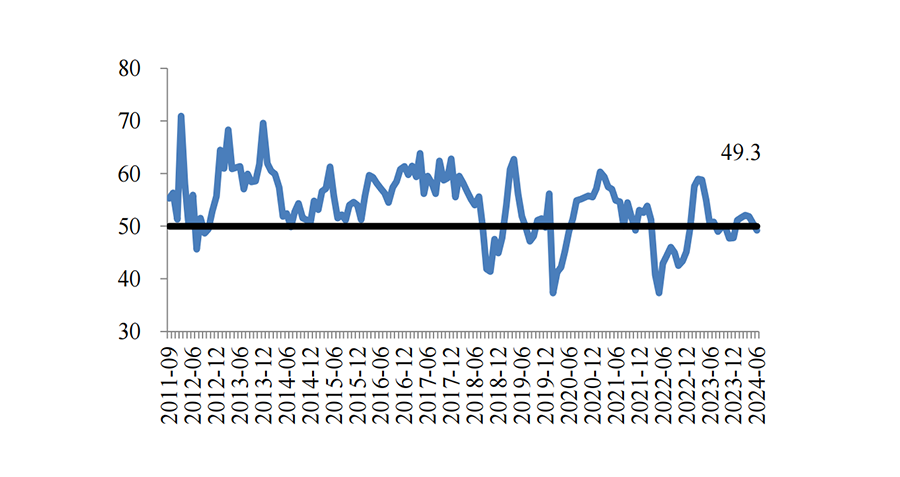

The CKGSB Business Conditions Index (BCI) is a pioneering research project initiated by Dr. Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business (CKGSB). Launched in September 2011, the BCI is a forward-looking, monthly survey that gauges the confidence sentiment of private business owners in China. Over the past 13 years, the index has revealed critical insights into China’s evolving economic landscape, offering a comprehensive view of the challenges and opportunities private businesses face.

Since its inception in 2011, the CKGSB BCI has consistently highlighted several structural characteristics and trends within the Chinese economy. By examining data from past indices, we can draw meaningful conclusions about China’s economic performance and the factors influencing it.

1. Economic Growth and Private Enterprise Challenges

China’s economy has seen remarkable growth over the past few decades, yet this growth has been accompanied by persistent challenges for private enterprises. The BCI data reveals that private small and medium-sized enterprises (SMEs) in China, despite their efficiency and innovation, continue to struggle with financing issues. This resource mismatch has been a significant obstacle, preventing many high-potential companies from achieving their full growth potential.

For example, the financing environment for private SMEs has remained challenging, with high costs and difficulty in securing loans. This has been a recurring theme in the BCI reports, emphasizing the need for policy reforms that can ease access to capital for private businesses. Addressing these financing challenges will be crucial for sustaining economic growth and fostering innovation within the private sector.

2. Impact of Economic Policies

The BCI has consistently shown that economic policies have a profound impact on the business conditions of private enterprises. Notably, the stringent financial market regulations implemented in 2018 led to a sharp contraction in financial resources, adversely affecting the operating conditions of surveyed companies. This underscores the sensitivity of private SMEs to policy changes and the importance of a stable and supportive regulatory environment.

The data also indicates that policy measures aimed at stimulating the economy, such as those implemented during the COVID-19 pandemic, had mixed effects. While initial measures provided a boost to economic activity, the resurgence of challenges such as deflation and sluggish demand highlighted the need for sustained and well-targeted policy interventions.

3. Deflationary Pressures and Economic Stability

One of the most significant findings from the BCI data has been the persistent deflationary pressures within the Chinese economy. Despite official government statements to the contrary, the BCI price index has indicated deflationary trends, particularly in the prices of intermediate products. This discrepancy underscores the importance of independent data sources in providing an accurate picture of economic conditions.

Deflationary pressures pose a risk to economic stability, as they can lead to reduced consumer spending and investment. The BCI data suggests that addressing deflation will require targeted measures to stimulate demand and support price stability. This will be critical for maintaining economic momentum and ensuring long-term growth.

Based on the comprehensive data provided by the CKGSB BCI, several predictions can be made about the future of China’s economy:

1. Continued Importance of Private SMEs

Private SMEs will remain a cornerstone of China’s economic fabric. Policies that enhance their financing capabilities and operational efficiency will be key to future growth. By improving access to capital and reducing regulatory burdens, policymakers can support the development and expansion of these vital enterprises.

2. Policy Reforms

Reforms aimed at creating a stable and conducive financial environment will be essential for driving economic progress. Ensuring that economic policies support rather than hinder private enterprises will be crucial for sustaining growth and fostering innovation. This includes measures to improve the transparency and efficiency of financial markets, as well as targeted support for sectors facing the greatest challenges.

3. Focus on Innovation and Sustainability

The future of China’s economy will increasingly depend on innovation and sustainable practices. Encouraging entrepreneurship and sustainable business models will be critical for long-term success. This includes investing in research and development, promoting green technologies, and supporting the transition to a more sustainable and resilient economic model.

The CKGSB Business Conditions Index has become an indispensable tool for understanding the confidence sentiment of private business owners in China. Its insights over the past decade offer valuable lessons and predictions for the future, emphasizing the need for policies that support SMEs, encourage innovation, and address structural challenges in the economy.

With nearly 400 alumni companies participating in each month’s survey, the CKGSB BCI will continue to provide critical data and analysis, helping to shape informed economic policies and support the growth and development of China’s private sector. By leveraging these insights, we can work towards a more vibrant, resilient, and sustainable Chinese economy.