A case study by Li Mengjun, a researcher at the CKGSB Research Center for Social Innovation and Business for Good, and conducted under the guidance of Professor Zhu Rui of CKGSB, explores the future of eco-fashion in China.

Liang Zi, an eco-minded designer, first stumbled across Gambiered Silk in 1994 and instantly felt a deep connection to the texture and technique used to produce this ancient Chinese material. Gambiered Silk is hand-dyed with the juice of dioscorea cirrhosa, a wild plant unique to Guangdong Province in southern China and known for its medicinal properties. It is produced in the open without the use of chemicals or machines, which Liang Zi felt reflected the harmony that should exist between humans and nature.

Liang Zi, an eco-minded designer, first stumbled across Gambiered Silk in 1994 and instantly felt a deep connection to the texture and technique used to produce this ancient Chinese material. Gambiered Silk is hand-dyed with the juice of dioscorea cirrhosa, a wild plant unique to Guangdong Province in southern China and known for its medicinal properties. It is produced in the open without the use of chemicals or machines, which Liang Zi felt reflected the harmony that should exist between humans and nature.

The material and process surrounding it motivated Liang Zi to establish her company, TANGY • Gambiered Silk, with the hope of both protecting the legacy of, and injecting new vitality into, a piece of 500-year-old cultural heritage. Twenty years later, the company is established as one of the many boutique Chinese companies that meet the demands of the growing middle-class. Like other entrepreneurs, Liang Zi has faced ever-changing consumer requirements, growing costs, sales channel issues, as well as marketing and management challenges.

TANGY’s sustainable brand image initially helped it achieve a reputation and broad consumer support. The business grew quickly and by 2009, TANGY had opened over 400 stores in more than 160 cities across China. As time passed, however, sales declined year-on-year. By 2019 the number of stores was down to 93, including 53 franchised stores and 40 direct-sale stores. TANGY’s management has tried different ways of improving sales while sticking to the core concept of environment protection, but none of the changes have yet worked.

Product mix and pricing

The company currently has two product lines, TANGY for the mid-market and TANGY Collection for the high-end. The average order value of TANGY ranges from RMB 2,000 to 3,000 ($305-$458), while for the high-end it is over RMB 5,000.

TANGY is aimed at consumers aged 45-65 with core buyers in the 50-59 age bracket. This demographic mostly resides in major cities such as Beijing, Guangzhou, Shanghai and Shenzhen and usually wear the clothes on a daily basis. TANGY Collection is aimed at high-income earners with strong cultural awareness. Typically they are aged 35-55, with most buyers being in the 40-49 age group. Customers of TANGY Collection tend to have an annual income of RMB 500,000-2,000,000 and wear the products when attending events.

Producing the TANGY Collection requires a large amount of Gambiered Silk. The production process for this material is extremely complicated: producing a quality batch takes six months and involves more than 30 steps. Climatic conditions, such as humidity, sunlight, temperature and wind direction can influence the process, so production only occurs during a few months each year. The strict production requirements create challenges to the timely supply of raw materials, and the manual process incurs high labor costs.

