In the wave of global economic transformation and technological revolution, unicorn companies, as exemplars of innovation-driven growth, continue to capture attention from all sectors.

How are unicorn companies able to grow in an environment marked by global economic uncertainty? In an era of rapid technological advancement, which industries still have the potential to become the focal points of capital and innovation? In the face of escalating international competition, how can Chinese unicorns achieve breakthroughs?

Recently, Professor Teng Bingsheng from Cheung Kong Graduate School of Business delivered a keynote speech at the 2024 16th Startup 100 Future Unicorn Conference. His talk, titled “The Global Ecosystem of Unicorns from a Long-term Perspective,” provided an in-depth analysis of the current survival and development trends of unicorn companies in the global context. He explored the crucial role of long-termism and new productivity forces in driving unicorns to break through, and shared his unique observations and reflections on the development of unicorns in the face of global competition.

Professor Teng pointed out that, despite the challenging economic environment, unicorn companies are still performing well overall, showcasing three major trends: rapid technological innovation, globalization, and diversification. Fields such as artificial intelligence, smart manufacturing, and automotive transportation have become hot spots for financing. From a long-term perspective, patient capital is more likely to foster disruptive innovation, while the construction of strategic ecological niches has become especially critical. The following is a condensed version of his speech.

Key Points:

In the increasingly complex and competitive global landscape, Chinese unicorn companies need new forms of productivity and long-term capital to break through.

Startups need to identify disruptive technologies with potential to drive the growth of their business models. In this process, it is crucial to observe which models can adapt to the market, which advantages can form competitive barriers, and how to create strategic control points and moats. These are the most important considerations when building the startup’s ecosystem.

Main Content:

Three Major Trends of Unicorns: Technological Innovation, Globalization, and Diversification

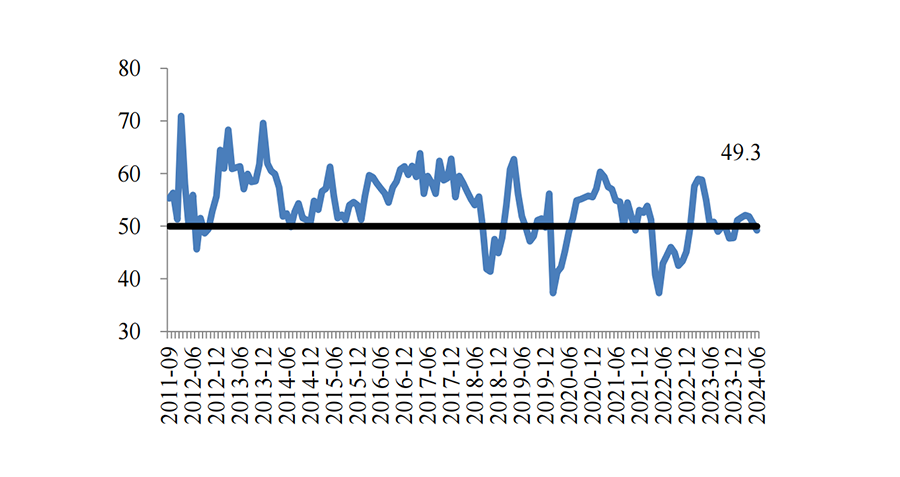

Despite slowing economic growth, unicorn companies’ overall performance remains on par with last year, with performance in the third quarter of 2024 showing even stronger results, and their overall valuation exceeding the previous year’s level. Although the global economy did not experience a sharp V-shaped rebound, it is currently in a stable L-shaped phase, with central policies remaining steady. As the saying goes, “Patience is key,” and from a venture capital perspective, a stable environment is good news.

From the distribution of unicorn companies in the third quarter of 2024, we can observe some patterns: despite significant differences in financing amounts across projects, the automotive sector, though fewer in number of deals, attracted enormous capital. Artificial intelligence, smart manufacturing, and automotive transportation are the three dominant sectors, clearly leading in financial flows.

From the global distribution of financial flows to unicorns in Q3 2024, AI and business service sectors dominate, reflecting concentrated hotspots.

Additionally, the global and China top 10 unicorn lists remain relatively stable, with no significant fluctuations. On a global scale, China and the U.S. continue to dominate, with the global landscape remaining unchanged.

Despite the surge of emerging players in the semiconductor field driven by the AI wave, the leading companies remain the familiar giants, showing considerable stability.

In the Chinese market, unicorns exhibit three prominent trends: rapid technological innovation, globalization, and diversification.

Technological Innovation is a national strategic priority for China, and the technological competition between China and the U.S. has been and will continue to be the main focus over the past decade and in the next one. The autonomy and irreplaceability of Chinese enterprises are currently the most critical focal points for maintaining a leading position. . For unicorns and potential unicorns, technological competitiveness forms the most critical foundation for their rise.

