This survey was led by Dr. Zhang Xiaomeng, Associate Professor of Organizational Behavior, Associate Dean for Executive Education and Co-Director of Leadership and Motivation Research Centre at the Cheung Kong Graduate School of Business (CKGSB)

In the face of the sudden COVID-19 outbreak, every company in China has had to take unprecedented actions. While the state undertakes measures to support companies facing existential woes, entrepreneurs are actively helping themselves, and each other. The CKGSB Leadership and Motivation Research Center has launched a series of surveys to understand the core concerns and strategies of entrepreneurs in a wide range of sectors in these fast changing and challenging times. This research will hopefully feed into the business community’s debates, and help businesses turn risk into opportunity.

The first theme we address is “Resuming work.” We call this a “game of survival and confidence.” We sent our survey out to senior executives in CKGSB’s Executive Education and Executive MBA programs and received anonymous responses from students from across industries and seniority levels.

To make the process as timely and efficient as possible, the survey was distributed and retrieved within a 24-hour period from noon 12-13 February. We received a total of 1,112 surveys.

Strengthening resolve in times of trouble; a people-oriented active response

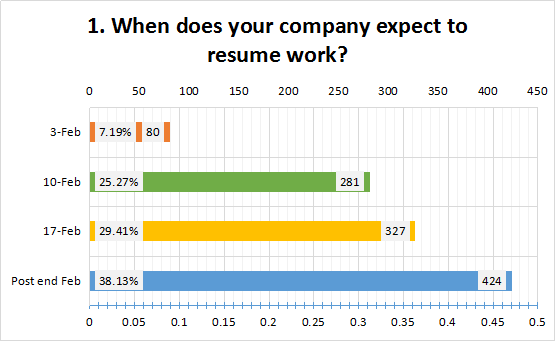

1. Most companies (67.5%) have decided to resume work on or after February 17. Of these, most have decided to resume work at the end of February at the earliest (38.13% of the total sample).

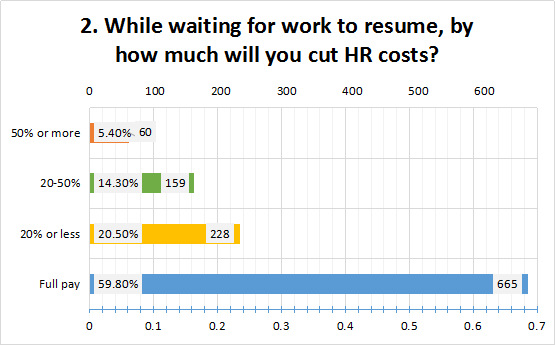

2. More than half of surveyed employers have decided against pay cuts despite work being put on hold. A total of 665 companies (59.8%) continue to offer full pay.

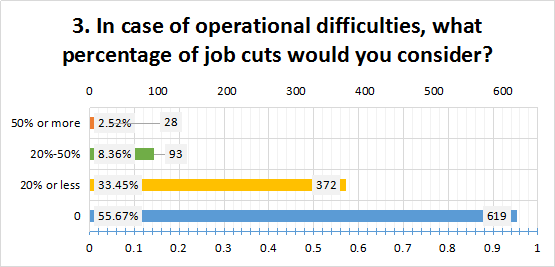

3. More than half of all surveyed employers will not lay off staff despite operational holdups; a total of 619 companies or 55.67%.

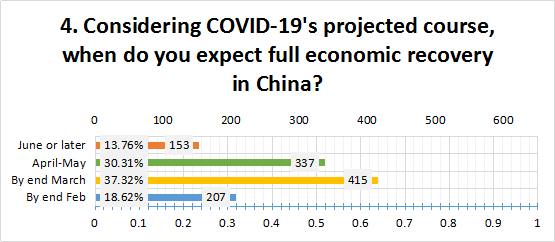

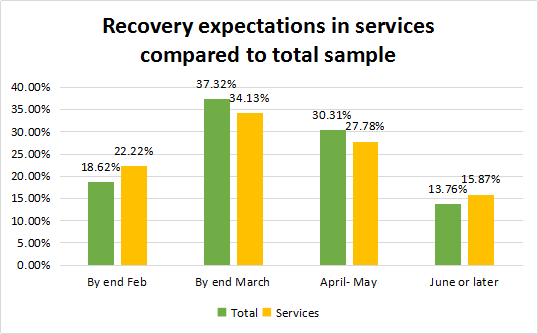

4. 55.84% of surveyed employers believe they will be able to resume normal production and operations by the end of March. 18.62% of employers have chosen to resume work before the end of February. 37.32% have decided to resume work before the end of March. 13.76% of respondents believe full economic recovery will take until at least June.

