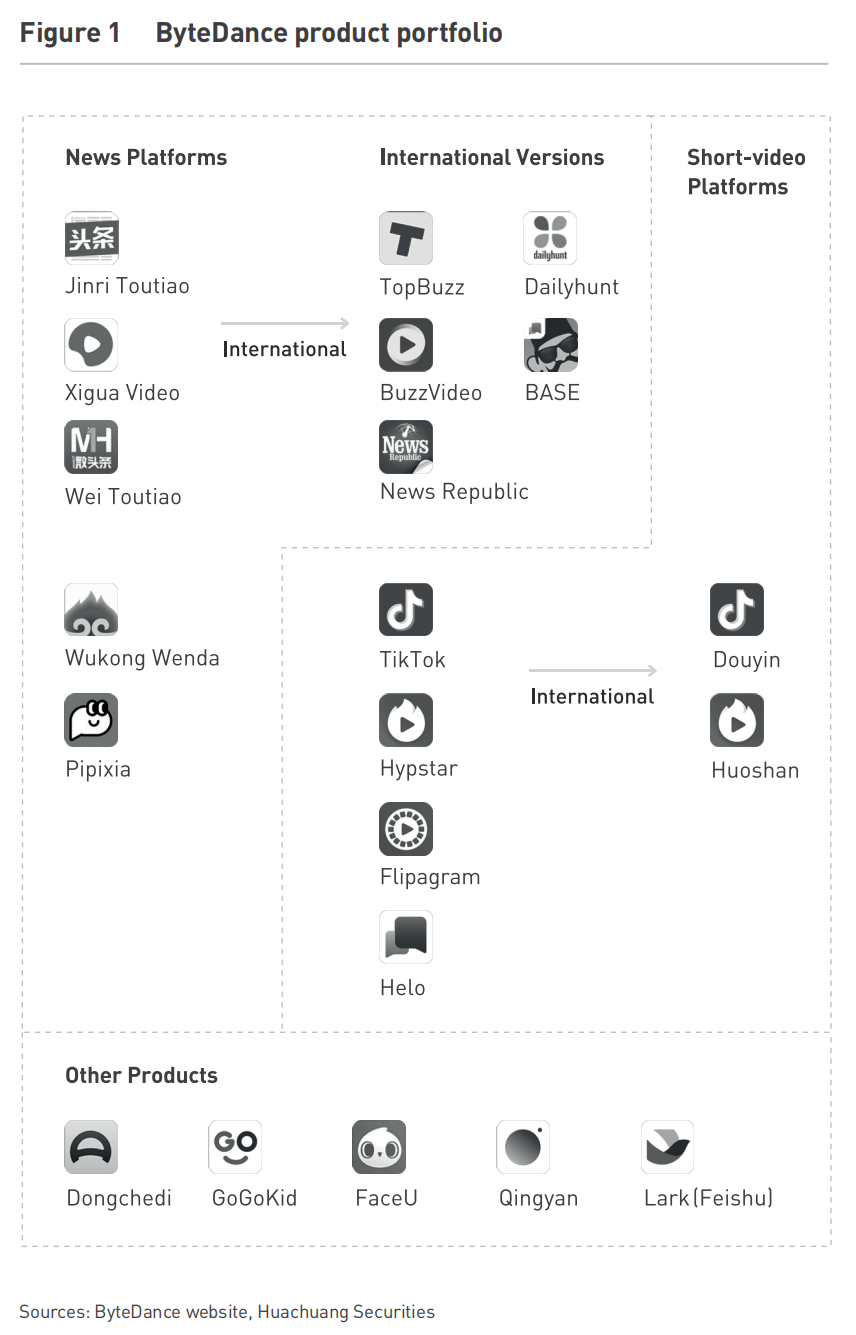

ByteDance has evolved into one of the most globalized Chinese internet companies, driven by innovative algorithms, a diversified content ecosystem, and aggressive international expansion. In 2022, the company’s revenue surpassed USD 80 billion, a 30% YoY increase. TikTok alone reached 150 million monthly active users (MAU) in the U.S. by 2023. This article will introduce ByteDance’s globalization in three acts, highlighting its strategic growth through Toutiao, Douyin, and TikTok. However, geopolitical tensions, particularly in the U.S. and India, have created significant roadblocks for its continued global expansion.

Act 1: Toutiao – The Foundation of ByteDance

In 2012, Zhang Yiming founded ByteDance with the launch of Toutiao, a news aggregation platform powered by AI. – Toutiao’s breakthrough was its personalized content recommendations, which reshaped how users consumed news in China.. By 2014, Toutiao had secured USD 100 million in Series C funding, boasting 120 million users and 40 million MAU. Key to its success was a proprietary recommendation algorithm, which became the foundation for future ByteDance products, including TikTok’s ‘For You’ feed. Seamlessly integrating into ByteDance’s broader growth strategy, Toutiao’s success was largely attributed to its innovative business model and revenue structure:

- AI-Powered Personalization: Toutiao’s algorithm continuously adapted to user behaviors,, significantly increasing engagement and content consumption..

