Li Haitao; Professor of Finance, Dean’s Distinguished Chair Professor of Finance, and Associate Dean for Chinese MBA of Cheung Kong Graduate School of Business;

Zhai Xinrong; Senior Manager of Shanghai Petroleum and Natural Gas Exchange

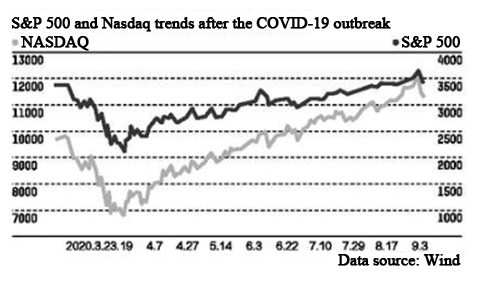

On September 4th 2020, the Nasdaq Composite, the S&P 500 and the Dow Jones Industrial Average (DJIA) all recorded their worst single-day stretches since June, falling by 4.96%, 3.51% and 2.78% respectively. The next day, U.S. stocks continued to tumble with the Nasdaq, S&P 500, and Dow Jones falling by 1.27%, 0.81%, and 0.56% respectively. Such a huge stock market slump weakened confidence in the rising U.S. stocks, triggering even more concern for the market.

Fluctuations in the stock market always give rise to concern and lead to questions like whether the stocks will continue to fall, if the current decline is a trend or a temporary shock, and what the main reasons and logic are for the fluxes.

Although the September 4th to 5th stock tumble can hardly be viewed as an inflection point, the accumulated valuation bubble poses a threat to the stock market, as risks of collapse could affect and dominate U.S. monetary and fiscal policies.

In general, we can deconstruct the fluctuations in the equity market down to liquidity, corporate profit and risk appetite. Currently, the Federal Reserve has not shown any intention to tighten liquidity. Corporate profit is also laden with risk as a result of the trade frictions in the G2 (the U.S. and China) and the trend of reverse globalization. U.S. companies would face a major blow if they lost China’s consumer market, the largest consumer market in the world. Due to reverse globalization and the U.S. trade deficit, China’s RMB would then appreciate rapidly as the US dollar depreciates. American companies would face greater pressure in their exports. As for risk appetite, the United States presidential election poses a major risk as political uncertainty continues to disrupt the U.S. stock market.

The Federal Reserve’s ambiguous guidance on interest rate targets has triggered market concerns

On August 19th, the Federal Reserve released the minutes to the Federal Open Market Committee (FOMC) meeting it held at the end of July. Federal Reserve officials were expected to discuss more dovish topics that would signal whether or not they would further ease the monetary market through policies such as Yield Curve Control (YCC). With no such discussions found in the minutes, market expectations for a further easing were dashed. As a result, both the U.S stock market and its gold market experienced a downward trend, with spot gold dropping by over 3% (the Federal Reserve has shown no signs that it will create liquidity favorable to gold investors), the US dollar rocketing and Treasury yield curve rates rising.

On August 27th, at the annual Jackson Hole Economic Policy Symposium sponsored by the Federal Reserve, Chairman of the Federal Reserve Jerome Powell declared that the Federal Reserve’s new inflation policy strategy would be to slowly update its inflation targeting to average-inflation targeting, but failed to discuss any detailed solution in how it would achieve this. The market interpreted this as the Federal Reserve facing a dilemma. On the one hand, it needed to convey the message that monetary policies would be tightened at some point in the future to combat inflation expectations in financial market transactions, thereby preventing more asset price bubbles. On the other hand, the Federal Reserve should be giving the market more confidence that monetary policies would not be tightened immediately after the inflation objective is reached.

The Federal Reserve does not want to indulge in inflation expectations that would thereby cause bigger asset price bubbles. Nor does it want the market to lose confidence in the Federal Reserve’s easing policies, as a shortage of quantitative easing policies would cause deflation and flag economic demand. As such, the Federal Reserve held an ambiguous stance in August when the stocks continued to rise.

It is our view that the Federal Reserve’s quantitative easing policies have not been updated and that its vague and uncertain statements have actually disrupted the market. This view is iterated by a statement released on July 29th where it was declared that, “the Committee has decided to maintain the target range for the federal funds rate at 0 to 1/4 percent. In order to support the flow of credit to households and businesses, the Federal Reserve will increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities over the coming months, at least at the current pace, to sustain smooth market functioning.”

Simultaneously, the Federal Reserve needs to extend its quantitative easing scale so that the average-inflation targeting policies are more convincing. Currently, the Federal Reserve’s bond purchases are at a steady growth rate. As of September 2nd, the Federal Reserve holds $4.39 trillion of U.S. Treasury Securities, an increase of $81 billion within the past four weeks. This is lower than the previous estimate of $120 billion of U.S. Treasury Securities per month but it is not a sufficient reason for the marginal tightening by the Federal Reserve. The Federal Reserve continues to increase its holdings of U.S. Treasury Securities and is showing no sign of quitting the market.

