China is revising the laws that govern the variable interest entity, a complicated structure used by many companies to bypass foreign investment restrictions. What are the implications?

Last month, China’s Ministry of Commerce released a draft of the Foreign Investment Law, a new piece of legislation that attempts to integrate, update and replace the existing laws on foreign investment made more than a decade ago.

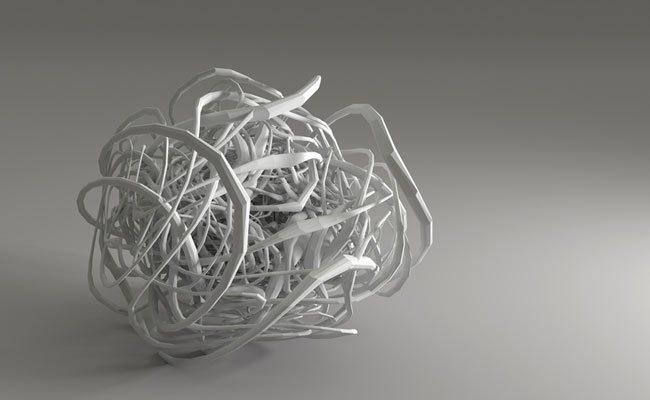

The draft has since drawn a lot of attention because it would rein in a well-known but circuitous company structure called variable interest entity (VIE), which is used by many overseas-listed Chinese internet firms such as Baidu and Alibaba to bypass foreign investment restrictions. Under a basic VIE structure, foreign investors buy into an offshore shell company, which, through a complicated web of contracts, controls the domestic company holding licenses to operate in industries otherwise under strict government control. According to the draft, foreign investors who adopt similar arrangements to invest in restricted areas would be subject to not only heavy penalties but also imprisonment.

But it doesn’t mean that all VIEs would become illegal. An interpretation document released along with the draft proposes that if the actual controllers of the companies are proven to be Chinese nationals, the VIEs shouldn’t be considered as foreign entities. In addition, industries closed to foreign investors could be opened up later as policies shift, which means that existing VIEs might not be violating any restrictions by the time the law goes into effect.

On the other hand, the future of VIEs is only one issue addressed in the draft, which also covers other areas including loosening the approval system for foreign investment and establishing a routine supervision mechanism.

To help you better understand the implications of the newly proposed rules, we talked to Wang Shuo, partner at Allbright Law Offices, Shanghai’s biggest law firm by revenue. Wang has advised on multiple cross-border initial public offerings (IPOs) and domestic asset acquisitions for foreign companies.

Interview excerpts:

Q. What are the major differences in the new draft from current laws on foreign investment?

A. The three current laws that regulate foreign investment are outdated—they were designed in accordance with old tax policies that benefited wholly foreign-owned entities (WFOE) or joint ventures before the 2006 tax reform, which leveled up the income tax rate for domestic and foreign-invested companies.

So the new draft is a reflection of the new policy environment, which is that foreign investment will be granted so-called national treatment in all non-restrictive industries. The government has been moving towards the direction for a few years and it is an important step to further reform and open up China’s economy.

Under the current legal system, there’s a strict industrial catalogue that defines what foreign investors can invest in and how much they can invest in. It’s highly limited and also leaves industries not on the list in a legal grey area.

The new draft proposes to replace the catalogue with a negative-list, which means that in theory, anything off the list should be equally open to foreign investment.

Going forward, I think the negative-list will gradually shrink and more and more industries will be open to foreign investors. The government has already been giving up approval powers in the past few years, and the new draft also abandons the current approval system in non-restrictive industries (foreign investors can enter without seeking approvals). So overall I think the new draft is a game changer if it becomes law.

Q. What does it mean for existing and future VIEs?

A. It’s quite clear in the interpretation document that the government would allow existing VIEs in restricted industries to operate as long as their actual controllers are Chinese nationals. But the uncertainly is that what will happen to current VIEs that are, in fact, controlled by foreign investors? This is an issue that the draft didn’t clearly address.

And if the draft becomes law in the future, it’ll have a great impact on companies’ decisions [regarding] whether to adopt a VIE structure. For example, if a foreign-invested company can be recognized by the government as an entity controlled by Chinese nationals, then it doesn’t need to adopt the structure to go public.

In addition, one important reason that internet companies chose to list overseas is that the Shanghai stock market has strict restrictions on profitability and valuations—JD.com, which is still making losses, wouldn’t be allowed to list in Shanghai under current rules. But as the capital market reforms go on, the regulations may soon change and give internet companies more opportunities to list in domestic markets. So in all, I think less and less companies will resort to VIEs to go public going forward.

Q. Which industries do you think will be opened more to foreign investment?

A. As for specific industries, I think it’s going to depend on a complicated policymaking process by various departments and regulators of the central government. It’s safe to say that restrictions will remain in those highly strategic or sensitive industries such as energy and finance. On the other hand, I think it’s likely that there will be fewer restrictions in the internet industry because it involves the legalities of a lot of giant internet companies that are listed in offshore markets.

Q. The draft proposes that since foreign investment will no longer be subject to government approvals in non-restrictive industries, there should be a regular inspection mechanism to make sure foreign investors are in line with the law. Does it mean that foreign companies will face more scrutiny from the government in their day-to-day operations?

A. I think inspections are already a part of the current system. The Ministry of Commerce and the State Administration of Foreign Exchange keep very strict supervisions on fund flows and usages in foreign investment.

And since we’re moving towards giving foreign investors national treatment, foreign companies will only be subject to similar levels of supervision applied to domestic companies. It’s hard to imagine that the government can suddenly become the Gestapo and go after foreign companies. It’s contradictory to the very idea of boosting foreign investment by abandoning the red tape in the approval system.

Q. The draft is still seeking public comments. When do you think it’ll become law?

A. I think it may take quite some time before it becomes law. It’s possible that there’ll be multiple rounds of drafts—it’s a way for the government to get feedbacks from various interest groups, including those VIE companies.

Also, the Ministry of Commerce is only one department in the State Council. It may also involve input from National Development and Reform Commission (NDRC) or other regulators who have authority over this subject. Provincial officials may offer their own opinions as well.

So in my opinion is that the draft isn’t going to become law in 2015. A rather optimistic prediction is that it’ll reach the National Congress (China’s top legislature) by 2016.