- Advertising Dominance: By 2017, Toutiao’s personalized news feeds became a leading digital advertising platform in China, generating positive cash flow within its first year.

- User-Generated Content (UGC): With the 2014 launch of “Toutiaohao”, the platform enabled users to create and distribute content, attracting 10,000 media partnerships by 2019.

- Global Expansion Challenges: While TopBuzz, its first international product, gained initial traction, it failed to replicate Toutiao’s success due to intense competition from Google News and Facebook.

Act 2: Douyin and the Short-Video Boom

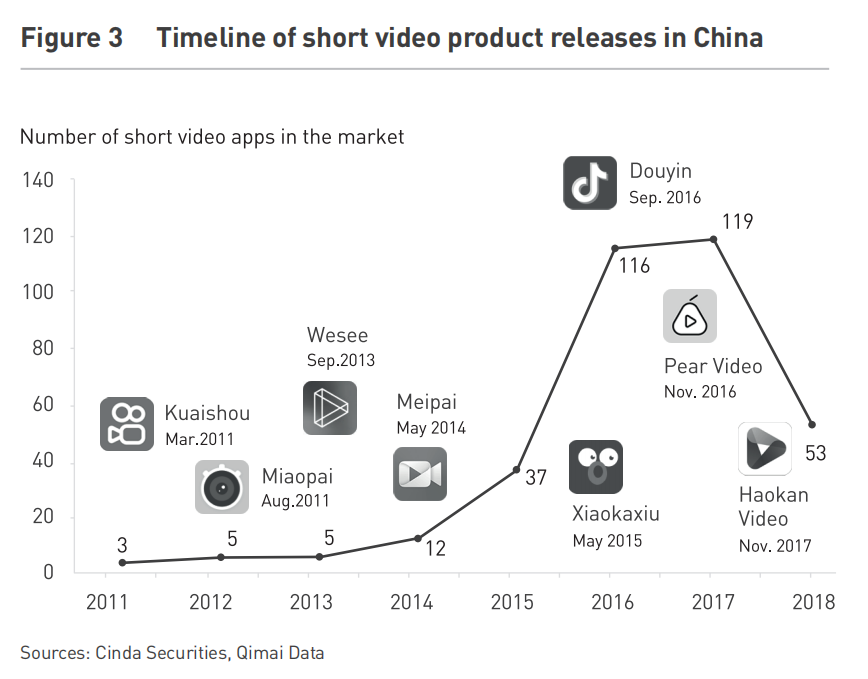

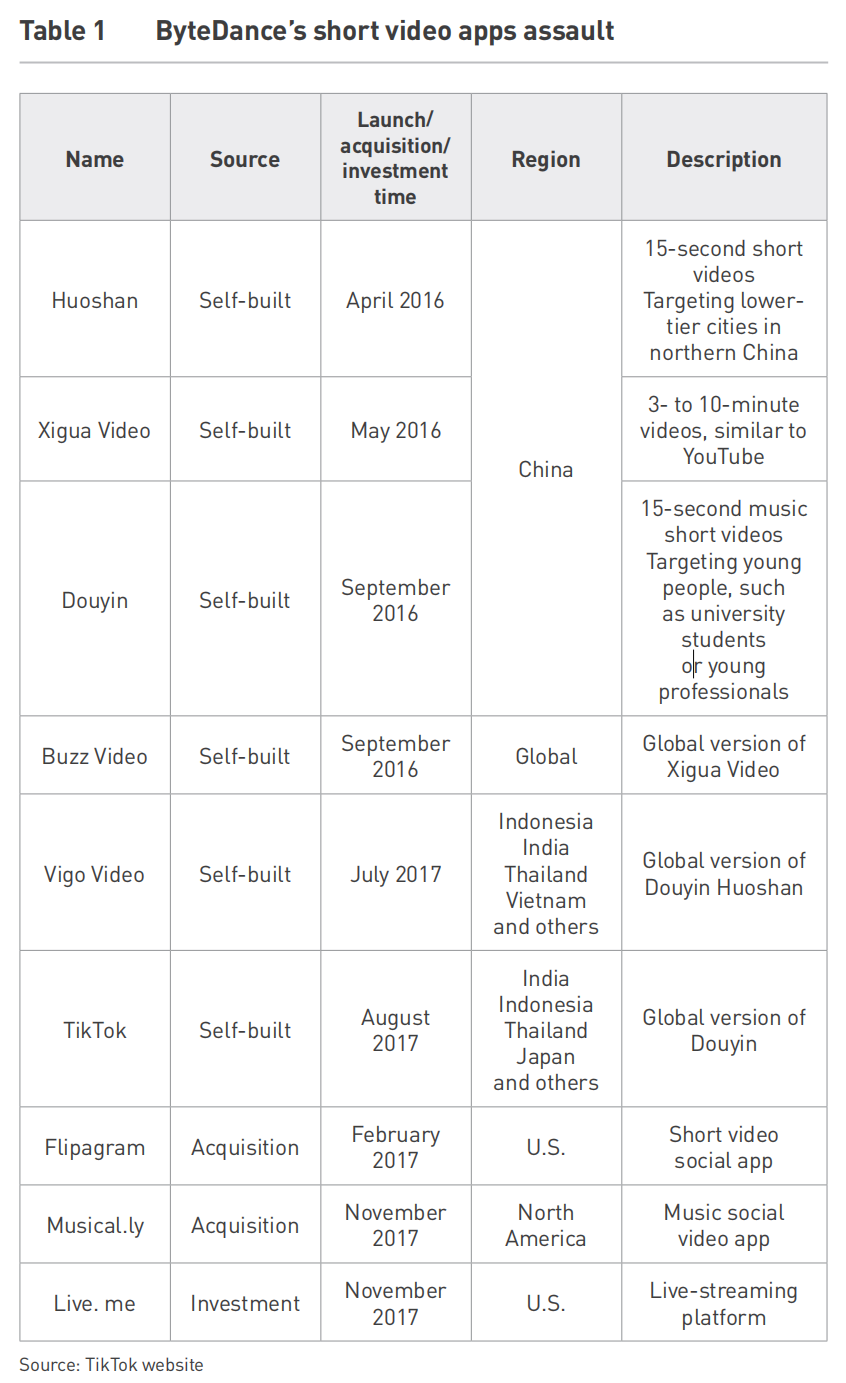

