Asset Pricing, Automation, Banking, China’s Industrial Economy, Corporate Finance, Entrepreneurship, Financial Regulation, Manufacturing, Stock Markets

Chuang, EMBA, EE, Chinese MBA, English MBA, Global Programs

Phone: +86 10 8518 8858 ext. 3323

E-mail: jgan@ckgsb.edu.cn

Professor of Finance, Director of Center on Finance and Economic Growth, Cheung Kong Graduate School of Business (CKGSB)

PhD, Massachusetts Institute of Technology

Areas of Expertise: Asset Pricing, Automation, Banking, China’s Industrial Economy, Corporate Finance, Entrepreneurship, Financial Regulation, Manufacturing, Stock Markets

Professor Jie Gan holds a Ph.D. from MIT and is currently a Professor of Finance at Cheung Kong Graduate School of Business (CKGSB) and a former Associate Dean of Technology Innovation and Alumni Affairs. Prior to joining CKGSB, she was a professor in finance at Hong Kong University of Science and Technology and an assistant professor (tenure track) at Columbia Business School. She has published extensively on banking and finance in top academic journals. In 2011, she was the runner-up for the prestigious Brennan Award for Excellent Papers. Her research and teaching were featured in major media outlets, such as Wall Street Journal, Financial Times, and the Economist.

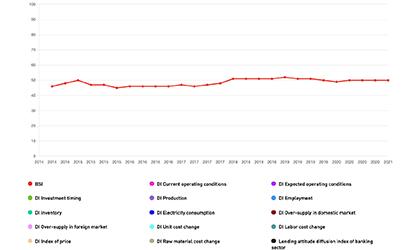

Professor Gan conducts a large-sample survey of about 3000 industrial firms every quarter. The resulting Business Sentiment Index (BSI) and the unique insights generated have been regularly reported by top media outlets, such as Wall Street Journal and FT. The time series of Professor Gan’s economic indices can be accessed through the Bloomberg terminal.

Professor Gan’s industry experience is in technology innovation. She has invested in and mentored five unicorn companies from their early stages. She is a co-founder of XbotPark in Dongguan Songshan Lake, China, considered the best tech incubator in China. She founded Zhixing Institute of Business Practices for Tech Entrepreneurs, which aims to systematically help tech founders enhance their business insights and abilities by combining highly practical teaching and coaching with tech incubation. From 2015 to the present, among companies invested in and mentored by Professor Gan, at least one company per year has been awarded by Time magazine as Best Invention of the Year.

In her leisure time, Professor Gan is an avid contemporary art collector. She is also active in promoting young artists worldwide, which to her resembles angel investing and tech incubation. She enjoys reading, watching movies, meditation, traveling, and fitness exercises, such as jogging, swimming, hiking, and Chinese martial art.

Seminars:

Sloan School of Management at MIT, Columbia Business School, Wharton School at University of Pennsylvania, University of Wisconsin Business School, City University of New York, Chinese University of Hong Kong, Hong Kong Polytech, Hong Kong University, HKUST, City University of Hong Kong, University of California at Berkeley; University of Texas at Austin

Federal Reserve Banks: Chicago, Cleveland, New York; Milken Institute

Conferences:

Presenter: Eastern Finance Association Conference 2002; NEBR Corporate Finance Summer Institute 2003; AFA 2004, 2009; Financial Intermediation Research Society Meeting 2004 & 2006; “Accounting, Transparency and Bank Stability” Workshop 2004 at Basle (jointly sponsored by BIS and JFI), WFA 2004, 2006, & 2008, EFA 2004 & 2005, China International Finance Conference 2004 & 2006, City University Finance Symposium 2005, RFS-IU Conference on the Causes and Consequences of Recent Financial Market Bubbles 2005; Summer Real Estate Symposium (2006 & 2008); Indian School of Business Summer Camp (2007); Emerging Market Corporate Finance Conference (2007); NBER China Workshop (2008)

Discussant: AREUE Conference (2002); WFA Conference (2002); EFA Conference (2002); Financial Intermediation Research Society Meeting (2004 & 2006); China International Conference in Finance (2005, 2008, 2009); Paris Corporate Finance Conference (2009)

Session Chair: Eastern Finance Association Conference (2002), China International Conference in Finance (2008, 2009).

Referee:

Journal of Finance, Review of Financial Studies, Journal of Financial Intermediation, Journal of Banking and Finance, Journal of Money, Credit, and Banking, Scandinavian Journal of Economics, Southern Journal of Economics, Japan and the World Economy, Journal of Japanese and International Economy, Japan and the World Economy, Pacific-Basin Journal of Finance; Journal of Real Estate Research, B.E. Journal of Economic Analysis, Economics of Transition

Editorial Positions:

Journal of Banking and Finance, Associate Editor, 2008-present

International Review of Finance, Associate Editor, 2008-present

Quarterly Journal of Finance, Associate Editor, 2010-present

Journal of Financial Economic Policy, Editorial Advisory Board, 2007-present

Y Combinator: Bootcamp for Startups, 2015

Articles

NON-ACADEMIC WRITINGS

My View of the Chinese Stock Market (Fall 2007)

[English] [Chinese]

This article is based on a talk given in Beijing’s Financial District on Sept. 26, 2007.

China Story and Current Market Valuation (Fall 2009)

21 Century Herald, Oct. 2009

[English][Chinese]

今年中國經濟政策「進退兩難」(信报,2010年2月23日)

[Chinese]

确立沽空机制是优化市场运作之本 (信报,2010年4月20日)

[Chinese]

In Refereed Journals:

Book Chapters: