Made in China 2025: Looking at a decade of China’s self-sufficiency drive

Developing Brands in China: AI is driving forward an already digital-forward market

Shipping and Logistics: China’s expanding maritime role

Robotics in Industry: China is set to lead in the application of embodied intelligence

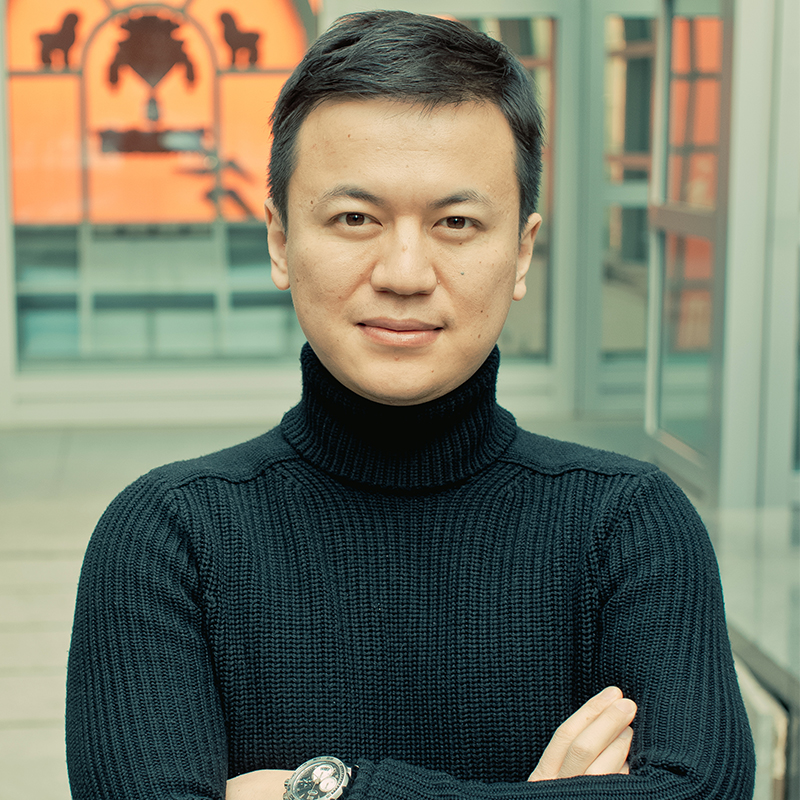

PROFESSOR ANALYSIS

See More

CKGSB Publication

China and the Global AI Race

This white paper shows how organizations can thrive by leveraging China's deep integration of artificial intelligence with its advanced manufacturing and data ecosystems. Understand the profound shifts happening in open-source AI, robotics, and leadership, and see how they are creating new models for global growth and innovation.

Discover