Sales channels and marketing

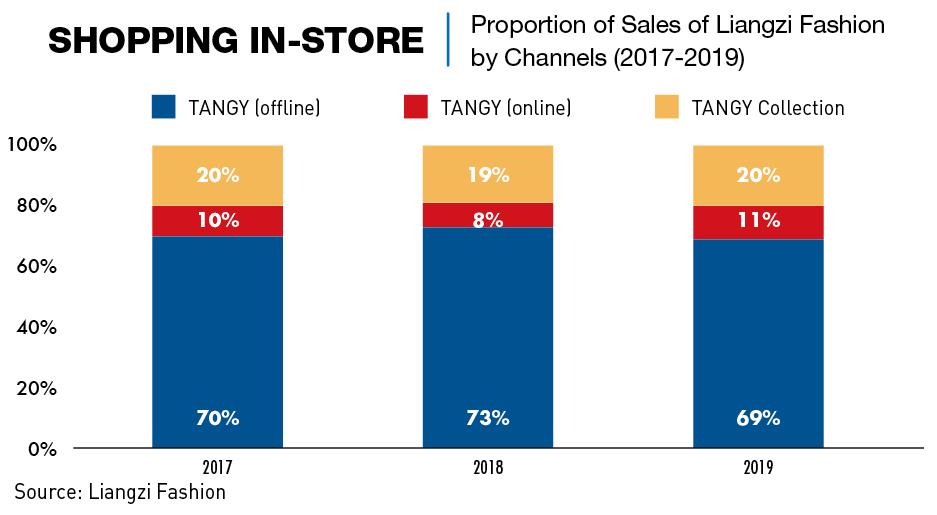

TANGY now has both online and offline sales channels. TANGY Collection is only available offline. But even the sale of TANGY products is 89% offline.

Liang Zi had earlier created an online sales channel. Branded Liangzi Fashion, it was originally intended to help the company clear stock and materials at a low price. But the concept attracted a new group of price-sensitive consumers. However their lack of brand awareness damaged the TANGY name, and online sales grew only slowly through to 2019.

Offline, Liangzi Fashion mainly sells in department stores and shopping malls that match its higher-end brand positioning. It also promotes its concepts, culture and brand values through activities such as culture & art exhibitions, cultural fairs and fashion weeks.

In terms of online marketing, Liangzi Fashion attracts target customers by developing Gambiered Silk “experience products.” On social media, it provides special coupons for consumers who follow TANGY or who purchase its products. It also organizes EMBA exchanges for working students to study at a top international institution, livestreams Gambiered Silk production, and organizes online flower festivals and other interactive activities to attract both online and offline customers.

Customer management

To promote sales, TANGY• Liang Zi explores the needs and pressure points of consumers through data analysis and surveys. It uses the findings to enhance the offline service experience of members and to converse with online members using targeted marketing.

For member management, the company has established a member label database and a membership system. For highly “sticky” customers, the company offers specific promotions and benefits. The TANGY system has accumulated tens of thousands of registered members, but the number of new members in both product lines has been declining, as has repurchase rates.

According to the analysis by the company’s management, the main reason for the decline is that the benefits of shopping mall membership programs exceed those of the TANGY membership program. The decline in both the repurchase rate and the number of new members has created challenges for the company.

Challenges facing TANGY• Liang Zi

As one of the first designer clothing brands established in China, TANGY• Liang Zi has gone through more than 20 years of development. During the first two decades, TANGY adhered to the original intention of eco-environment protection and realized rapid development while protecting Gambiered Silk. However, with market competition intensifying, few customers and production and sales costs increasing, the company faces continuous decline in sales. The challenges are:

Challenge 1: Brand operation and marketing capabilities need to improve.

TANGY products are mostly made of Gambiered Silk, cotton, flax, wool and other natural fabrics. Different from other durable fabrics, Gambiered Silk is too delicate to be machine washed or treated with chemical agents. It can only be hand-washed and air-dried. These washing demands may adversely affect the attractiveness of products among customers. Compared with other designer brands engaged in multi-brand operation, such as JNBY Design, the company finds itself stranded in servicing an aging demographic. A failure to develop the brand name amongst the 1980s and 1990s generations could be one reason why sales are declining as these cohorts increasingly assume spending power.

Challenge 2: Online sales channels are weak and sales positioning affects brand power

TANGY’s online sales channels were originally established for stock clearance. Hence, the styles of products online are slightly outdated and carry a low price. While it adds little to the bottom line, it may be negatively impacting the perception of consumers concerning the TANGY brand.

Challenge 3: Employees are aging, while production and time costs of Gambiered Silk are not easy to control

TANGY is also facing production challenges. The production of Gambiered Silk is complicated and a small mistake or a slight change in weather may boost the reject ratio. Also, employees are aging, especially first-line craftsmen. As the production of Gambiered Silk entails long-term experience, it is impossible for TANGY to solve this problem in a short period by employing a large group of young employees.

