY is striving to build a global brand and become an industry-leading equipment manufacturer,” a SANY spokesperson told CKGSB Knowledge. And the company’s high-tech approach will help it significantly in getting to the top.

Manufacturing business

SANY Group can trace its origins back to a welding materials factory founded in 1986 in Lianyuan, a city in China’s central Hunan Province. In 1991, the company was renamed SANY Group and its headquarters moved to the provincial capital of Changsha.

The group has since dramatically expanded and diversified, both geographically and in terms of the services that it provides. There are now 11 main companies, with almost 30 total subsidiaries, across the world under the SANY Group banner, including heavy equipment and engineering tool manufacturers, a bank, two types of insurers, a property developer and a polytechnic college in Hunan.

Although they seem disparate, each of these individual companies holds something of a link to SANY’s core business. The Bank of Sanxiang is the first private bank in China oriented towards the integration of industry and finance and the Hunan SANY Polytechnic College offers engineering courses, among others.

While many of the businesses under the SANY Group banner are registered, and in some cases listed, in China—SANY Heavy Industries went public on the Shanghai Stock Exchange in 2003—there are also subsidiaries registered in India, Europe and the US. SANY has production bases in Brazil, Pakistan and Indonesia, among other places.

The company has been exporting its products since 2006 and in 2021, SANY’s sales reached $16 billion, of which $3.72 billion were attributed to sales outside China, a 76% increase on the previous year.

SANY has mostly grown through sustained investment in R&D and a service ethos. “Although SANY has received various subsidies from the Chinese government throughout the years, the company has mostly grown to become one of the world’s largest machinery makers through the reinvestment of its profits,” says Rashad Sablouh, an independent construction and mining machinery consultant.

“Sticking to our mission ‘Quality changes the world,’ SANY invests about 5% of its annual revenue on R&D and in terms of technology development, SANY holds 10,613 patents,” says a company spokesperson.

According to the 2022 Yellow Table, a ranking of heavy equipment manufacturers made by construction media company KHL, SANY was fourth in global heavy equipment sales in 2021, trailing international rivals Caterpillar and Komatsu, and Chinese firm XCMG. Sales in 2021 for the world’s 50 largest construction equipment OEMs amounted to $232.7 billion.

In terms of heavy equipment manufacturing, SANY’s core product line, the company has managed to take a global lead in some categories. For 11 years, SANY has been number one for excavators in the Chinese market and since 2020 it has been the global leader with around a 15% share. SANY sold more than 100,000 excavators in 2021, generating $6.3 billion in revenue, 40% of the company’s overall revenues.

While there is no shortage of Chinese competitors, there has only been one other aside from XCMG to really challenge SANY. “One of SANY’s main local competitors is Zoomlion, which has recently beaten their Guinness World Record for the tallest concrete truck pump, with an impressive 101m,” says Diana Derval, Chief Investigator at DervalResearch.

Built different

SANY broadly operates in four main business areas: excavators, heavy equipment, mining machinery and renewable energy. The company competes effectively in each of these fields by providing a combination of advanced technology and services.

But large-scale digital transformation has been crucial to the success of the company in building an efficient organization from its vast array of businesses. As part of the transformation, SANY has developed an Industrial Internet of Things (IIoT) platform to spearhead the wider digitalization of the company. The platform, RootCloud, has since been spun off into its own company.

RootCloud surveyed all of SANY’s 90 factories across China and worked out that 6,000 of the 8,000 pieces of manufacturing equipment were “dumb,” that is not connected through IoT technologies. It determined that this resulted in a serious lack of coordination and the siloing of gathered data which was having an impact on SANY’s business.

RootCloud’s analysis had a huge impact and led to SANY’s massive digital transformation. Speaking at the 2018 China’s National People’s Congress SANY Chairman Liang Wengen said, “Either say goodbye to the past or say goodbye to the industry.”

SANY’s transformation had begun in 2012 with the opening of its first smart factory, which is called the No.18 Factory. The production process was simplified and mixed-model assembly—assembling multiple different products with similar production processes in the same place—was introduced, saving space and materials and thereby simplifying manufacturing. Most importantly, the new factory required less labor and thus played a part in SANY reducing its workforce by 20,000 between 2012 and 2021 despite increasing its output.

First implemented in 2017, the RootCloud platform covers tools such as digital twins to enable more efficient testing and R&D as well as data collection and AI analysis tools, grew out of SANY’s drive to integrate the Internet of Things (IoT) into both its production and products.

The No. 18 Factory has since been designated a Lighthouse Factory, and using the RootCloud platform it produces 30TB of data every day from 1,540 sensors and 200 networked robots. Before RootCloud, the analysis of 10GB of R&D test data could take up to three hours, but it can now be achieved in under five seconds.

