Awareness about socially responsible products is increasing, but are consumers willing to pay a premium for them?

Fair trade coffee or regular coffee? Do you agonize over that decision? If your answer is yes, you are part of a subset of consumers who prefer to buy socially responsible products. A few consumers, particularly in developed countries, have started caring about how companies treat employees, animals and the environment. As a result, things like fair trade coffee, organic food, environmentally safe cleaning products, cosmetics which don’t use animals for testing and electric cars are slowly gaining popularity.

But there’s a flipside. Socially responsible products often come with a higher price tag. Will consumers pay more for these products? Russell Winer, the William H. Joyce Professor of Marketing at New York University’s Stern School of Business, recently co-authored a paper with Stephanie Tully, examining consumers’ willingness to pay for socially responsible products. In this interview, Winer explains how much of a premium consumers are willing to pay, and what kinds of socially responsible products tend to be more popular.

Q. In recent times, consumers, especially those in the west, have become more aware of socially responsible products—be it fair trade coffee or the working conditions in iPhone factories in China. In your assessment, how has this awareness translated into popularity for socially responsible products? Are socially responsible products ubiquitous in consumers’ lives or do we still have to reach a tipping point?

A. From my experience in the US and also in Europe there has been a fair number of new products being introduced that have some sort of socially responsible dimension. You mentioned fair trade coffee. There are many coffee roasters and retailers now that emphasize the fact that the coffee that they buy is from countries and from farmers that have fair practices. We are seeing an introduction of more products, for example, cleaning products that are trying to reduce the use of hazardous chemicals and replacing them with more natural ingredients. For example, houses and apartment buildings are built to ecological standards.

More and more consumers are interested in this kind of product and as a result companies are starting to think about supplying these kinds of products to consumers. So I think a lot has been driven by consumer need and we are starting to see more and more products that are safe for the environment, have some kind of safe labor practice and maybe treat animals humanely in terms of production.

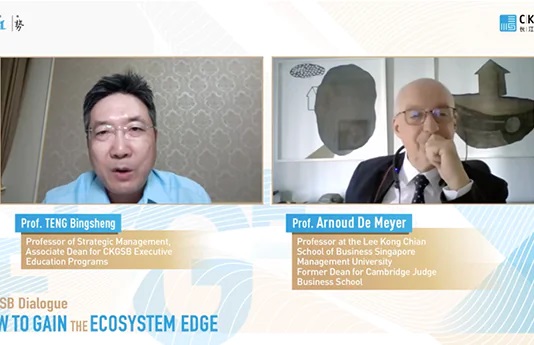

(Watch the video below)

Q. For companies, what’s at stake here beyond heightened consumer awareness? So, if they are not thinking about socially responsible products, do they stand to lose?

A. Overall, companies are becoming more aware of what we call corporate social responsibility (CSR) issues. That’s not just related to environmentally safe products, but also things that they do in the community and those kinds of activities. Academic research has found that investments in CSR have a positive impact on consumer awareness, stock price, profitability, etc. So I think that there is something in it for both sides. There is something in it for consumers who can feel good about buying products that have these dimensions, and also for companies that are satisfying these needs and perhaps as a result, increasing their sales or profits.

Q. While companies think through socially responsible products, how can they do it in such a way that it is closely aligned with their own interests and business goals?

A. An example that I’d like to use is the Clorox Company. Clorox is best known around the world for bleach, which is not the most environmentally safe product. In the US, they introduced a line of cleaning product called Green Works. They’ve [replaced] the chemicals in the product with natural ingredients that hopefully have the same cleaning capabilities but are more environmentally safe. That’s a good example of a company that has found success to some extent in doing good.

There are other companies that have done that. There is a toothpaste brand called Tom’s of Maine and Ben & Jerry’s ice-cream. When you buy products from [some companies], they make donations to countries for safe water and a number of things. That’s the way they’ve tried to position themselves in the marketplace. They are doing good, but it’s also part of what we call value proposition. So it’ll appeal to consumers, differentiate them from other companies, and also provide some benefits to some people at the same time.

Q. When customers first see these products, what goes on in their mind? How do they think through their decisions? For example, is buying coffee just about satisfying an urge for caffeine or are there more layers to that decision?