As consumer preferences shifted toward short-form video, ByteDance launched multiple short-video apps in 2016, including Douyin and Huoshan. Douyin quickly emerged as the leader, leveraging AI-powered recommendations and an aggressive marketing push.

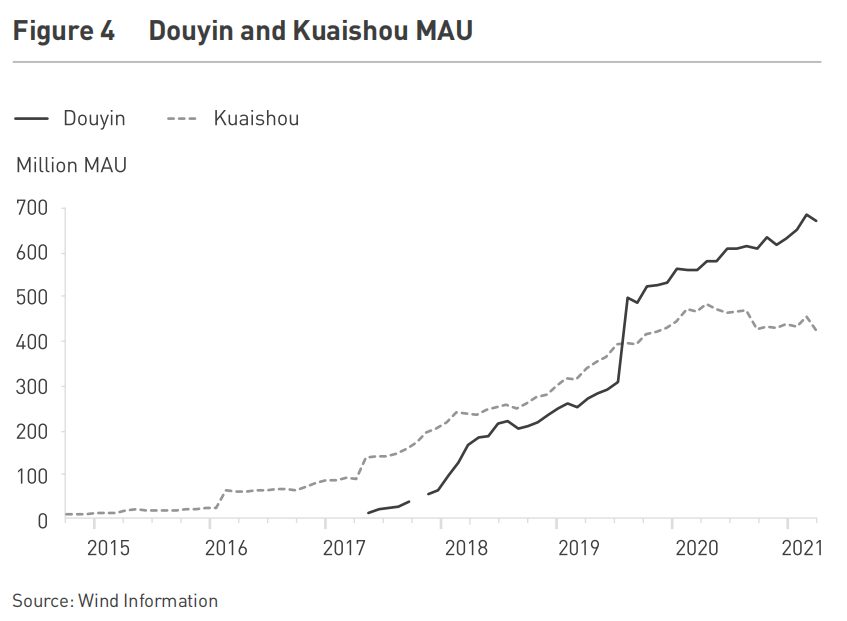

By mid-2019, Douyin had exceeded 300 million daily active users (DAU) in China, surpassing competitors like Kuaishou (see Figure 4). ByteDance effectively monetized Douyin through:

- Advertising: In 2020, ByteDance captured 37% of China’s total internet advertising revenue, amounting to approximately USD 30 billion.

- E-Commerce Integration: By 2021, Douyin’s gross merchandise value (GMV) soared RMB 730 billion (USD 109 billion), making it one of China’s top online shopping platforms.