Globalization is both an active and passive phenomenon. Unicorn companies often exhibit strong initiative, while traditional manufacturing companies are more reactively-driven by the need to relocate production abroad or shift entire supply chains overseas. Unicorns, however, are generally more proactive in expanding into international markets.

Diversification has become another key development path for unicorn companies in recent years, seeking new growth curves based on existing businesses. Whether it’s Little Red Book (Xiaohongshu) or JD Technology, these companies’ second and third growth curves have emerged much faster than before, which is one of the three major trends we observe among unicorns.

AI and semiconductors are undoubtedly two core sectors. We have observed that many of the newly-minted unicorns are concentrated in these fields.

Embracing Long-termism and Preparing for the Future of the Industry

In the current challenging economic environment, it is particularly important to adopt a long-term perspective. For private equity (PE) firms, their operations inherently have a long-term nature, such as the LP-GP cooperation model, where a typical “5+2” contract period is already considered long-term. Many of the projects I’ve been involved with have experienced delays, and the original 5+2 timeframe was often extended by several more years.

This long-term perspective shares similarities with the trend of “going global” — a combination of both proactive choices and many reactive factors, with the latter often playing a significant role.

Adhering to long-termism is more likely to drive disruptive innovation, and these unicorns driven by long-termism often emphasize strong connections with end-users (C-end). As of 2023, 62% of unicorns globally have some form of B2C system. Although their core businesses may not entirely come from C-end, they still place great importance on reaching practical results. For example, in AI application, achieving tangible results, such as in intelligent manufacturing, industrial robots, intelligent services like remote operations, is easier than developing large-scale models.

In today’s relatively harsh economic environment, we have observed a shift towards a more patient, steady approach. In this L-shaped era, people are becoming more willing to move forward patiently and steadily.

In a study covering 68 Chinese unicorn companies, 61 companies stated that a unique technology influenced the direction of their development; 65 companies believed early strategic alliances were crucial to their growth; and 64 mentioned that the founders’ prior experience played a crucial role in guiding the company’s early-stage direction. This indicates that path dependency and prior accumulation are crucial for such companies’ long-term development.

Long-term-focused companies typically possess several key characteristics: strong shareholder backgrounds, excellent management capabilities, reasonable industrial chain layouts, a high emphasis on R&D, and a strong sense of social responsibility.

At the same time, we see that the government is gradually strengthening its focus on a long-term perspective, too. In April 2024, the Political Bureau of the Central Committee in China proposed to strengthen “patient capital.” The resolution passed in the 20th Central Committee’s Third Plenary Session in July 2024, where “patient capital” was repeatedly mentioned. Moreover, the resolution emphasized the need to “build a financial technology system that aligns with technological innovation, to strengthen financial support for major national technological initiatives and tech-based SMEs, and to improve policies that support early, small, long-term, and hard-tech investments,” as well as to better leverage the government’s investment funds in developing patient capital.

The Concept of Patient Capital and Its Role in Long-Term Investment

The concept of “patient capital” is even more far-reaching than what we have traditionally understood as long-termism. For instance, the investment funds of state-owned enterprises (SOEs) may have a term of up to 15 years, which is twice as long as the typical equity investment funds. This ultra-long-term design is unprecedented and demonstrates great innovation.

Some state-owned companies have even been able to issue bonds with a maturity of 10 to 15 years at an interest rate lower than 2.65%, which extends the entire investment cycle. In this long-term process, we need to gradually shed the previous sprint mentality to better adapt to the current macro environment.

In recent years, SOEs have significantly increased their investment in strategic emerging industries, leading to a qualitative leap. In the entire venture capital environment, the participation of state-owned capital has undoubtedly played a stabilizing role in maintaining equilibrium.

Against this backdrop, we are beginning to see some outstanding examples. A typical case this year is the massive success of Black Myth: Wukong (黑神话•悟空). Back in 2007, the CEO of Game Science, Feng Ji, criticized the state of the domestic gaming industry in a long article titled “Who Killed Our Games,” pointing out that the failure of free-form games was due to the greed and short-termism of capital, which led to a lack of craftsmanship in related works.

However, this year we saw Black Myth: Wukong achieve huge success. The game took seven years to develop, with the cost of development per hour of gameplay reaching 15 to 20 million RMB, and the total investment scale amounting to around 300 to 400 million RMB. If the same rush-for-profit mentality had been followed as in the past, this would have been impossible. What we observe is that a few companies have emerged successfully through long-termism and patient capital, which gives us greater confidence that long-term investments, though challenging, are indeed achievable.

Previously, such long-term investments were very difficult. One of my students, for instance, spent 20 years investing in a valuable forest area in the Chinese province of Hainan. After 20 years, the return on investment is expected to exceed an annualized 10%. However, in the environment at the time, even an investment promising a 10% return per year was hard to make over a 20-year span. Perhaps today’s environment has changed, making such decisions more open-minded and long-term.

