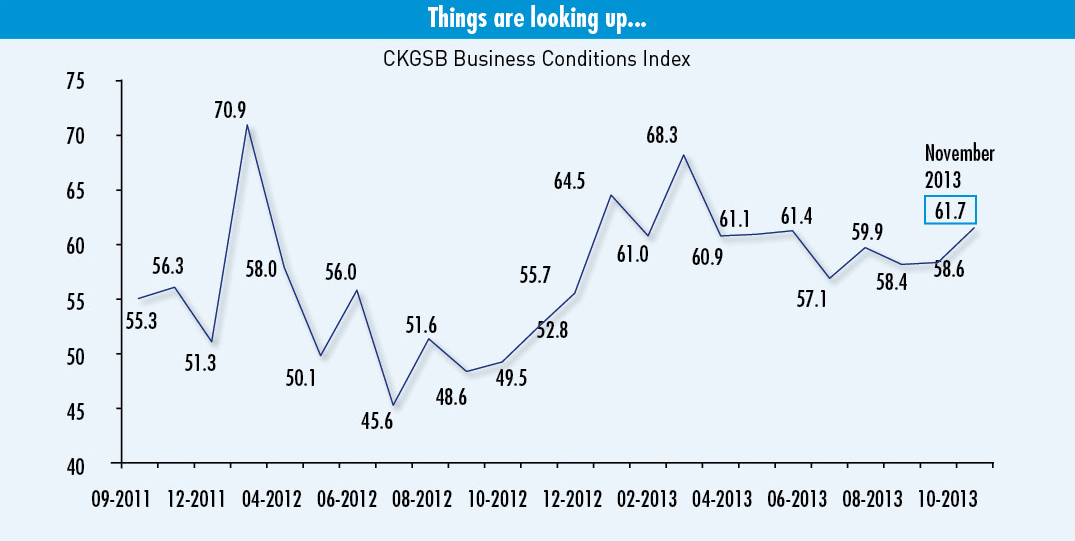

The state of the Chinese economy: the latest CKGSB Business Conditions Index shows that business are gearing up for growth

Business sentiments seen to be warming thanks to better-than-expected economic data released in October and November, and optimism surrounding the Third Plenary Session of the 18th Communist Party of China Central Committee. Each month CKGSB’s Case Center and Center for Economic Research conduct a survey of leading entrepreneurs in China to gauge and track changes in their business sentiment. The result of this survey, the CKGSB Business Conditions Index (CKGSB BCI), produced under the guidance of Li Wei, Professor of Economics and Emerging Markets Finance, provides a barometer on the state of the economy as viewed from the eyes of China’s entrepreneurs.

The CKGSB Business Conditions Index for November 2013 shows a positive reading of 61.7, which is 3 points higher than last month’s figure of 58.6 (see CKGSB Business Conditions Index). (See CKGSB Business Conditions Index for August, click here.) As 50 is the threshold between a positive and negative outlook, the 2013 average of 61.2 (7.3 points higher than this time last year), shows that most of our sample of business leaders in China is optimistic about business conditions over the next six months.

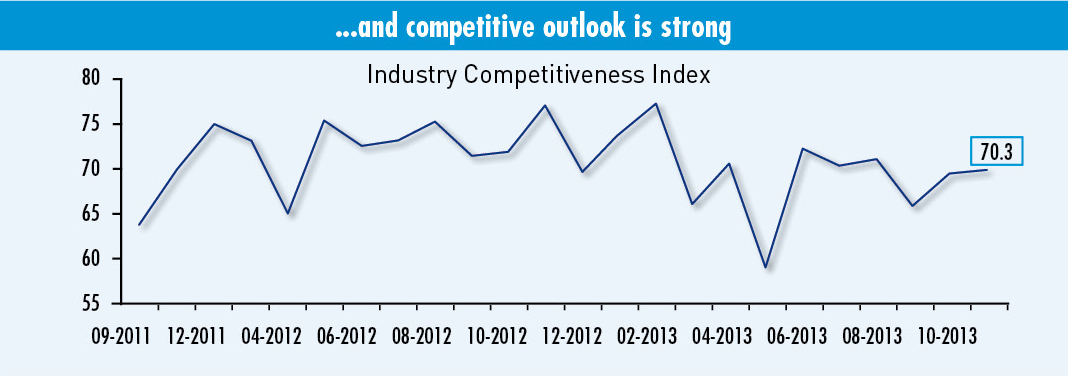

The CKGSB BCI questionnaire asks respondents to indicate whether their firm is more, the same, or less, competitive that the industry average. From this we derive a sample competitiveness index (see Industry Competitiveness Index). Consequently, as our sample firms are in a relatively strong position in their respective industries, the CKGSB BCI indices are higher than government and industry PMI indices. Thus users of the CKGSB BCI index may focus on changes over time to forecast trends in the Chinese economy.

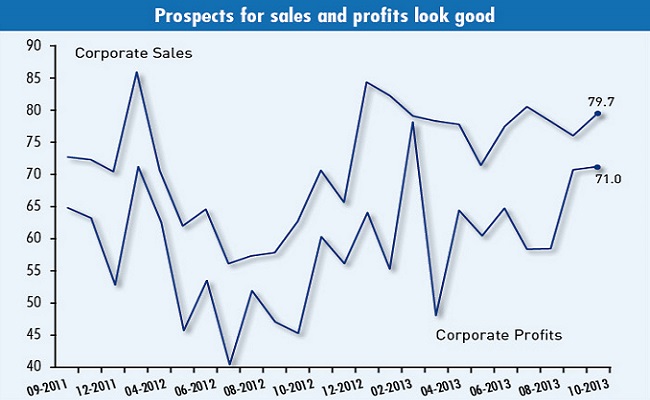

The corporate sales index rose 3.4 points from 76.3 to 79.7. However, the expectation of higher sales has only led to an increase in the corporate profit index of 0.3 points to 71.0 (see Corporate Sales and Corporate Profits). Together these two indices show that firms are comparatively optimistic about the next six months.

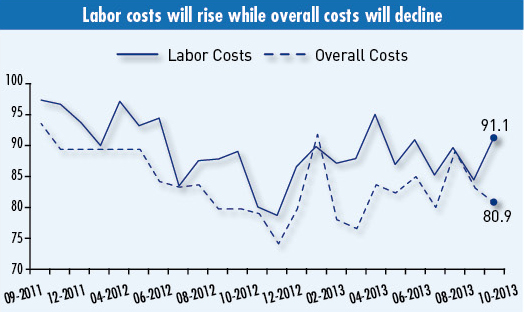

The labor cost index increased from 84.4 to 91.1 while the overall cost index decreased from 83.5 to 80.9 (see Labor Costs and Overall Costs). It appears that the majority of sample firms anticipate costs rising on last year.

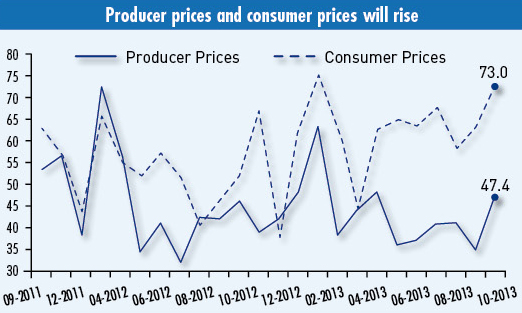

The consumer prices index rose 9.8 points from 63.2 to 73.0 (See Producer Prices and Consumer Prices). The producer prices index rose 12.4 points to 47.4, a reduction in exposure on last month. The rebound in producer prices is indicative of a potential for export inflation next month.