Following the previous three infographics which highlighted Chinese outbound investment in the real estate, automotive and energy sectors, this week, we look at how Chinese companies are shopping for groceries around the world.

Last year, we showed our readers how China imports food from other countries to feed its huge population: corn from the US, soybean from Brazil and beef from Australia all find their way to dinner tables in China. According to data from the Association of Food Industries by 2018, China will become the world’s largest consumer of imported food, with an estimated market value of nearly $80 billion.

But with nearly one-fifth of the world’s population to feed, that is clearly not enough. China is, after all, the world’s largest consumer of meat (the Chinese apparently eat six times as much pork as people in the US), corn and wheat. China is also the largest consumer of red wine—yes, it isn’t France. And soon China will be the world’s largest consumer of processed food as well.

Which is why, Chinese companies are now actively buying up foreign companies in the food and beverage sector.

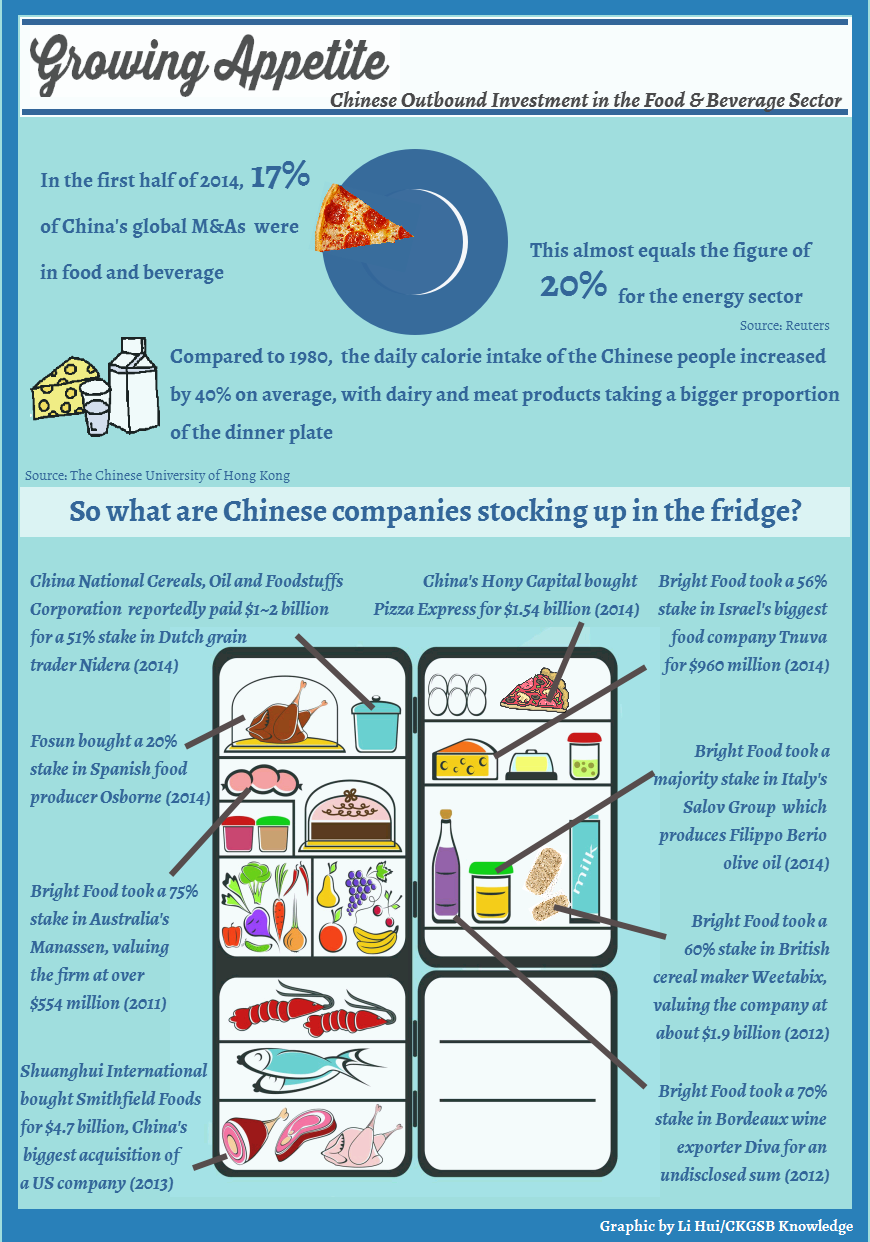

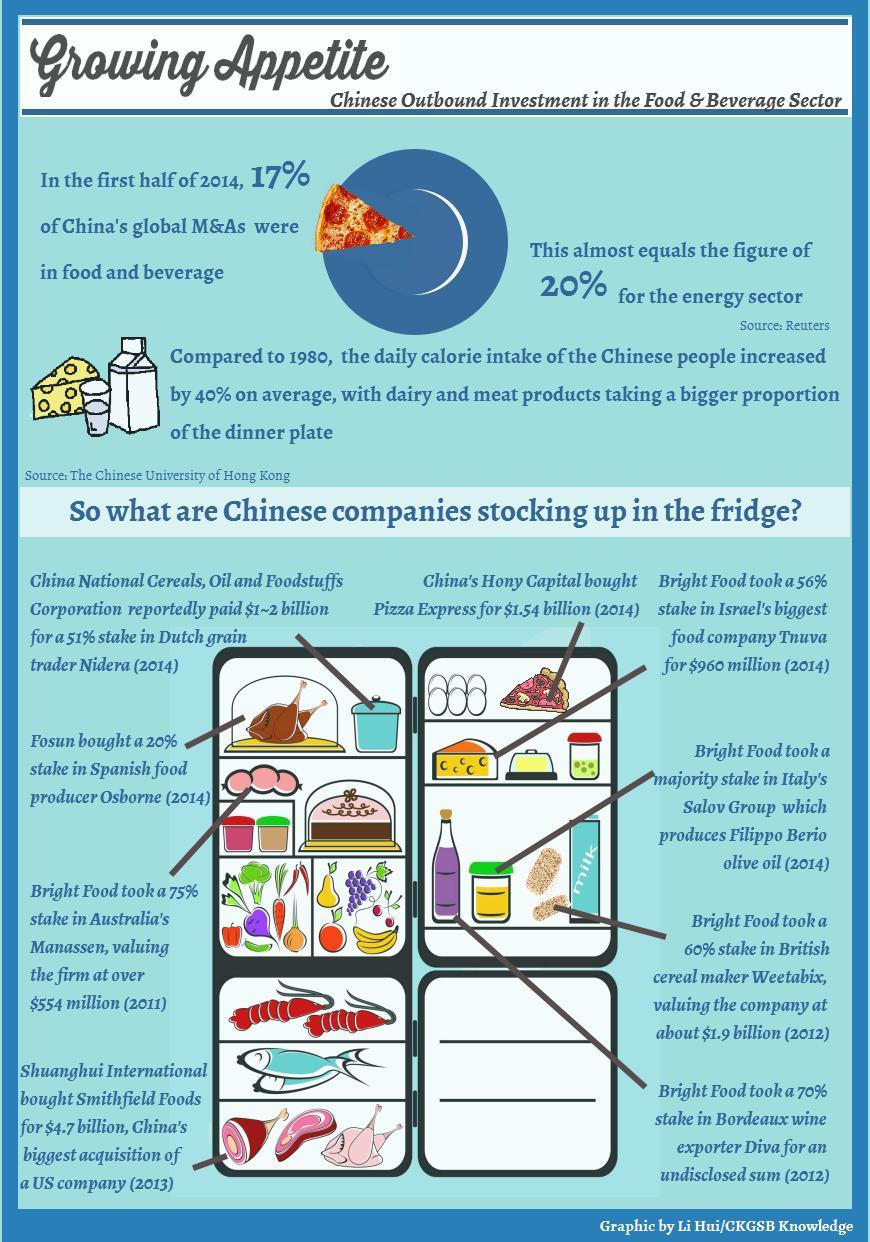

In the first half of 2014, 17% of all Chinese global mergers and acquisitions were in the food and beverage sector, a figure that nearly rivals the 20% for energy investment. In 2013, Shuanghui International’s $4.7 billion purchase of Smithfield Foods, the largest pork producer and processor in the US, became the biggest acquisition of a US company by a Chinese company. This particular deal ran into a lot of controversy when members of the US Congress, environmentalists and consumer groups asked the Committee on Foreign Investment in the United States to block the deal.

In 2012, Bright Food, one of China’s largest conglomerates in the food industry, took a 60% stake in British cereal maker Weetabix, valuing the maker of Alpen cereals at about $1.9 billion. Earlier this year, Bright Food hit the headlines again by acquiring a majority stake in Italy’s Salov Group, which produces Filippo Berio olive oil. More recently, China’s Hony Capital set its sights on a new favorite food of the Chinese: the humble pizza. It bought the well-known British restaurant chain Pizza Express for around $1.54 billion.

Did this whet your appetite? Scroll down to read more about China’s buying binge.