China’s industrial economy is still at the bottom of an L-shaped economic trend despite Q2’s GDP is better than expected, according to the latest CKGSB survey of over 2,000 industrial firms nationwide. The survey, led by CKGSB Professor Gan Jie, shows that the biggest challenge facing the industrial economy is still overcapacity and weak demand.

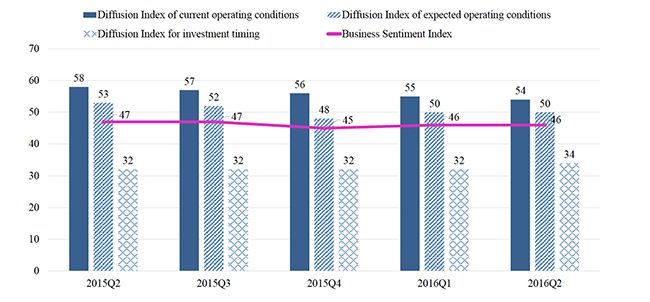

The Business Sentiment Index (BSI), a major indicator of the survey, stood at 46 in Q2 2016, the same as last quarter, and indicated a contraction mode. The BSI, conducted in a way similar to the US Consumer Sentiment Index, is the simple average of three diffusion indices including current operating conditions, expected change in operating conditions and investment timing.

With regard to current operating conditions, only 14% of surveyed firms replied “good”, 79% replied “neutral” and 7% replied “difficult”. Compared to Q1 2016, the diffusion index was 54, downs slightly from 53. The diffusion index for expected change in operating conditions is 50, just at the turning point and the same as last quarter.

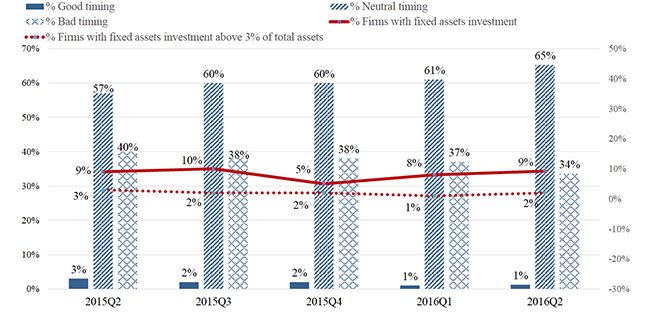

But the fixed investment remains sluggish, with only 1% of the firms considering it’s a good time to make fixed investments and only 9% of firms actually making investments in Q2 and a mere 2% made expansionary investment. According to the poll results, the sluggish pace of investment will not improve in the near future with only 6 firms, accounting 0.3% of polled, saying they plan to make investment in Q3.

Most of the country’s fixed investments in Q1 and Q2 were dominated by government-led investment and Professor Gan’s survey found this trend would be a persistent one.

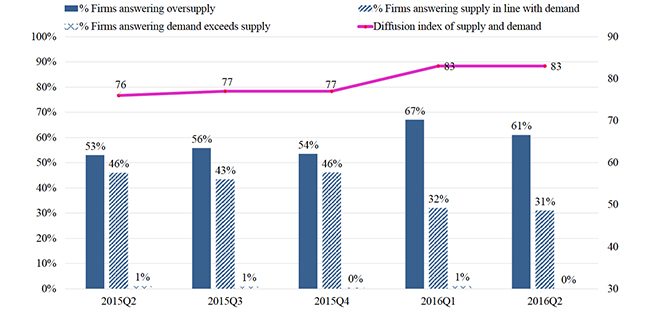

Overcapacity is still the biggest challenge. According to the survey, 60% of the firms reported an oversupply in the domestic market in Q2, with the diffusion index reflecting oversupply hitting another historical high at 83.

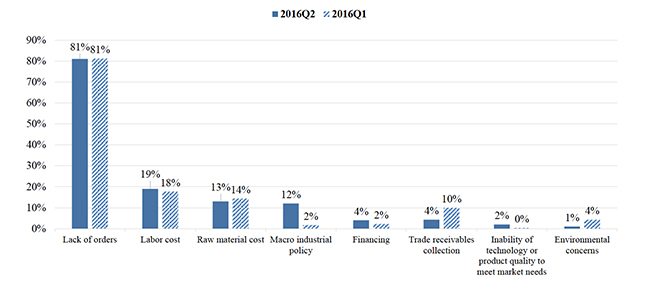

Weak demand is still a major factor limiting the industrial economy. 81% of the firms surveyed in Q2 cited a lack of orders.

Compared to Q1, significantly more firms, from 2% to 12%, expressed concerns about both the macro economy and government policy as constraining factors for future production.

Financing is still not a bottleneck for the industrial economy: only 4% of firms cited financing as a constraining factor. However, according to the survey, the fact that financing is not a bottleneck should be set against the backdrop of a declining industrial economy.

Therefore, against the background of overcapacity, government’s new round of stimulus this year focusing on loosening monetary policy and infrastructure investments has resulted in that a great amount of credit has entered real estate and commodities, rather than real economy, causing a rapid run-up asset prices, commented Professor Gan.

Gan said that inflation remains a long-term concern. “Government investments are being made into infrastructure, but as private investment continues to decline, it is clear that monetary and fiscal stimuli alone cannot revive the industry given the severe overcapacity that exists.”

However, despite all these short-term challenges, she added that there are still a number of areas for growth, including the rise of new industries such as the service sector and internet-related businesses, the reform of state-owned enterprises and urbanization, meaning that the long-term outlook for the Chinese economy provides reasons for optimism.