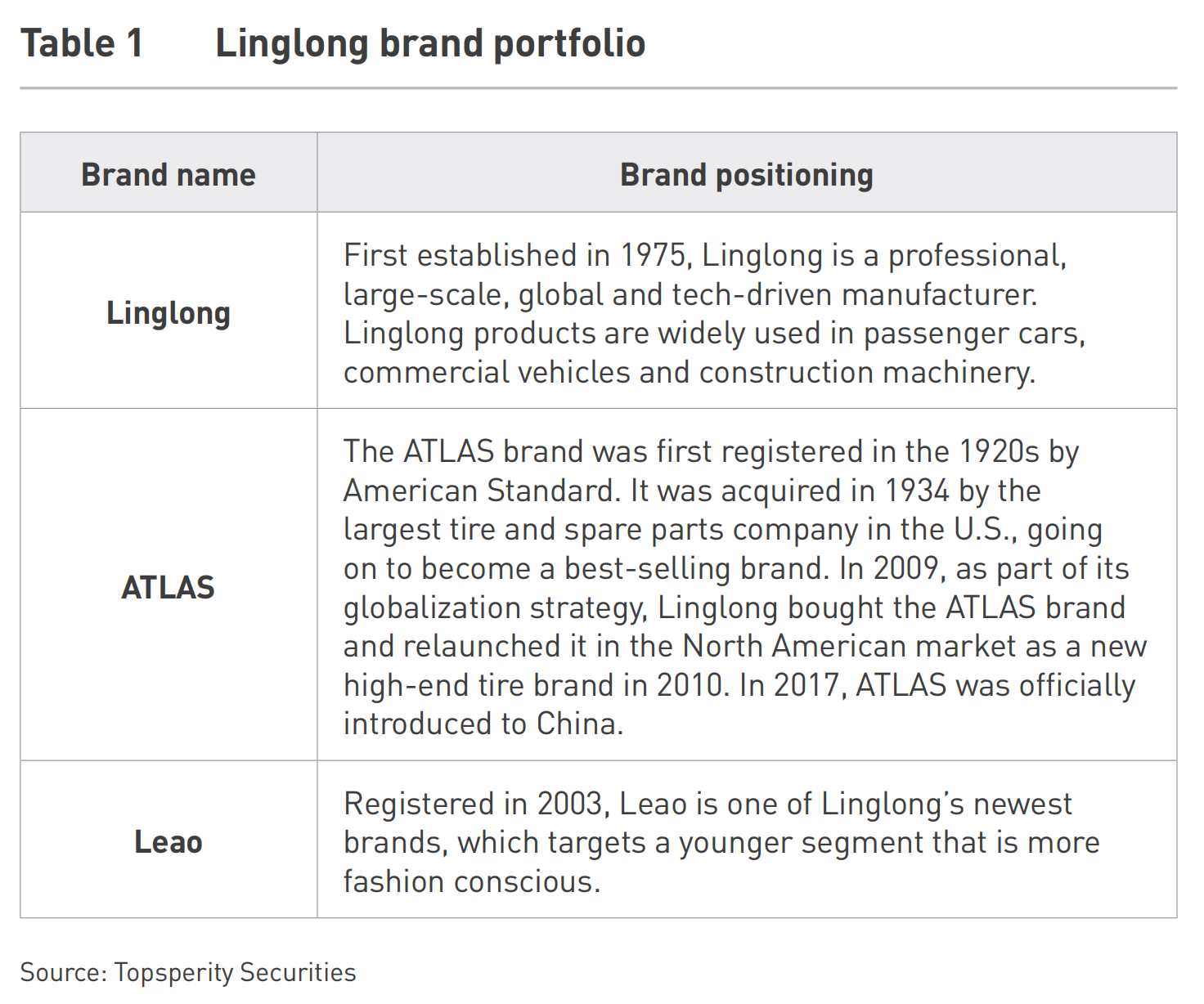

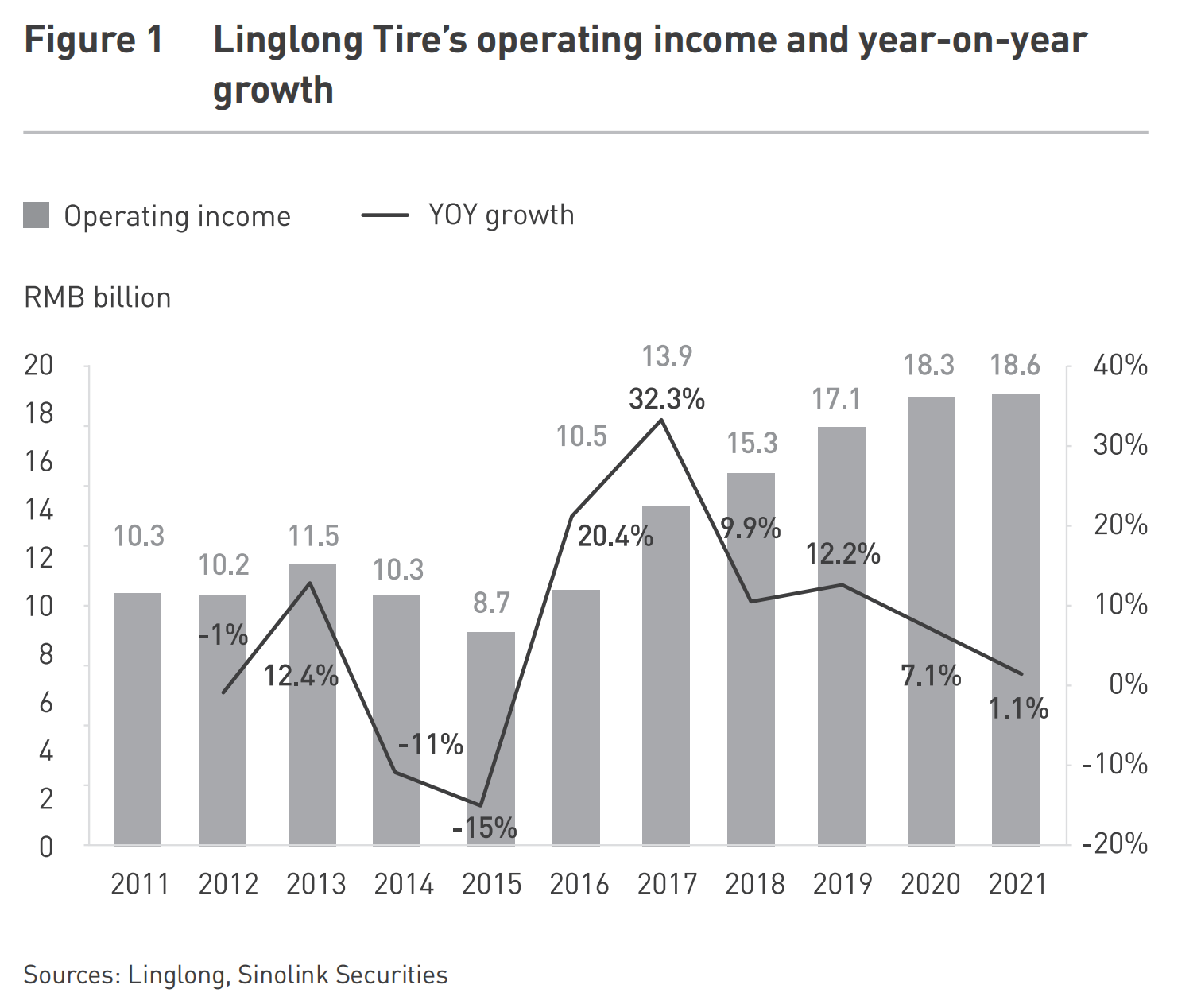

Over the past four decades, Linglong Tire has evolved from a modest Chinese tire repair plant into a globally competitive tire manufacturer, exemplifying China’s rise in the international automotive industry. By 2020, Linglong was China’s top producer of semi-steel and radial tires and ranked 12th globally, generating RMB 18.38 billion (USD 2.73 billion) in revenue, a leap from RMB 8.73 billion (USD 1.30 billion) in 2015. Its products reach 173 countries under brands such as Linglong, Leao, and ATLAS, manufactured in seven global production bases (see Table 1). In this article, we look into Linglong’s journey of globalization and try to understand what it did right, and wrong, for manufacturing companies who are thinking of expanding their business.

Linglong’s Domestic Growth and Initial Globalization

Linglong began operations in 1975 and went public on the Shanghai Stock Exchange in 2016. Initially, tires were scarce in China in the 1980s, making them highly valuable commodities. Linglong’s strategic response to market scarcity was aggressive expansion and technological investment. In 2016, Linglong established China’s first large-scale comprehensive tire test facility in Shandong, becoming Asia’s largest of the sort and marking a key milestone in China’s tire innovation.

It established a plant in Thailand in 2012 to mitigate tariffs, reduce exchange rate volatility, and boost international profitability. But facing heavy U.S. tariffs starting in 2015—Chinese tire exports to the U.S. dropped dramatically from 50.4 million tires in 2014 to only 2.8 million by 2019—Linglong accelerated its globalization. By 2020, overseas plants contributed over 70% of Linglong’s net profit.

A Robust Brand Strategy

Linglong positioned itself competitively against global giants such as Michelin and Bridgestone by offering comparable tire quality at more attractive prices. International brands typically spent 30% of costs on labor, whereas Chinese firms, including Linglong, allocated around 10%, investing heavily in raw materials instead. This distinct cost structure significantly improved Linglong’s profit margins and market competitiveness.

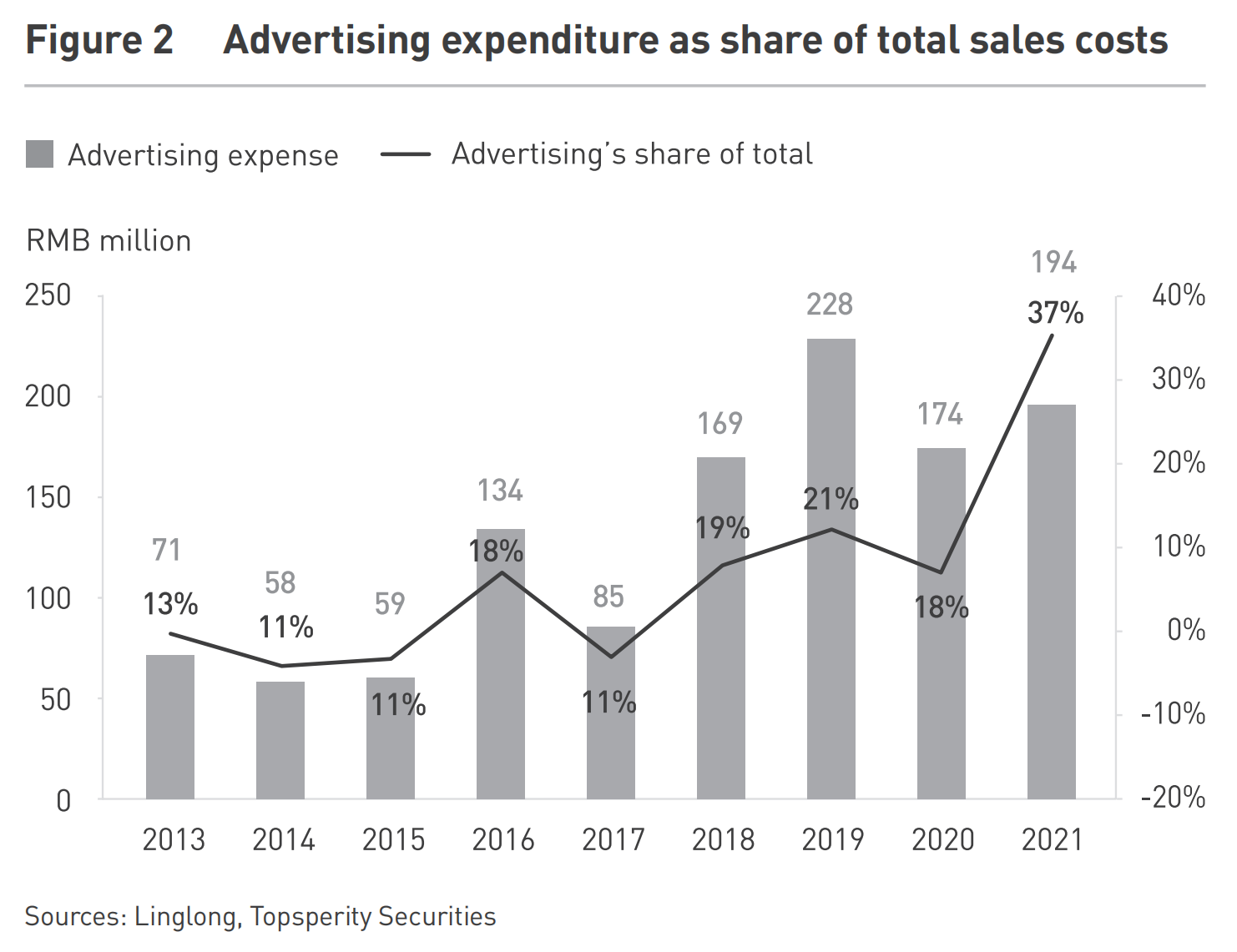

Branding impact remained a critical challenge to Linglong. Established brands like Michelin command premiums due to its historical legacy. To elevate its brand, Linglong adopted a robust marketing strategy, including widespread advertising campaigns in elevators, airports, and railway stations across China, reaching an audience of 300 million in 2020. It invested RMB 174 million (USD 25.87 million) in advertising alone, alongside strategic sports partnerships, such as collaborations with European soccer teams (Juventus, Wolfsburg) and NBA’s Cleveland Cavaliers, significantly enhancing its global visibility. By 2021, Linglong’s brand value climbed to RMB 59.67 billion (USD 8.87 billion), making it one of the top ten global tire brands and the only Chinese company on this prestigious list (see Figure 2 &3).

Digital Transformation and New Retail Strategy

Linglong recognized early that digital transformation was key to sustaining growth. In 2019, the company partnered with Tencent and HUAZHI IMT to launch its digital transformation initiative.

