A combination of factors such as a slowing Chinese economy, rising costs, lethal competition and increased government scrutiny are changing the dynamics of business for MNCs in China. How should they cope?

In the past three decades, China was the place to be for multinational companies (MNCs): a cheap labor force, effective infrastructure and an increasingly affluent population—all extremely attractive to corporations looking for the next growth hotspot.

But as the roaring Chinese economy starts to cool down and consumers begin to mature, it is changing the market dynamics for MNCs in China. Rising labor costs and competition from local players are further slicing already thin margins; and new uncertainties in the regulatory environment are keeping MNC country heads awake at night. Things can change quickly in China: for instance, China just wrote a dozen or so Japanese auto part makers a $200 million ticket for violating the country’s anti-trust regulation, the biggest fine since the law’s establishment.

In addition, concerns over the security of western technology products and food safety scandals that involved almost all foreign fast food chains have prompted people to ask, “For MNCs in China, are the good old days over?”

But there may not be a clear-cut answer to this question, says Anil K. Gupta, a renowned globalization and strategy expert from the Robert H. Smith School of Business at the University of Maryland. Gupta, who co-wrote Getting China and India Right and The Silk Road Rediscovered, says that while companies in certain sectors face more challenges than those in others, China is unlikely to make sweeping policy changes that will simply expel foreign companies; and in most consumer goods sectors, China will remain a market where the best companies win.

Except for regulatory issues, Gupta believes that MNCs in China need to adjust their investment in accordance with the market trends, focusing on branding and marketing to win over consumers who would no longer pay a premium just for a brand’s origin.

Excerpts from an interview:

Q. China is changing rapidly. The economy is not growing as fast as it was in the past, costs are rising and local competition is becoming very strong. At the same time, it seems that for MNCs, the ease of doing business in China is changing as well. It appears as though the strategies that worked well for them 10-15 years ago will not work anymore. What are your thoughts on this?

A. From 1982-2010, the economy grew at around 10% a year. Now we are talking about 7% and 7.5%. [In] the next five years, the growth rate is not likely to increase from what it will be this year. If anything, it will slow down. Given the size of the economy and [its] stage of economic development, it will still be very robust. Companies have to be prepared that the days of 8%, 9%, 10% [growth] are gone for good.

How many economies are growing at 6%, 7%? Not that many. So in that sense, China still remains a large growing market, but what multinationals need to do is plan for, in terms of investment, a 6-7% growth. If you assume an 8-10% growth but the reality is 6-7%, you are going to be in deep trouble. But if you assume 6-7% and you plan for it, you are going to be fine. So that’s the number one implication for multinationals.

Number two is that as the economy becomes more mature, the days of easy money are gone. Now you have to fight for your money. China is a supply-driven economy in a lot of industries—you have significant overcapacity not just in steel and cement, but also in industries like consumer goods and auto. Then the growth rate slows down, the brutality of competition gets even harder. If competition gets tougher and the days of easy money are gone, for companies, aside from investment implications, it has significant implications for the types of sales and marketing people that you have.

Senior executives at big multinationals say, “[In] the last 20 years, on the sales side, basically you could have order takers, and life would be fine. Now, you need people who know how to market, who can talk [about] value proposition, who can talk about why this product or service is better than the competition’s, and give reasons for the customers to believe what you are saying”. So essentially, it’s a shift from sales and marketing.

Along with that, in the consumer goods sector [there is a] significant need for investment in branding, not just because of competition and slow growth, but because a lot of Chinese consumers in definitely the tier-one, tier-two, and in some cases, tier-three cities, are not [buying] the car or that particular brand of the sneakers for the first time. They are making repeat purchases, which mean that they are no longer naïve, inexperienced customers. [Also], they are a bit more affluent. Therefore, the importance of branding and differentiation goes up.

In the technology sector there are some challenges for IBM, Microsoft, Oracle, etc., [that] we’ve been reading in the papers recently because the Chinese government wants to build Chinese champions. Therefore, one way in which the government is going about it is to make life a little bit difficult [for MNCs].

