What is happening to China’s once-booming unicorn ecosystem? Why are unicorns, previously fueled by rapid growth and aggressive capital, now struggling to differentiate themselves?

In this article, we explore why unicorns have now chosen to adopt more pragmatic strategies, how government-backed funds are becoming the dominant players, and what trends are shaping the future of startups.

01 The New Trends in China’s Unicorn Ecosystem.

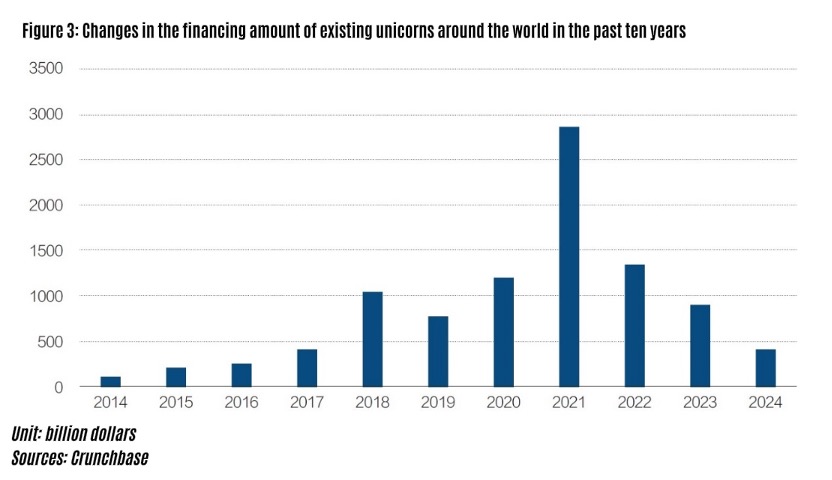

As high-risk, high-reward investments, the slowdown in the growth of unicorns is largely due to more cautious investors. According to data from the global venture capital platform Crunchbase, the amount of capital flowing into unicorn companies has significantly decreased compared to previous years (see Figure 3), making it challenging to sustain the rapid growth that we have seen before.

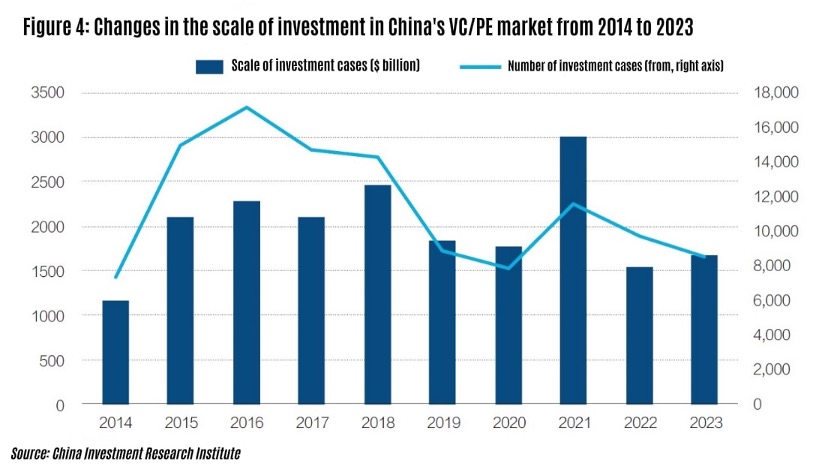

In China, the scale of venture capital (VC) and private equity (PE) investment has hit its lowest point in a decade (see Figure 4). Multiple factors have contributed to this situation, which has led to the bursting of the valuation bubble for many startups:

- Global economic uncertainty,

- Slower economic growth both domestically and internationally,

- Rising capital costs due to the U.S. Federal Reserve interest rate hikes,

- Geopolitical risks,

- Ongoing trade and technology tensions between China and the U.S.,

- Increased domestic regulation of emerging and financial sectors, among others.

The mindset around entrepreneurship and investment has become more rational, shifting away from the unchecked pursuit of growth and expansion towards prioritizing long-term value and profitability. Even China’s tech giants, once heavily invested in startups, are now pulling back.

China’s unicorn ecosystem is transitioning from one investment cycle to the next. A key emerging trend within this ecosystem is the combination of industrial support policies, government-guided or industrial investment funds, state-owned investment institutions, and industry-driven investments.

The mindset around entrepreneurship and investment has become more rational, shifting away from the unchecked pursuit of growth and expansion towards prioritizing long-term value and profitability.

According to research from Zero2IPO Research, the proportion of investment by state-owned institutions in China’s equity market rose from 10% in 2019 to 22% in 2023. This trend reflects a structural shift in the composition of primary market funding in China:

- An increase in the proportion of state-owned investors and a decline in foreign investment,

- The gradual disappearance of market-driven limited partners (LPs),

- A significant retreat of the U.S. venture capital firms,

- State-owned and industrial capital supporting national strategies becoming the primary investors in RMB-denominated funds,

- Policy-driven LPs and industrial capital dominating primary market funding,

- The frequent establishment of government-guided funds with capital in the hundreds of billions.

