Plant-based meat producers are beginning to battle it out in China, a market little known for vegetarianism.

As Julia Yuan, an advertising company executive in her mid-20s, lines up to get lunch at a Starbucks outlet in the city of Wuxi in East China, she zeros in on a meatless lasagna. “I’m moving away from meat,” she says. “Everyone says meat is killing the earth, so it makes me feel good … like I’m doing my part.”

Till a few years ago, people like Yuan were very much the exception in China, a nation known in recent decades for its heavy consumption of meat. But attitudes are changing, especially among the urban young. Big piles of pork in the middle of the dining table are beginning to give way to plant-based substitutes prepared and presented to appeal to the palates of environmentally aware youngsters.

As food habits change, growing legions of both smaller restaurants and major brands are jumping to profit from this meatless trend.

Burger King, KFC and Starbucks are all now offering meat substitute food products in outlets in major cities. The idea clearly resonates with a new generation in China that is in tune with millennials around the world looking to protect the earth from environmental damage.

“It’s not so much about health for me,” Yuan adds. “I can taste the difference, but it’s not that great of a sacrifice, so why not? The earth is in trouble and climate change is real.”

Bon Appetit!

In January, fast food chain Dicos, with 500 outlets across the country, added JUST Egg—a plant-based egg substitute—to its menu and replaced real eggs with the product in the Dicos breakfast menu.

“One week after launching JUST Egg, Dicos reported a 24% increase in breakfast sandwich sales versus last year,” says Andrew Noyes, JUST’s head of global communications.

The concept of “flexitarian,” defined as someone who is primarily a vegetarian but occasionally eats meat or fish, is also becoming more relevant for restaurants when they consider revising their menus. And it’s not just Western fast-food operations which are doing this. Restaurant chains like Jixiang Wonton, a dumpling soup outlet, also recently introduced plant-based products.

“As first-tier cities and second-tier cities become wealthier, you see an emergence of concerns as people start putting more importance on lifestyle and the food they eat, whether it’s coming from health, safety or wellness,” says David Laris, chef and CEO of David Laris Creates, a China-based consulting company specializing in food and beverage outlets.

In 2020, the fake meat industry gained much added traction thanks to the pandemic. “In recent times, plant-based meat substitutes—which are seen as a healthy and eco-friendly alternative—have risen in popularity. This was fueled even more so by COVID-19, which led to 80% of consumers paying more attention to eating healthier after the pandemic,” says Qinxin Aw, Strategy Partner at media agency network Mindshare China, referencing a study by Nielsen.

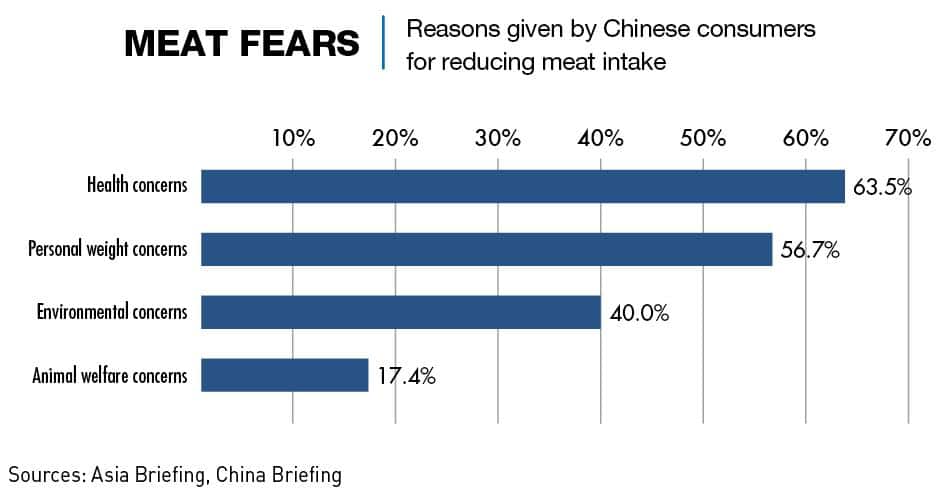

Underlying the trend are both changes to personal eating habits and attitudes, and also an environmental awareness of the need for both food security and reduced greenhouse gas emissions, something which meat production hugely contributes to. China has pledged that its greenhouse gas emissions will peak by 2030 and that the nation will become carbon neutral by 2060. The government has published guidelines seeking to cut meat consumption in half by 2030, partly to meet these obligations, but also to address increasing health problems.

