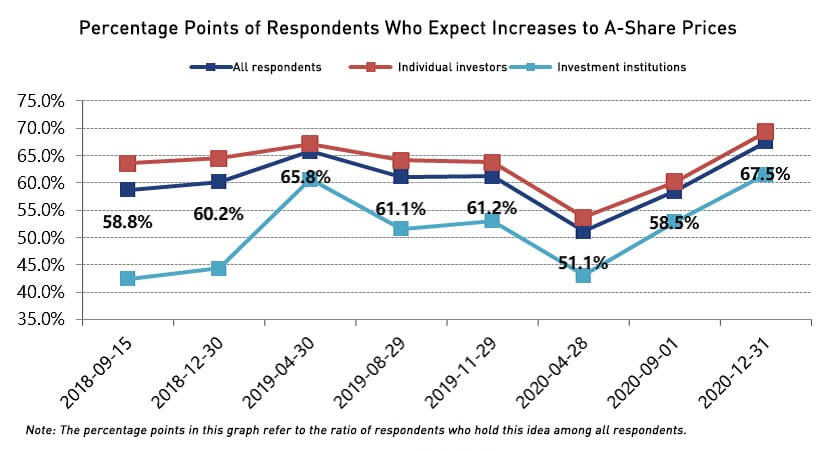

Positive investor sentiment across the board underscores China’s undeniable success in controlling the spread of Covid-19. The latest Cheung Kong Graduate School of Business Investor Sentiment Survey (CKISS) 2020 Q4 data reflects survey responses from 2,500 individual and institutional investors, who feel more optimistic towards China’s financial markets, China’s real estate and the US-China trade war. Respondents were more optimistic about A-shares than in the previous quarter, with 67.5% expecting increases to A-share prices, an increase of 9 percentage points (pp) compared to the previous quarter.

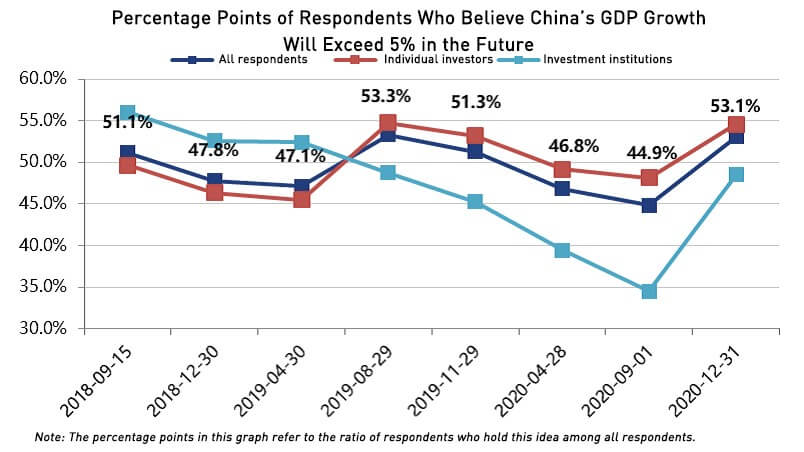

Investor sentiment is also more optimistic towards Hong Kong share prices with 50% of respondents expecting a rise, representing an increase of 15pp compared to the previous quarter. This optimism stems from confidence in the fundamental factors that underlay growth, and the controllability of risks. In terms of fundamental factors, about 53% of respondents believe that China’s annual GDP growth will exceed 5% in the future, an 8.2pp increase over the previous quarter.

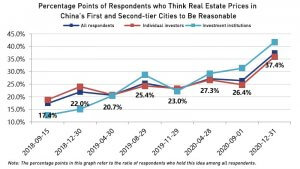

Respondents also showed a positive outlook towards the future performance of A-share listed companies. Roughly 45% of respondents expected A-shares to have a future annual average net profit growth of over 10%, which is up 7.7pp compared to the previous quarter. In terms of risk, 64% of respondents believe that A-share prices are reasonable; this is down 2.2pp compared to the last quarter, but still high by historical standards. Respondents also felt that real estate prices in China’s first and second-tier cities to be reasonable, this is nearly 20pp higher than two years earlier.

Investors also increasingly downplayed the negative impact of the US-China trade war, with approximately 46.7% of respondents believing that the trade war would benefit China in the long-term, this figure has almost doubled compared to two years earlier.