Historically that has happened, for instance, Google is not here, Baidu is here. It used to be something confined narrowly, largely to the internet domain. But now we see that approach spreading more widely in the technology sector. So I think in the technology sector companies face challenges. It’s not clear yet how the policy will evolve. I think certain sectors like steel, cement, telecom, the airlines, and certain parts of banking, have been closed to multinationals in the past, and are by and large likely to remain closed.

There are certain sectors, typically consumer goods where the market has been pretty open. It’s like: “May the best company win.” I anticipate that that will continue in the future.

Q. In the past, western brands used to stand for high quality, but that status has somehow been tarnished due to repeated scandals, such as the ones we have repeatedly seen in food safety. How should MNCs, especially in consumer goods and retail react to this? They cannot assume they are a premium brand just because of their origin or brand name anymore.

A. The Chinese citizens, consumers, and the government are exceptionally sensitive [about quality not only in the food sector, but in pharmaceuticals as well]. There, McDonald’s, KFC and Wal-Mart, have to be super conservative, super careful, that they don’t make mistakes. The internal control systems and training systems need to be extremely robust.

There will be instances, where allegations will be made by an employee, an ex-employee, a television station, or a newspaper. It’s not a government agency saying, “We have proof that you have violated this particular code.” If some of those allegations are true, the company has to apologize, act and correct. Sometimes the allegations may not be true. There the company needs to be very proactive in terms of working with the media, and the government agency to set the record straight. In the past, it has been done successfully, unless the government agency itself wants to make life a bit more difficult for the company. If that is the case, then you have to accept it because you can’t do very much about it. Ultimately, if it’s a tension between the company and the government, the government will win.

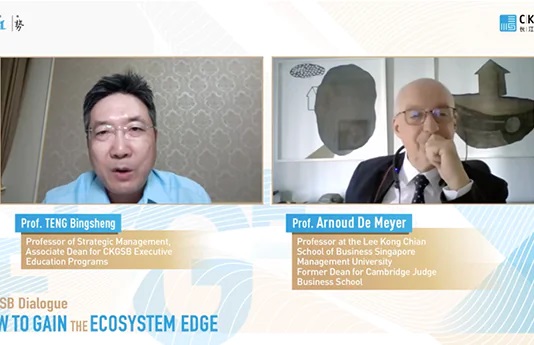

[Watch video below]:

Q. If we look at 15 years ago versus today, people would have loved to work for multinationals. That is changing today. A lot of people find it more attractive to work for state-owned enterprises (SOEs). MNCs are finding it harder to find talent then retain them. How is that changing the playing field for MNCs in China and how should they react?

A. One could imagine, at a very senior level, if you are the head of Deutsche Bank, and ICBC made you an offer to come to a very senior level, we will see that happening. But other than that, if you see people at upper-mid level, people with 10-15 year experience in multinationals, it won’t be that easy for SOEs to attract them. [If they have] been working for Apple, Qualcomm, IBM or Intel for the last 15 years, basically… their mindset and cultural DNA as a professional has changed. They like the kind of culture that a multinational has.

If you are looking at young people fresh out of college, I could imagine that they may gravitate more towards the SOEs than multinationals. But if you look at the young, fresh out of college level in general, life for them is very tough. Even six months out [of college], what percentage of them get jobs? At that level, you don’t have the scarcity, so the multinationals don’t face [a problem]: some will go to the SOEs but the MNCs still can have their pick. Right now, I don’t see talent, retention, HR, as an issue for the multinationals. In future, could it become an issue? Maybe, but it could also depend on how rapidly the SOEs undergo reform. I wouldn’t bet that they’ll undergo reform at a rapid pace.

Q. In what areas will we see more competition from Chinese firms? How will that change MNCs’ strategy going forward?

A. It will vary sector by sector. There are certain sectors where Chinese companies dominate and have dominated because of national policy. Basically foreign companies are not welcomed: such as steel, cement, telecom, airlines, wind power and solar. Chinese companies are likely to continue to dominate [there]. There are certain sectors where Chinese companies would like to be significant competitors, say athletic shoes. You look at the competition between multinationals, Nike, Adidas, the top two, versus Li-Ning. Li-Ning would like to join the likes of these two, but that is not going to be easy and I wouldn’t predict that [even] in the next 10 years, Li-Ning would be able to join the likes of Nike and Adidas.