However, post-pandemic, the financial health of local governments has become strained, limiting the scale of funds available for investment in emerging enterprises. Furthermore, a sluggish real estate market has reduced revenues from land sales, further shrinking available capital for startups.

In terms of venture capital fund size, since 2023, the domestic market has been on a downward trend. Indicators such as fundraising amounts, investment volumes, the number of investment events, and the establishment of new investment firms have all declined. Many investment firms created in previous years are now undergoing consolidation, with state-owned investment firms accounting for an increasing market share and adopting a more cautious investment style. More policies are being introduced at the national and local levels to guide patient capital into the market.

Government-backed funds typically target enterprises that are ‘specialized, refined, unique, and innovative.’ These companies often possess strong innovation capabilities, a significant market share, and key technologies. Additionally, they align with national priority industries, establish their headquarters locally, and contribute to job creation and tax revenue.

Policy-driven investments in emerging industries are no longer solely focused on rapid growth in valuations but are increasingly characterized by early-stage, smaller-scale, and technology-driven investments. Hard technology companies, in particular, face longer and more challenging commercialization cycles, leading to the emergence of unicorns primarily driven by advanced technological innovation and the digital and intelligent transformation of industries.

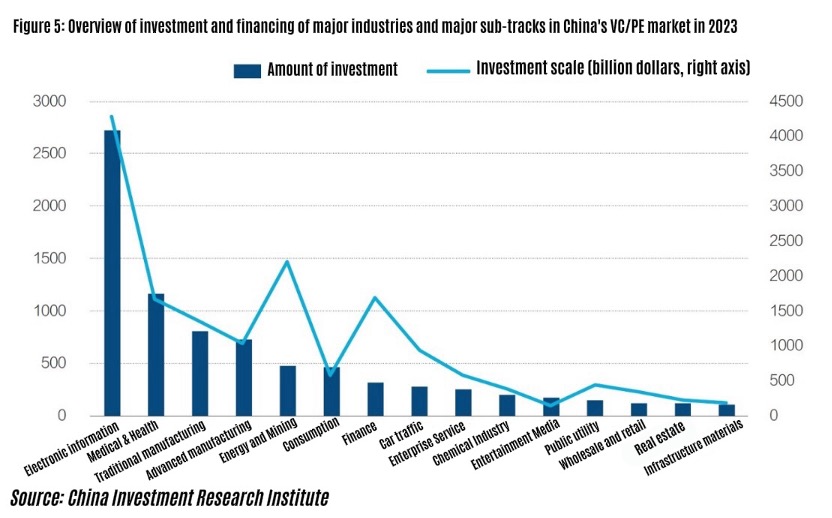

In the new industrial cycle, technological innovation has become the dominant theme in China’s investment market, with the electronic information sector leading the charge and generating the highest returns in terms of exits.

Compared to the previous emphasis on “Mass Entrepreneurship and Innovation,” today’s startups are valued more for their technological attributes and commercial viability. The focus of investment has shifted from sectors such as financial innovation, consumer internet, and the sharing economy to strategic emerging industries like semiconductors, new energy, and high-end manufacturing—fields with hard technology attributes. This shift aims to meet the demand for domestic substitution while empowering the optimization and upgrading of the real economy’s industrial structure.

In the new industrial cycle, technological innovation has become the dominant theme in China’s investment market, with the electronic information sector leading the charge and generating the highest returns in terms of exits (see Figure 5). Among the various sub-sectors, the semiconductor industry has been the most active. Since 2023, the top five industries with the most investment cases have been semiconductors and electronic equipment, IT, biotechnology or healthcare, machinery manufacturing, and clean technology or new energy.

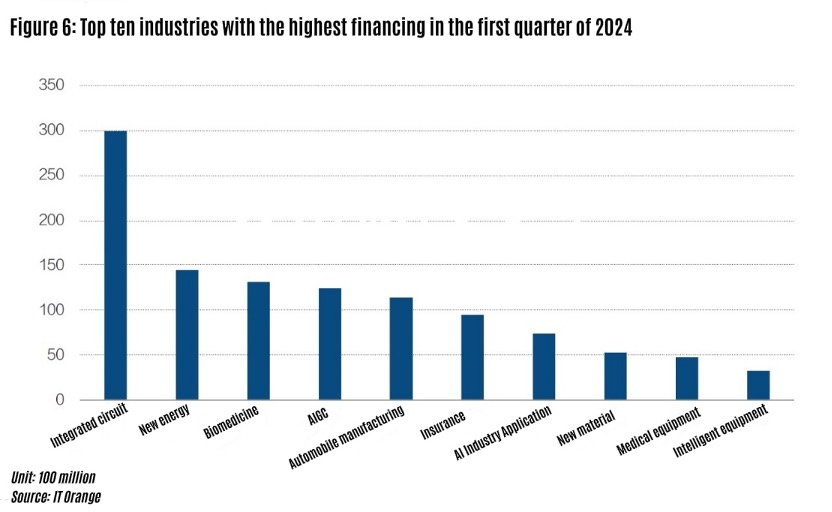

One of the most exciting trends is the rise of generative AI, which has made artificial intelligence the hottest trend in business innovation. From infrastructure to commercial applications, AI is driving the emergence of new unicorns. In the first quarter of 2024, financing in AI-generated content (AIGC) and AI industry applications reached nearly 20 billion RMB, surpassing new energy investments and trailing only the integrated circuit sector (see Figure 6).