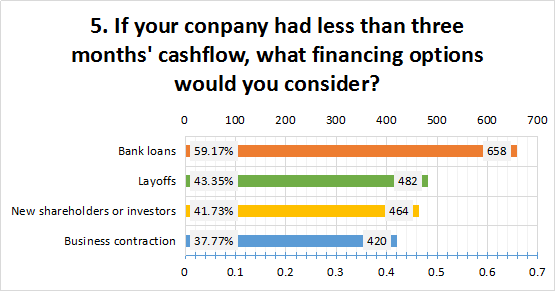

5. Companies feel the most effective ways to deal with an unexpected financing crunch are in order: bank loans (59.17%), layoffs, and pay cuts (43.35%), bringing in new shareholders and investors (41.73%), and business contraction (37.77%).

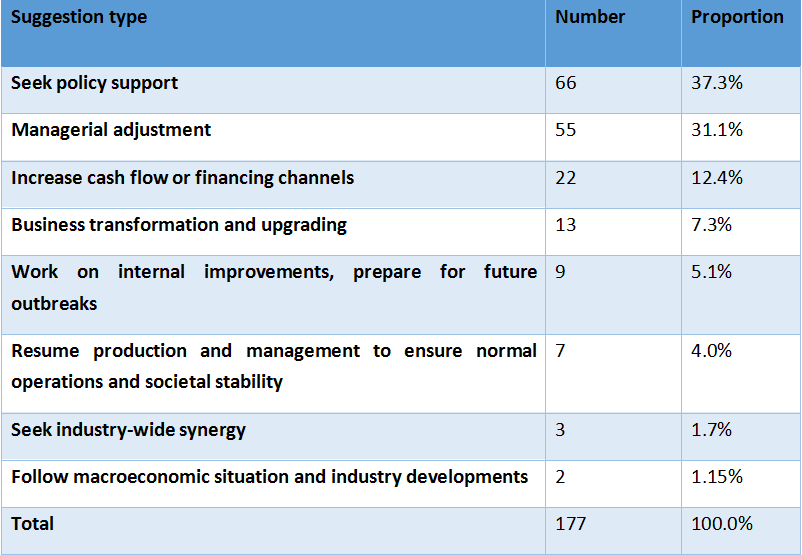

We also solicited entrepreneurs’ thoughts on how they would lighten the financing burden, using open-ended questions. Of the 1,112 respondents, a total of 139 valid responses were collected, and 177 suggestions were made. Of these, the top three were: seek policy support (37.3%), make managerial adjustments (31.1%), increase cash flow or financing channels (12.4%).

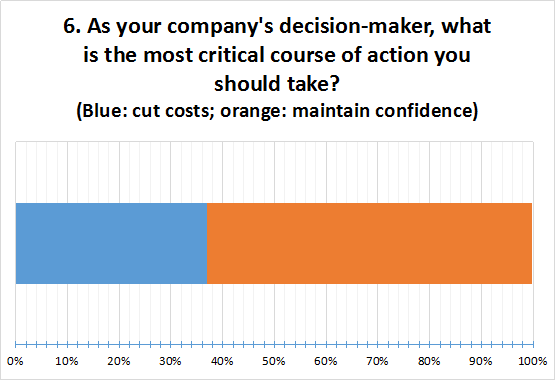

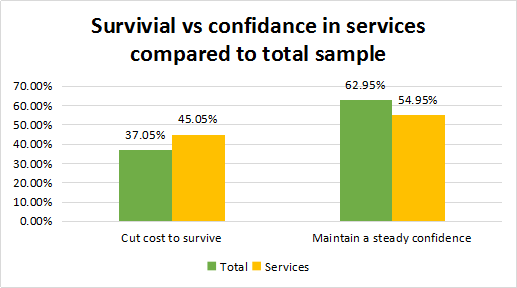

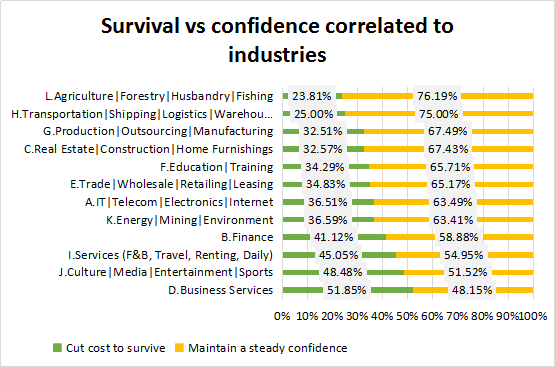

6. Over 60% of entrepreneurs are doing their best to stay positive. Specifically, 700 entrepreneurs are focusing on “maintaining staff confidence to overcome difficulty” (62.95%) and 412 respondents have chosen to “cut costs to keep the company afloat” (37.05%). This reflects the level of confidence and a key decision-making trend at the time of questioning. Economic conditions and corporate cash flow should be tracked as the epidemic runs its course.

