CKGSB’s Business Sentiment Index shows that China’s industrial economy has finally stabilized after a year of contraction.

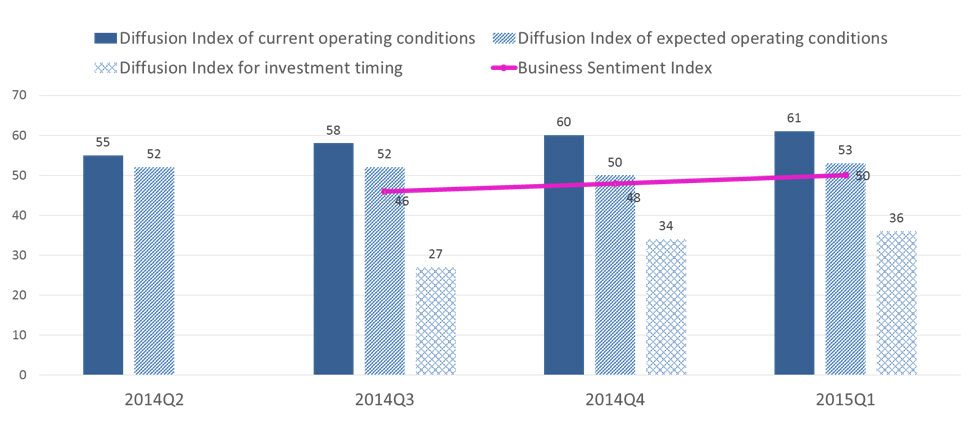

China’s industrial sector has been passing through a rough phase, but there are enough reasons to be optimistic. According to a survey of about 2,000 industrial firms in China, after a year of contraction in 2014, China’s industrial economy has finally stabilized in the first quarter of 2015. The survey, done by CKGSB’s Center on Finance and Economic Growth and led by Gan Jie, Professor of Finance, shows that the Business Sentiment Index (BSI), which is at 50 currently, is right at the turning point between expansion and contraction. In contrast, the BSI stood at 48 in the fourth quarter of 2014 and 46 in the third quarter.

The BSI, which is constructed in a way that is similar to the US Consumer Sentiment Index, is the simple average of three diffusion indices, including current operating conditions, expected change in operating conditions and investment timing.

Talking of current operating conditions, there has been a consistent improvement over the last four quarters. The vast majority of firms expect the operating conditions to be similar in the next quarter, with the diffusion index increasing from 55 in Q2 last year to 61 in Q1. This is largely due to the fact that the number of firms reporting difficult operating conditions has declined consistently, from 19% in 2014 Q2 to 4% in 2015 Q1.