So I think the marketing strength, the technological strength, the pre-existing scale, market share, mind share that the western brands have would be almost impossible to ‘dis-acknowledge’.

Thinking of beverages, take Coca-Cola and Pepsi. Of course there are Chinese competitors and they would like to be as big as Coca-Cola and Pepsi in China, but it wouldn’t be easy at all. Because these are sectors not only in China, and the scale effects are very large. The first-mover effect is very large. But on the other hand, if you take foods or toiletries, in almost every country, you do have players that are number one or number two by market share, but you don’t have [that] in beverages or in athletic shoes. Two companies basically have locked up the market. So the market tends to be much more fragmented for a whole variety of reasons, nothing to do with government policy, just economic reasons.

We see the same thing here that in a lot of the FMCG products (fast-moving consumer goods), the market tends to permit many players to compete and permits new players to come up. Over time, these large existing players will catch up with them. In foods, I expect Chinese competitors to become bigger and stronger over time. Some of that just due to sheer effort within China to become bigger and stronger, some of it, because the Chinese company made some smart acquisitions abroad—a brand or technology—and then brought that to China. In those sectors, I see Chinese competition becoming stronger.

In technology, of course Huawei is very strong in China and globally, and ZTE as No.2. I expect them to continue to be strong players. Lenovo dominated the PC market, but the market is shifting to tablets and smartphones and etc. Xiaomi is emerging as a very strong player. You have Apple and Samsung. So I think the battle between these will continue, but there is every reason to expect that in consumer electronics, in addition to your Samsung, LG, Apple or Sony, we will see Chinese players battling it out, and that would include Lenovo and Xiaomi for sure. But also Huawei and ZTE are moving towards handsets and so on so there will be other players in consumer electronics. In consumer electronics we will see both the multinationals as well as Chinese players in the market place, fighting it out. That battle may go on for an extended year of time, but [there may] not necessarily [be] a clear winner.

In software, it’s going to be harder because global scale tends to be hugely important in software, not from a manufacturing point of view but from a R&D point of view.

Q. The last couple of months have been tough for some MNCs in China. We’ve seen raids on Microsoft and Mercedes-Benz, the GlaxoSmithKline case is still in court. We are seeing an increasing amount of scrutiny from the government. Do you think this will be the new norm for MNCs in China?

A. One still has to wait and see because this is a fairly new development in the sense that it used to happen occasionally before, but now in the last 2-4 months, we’ve seen it across many companies. But clearly it means that if you are a multinational in China, in some cases, maybe the screws are being turned on you tighter, sort of like what happened to Google. In certain domains, especially in the IT sector, also because of the Snowden effect, the Huawei effect, in terms of the US pretty much being blocking Huawei from the US market, that some companies may not find it easy to continue in China as the screws become tighter and tighter.

On the other hand, in certain areas, for example in pricing issues, there is much more scrutiny and pressure—[such as for] Mercedes-Benz, Audi, BMW and Jaguar Land Rover. But I don’t think that these screws are being turned in terms of: “We don’t want you”. The signals that I read in the automobile sector which has been one of the sectors that has been under pressure especially in pricing, it’s even possible that the government changes its policy in terms of 50:50 joint ventures versus a wholly foreign-owned enterprise. It’s possible that one day the policy changes [to allow] foreign car companies to set up a 100% wholly foreign-owned enterprise.

Q. Earlier this year, The Economist published a cover story which, among other things, said that China is losing its allure for multinationals and that the China “gold rush” is over. Is this an overly pessimistic point of view?

A. I think it’s sector by sector. In some sectors, particularly the technology sector, it may be that the “gold rush” is over. This may be the early days that happened to Google, but it’s still too early that one still has to wait and see how the policy emerges. In automotives and consumer goods, the days of easy money are over. But if you look at the size of automobile, beverage or athletic shoes market 5-10 years from now, it will be significantly bigger than it is now. So western MNCs will either continue to be market leaders or have major market positions although they might be fighting it out with Chinese companies. In order for the companies to dig out the gold, they would need to make sure that their investment is in line with the growth rate of say 6-7%, not 10%. No.2, they [need to] look at China as a marketing game. If you do that, it will be a bigger market. If that is a bigger market, there is going to be more market to be made.