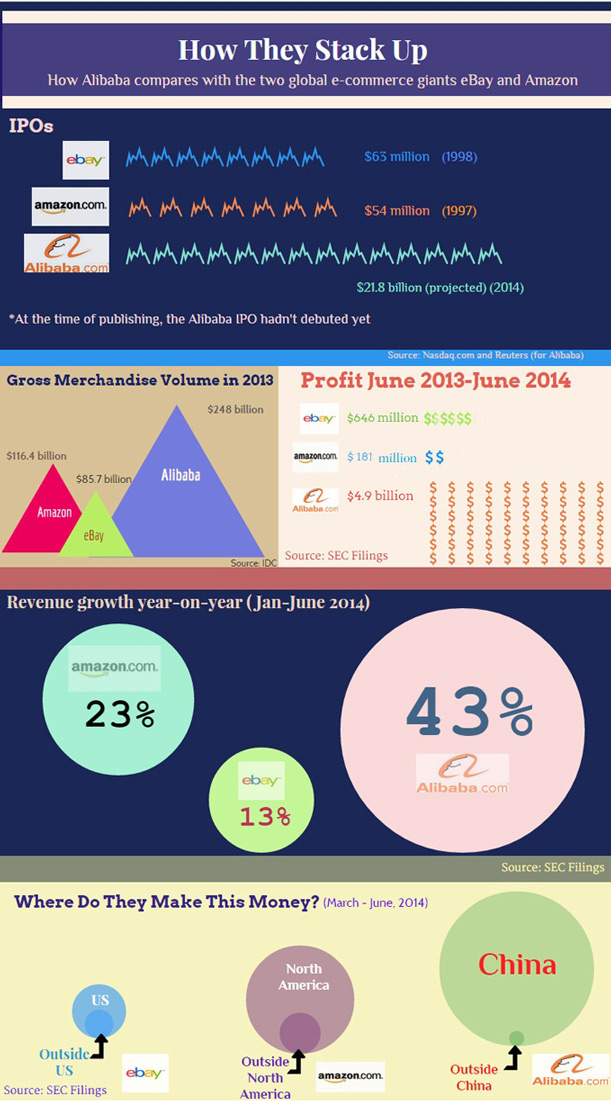

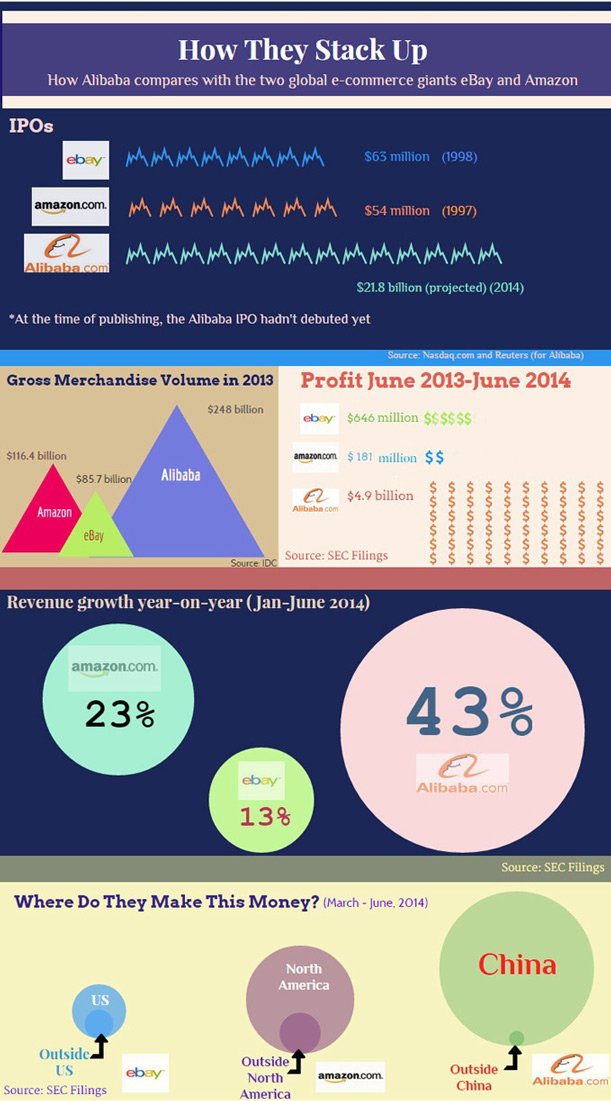

How do the three e-commerce giants stack up? We take a look at Alibaba vs Amazon vs eBay.

With Alibaba poised to join the US stock markets in barely hours from now, we offer you a glimpse of the size and might of China’s e-commerce behemoth. We compare it to two of its western counterparts: eBay and Amazon. Riding high on China’s consumer and entrepreneurial boom, Alibaba is already bigger than Amazon and eBay combined in terms of total transaction volume. On Single’s Day last year (11 November 2013), Alibaba’s transaction volume was a whopping $5.7 billion in one day! On a whim we did a back-of-the-envelope calculation back then which left us dumbfounded: if Alibaba were a country and if we use that day’s sales as a proxy for GDP, it would be the 148th-largest country in the world ahead of the likes of Malawi and Bermuda.

At the initial public offering price of $68 a share, Alibaba’s value now stands at $167.6 billion and is poised to replace Amazon as the world’s largest online retailer by market capitalization.

Intrigued? Read on.

As you can see from the graphic, the transaction value on Alibaba’s shopping platforms, thanks to its dominance in China’s vast e-commerce market, is bigger than that of Amazon and eBay combined.

The firm has also shown strong growth momentum in recent quarters, outpacing its American counterparts in revenue; some investors estimate that its profit will grow to $7 billion in 2015.

However, one of the uncertainties about Alibaba’s future growth is whether it can compete head-to-head with Amazon and eBay on a global scale.

Currently less than 10% of the company’s revenue comes from outside China, while Amazon and eBay enjoy a much bigger slice of the international market. On the other hand, Alibaba’s two competitors are not doing well in China at all—eBay pulled out of the Middle Kingdom way back in 2012, while Amazon China has garnered a mere 2.7% of the local market, according to China E-Business Research Center.