On November 22nd, the CKGSB MBA Financial Innovation Module wrapped up in Shanghai. This four-day module gives students from the CKGSB MBA Program an opportunity to learn about how financial innovation impacts China’s economy, as well as the opportunity to visit pioneering enterprises to see first-hand how Shanghai is developing into a leading financial center.

Academic Lectures

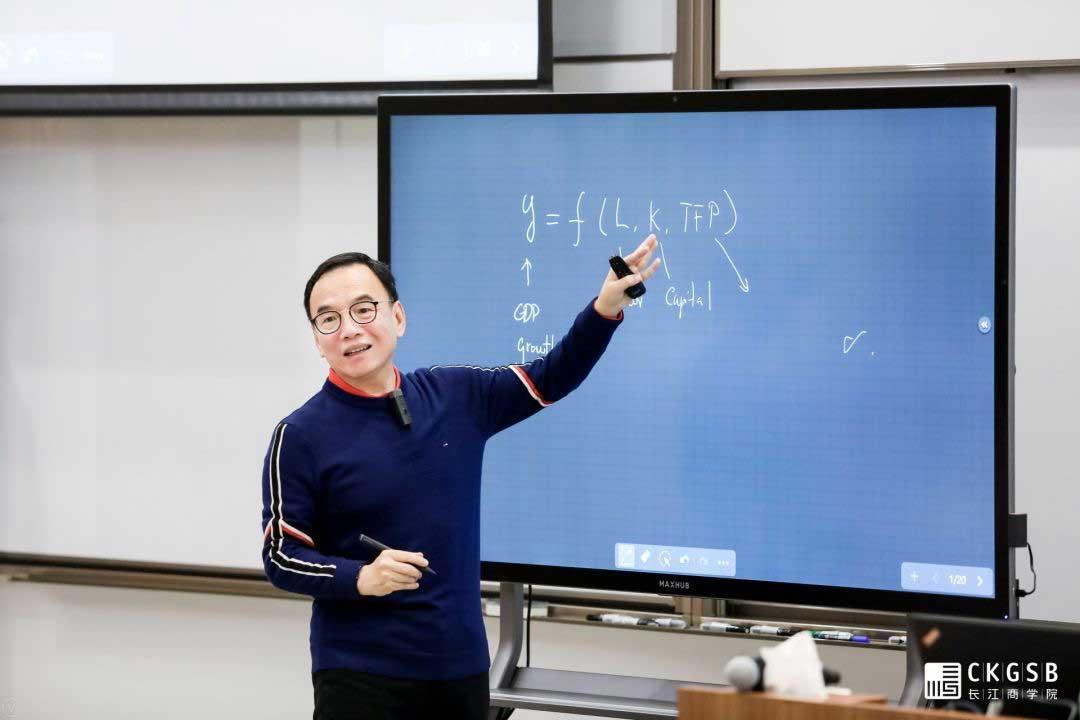

To equip MBA students with sufficient knowledge on China’s economy and financial innovation, the module offered over 12 hours’ of academic lectures by Professor Li Haitao, Dean’s Distinguished Chair Professor of Finance, Professor Mei Jianping, Professor of Finance, and Professor Zhang Gang, Assistant Professor of Economics.

Professor Li Haitao discussed China’s economy in transition, during which he shed light on the internal and external challenges of the Chinese economy, the development of China’s service industry,the current state of China’s manufacturing, and China’s financial reform to support the real economy.

Professor Mei Jianping shared his insights on the Chinese economy from a financial perspective. Professor Mei gave a clear analysis on the sustainability of economic growth was illustrated through interesting economic models, as well as discussing the niche of art investment.

Lisa Zhu, a student from the 2019 MBA class said: “Professor Mei’s lecture popularized the concept of art investment for us, and laid a basic framework of the new concept for ordinary people taking art as an investment channel. As an MBA student with an art background, I highly appreciate Professor Mei’s class. All these open up a broader thinking space for my future study of ‘art + business’.”

During the lecture on financial innovation and systematic risk, Professor Zhang Gang introduced the financial system, frictions and innovations, and household debts in China. He discussed the anatomy of the 2008 Great Recession from the perspectives of financial innovations and the rise of systematic risk, collapses in housing prices, responses by the government, and the slow recovery aftermath.

Corporate Sharing

The Program also offered opportunities for students to learn more about front-line financial companies and institutions including Morgan Stanley, Shanghai Stock Exchange, Mercer, and Vision Credit.

Xu Lei, Executive Director of Morgan Stanley (China) Private Equity Management Co., LTD., and CKGSB EMBA alumnus, gave an overview of China’s A-shares, private equity, and alternative investments.

Jason Key, CKGSB 2018 MBA student from Korea said, “the most impressive part of his lecture was about value creation. Throughout the whole investment horizon from the buyout decision to the exit stage, I was very impressed by his knowledge, especially on how to create additional value in invested companies.”

MBA students also visited the Shanghai Stock Exchange, followed by a visit to Mercer, during which Daimler Qiao, Partner at Mercer China, gave an overall introduction of the company, and Leo Shen, China Wealth Leader of Mercer, shared insights on China’s financial industry.

Leo Shen noted: “I think there are three opportunities. First, China, as the second-largest market in the world for asset management, is still a blue sea. Second, with the opening of the domestic capital market, our employees and institutions will have a larger stage to pursue higher goals. Third, in the case that the pension scale of the mature international system exceeds GDP, we institutional investors will make a bigger difference in the state’s key development of the third pillar of pensions, as well as the liberalization of the pilot cities for individual tax incentives.”

On the last day of the Financial Innovation Module, Yisheng Gong, Chief Risk Officer of Vision Credit, introduced Vision Credit’s risk control system, details of their products, including the R & D process, their strengths and weaknesses, as well as their overseas competitors.

Networking Event

CKGSB MBA also hosted a networking event on November 21st for all participants of the Financial Innovation Module. MBA alumnus Peter Mao, Co-founder of Panda Capital, delivered a keynote speech, sharing his personal experience and some suggestions for the current MBA students. The event also served as a platform for students to communicate directly with their potential employers.

This action learning module also marks the end of the MBA journey for the 2018 class, with a farewell ceremony organized on their last day.

Jason Key, CKGSB MBA student from Korea, reflected on the whole module, “I think the whole CKGSB MBA Financial Innovation Module in Shanghai program was well-designed and gave me a great exposure to city of Shanghai, as a center of global financial industry. Insightful lectures by prominent professors and several company visits including Shanghai Stock Exchange, Mercer China and Vision Credit were very helpful.”