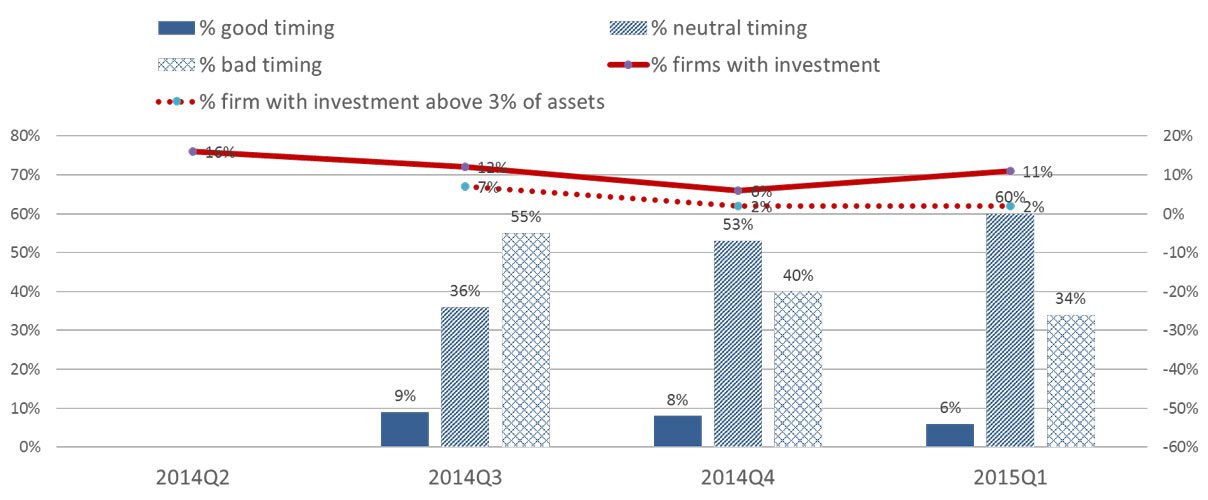

However, investment sentiment is a different story. Only 6% of the survey respondents considered the timing to be “good” for investment while 34% thought it was “bad,” yielding a diffusion index of 36, far below the turning point of 50. Consistent with weak investment sentiment, only 11% of firms made fixed investments in Q1. The vast majority of firms invested less than 3% of their assets—a level that roughly covers depreciation, which leaves only 2% of firms in a true expansion mode, a decline from 7% in 2014 Q3.

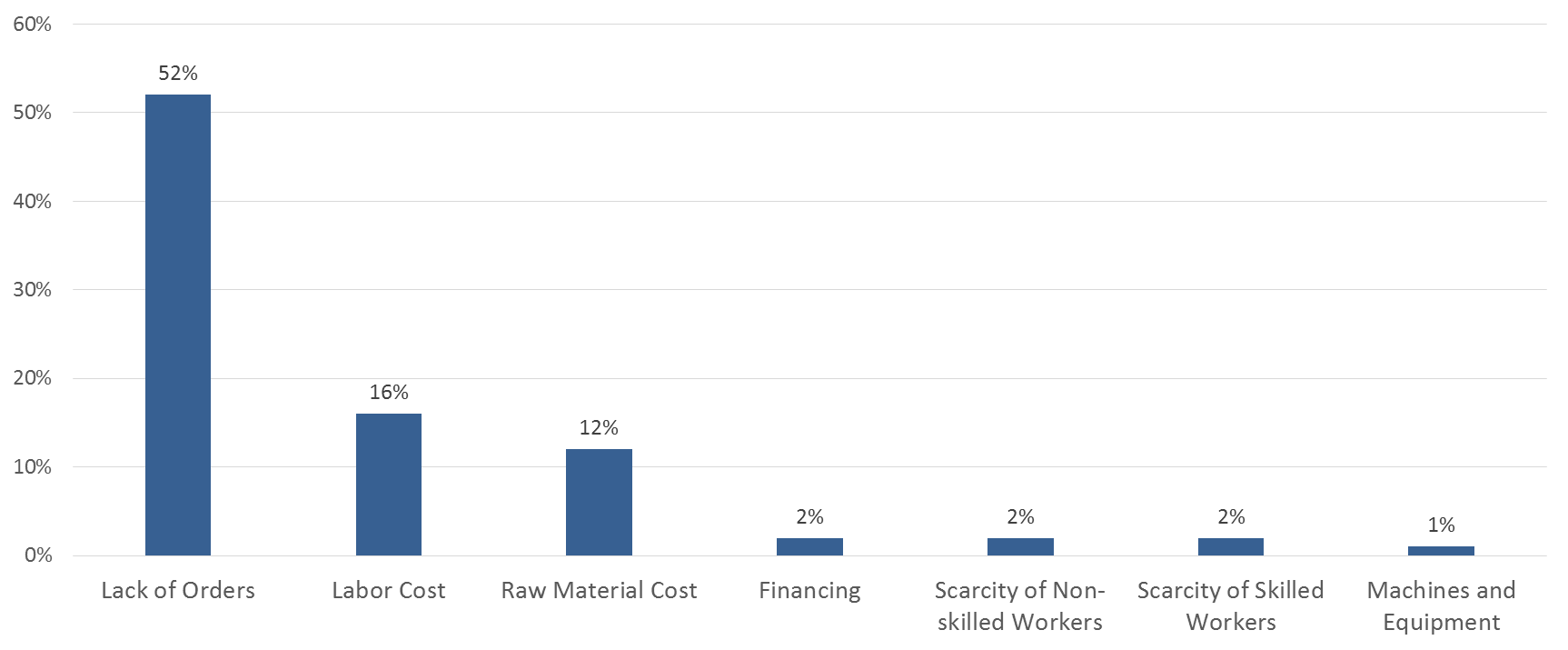

In terms of challenges going forward, most firms believe that weak demand is the biggest followed by labor and raw material costs.