The Cheung Kong Investor Sentiment Survey is a quarterly report on investor sentiment and expectations of China’s capital markets overseen by Cheung Kong Graduate School of Business’ Professor of Accounting and Finance Liu Jing. The survey began in January 2018 and is based on 2,500 samples conducted in 13 major Chinese cities. The findings for 2020 Q4 were gathered from investor sentiment questionnaires collected during December 2020, A-share listed companies’ financial statements for the third quarter of 2020, and the latest macro data from both Chinese and overseas capital markets. The report comprises of two sections. Section one highlights and detailed findings from the questionnaires to provide a better understanding of investors’ views on future trends in the stock market, real estate, and other assets, and on macro indexes such as economic growth. In section two, factors driving investor sentiment are analyzed from the perspectives of the macro economy and listed companies.

The survey also reveals a weakening in respondents’ negative sentiment towards Hong Kong stocks. While expected returns remains negative, the number of investors expecting a rise in the Hang Seng Index (HSI) increased significantly with 46.4% of respondents more confident that Hong Kong stock prices would increase, up 14.3pp compared to the previous quarter.

Investors favored stocks and stock funds, with a net increase of 20.9% in the number of stock investors; this is a slight decline compared to the previous quarter, but overall shows an optimistic trend. The number of stock fund investors increased by 16.5%, 2.7pp higher than the previous quarter.

Investors’ optimistic sentiment is rational, but still relatively conservative

Most core factors underlying China’s capital market in 2021 remain promising, with overall risk remaining stable. We may be at the starting point of the greatest, most sustained bull market within the last decade. There are six reasons for this.

The COVID-19 pandemic

In 2020 and 2021, the main drivers of capital markets and the real economy have been the pandemic, and governmental and societal responses to the pandemic. Of the major world economies, China is the only country that has been able to control the pandemic so far and returning to somewhat economic normality. We expect the COVID-19 pandemic to be controlled worldwide in the first half of 2021, through mass vaccination. If the vaccines fail to work as desired, the strict measures and practices implemented in China will be the only way to combat the pandemic. These strict measures and a zero-tolerance policy towards COVID-19 remain the most effective solutions currently available to any country.

The real economy

In the first three quarters of 2020, the United States economy saw a decline of 23% in GDP, compared to the same period last year; The Eurozone economy declined by 21%, and Japan by 17%. By comparison, China’s economic performance was good, with a year-on-year GDP increase of 0.2% in the first three quarters; GDP remained similar in scale to the same period in the previous year. Unlike the United States, Europe, and Japan, China’s economic recovery mainly reflects the benefits of effective, low-cost pandemic containment measures, while the former three have largely relied on strong but ineffective, stimulus and fiscal policy measures which carry serious after-effects.

The international environment

Following the US presidential election, President-elect Joe Biden may introduce more rational and systematic policies concerning China, which will help to reduce investment uncertainty and the risk of both cold and hot wars.

China’s commitment to reform-and-opening-up

China’s commitment to further reform-and-opening-up has been evident over the past year with its capital market reforms, the unprecedented free-trade port policy implemented in Hainan, the signing of the Regional Comprehensive Economic Partnership (RCEP) and the China-EU Comprehensive Agreement on Investment (CAI). China can expect further growth with continued reform and opening up policies.

Global zero interest rates

The impact of COVID-19 on the economy has forced various countries’ central banks to rapidly inject currency and cut benchmark interest rates to zero. Among the major economies worldwide, China is the only country to retain a positive interest rate, at around 2.5%. As benchmark interest rates fall to zero, all investments offering positive returns appear very attractive.

Low estimated stock valuations

Estimated valuations of China’s stock market have reached their lowest point in over twenty years. Currently, the estimated value of the A-share market is only slightly higher than the net asset value of its constituent companies.

About the Cheung Kong Investor Sentiment Survey (CKISS)

The Cheung Kong Investor Sentiment Survey (CKISS) is a survey on investor sentiment and expectations in the capital market, co-sponsored by Cheung Kong Graduate School of Business’ (CKGSB) Center for Investment Research and the Business Scholars Program. It is led by Doctor Liu Jing, CKGSB Professor of Accounting and Finance and Associate Dean, and CKGSB researcher Chen Hongya.

The first survey was conducted in January 2018 and targeted over 60 outstanding entrepreneurs. In August 2018, the survey expanded its scope to 13 major Chinese cities and conducted on a quarterly basis with approximately 2,500 valid samples, including 1,900 samples from individual investors and 600 from institutional investors. The Center for Investment Research at CKGSB aims to offer a more comprehensive understanding of the capital markets in China and abroad using CKGSB’s unique theoretical & practical perspective.