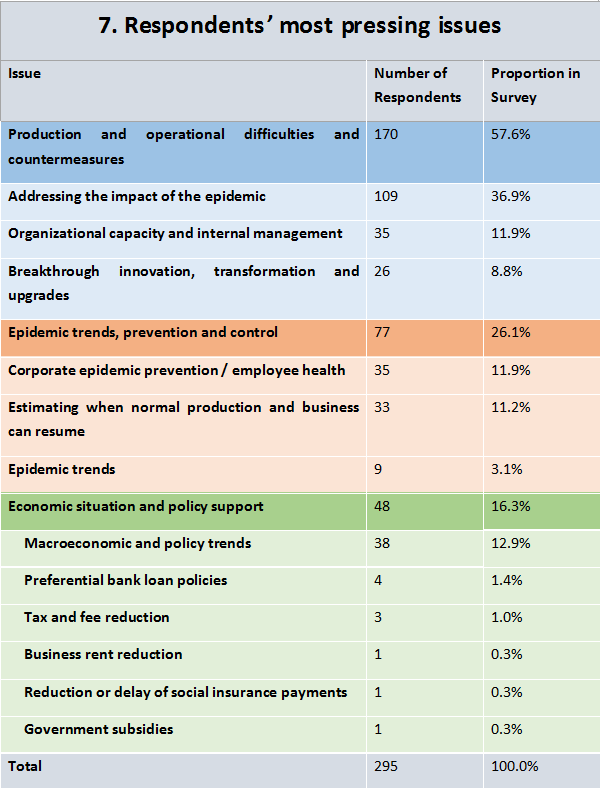

7. We used open-ended questions to explore our respondents’ most pressing issues. Of the 1,112 questionnaires, 127 valid responses were retrieved, containing 295 issues, which were divided into three categories: production issues and countermeasures (170 responses, accounting for 57.6%), epidemic trends, prevention and control (77 responses, 26.1%), and the economic situation and policy support (48 responses, 16.3%). Among production issues and countermeasures, the top three are: how to deal with the impact of the epidemic, organizational capabilities and internal management, and innovation, transformation, and upgrading in preparation for future outbreaks.

8. Comparative industry analysis

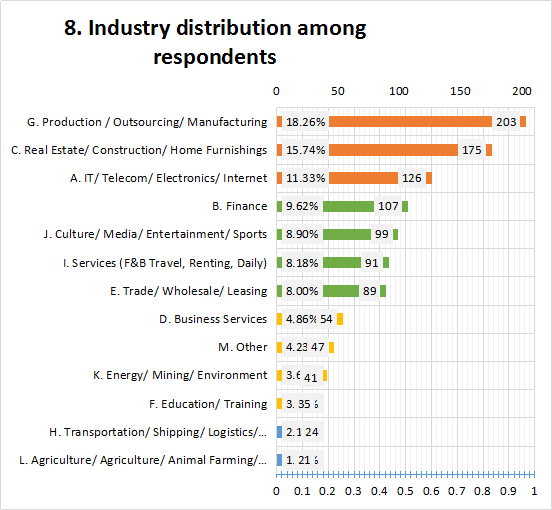

To collect responses in a timely manner, this first survey in the series comprised of just eight questions, the final one looked at the industry the respondent worked in. Industry distribution from 1,112 questionnaires is shown above.

The top three industries surveyed were: Production/ Processing/ Manufacturing (18.26%); Real Estate/ Construction/ Home Furnishings (15.74%); IT/ Telecom / Electronics/ Internet (11.33%). The industries with the lowest ratios were Agriculture/ Forestry/ Animal Farming/ Fishing (1.89%); Transportation/ Shipping / Logistics/ Warehousing (2.16%); and Education/ Training (3.15%).

Note: Industry classifications refer to the “2019 National Economic Industry Classification,” modified for convenience. Our data also includes companies that are not in the above industry classification, operating across sectors, or not operating in specific industries. Due to the scattered data, we temporarily excluded these options from our industry comparative analysis.

