The CKGSB Business Conditions Index shows that companies are expecting the Chinese economy to encounter some difficulties in the coming six months.

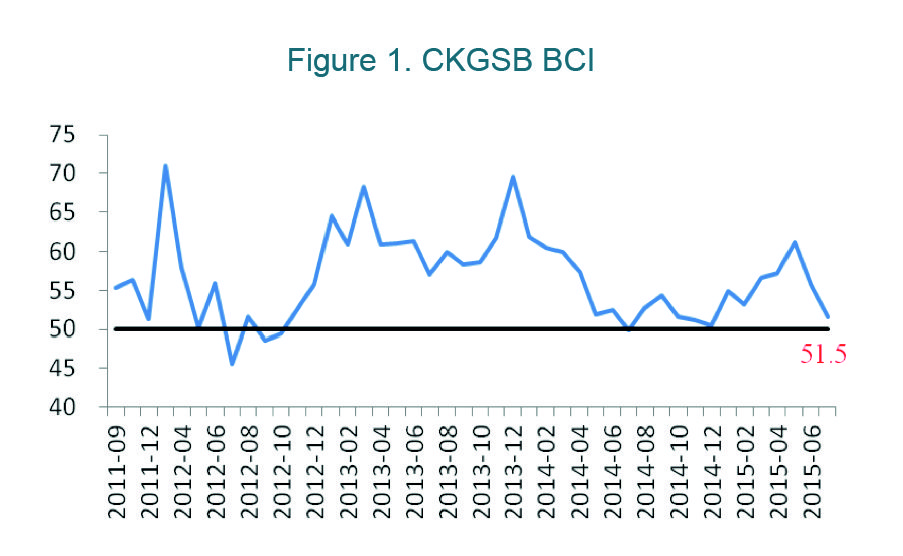

In July 2015, the CKGSB Business Conditions Index (BCI) registered 51.5, a drop on June’s index of 55.6, and now only just above the confidence threshold of 50 (Figure 1). In May 2015, the BCI was at a considerably higher 61.3, but the past two months have taken almost 10 points off the index. This shows that for the majority of relatively successful firms in China, optimism in business conditions over the next six months has been cooling. According to our sample, companies are expecting that the Chinese economy will encounter some difficulties over the next six months. The extent of the trouble will need further examination.

The CKGSB BCI comprises four sub-indices for corporate sales, corporate profits, corporate financing environment, and inventory levels. Of these four sub-indices, three are forward-looking indicators, and one, corporate financing, measures current business sentiment. These four sub-indices for July are discussed below:

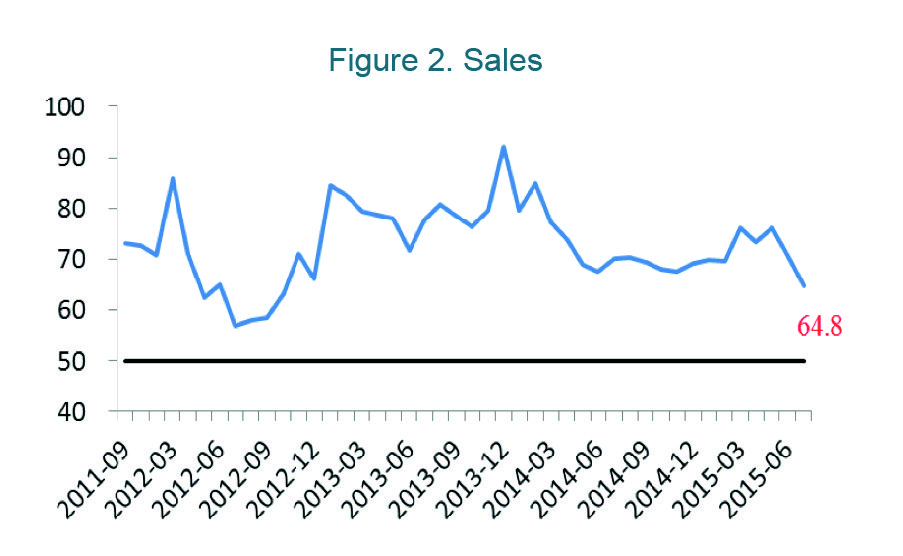

The corporate sales index echoed the overall index by experiencing a sharp decline, from 70.8 in June to 64.8 in July. Of the four sub-indices, just one rose in July, and the other three dropped. The best performer of the four, the sales index, fell six points. However, they remain above the confidence threshold and therefore represent firms’ continued optimism in these areas.

For profits, the situation is similar. The index has clearly fallen this month, now registering 48.6, which is below the confidence threshold. As Figure 3 shows, in nearly four years of surveying, a number below the confidence threshold has been rare. This reading shows that companies have a slightly negative outlook on expected profits over the next six months.