Liang Zi has managed to bring back a clothing fabric with a rich history, synonymous with nobleness, healthiness and environmental friendliness. But the question is: How will Liang Zi Fashion develop in the future?

Lessons from peers

Like TANGY • Liang Zi, other designer brands also face market pressure from the success of their own online sales channels, as well as falling margins caused by the influx of foreign high-end brands with flexible supply chains of fast-fashion brands. The question for Liang Zi fashion is how to strike a balance between staying true to the original concept and satisfying changing market demands.

Other players in the same space as TANGY • Liang Zi are also having mixed fortunes.

Exception, another designer clothing brand, was established at the same time as TANGY • Liang Zi. It took a different path in the designer clothing market with elegant design based on an inheritance of Oriental culture and a brand concept of “origin, freedom and purity.” But high prices and the failure of its designs to attract younger generations means its expansion has been impacted. The company has developed special stores such as “double-service” and eco-stores to try and improve sales, but has invested little in online channels.

JNBY Design has successfully solved the contradiction between designer brands and the mass-market with a multi-brand incubation approach. So far, JNBY Design has incubated seven sub-brands, including Croquis, JNBY, JNBYHOME, jnby by JNBY, less, SAMO, and Pomme de terre that cater to consumers of different genders and ages. JNBY Design is also exploring overseas markets. At present, it has 39 distribution outlets and five direct-sale stores outside of mainland China, in 17 countries and regions in the world.

ICICLE Group is an environment-friendly Chinese designer brand with a management concept of globalization. It was founded in Shanghai in 1997 and has incubated numerous brands, including ICICLE and SILEX. In 2018, ICICLE Group acquired CARVEN, a famous French brand. ICICLE adheres to the concept of “comfortable and environment-friendly commuting clothes,” uses natural fabrics and shows its unique charm through a low profile. It is committed to providing high-quality, easy-to-care-for pure natural commuting clothes for young, middle-class people.

Stella McCartney, a well-known British eco-fashion designer, has a development concept of protecting wildlife and developing sustainable fashion. She refuses to use leathers and furs in designs and insists on the research and application of environment-friendly clothing fabrics. In 2001, she co-founded Stella McCartney with Gucci. However, profitability was a problem. In 2004, Robert Polet, the then CEO of Gucci Group, gave McCartney an ultimatum: the company must be profitable within three years, otherwise financial support may be withdrawn. McCartney began to turn a profit two years later.

Stella McCartney’s design idea of using sustainable materials coincided with that of Adidas. Adidas had hoped to launch a high-performance women’s sport suit made of new fabrics that balanced the sense of design and performance in 2005. A joint product series, Adidas by Stella McCartney, was then born—the first functional sports product series run by a first-class brand designer in the global sports market. Through its collaboration with Adidas, Stella McCartney earned profit for the first time. This cooperation continues today. In addition, Stella McCartney also launched environment-friendly clothes worldwide with H&M, which resulted in an immediate increase of 11% in sales that month and achieved great success.

Relying on its research and application of environment-friendly fabrics and crossover cooperation, Stella McCartney has increased brand awareness, improved business performance and become an international brand covering 72 countries. Stella McCartney has since developed men’s, women’s and children’s clothing, as well as luggage and undertaken many joint product series.

Facing fierce market competition, these designer brands have each innovated in different ways.

Where to TANGY?

When looking back over the history of the company she founded, Liang Zi says, “The production of Gambiered Silk may not make or may even lose money in the short run. The process of getting consumers to accept and like Gambiered Silk is a long one. Therefore, the production of Gambiered Silk cannot continue without perseverance. It can be said my deep love for Gambiered Silk is the reason for TANGY’s success. I have always believed that good things will be accepted sooner or later.”

The COVID-19 virus has also added a new level of unprecedented challenges to TANGY, a brand that has primarily relied on offline sales. Will TANGY be able to meet its existing challenges and survive through a pandemic? Only time will tell. Stay tuned.