Based on our results, we have selected the following key issues for our industry comparison, and look forward to gaining additional insight into the impact of the epidemic on a range of industries.

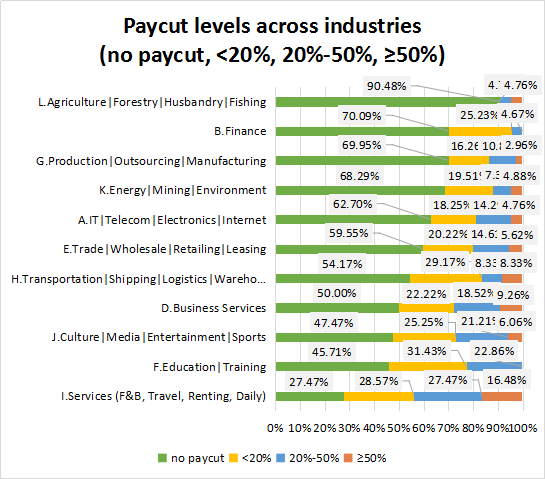

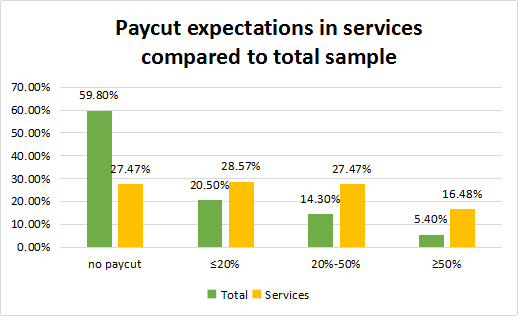

- Regarding staff pay, the three industries most unlikely to cut pay (non-reduction of wages) are Agriculture/ Forestry/ Animal Farming/ Fishing; Finance; and Production/ Processing/ Manufacturing at 90.48%, 70.09%, and 69.95%, respectively. Conversely, companies most expecting to have to impose some degree of pay cut were in the service sector (72.53%); followed by Education/ Training (54.29%), and Culture/ Media/ Entertainment/ Sports (52.53%). Greatly impacted by the epidemic, only a minority of companies in these industries can ensure that on return to work, they will be able to pay employees full salaries. Among them, 16.48% of service sector respondents expect pay cuts of 50% or more, 10% higher than for the sample as a whole (5.40%).

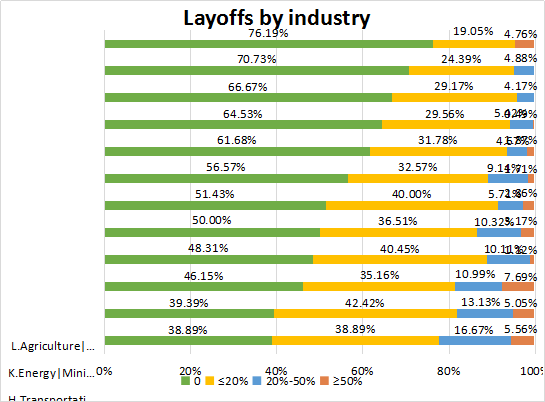

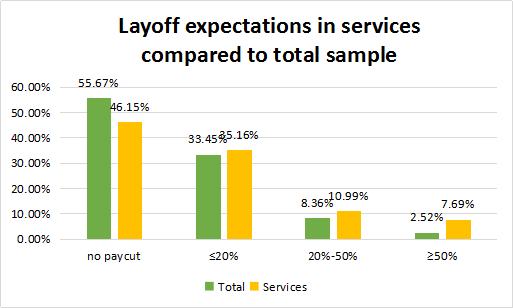

- Regarding layoffs, the three industries at the top of the zero layoffs list are Agriculture/ Forestry/ Animal Farming/ Fishing, Energy/ Mining/ Environment, Transportation/ Shipping/ Logistics, and Warehousing, at 76.19%, 70.73%, and 66.67% respectively. The three industries most expecting layoffs are Business Services, Culture/ Media/ Entertainment/ Sports, and Services, at 61.11%, 60.61%, and 53.85% respectively, showing how badly affected these sectors expect to be by the epidemic. Fewer companies in these sectors can guarantee there will be no layoffs after work resumes.