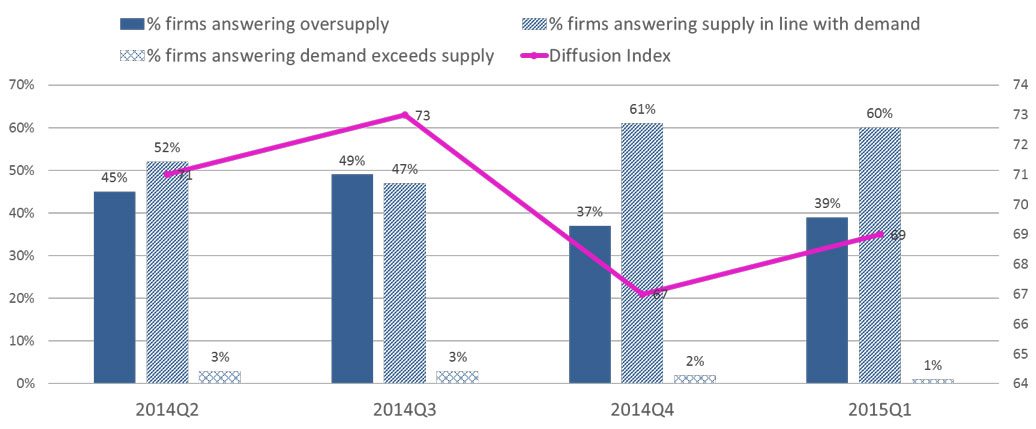

Although weak demand is still a prominent problem, due to a span of reduced investment, the severity of excess capacity has actually decreased over time. In 2014 Q2, as many as 45% of firms reported supply exceeding demand. That number had dropped to 37% by 2014 Q4 and 39% by 2015 Q1. The number of firms reporting excess capacity of more than 10% has continuously declined in the past year, from 15% in 2014 Q2 down to 6% in 2015 Q1. Firms reporting excess capacity of more than 20% have declined from 8% to 2%.

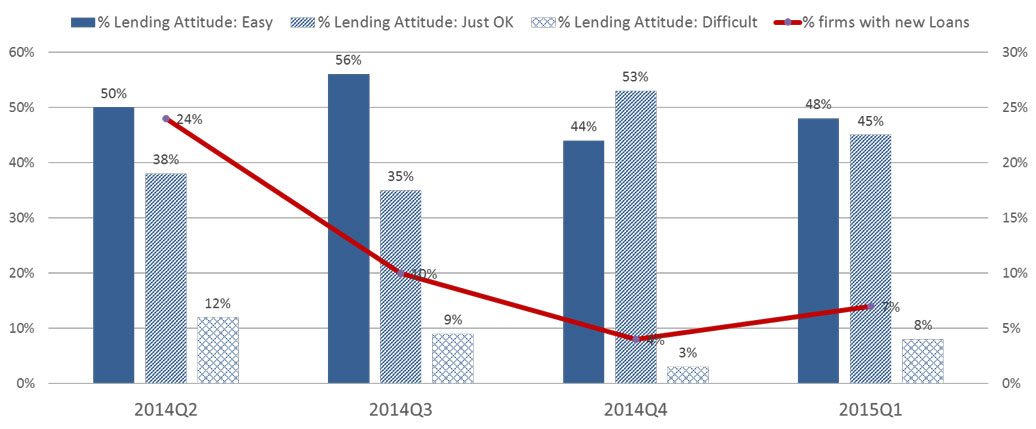

Financing, on the other hand, is not considered a bottleneck for growth with 96% of firms relying on internally-generated funds. As far as loans are concerned, very few—8%—of the respondents reported difficulties in the lending attitudes of banks. But Gan Jie, who leads the survey, stresses that the fact financing is not a bottleneck must be viewed against the backdrop of an industrial economy in slight contraction, adding that financial reform is still important. If the financial system cannot allocate resources in an efficient manner, she says, then financing would likely become a bottleneck when the economy recovers.

For the full report, please click here.