In 2020, Linglong introduced a smart marketing cloud platform—the tire industry’s first “industrial internet” platform—digitizing its distribution channels and connecting its offline stores seamlessly to consumers. Through QR code tracking and real-time data analytics, Linglong enhanced its inventory management and customer interactions. This digital shift allowed dealers to minimize inventory, precisely match supply with demand, and optimize their production schedules, significantly enhancing efficiency.

The company expanded its new retail model and announced its plans to establish by the end of 2023 a comprehensive sales network with 300 strategic cooperative dealerships, 2,000 flagship stores, 5,000 core brand stores, and 60,000 cooperative stores across China. Linglong’s strategy seeks to strengthen consumer relationships and significantly boost replacement tire sales. Its chairman Wang Feng expects that by 2025, Linglong’s customer base will expand to at least 50 million, representing over 20% of China’s market.

Challenges and Future Outlook

Despite substantial achievements, Linglong faces challenges, including ongoing geopolitical tensions, market saturation, and brand recognition gaps relative to international competitors. However, the rapid growth of China’s domestic electric vehicle (EV) market presents new opportunities, allowing Linglong to leverage its cost and technological advantages. EV market growth resets competition dynamics, enabling Chinese tire producers to bypass traditional barriers linked to established automotive industry relationships.

Linglong’s continuous expansion strategy includes building a new production base in the Americas, further diversifying geographic exposure and mitigating geopolitical risks.

Its chairman Wang Feng emphasized Linglong’s long-term commitment to internationalization, highlighting six strategic dimensions—talent, R&D, marketing, manufacturing, branding, and cooperation—as essential for its global competitiveness. By continuing digitalizing its operational model, Linglong aims to foster consumer loyalty better and improve its brand’s global standing.

Linglong Tire’s journey mirrors China’s broader industrial transformation, as the country shifts from being a low-end manufacturer to an innovative, brand-driven economy, leveraging digital technology to drive growth and consumer engagement. As it advances toward its ambitious global objectives, Linglong exemplifies how digitalization strategies and innovation can propel emerging companies into prominent positions in traditionally saturated industries.

This article is part of the “Unleashing Innovation in China” series, which explores how companies are driving innovation and reshaping industries in one of the world’s most dynamic markets. For more insights, visit: Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion – CKGSB Knowledge