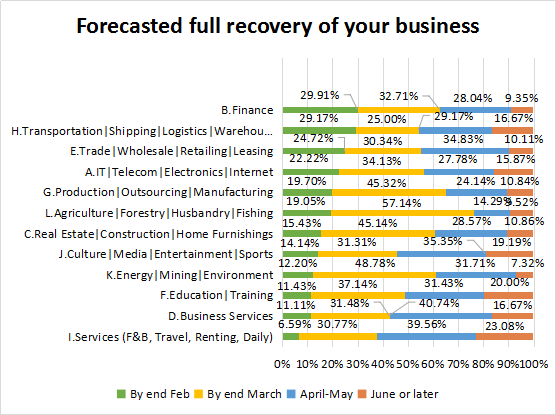

- As for forecasts of when China’s economy will be back in full flow, Finance, Shipping/ Transportation/ Logistics/ Warehousing, Trade / Wholesale, Retail, and Leasing, accounting for 29.91% and 29.17% and 24.72% respectively responded “end of February.” Those planning for the end of March were Agriculture/Forestry/ Animal Farming/ Fishing, 57.14% in total. Sectors opting for April to May as most realistic include Business Services, accounting for 40.74%. Manufacturers have a fairly gloomy outlook – with 23.08% believing recovery in June or even later are a distinct possibility, just 6.59% selecting full recovery before the end of February and 30.77% by the end of March. Generally speaking, most manufacturing companies believe full operations will only resume after April.

Industry focus: Comparative analysis of the service industry

The above analysis compares different decisions taken in various sectors about restarting work after the extended Chinese New Year break. Of these, the service sector is one of the most affected. For a more intuitive presentation, we compare results from the service sector with the sample as a whole. Follow-up reports will present focused analysis of each sector in turn.

In terms of pay cut options, 27.47% of business leaders in the service sector have opted to maintain full salaries for their staff, which is roughly 31% lower than for the sample as a whole (59.80%). Other salary reduction options are selected significantly more than for the sample as a whole.

In terms of layoffs, 46.15% of service sector companies have decided not to lay off staff, which is roughly 9% lower than for the overall sample (55.67%); other layoff options were explored, more than the overall sample.

As for deciding when to resume work, 6.59% of service sector companies have opted for the end of February, lower than the sample as a whole (18.62%). The figure for restarting work by the end of March is also lower than for the overall sample. The proportion of service sector respondents who have picked April to May, and June and beyond, is higher than the overall sample. Service sector companies seeing April to May as the most realistic period to restart work has come in with the highest proportion, at 39.56%.

As for company survival and business confidence, 54.95% report having a focus on maintaining steady confidence, which is lower than the overall sample at 62.95%, but still over half.

Correlation analysis

Here we further analyze the correlation between expectations on returning to full business hours and decisions regarding pay cuts and layoffs, and focus on survival or confidence, by considering pay cuts and layoff plans against others in different industries.

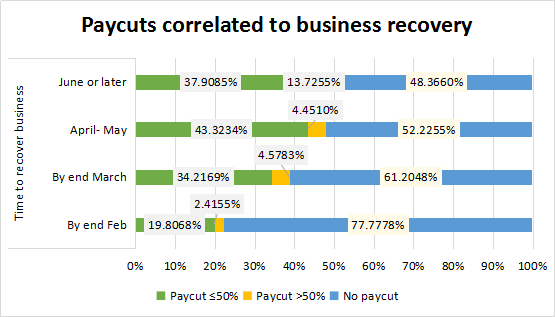

1. From the perspective of pay cuts, we can see that according to the chart, the later companies expect to resume operations, the lower their expectations of paying full salaries and the higher the possibility they will impose pay cuts. Among respondents that expect to resume work in June or after, in absolute terms and proportion, companies expecting to cut pay by 50% or more were the highest, at 21, accounting for 13.73%, which was 8.33 percentage points higher than the total (5.40%).

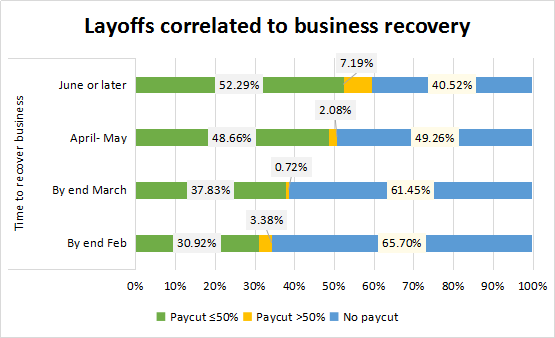

For layoffs, we see a similar trend. The later companies expect full recovery, the lower their expectations of zero layoffs, and the higher they judge the chance of layoffs. In the group expecting operations to resume in full either in June and after, the absolute number and proportion of companies expecting more than 50% layoffs were the highest, accounting for 11.19%, a proportion 4.67 percentage points higher than for the sample as a whole (2.52%).