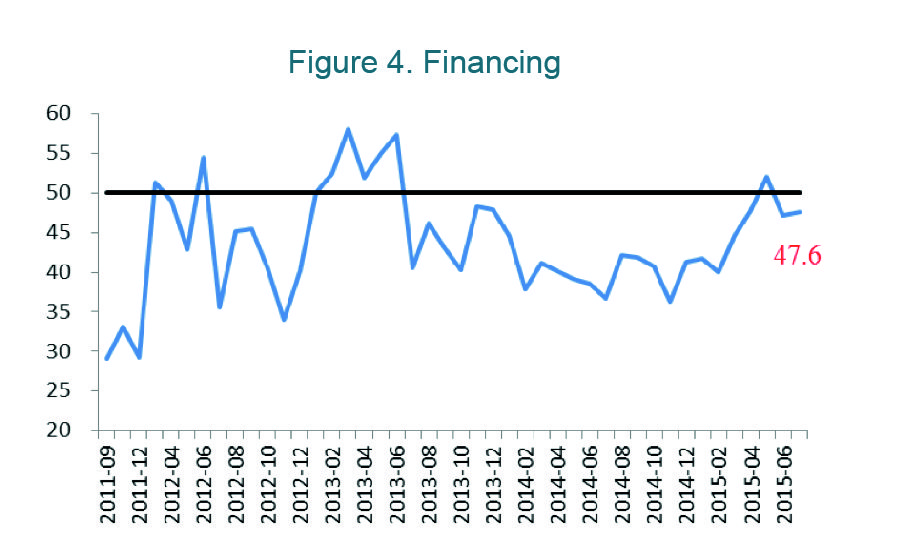

The financing index rose in July—the only one of the four sub-indices to rise—from 47.2 to 47.6. However, we should note that this figure is still below 50. If we take a longer term perspective, the financing trend has been U-shaped in the period since June 2013. At present, the index is performing relatively well. Our sample of mainly private Chinese small and medium-sized enterprises (SMEs) focused on the domestic market do face difficulty obtaining and dealing with the high cost of financing. However, given a lengthy period of underperforming of this indicator, the financing situation is not as dire as in the past.

The government has made a public commitment to boost the availability of social financing. However, while economic stimuli have been thrown into the mix, social financing has not grown alongside. In the 25 months from June 2013 to June 2015, the scale of social financing has only seen positive year-on-year growth for seven months, with the rest of the period in negative figures. In the past year, growth in social financing has occurred in just two months.

In 2014, the central bank reduced the statutory reserve twice, in April and in June, aiming in part to support small and micro-enterprises. With the shift to a slower pace of growth in China, private SMEs have experienced difficulty obtaining financing, which means year-on-year growth in social financing has been extremely weak. A slower GDP growth rate may give SMEs a greater risk of default compared with state-owned companies. To protect themselves from this, financing institutions have tightened borrowing rules rather than relaxing them. Even if there is official support on paper, the money flow to private SMEs is still restricted by the economic reality, and financing has not been made easier at all.

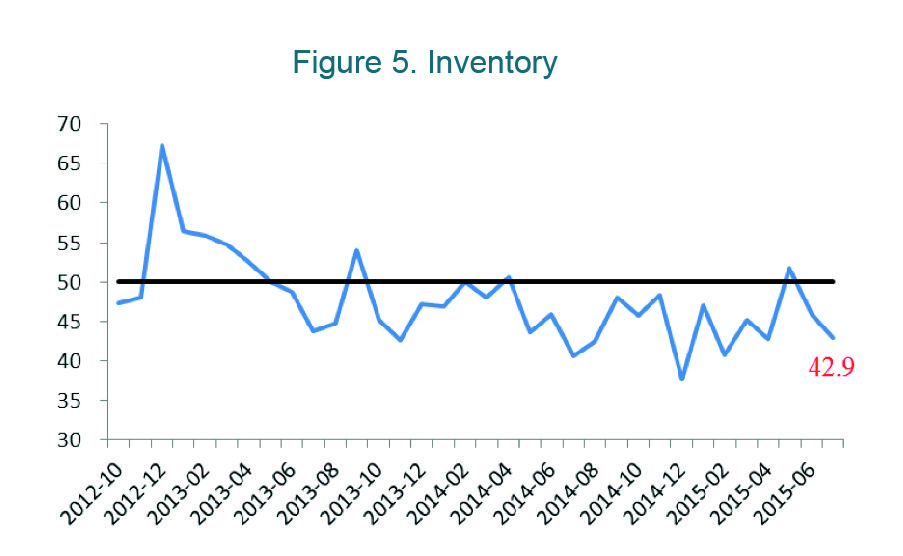

The index measuring inventory levels registered 42.9 in July, a fall on last month’s index of 45.9. In May, confidence in the ability to shift inventory had risen above the confidence threshold to 51.7. Since then, private SME businesses have appeared to lose their regained confidence in inventory turnover.

In May 2015, the overall index and its four sub-indices all rose. In June they all fell, and in July three of them fell. Recently, the National Bureau of Statistics announced that GDP growth in the first half of 2015 was 7%, exactly on target. On a sequential basis, quarterly growth has risen sharply, from 1.4% in the first quarter to 1.7% in the second. Now, official and market commentators mostly believe that the economy will be better in the second half of 2015, or at the very least will not be worse. Our data cannot support or refute this view, but from the perspective of business operations, a lot of structural problems have still not seen significant relief, so even if the second half of the year sees an economic improvement, the situation next year will probably still not be great.

The CKGSB Business Conditions Index is produced by Cheung Kong Graduate School of Business’ Case Center and Center for Economic Research under the direction of Li Wei, Professor of Economics and Emerging Markets Finance.