New Productive Forces: The Key Driving Force for Industrial Upgrades

The concept of new productive forces aligns closely with patient capital. Since Trump’s presidency, the trade and tech wars between China and the U.S. have escalated. After Trump declared victory in the 2024 U.S. presidential election on November 6, several technology-related blockade measures against China have quietly been put into action. If these plans are being initiated before he formally assumes office, we can foresee an even more challenging competitive environment when Trump begins his second term.

Many still underestimate Trump after his first term, thinking of him merely as a businessman who can resolve many issues through negotiations, neglecting his underlying values and logic. However, I believe that when Trump enters his second term, many things will change. For example, he could resolve the Syria issue without bloodshed and force Russia to withdraw—this would only be the beginning. Although we cannot predict how the Russia-Ukraine conflict will ultimately end, my advice is not to underestimate the challenges Trump 2.0 will face, especially in the areas of technology and trade.

In many ways, China now faces an increasingly complex economic landscape, necessitating a greater focus on cultivating new productive forces. In the United States, seven major tech giants have generated immense value, whereas many of China’s leading companies remain heavily concentrated in B2C sectors, with traditional technologies still playing a dominant position. To break through existing bottlenecks, China must urgently rely on the development of new productive forces and the support of patient capital.

Against this backdrop, the government is working to establish the following system:

- Basic force: Around 1 million innovative SMEs with high specialization, strong innovation capacity, and potential for development.

- Core force: Around 100,000 “specialized, refined, distinctive, and innovative” SMEs that are specialized, efficient, and of high quality.

- Pivotal force: About 10,000 companies in key areas of the industrial chain, with outstanding innovation.

If we can form such an ecological matrix and pyramid structure, there will be an opportunity for long-term cooperation with the U.S. innovation ecosystem.

In this process, “gazelle companies”—those with strong innovation capabilities, rapid growth, and a short development cycle—are the future unicorns. The concept of “gazelle companies” was first introduced by David Birch, an economics professor at the Massachusetts Institute of Technology (MIT). Gazelles are characterized by their small size, excellent running speed, and jumping ability, symbolizing small- and medium-sized enterprises (SMEs) with high growth rates and large potential for expansion. Birch defines gazelle companies from two dimensions: their initial size and their sustained growth rate.

Early-stage tech startups, although growing rapidly, are also extremely fragile, often failing in large numbers during the “valley of death.” Therefore, we need to support these gazelle companies in multiple ways. “To invest early, invest small, and invest well” is almost an impossible task. Thus, balancing early-stage investment with small amounts, while ensuring investment quality, places high demands on the expertise of investors and the precise support of government policies.

From a long-term perspective, the construction of a strategic niche becomes crucial. For entrepreneurial companies, they need to identify disruptive technologies with growth potential and experiment with them. Based on these experiments, they can gradually move toward executing and expanding their business models. In this process, it’s essential to observe which models can adapt to the market, which advantages can form competitive barriers, and how to build strategic control points and moats. These are some of the most important factors in the ecosystem.

Looking at the development of unicorn companies in the global ecosystem, China remains firmly in second place, with the gap between China and the U.S. not widening further. I believe this presents an opportunity.

As of June 19, 2024, the U.S. comes first with 662 unicorns, representing a total valuation of over $2.153 trillion. China is in second place with 169 unicorns, valued at $641.7 billion. India ranks third with 71 unicorns, valued at $192.24 billion.

Although the focus areas of the two countries differ, after years of development and collective efforts, China is now in a position to compete on equal terms with the U.S., which is crucial.

In terms of the industrial distribution of unicorns, 91% of the U.S. unicorns are in the tertiary industry (services), 8% in the secondary industry (manufacturing), and only 1% in the primary industry (resources). This is a characteristic feature of modern, economically developed countries and regions, where the service sector dominates. In the case of unicorns—highly capital-intensive entities—this distribution aligns with the expectations of capital.

In China, while the tertiary sector also dominates, accounting for 63.8% of the unicorns, the secondary sector’s proportion should not be overlooked, reaching 35.68%. This clearly reflects China’s comprehensive advantage as a “manufacturing powerhouse.” In a sense, the combination of China’s primary, secondary, and tertiary industries could be more competitive.

Looking ahead, Chinese companies need to find their unique advantages within the global ecosystem. While U.S. companies are more active in fields such as blockchain and digital currencies, China has already surpassed the U.S. in areas like artificial intelligence, advanced manufacturing, and automotive transportation. Overall, China’s position in the global innovation ecosystem remains strong. With precise policy regulation to stabilize the real estate and stock markets, I believe that the venture capital sector will emerge from its cold winter period and embrace a spring of opportunity in the coming years.