Until four decades ago, the average person didn’t eat much meat: in 1980, annual consumption was 14.6 kg per capita. And it is now around 50 kg, which is still less than half of US levels.

“As livestock farming produces 20% to 50% of all man-made greenhouse gases, finding alternative protein sources is crucial to meeting these targets,” says Franklin Yao, CEO of YouKuai Group, the company behind the Chinese plant-based meat substitute brand, Z-Rou.

Growing sensitivity toward animal cruelty is playing into the meatless trend as well. “Every once in a while, I stumble upon some videos of animals in slaughterhouses or production settings and I feel guilty about eating meat,” says fashion blogger Haru. “Then I try to eat vegetables and fruits or ‘fake meat’ instead of real meat for a day or two.”

But health is also a factor supporting the trend. “Our research into meat substitutes suggest that health concerns, rather than environmental concerns, are driving adoption of flexitarian dining habits,” says Michael Norris Strategy and Research Manager at AgencyChina, a market intelligence firm. “Younger consumers hope a flexitarian diet can improve weight control, cholesterol levels and reduce their cancer risk.”

Prepping up

Traditional culture provides a foundation for a shift away from meat. Since at least the Tang Dynasty in the 8th Century, there has been a vegetarian strand to Chinese cuisine related to Buddhism. Take a stroll in the bylanes surrounding Buddhist temples in major cities and you are bound to find vegan restaurants serving mock meat dishes made with ingredients like tofu (bean curd), taro and gluten.

“If you look at the vegetable sections of a lot of regional cuisines, there are an awful lot of non-meat dishes in there, even if they may use pork fat for cooking,” says Laris. “The market is very used to vegetarian mock meat although what we are trying to do is not produce mock meat but plant-based protein—there is a bit of a difference.”

Green Common, a franchise vegetarian restaurant operator featuring veggie-burgers and substitute pork dishes, recently opened an outlet in a Shanghai shopping mall. Manager Nancy Zhang says almost all customers fall into one of two groups—either vegans who have already given up on meat, or young people who want to try something new. The clientele is mostly around 25-35 years old and is 60% female.

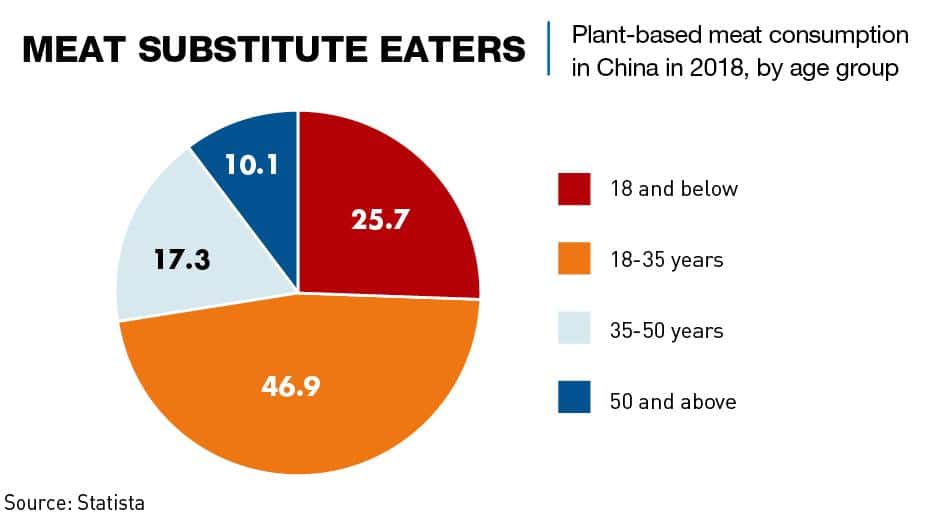

“As in the US, China’s cosmopolitan cities are leading the way, including Shanghai and Beijing. For example, consumers in Shanghai are very open and influential,” says Z-Rou’s Yao. The similarities between the kind of customers trying plant-based options in the US and China is something Noyes sees as well, but adds that in China, “they skew slightly toward more female, younger and more educated.”

Bringing home the bacon

A 2018 estimate valued the Chinese plant-based meat substitute market at $910 million and projected annual growth of 20-25%. This has attracted no shortage of international players and homegrown startups. “Currently, it is an open playing field for brands to venture into this growing category in China,” says Mindshare’s Aw.