Powell announced that in order to achieve the average-inflation target, the Federal Reserve’s current objective is about 1.4%. Despite this being much lower than the target 2%, he did not outline how this target would be achieved, leading to confidence issues.

On September 3rd, Charles Evans—President and CEO of the Federal Reserve Bank of Chicago, and Raphael Bostic—President and CEO of the Federal Reserve Bank of Atlanta, stated that they would consider supporting the Federal Reserve in releasing the latest guidance around federal funds rates, but only after acquiring more information and transparency on the economic prospect of the United States. Evans said that if he had a clearer view on the economic situation in the United States in the spring of 2021, he would know whether the Federal Open Market Committee needed to implement unconventional easing policies as it did during the last economic recovery. This implies that the Federal Reserve is still uncertain about providing guidance on further monetary easing, which may be one of the reasons for the decline in the stock market.

The U.S. Government has not implemented new fiscal stimulus bills

The U.S. Government has not implemented new fiscal stimulus bills, casting a shadow over the sustainability of its economic recovery.

What concerns the capital market the most is that an early withdrawal of government demand will trigger deflation expectations, if the demand of enterprises and the public has not fully recovered.

The U.S. Government should apply its lessons learned from the financial crisis in 2008 to the current circumstance. During the 2008 financial crisis, Secretary of the Treasury Henry Paulson, assisted the Republican Party and Democratic Party to reach an agreement on non-performing asset procurements. In September of 2008, Paulson implemented this $700 billion plan to purchase non-performing assets.

As of the end of August 2020, Congress has so far passed four rounds of relief measures to tackle the COVID-19 pandemic. This has pushed the federal government’s financial deficit up to $2.45 trillion, accounting for over 12.6% in the seasonally adjusted quarter-over-quarter (QoQ) GDP in 2020—a record high. Although the U.S. fiscal deficit is expected to reach a new high, the current deficit has already caused other countries to question the sustainability of the U.S. fiscal deficit and the expansion of national debt.

In early August, after days of deadlock, the financial incentive plan of the U.S. Government finally saw the light of day. The $1 trillion incentive plan indicates a further easing, with interest rates continuing to remain low.

At the beginning of August, the market anticipated that both the Republican and Democratic Parties would reach an agreement in the week of August 7th and propose new stimulus bills. To date, the two parties have yet to reach an agreement on the scale of the stimulus, with the Democratic Party passing their version of about $3 trillion- the Democratic Party’s position being that it will not accept a plan of less than $2 trillion. On July 27th, the Republican Party proposed a plan of $1 trillion dollars. With the previous fiscal subsidies due to expire at the end of July, on August 7th the Trump Administration declared that the President would sign an executive order offering unemployment compensation and temporary reductions on payroll tax in order to keep the weekly unemployment compensation—the current compensation has however, dropped from $600 per week to $400 per week.

Despite the new fiscal stimulus bills failing to pass, on September 1st, the White House announced a relief bill of $1.3 trillion for the COVID-19 stimulus. Speaker of the United States House of Representatives Nancy Pelosi however, rejected the bill stating that it was insufficient in helping Americans fight against COVID-19.

The delayed fiscal stimulus package has raised concerns as to whether the two parties are able to effectively work together, with these concerns affecting the equity market.

Accumulated risks in the stock market give rise to the possibility of a financial tsunami

In August, the average Price-to-Earnings (P/E) ratios of Dow Jones and S&P 500 reached 27 times and 33 times respectively, a huge increase compared to the 22 and 24 times two months before the COVID-19 outbreak. This current valuation surpasses the period of the dot-com bubble in 2000, and the period at the end of 2018 where the last fall back in valuation happened, with both dropping to about 19 times.

On March 23rd, before the Federal Reserve proposed unlimited quantitative easing, the P/E ratios of the Dow Jones and S&P 500 had dropped to about 16 times, within just 5 months this figure has nearly doubled. The increase in valuation is a result of monetary easing and inflation expectations. The Federal Reserve should carry out policies of persistent easing in order to curb deflation expectations caused by unemployment and economic recession.

The current stock valuation sits at a high point, with its sustainability dependent on two factors. First, the ability of the current monetary policies to provide a sustainable easing environment depends on the Institute of Supply Management (ISM)’s Manufacturing Purchasing Managers Index (PMI), and the core Personal Consumption Expenditure (PCE) Price Index. If the price continues to drop, the Federal Reserve may continue its monetary easing, but not vice versa. Second, its sustainability depends on whether economic demand can bounce back rapidly and that corporate profits make a recovery once the outbreak is controlled.

Based on the status quo, the Federal Reserve will continue its monetary easing and the new fiscal stimulus bills will eventually be passed, though it can hardly be viewed as the turning point for the U.S. stock market—the carnival has not stopped yet.

The statement of Evans and Bostic on September 3rd suggests that the Federal Reserve will not allow for unlimited easing. Digesting valuation needs higher corporate profit—another challenge as a result of reverse globalization. It will therefore be difficult to sustain the current high valuation, as disruptions in the leverage accumulated on assets will trigger a tsunami-like chain reaction.