02 New Challenges for Unicorns.

The evolution of entrepreneurial trends is now responding to the new demands of the digital economy. With the mobile internet surge driven by smartphones slowing down, the once-successful platform economy model—building a strong business narrative, attracting investment, spending heavily on user acquisition, and aiming for an overseas IPO—has lost its viability.

Unicorns today must embrace a more pragmatic approach to growth, as capital-driven strategies are becoming harder to leverage for differentiation. In this environment, technology-driven companies are now expected to play a greater role in empowering the real economy. Whether focused on soft or hard technologies, businesses must demonstrate genuine technological value. Founders with strong academic backgrounds and R&D expertise—often termed “scholar-type” or “expert-type” entrepreneurs—are increasingly sought after by both investors and the market.

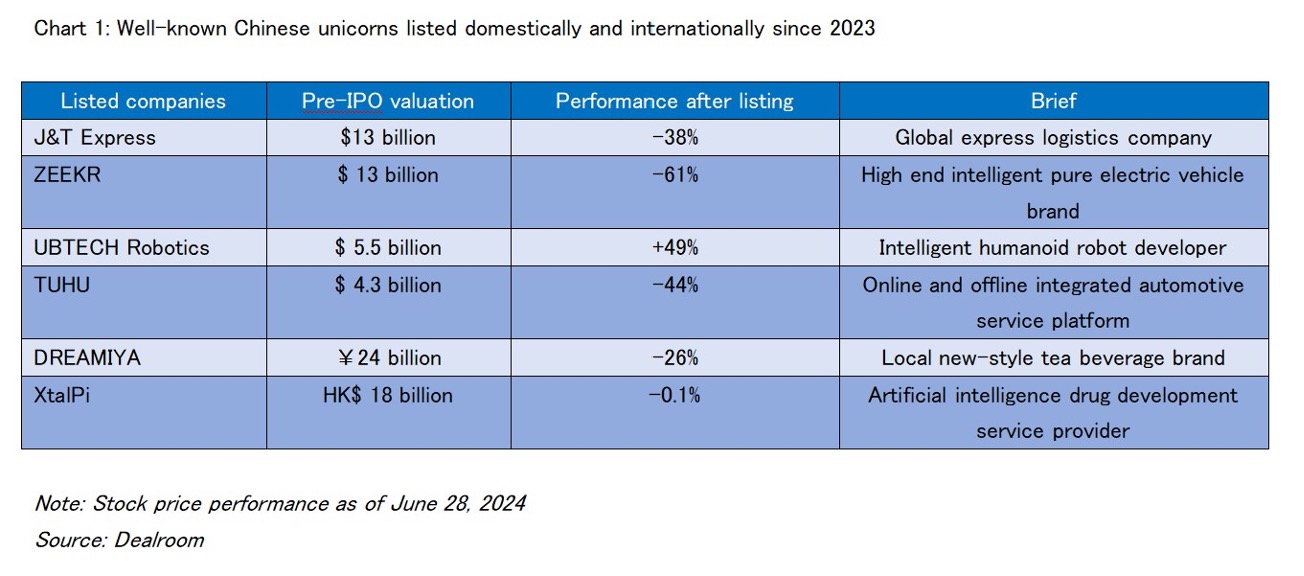

How do unicorns leave the stage? Unicorns that were previously overvalued have struggled after listing (see Chart 1), dampening investor confidence in unicorn valuations. For Chinese unicorns, stricter regulatory oversight in both A-shares and U.S. markets, higher IPO thresholds, and sluggish performance in A-share and Hong Kong stock markets have significantly reduced the scale of IPO exits. As a result, unicorn investors have limited exit opportunities and lower returns, making financing more difficult.

What does the future hold for Chinese unicorns? As the article reveals, the investment environment has shifted away from the high-risk, capital-driven model of the past, towards one focusing on long-term value and technological innovation. The question remains: Will today’s unicorns rise to this challenge, or will new, more innovative players take their place?

Note: This article was originally published in Caijing Magazine in Chinese.

https://www.mycaijing.com/article/detail/529240?source_id=43

By Teng Bingsheng, Professor of Strategic Management and Associate Dean for Strategic Research, CKGSB; and He Jianshi, Researcher at the Global Unicorn Ecosystem Research Center, CKGSB.