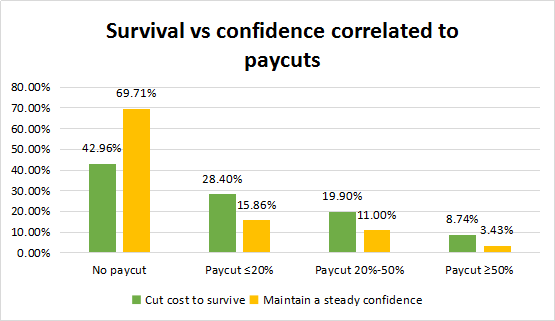

2. In analyzing the correlation between existential threat to survival, maintaining confidence and expectations for pay cuts, we found that companies more focused on maintaining confidence at this stage are more likely to pay salaries in full than companies focused mainly on survival. Conversely, when companies are more focused on ensuring survival at this stage, they are more likely, to various degrees, to consider pay cuts than the confidence maintenance group.

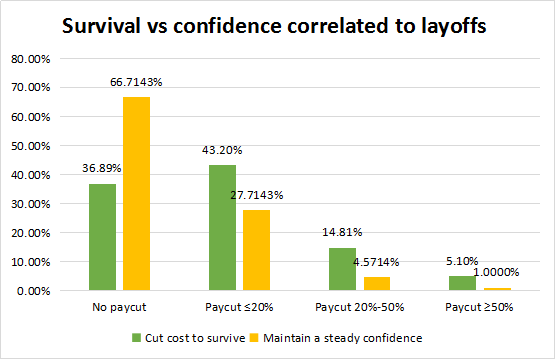

When analyzing the correlation between survival and confidence assurance and layoffs, we found similar results: When companies are more inclined to focus on maintaining confidence at this stage, they are 30 percentage points more likely to select zero layoffs than those focused on survival. Conversely, when companies are more focused on survival at this stage, their layoff preferences are, to various degrees, higher than those in the confidence group.

In analyzing the correlation between existential threat to survival and preserving confidence, we found that of the industries surveyed, the three industries with the highest percentage level of confidence are: Agriculture/ Forestry/ Animal Farming / Fishing (76.19%), Transportation/ Shipping/ Logistics/ Warehousing (75.00%), and Production/ Processing/ Manufacturing (67.49%); while the business services sector is 51.85% focused on survival (this is also the only industry with a confidence level below 50%). This is followed by Culture/ Media/ Entertainment/ Sports (48.48%) and Services (45.05%).

Summary and outlook

The above are the main findings of the analysis of the survey results, from which we can see that under the attack of the COVID-19 epidemic, the entrepreneurial group represented by CKGSB’s executive students showed the following common characteristics in their decisions on returning to work:

- Strengthening confidence and people-orientation: In the current situation, more entrepreneurs have opted to seek to maintain confidence and improve team cohesion. Most have chosen not to cut pay or lay off staff, deciding to focus on employee health and safety under these difficult business conditions;

- Overcoming difficulties and responding actively: While actively seeking policy support, most companies are focusing on internal preparations, adjusting operational and managerial tactics, protecting their cash flow, and expanding financing channels;

- Transforming and innovating: this unprecedented shock has forced companies to accelerate transformation and upgrading, focus on building organizational capabilities, and develop breakthrough innovations to enhance their core competitiveness.

The results of this survey reveal an important component of entrepreneurial leadership and organizational capabilities: resilience. The ability to recover and rebound after a period of adversity is key to the long term survival and success of a company. Adversity is both a test and experience of resilience. The more severe the adversity, the more difficult the organizational choices faced, and the greater the resilience an organization develops.

At the same time, in an epidemic, watchfulness between individuals, businesses and communities is increasingly important. In the face of great uncertainty, the sharing of information, resources and organizational capabilities not only helps individuals cope, but also gives rise to new cooperation models, formats and governance systems. This survey is also an attempt by the CKGSB Leadership and Motivation Research Center to develop a “co-creative” research model, focusing on the latest news, taking pain points faced by entrepreneurs as our starting point, and sharing perspectives backed up by statistical analysis.

Note: The above comprises the main findings of the Epidemic Busting Series Survey #1: Work Choices—The Game of Survival and Confidence. The full report with the remaining surveys will be released soon.