International entrants include Beyond Meat, JUST and Starfield, while homegrown players include Shanghai-based Z-Rou and Hong Kong’s OmniPork from Green Monday. Although the whole sector is quite new, some foreign brands have been around for a while. The largest independent meat substitute provider in the United States, Beyond Meat, was launched in 2012. Entry to the China Mainland market, however, has been far more recent, as has the rise of local competitors. Z-Rou was only launched in November 2019.

Norris sees the market as split into four main segments. Along with the obvious plant-based meats for Chinese and Western cuisines, he sees two additional segments—traditional Chinese snacks such as mooncakes and packaged snacks like alternatives to beef jerky. “Domestic players have localized their offerings from the get-go,” he says. “Most domestic players aren’t copying Beyond Meat and Impossible Foods by making burgers and steaks. Instead, they’re focusing on local dishes such as dumplings, mooncakes or meatballs, and opting for pork rather than beef flavors.”

This is certainly the approach taken by Z-Rou. “Our product has been created for China, and you can use it in dumplings, steamed buns and noodles. We wanted to create the least processed meat substitute product in China,” says Yao.

In November, Beyond Meat launched Beyond Pork especially for the Chinese market and will start local production during the first half of 2021 in the first of two announced factories in Zhejiang Province, close to Shanghai. OmniPork, currently made in Thailand, will also localize production in 2021 in a factory in the southern city of Guangzhou.

Localizing production will go some way to reducing costs, but meat substitute products are likely to continue to sell for a premium. Besides being a restaurant, Green Common also has a retail section and sells an OmniPork 690g pack of ‘minced pork’ for RMB 79, close to double the retail price of real minced pork, depending on the cut.

Z-Rou is selling its meat-substitute products to consumers through e-commerce platform Tmall and higher-end grocery stores and it hopes to break into the school cafeteria market, but pricing is a problem.

“The Chinese have [used] tofu [for centuries], it is true, but given that plant-based substitutes are unlikely to ever come down to a comparable price point, it is unlikely there will be high uptake among lower-tier consumers and older people,” says Aw.

Laris disagrees. “Production of plant-based alternatives is more expensive than cheaper meats right now,” he adds. “But as with all things, when innovation kicks in, I think the price will come down.”

Just desserts

Euromonitor published a report in 2019 saying 60% of Chinese people are receptive to the idea of a plant-based diet and 39% are reducing their meat consumption. But there remain persistent challenges for the plant-based meat market, and education and assuaging concerns about the products will continue to be important. “While more than 90% of consumers have heard of substitute meat products, nearly half of this group is unsure of what the products exactly entail,” says Aw.

While interest in, and consumption of, meat substitute products is growing among groups in the cities, a fundamental shift away from beef, chicken and pork seems unlikely in the near future. The fact that plant-based meat substitutes are processed foods is a huge barrier to acceptance by consumers given the emphasis Chinese usually put on ‘fresh’ ingredients.

Most of the industry is also currently centered on Shanghai, the largest and most prosperous city. As Green Common’s manager put it, “If you can’t succeed in Shanghai, you can’t succeed anywhere in China due to the openness of [Shanghai’s] consumers to new things.”

In the longer term, Yao sees a world where there is significantly less meat consumed overall, and points to the government-mandated targets to cut meat consumption as a key part of that. “The alternative-protein industry will play an important role and the market has huge potential,” says Yao.

“We’re seeing more and more opportunities and everyday there is another channel that we are seeing opening up,” says Laris. “Is there going to be enough space for everyone in that? In the short term, I think it could be a little bloody, but in the long-term it’s going to be a huge market.”

With the publication of the first standards for the industry in December 2020, the government seems to agree. The standards lay out how such meat substitute products should be labelled and also the amount of protein they should contain. Non-breaded plant-based meat should contain not less than 10g of protein for each 100g of product and for breaded and plant-based seafood it should be no less than 8g.

Ultimately, it will be a question of how consumers take to the product. “It is catching on among the younger generation as plant-based meat is generally being regarded as a weight-control healthy food ingredient,” says celebrity Master Chef Jereme Leung.

Even the traditional Chinese Buddhist market seems open to the new products. Lawrence Gao was born into a Nanjing-based Buddhist family which didn’t eat meat, but he was converted to the new-age approach in a coffee shop. “I had a plant-based ‘beef’ lasagna from Starbucks, and it tasted great. It is convenient for vegetarians to eat vegetarian food at any time without looking for vegetarian restaurants,” he says.

“We believe in compassion for all living beings and we are happy to see more non-vegetarians eating plant-based meat, and substitute it for real meat, so that animals can avoid suffering,” he adds. “This is the best.”