“SANY is utilizing several emerging technologies including artificial intelligence, big data, and the IIoT to enhance its operational and service capabilities,” says Sablouh.

The use of IIoT also enables greater operating efficiency in SANY products, enabling the “+ service” portion of SANY’s new ethos. Not only does the technology help with diagnosing problems when there are stoppages in the field but it can also be used proactively to prevent damage to the equipment. It is innovations like these that have led to SANY being named one of the “50 smartest companies” by MIT Technology Review.

Low costs are a part of SANY’s appeal to customers, but particularly in international markets, the service it provides plays a large role in making it a global force. As of June 2022, SANY had established localized distribution systems in more than 100 countries and regions, facilitating quick service in those areas.

“In the US, there has been a rapid growth in the number of SANY dealers across the country. Most places where you will find CAT, Komatsu and John Deere dealers, you will now see SANY machines also,” says Andrew Forrest, CEO of The Attachment Company LLC.

SANY offers a five-year, 5,000-hour warranty across all of its machines, an offer that surpasses all of its major competitors. “This warranty term combined with the competitive prices makes it a very good choice for customers looking to upgrade older equipment or buy new,” says Forrest. “We hear from a lot of customers that are really happy with their SANY machines and these are the two biggest reasons that they tell us of why they chose SANY.”

According to Sablouh, the total cost of ownership for a SANY machine can be 30% less than that of comparable top-tier manufacturers.

Digging a hole

While SANY’s international business has been thriving over the past decade, it is now facing a number of threats to its expansion. In particular, the risks associated with China’s decoupling from the West and the general negative perception of China in the US, are taking its toll.

“I think that there is now a negative connotation of Chinese-made equipment in the US heavy equipment industry,” says Forrest. “I can imagine that being one of the toughest barriers to entry to the US market.”

What may help SANY weather decoupling better than some of its Chinese competitors, however, is its emphasis on expanding the number of its overseas plants. Following on from the Indonesian factory, SANY has plans for ten more similar plants outside of China. “While most of the construction machinery and equipment companies manufacture their products locally, SANY has manufacturing facilities across the world, including in the Americas,” says Sablouh. “And that can help with impressions.”

The company, like many others in China, may also suffer short-term threats from the slowing of the Chinese economy, particularly in areas such as housing construction where the market is facing a variety of demand-side difficulties. For SANY’s equipment business, though, these risks might be offset by the government’s insistence on increasing infrastructure spending.

But perhaps the company’s biggest upcoming hurdle will be concerns related to sustainability and carbon neutrality—SANY’s products are being used in the so-far still dirty business of mining for commodities like cobalt and lithium used in products like solar panels and batteries. “SANY’s business is by definition environmentally unsustainable and constitutes a serious ESG risk for investors,” says Derval.

She feels that the management have yet to fully comprehend the problem. “Reading in SANY’s last CSR report that ‘water resource management’ and ‘community public welfare’ were considered by the company and their stakeholders as a medium priority and ‘climate change response’ as a low priority was therefore quite surprising,” Derval adds.

All windmills

But it is not all doom and gloom. SANY is already acting to make its product lines greener and also to make inroads into new greener product areas. In 2020, the company entered into a strategic partnership agreement with Chinese battery giant CATL.

“According to the agreement, both parties will expedite their joint development of new energy products in concrete machinery, mining machinery, cranes, port machinery, excavators and heavy trucks, alongside new big data-based technologies such as battery behavior tracking and fault self-diagnosis,” says a SANY spokesperson.

SANY has already developed electric port tractors which are in use in the Port of Xiamen, off-highway electric trucks are being used in mining in Brazil and electric mixer trucks are also in development. Electrification across the range is set to continue. In collaboration with GPSC, Leadway and RootCloud, the company is looking at providing battery swapping and battery-as-a-service to its clients.

Founded in 2008, SANY Renewable Energy is also one of the world’s top 10 wind turbine producers. In 2022, Windpower Monthly named the SE-17260 turbine as one of the top 10 onshore turbines for the second year running. Such recognition is likely to lead to further growth for this part of SANY’s business.

Road to development

SANY’s goal is to become a global brand and industry-leading manufacturer. To achieve this goal, SANY is concentrating on localizing production, greening products, and improving services, all underpinned by digital technology and solid R&D investment.

Xu Ming, SANY’s Senior Vice President, recently said to industry leaders in Munich, “SANY’s clients should never be concerned about the service or availability of equipment. All our equipment must be served and attended correctly.” For operators of equipment, unscheduled downtime can be extremely costly and lead to delays in infrastructure projects.

But looking to the future is the real target and Ding Shifeng, project leader on the opening of the Indonesian factory, said in a company statement that, “being smart means to be farsighted, and so we are now refocusing from international sales to international manufacturing, especially intelligent manufacturing.”