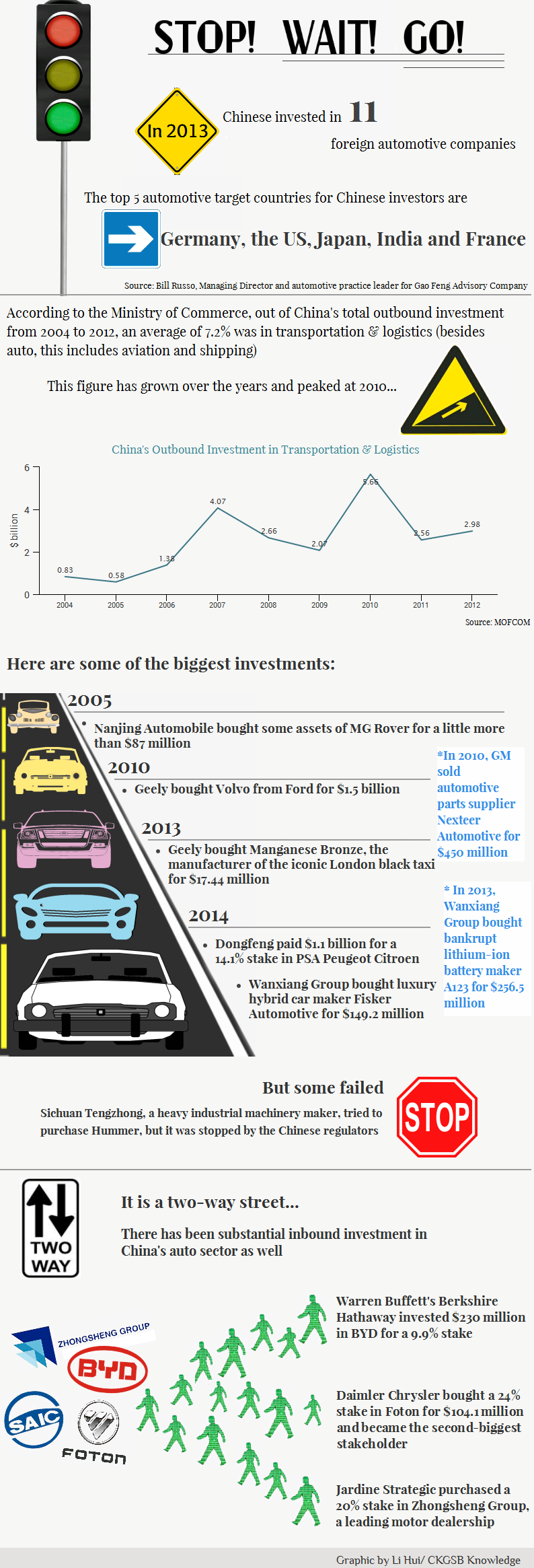

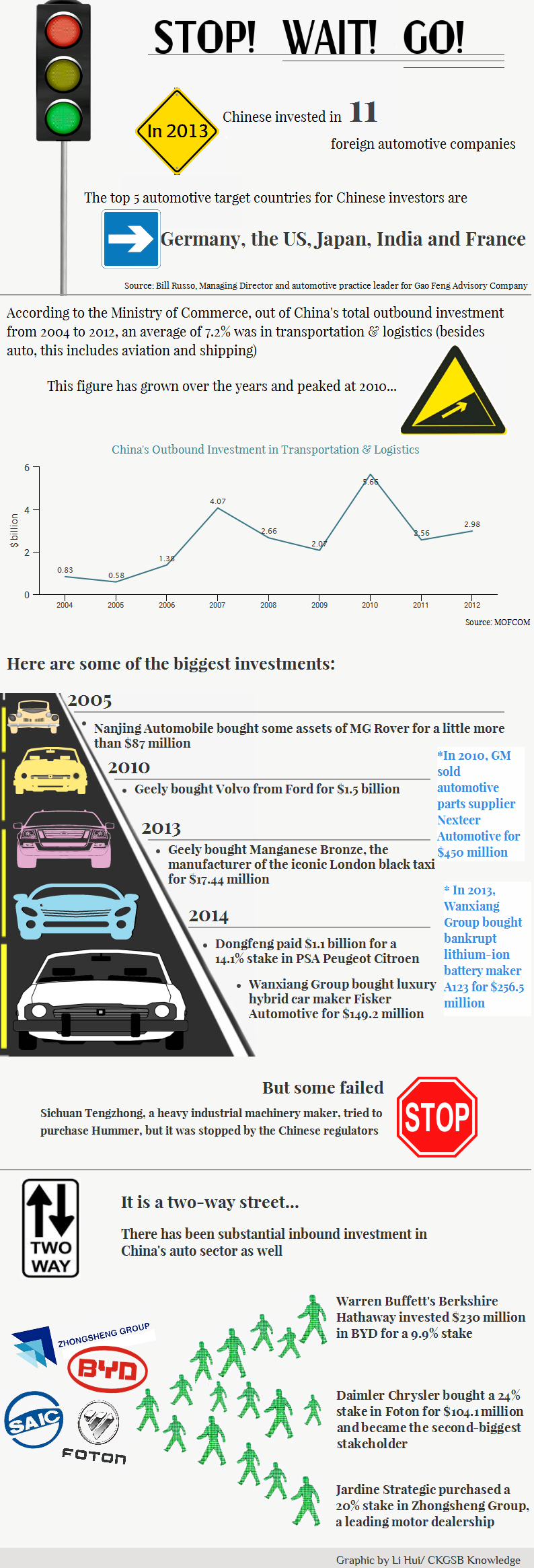

A look at how Chinese outbound investment in auto is rising and how marquee brands like Volvo Cars and Manganese Bronze now belong to Chinese companies.

Last week, we put together an infographic which showed how Chinese real estate companies are buying property in the west. This week, we take a look at China’s outbound investment in the automotive sector.

China’s auto industry has been growing at a consistent pace in the past few years. Despite being in a market where well-established auto brands like the Big Three German companies—Audi, Mercedes-Benz and BMW—dominate, Chinese carmakers, though much smaller and less known, have still managed to make their presence felt on the international stage. According to the Ministry of Commerce, in 2005, China exported 32,000 ready-to-use vehicles in total. This figure zoomed to 948,000 by the end of 2013.

This year, six Chinese automakers squeezed their way into the Fortune 500 list. The list includes Zhejiang Geely, which surprised everyone when it bought the Swedish auto manufacturer Volvo Cars from Ford Motor Company for a sum of $1.5 billion. Geely also made a big splash in the UK in 2013, when it bought the iconic London black cab manufacturer Manganese Bronze for $17.44 million. Similarly Nanjing Automobile, little known outside of China, bought key assets from British manufacturer MG Rover, while Dongfeng Motor rescued ailing French carmaker Peugeot Citroen by buying a 14% stake.

Chinese investors are also intrigued by the niche electronic vehicle sector. For example, one of China’s biggest auto manufacturers, Wanxiang Group, bought hybrid carmaker Fisker for $149.2 million.

See the infographic below to learn more about Chinese outbound investment in the auto industry.