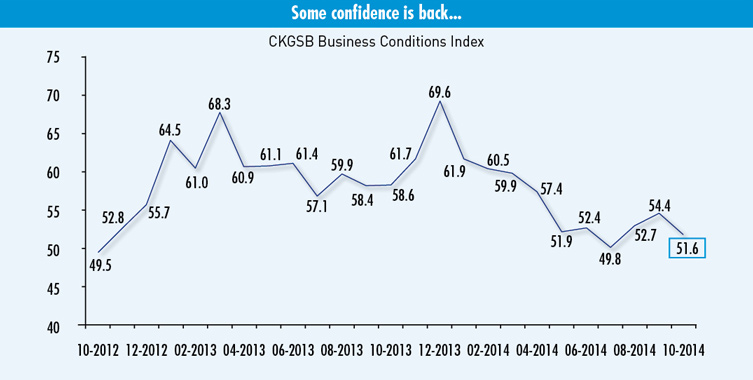

The CKGSB Business Conditions Index shows that after a challenging year, Chinese entrepreneurs have regained some of their confidence, but only just.

Each month CKGSBʼs Case Center and Center for Sustainable and Inclusive Growth conducts a survey of leading entrepreneurs in China to gauge and track changes in their business sentiment. The result is the CKGSB Business Conditions Index (CKGSB BCI), directed by Li Wei, Professor of Economics and Emerging Markets Finance, which provides a barometer on the state of the economy as viewed by Chinaʼs entrepreneurs.

The CKGSB Business Conditions Index reads 51.6 in October, lower than last monthʼs index of 54.4, but still above the confidence threshold of 50.

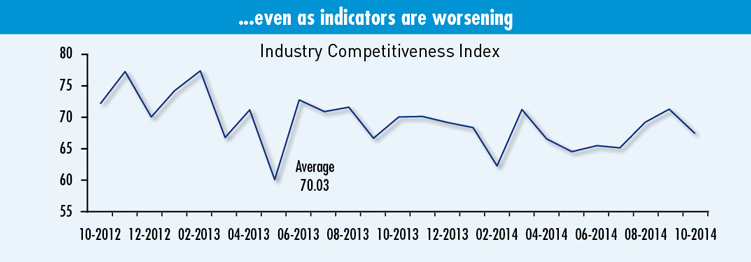

While a downward trend set in during the first quarter of the year, Q2 and Q3 have seen data rising. Chinaʼs macroeconomic conditions now appear to have stabilized. But compared with last year, risks of a downturn remain. In the questionnaire respondents indicate whether their firm is more, the same, or less, competitive than the industry average (50), and from this a sample competitiveness index is derived (see Industry Competitiveness Index). Consequently, as sample firms are in a relatively strong competitive position in their respective industries, so CKGSB BCI indices are higher than government and industry PMI indices. Users of the CKGSB BCI index may thus focus on data changes over time to forecast trends in Chinaʼs economy.

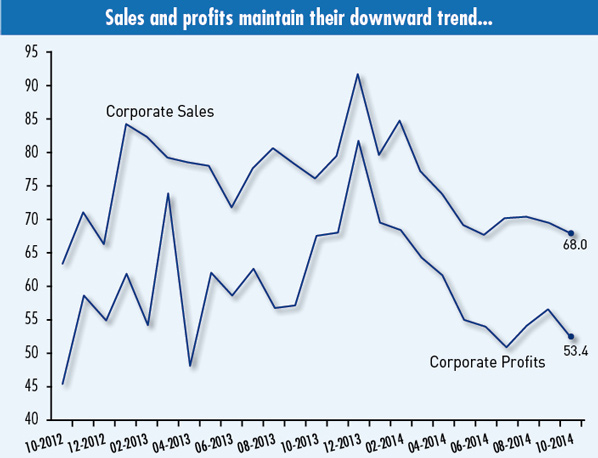

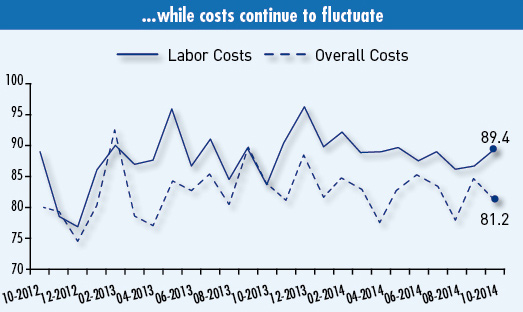

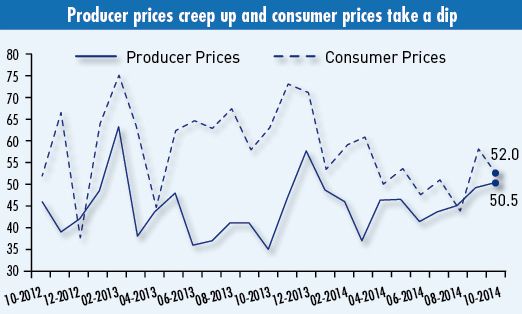

Looking to the four composite indices, corporate sales have fallen slightly from 69.5 to 68, indicating companies are still optimistic about sales in the next six months. The profits index has fallen from 58.2 to 53.4. Survey respondents expect labor costs to increase, based on the index rising from 87.2 last month to 89.4 this month. Total costs are expected to fall, with the index dropping from 84.7 to 81.2. These costs indices have wavered, but as they have remained consistently high, this is not particularly significant. The consumer price index has fallen, registering 52 this month, a drop on last monthʼs figure of 58. Entrepreneurs expect consumer prices to rise marginally in the next six months. The producer price index has risen from 49.2 to 50.5, crossing the confidence threshold for the first time since December 2013. The inventory index has rebounded, implying that overcapacity has eased.