Act 3: TikTok’s Global Expansion and Geopolitical Challenges

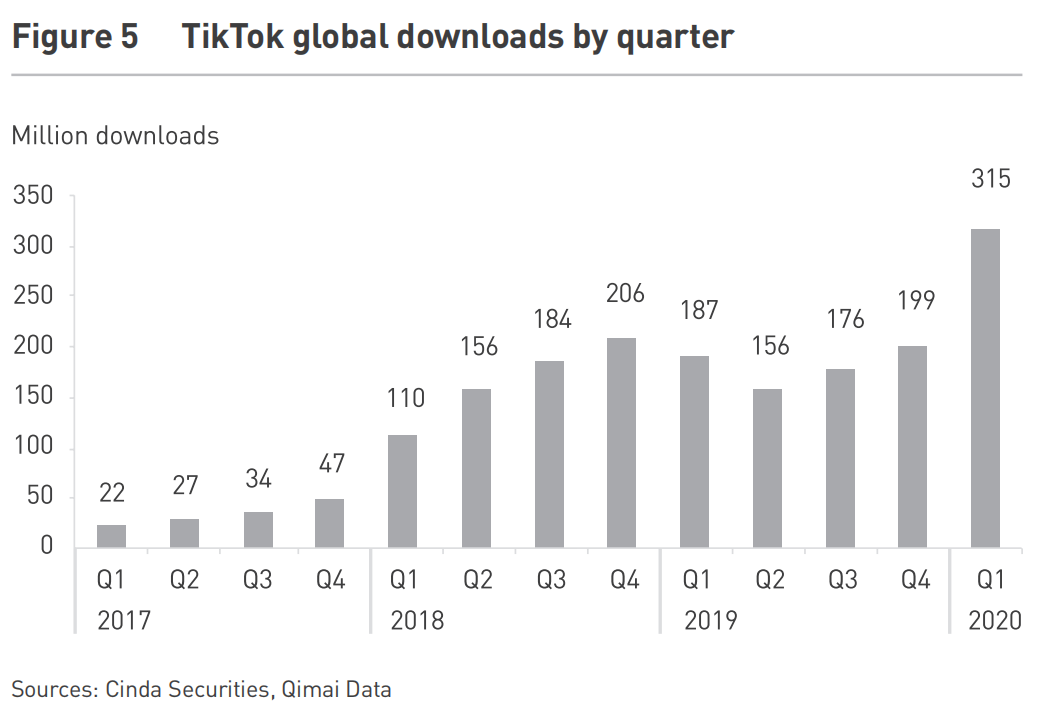

ByteDance’s most ambitious move came in 2017 with the launch of TikTok and its USD 1 billion acquisition of Musical.ly, which brought 60 million North American users into its ecosystem. By 2018, TikTok was the most downloaded short-video app worldwide, with 660 million downloads, growing fourfold from the previous year (see Figure 5).

However, TikTok’s global expansion has been far from smooth. TikTok has faced mounting regulatory scrutiny, primarily due to concerns over data security and geopolitical tensions. The most significant setback came in June 2020 when India banned 59 Chinese applications, including TikTok, citing national security risks. The ban effectively cut TikTok off from one of its largest markets, marking a major blow to ByteDance’s global ambitions. Shortly after, the company faced a similar challenge in the United States when then-President Donald Trump issued executive orders to ban TikTok and force ByteDance to divest its U.S. operations, and the ban was later revoked by President Joe Biden in 2021. However, concerns over TikTok’s data privacy did not dissipate.

ByteDance’s Strategic Adjustments

To navigate these regulatory challenges, ByteDance implemented several strategic shifts.

Recognizing the need to consolidate its core business, the company discontinued underperforming international ventures such as TopBuzz and Vigo Video, allowing it to concentrate resources on TikTok’s continued expansion and profitability.

Additionally, ByteDance expanded into the gaming industry with its acquisition of Mutong Technology for USD 3.7 billion, strengthening its foothold in the global gaming market.

In parallel, ByteDance sought to diversify TikTok’s revenue streams by aggressively developing its e-commerce ecosystem. TikTok’s push into online retail aims to replicate the success of Chinese platforms like SHEIN and Temu, offering integrated shopping experiences through short videos and live-streaming commerce (see Table 1).

As a result, TikTok has become a significant player in the global e-commerce landscape, further embedding itself into consumers’ daily digital habits.

Future Outlook: A Global Giant Facing Headwinds

Despite its remarkable rise, ByteDance faces continued challenges, including regulatory pressures, heightened competition, and macroeconomic uncertainties.

ByteDance’s story is a testament to AI-driven innovation, rapid execution, and adaptability in ever-changing global landscape. As the company continues to navigate geopolitical and regulatory complexities, its success will depend on maintaining its competitive edge in e-commerce, gaming, and content innovation, all while managing risks in an increasingly fragmented digital ecosystem.

This article is part of the “Unleashing Innovation in China” series, which explores how companies are driving innovation and reshaping industries in one of the world’s most dynamic markets. For more insights, visit: Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion – CKGSB Knowledge