A. Well, I think that they primarily wanted a cup of coffee, right? The environmental benefit is a secondary benefit. So, I don’t drink coffee, but I have the concern for the environment, but my concern for the environment is not going to make me a cup of coffee. So I think the basic interest in needing a house, building an office or buying a cup of coffee or the need to clean your bathtub is going to be the basic need and the secondary benefit is going to be the environmental concern, not the primary benefit.

The key issue of this product is the price, because generally, products that do have some kind of socially responsible benefit cost more in the market place. That really was the aspect that provoked my research interest in this topic: that whether or not people are willing to pay more for its benefits. So while I may want a cup of coffee, am I willing to pay a higher price for coffee where the producers conduct fair trade practices? What is the threshold indifference that makes me willing to pay more versus a less expensive coffee at McDonald’s?

What we found historically is that what people say they’ll do is not necessarily what they do. That’s a basic problem in marketing research. In a survey people generally say, “Yes, of course, I’d be willing to pay more for some products that treat animals better, have less chemicals, or companies that conduct fairly better practices”, but then people have budgets and families and recession hits. Maybe incomes are pinched. That’s where hard decisions have to be made. Trade-offs, right? Am I still willing to pay more for something I believe in when I can get something that may not deliver that benefit for less money? That’s really what drew my interest in researching this topic.

Q. How does this vary across countries? For many people in developing countries, this probably seems like a developed world luxury. What does your research suggest?

A. We took a look at a hundred or so studies that have been done on this and did a “meta-analysis”, a study across studies.[In our studies], we found that on average, people are willing to pay about a 16% premium for a product that has some kind of environmental benefit. Secondly, the most important benefit is a human benefit, not environment, not animal. Those are the major two findings. There is a premium, but it focuses on human benefits.

To get back to your question, we did not have enough studies across different countries to draw a conclusion there. For example, what would’ve been very interesting is to see that whether people in India are willing to pay the same premium, as, say, people in China, or the US or Europe. But because of these studies across studies, we can only use studies of the countries where the studies were done and we just haven’t done enough in those. So, our main findings are related to the price premium and the benefit.

We found that, in fact, there is a premium that people want to pay and in addition about 60% overall people are willing to pay some positive premium. We thought that these were quite interesting results–in n particular from a company’s standpoint, where companies are thinking about what benefit to emphasize. Shall I think about emphasizing my product? The finding was that the benefit that people think about the most is the human benefit. Maybe that makes sense because it’s related to people. It tells companies that if we are developing a product, we should think about developing the product from the perspective, if we can, of emphasizing labor practices or some other aspects.

Q. One of the other very interesting findings in your research is about where the consumers will or will not pay a premium. You make a distinction between durable and non-durable products. Why do you think people are more willing to pay a premium for non-durable socially responsible products?

A. Our hypothesis is that for non-durable products, there are more what we call social norms or peer pressure to buy socially responsible products. There is more publicity about chemicals in cleaning products or fair trade practices in coffee. People read about that more than whether or not a house is being built with lumber from an ecologically sustainable source. So we think that the reason we have that finding is that people talk more about those products because they are frequently purchased, they are part of our everyday lives, and they are more prominent in discussions. For durable goods, like electrical automobiles and for sustainable timber in houses, those exist–it is just that we don’t buy houses very often and we don’t buy automobiles very often. But we do buy coffee, cleaning products, paper, and things like that. That’s the reason that we find frequently purchased products tend to [command] a greater premium. It’s more relevant for people.

Q. In a country like China the awareness of socially responsible products is still very small and maybe non-existent in some cases. For a market as special and as big as this, how should companies tune their message regarding these products?

A. I don’t know how many products in China are trying to emphasize that yet, but I do know that individuals are becoming more environmentally concerned. If you look at air pollution issues in the big cities such as Beijing, if you look at water pollution, that’s well documented in China.

A company that could be on the forefront of this could be very successful because China is a huge market: a billion-and-a-half people. A brand or a company that takes leadership in this area could find a segment, and even if it’s a small segment in terms of percentage, because China has such a large population, it still could be a lot of sales.

You could get as low a market share as 0.5% or 1%, and that would [still] be a lot of volume. Companies that take leadership here could, in fact, be very successful.

In particular, I think these products tend to appeal the younger consumer and clearly some more affluent consumers. But if you take a look at the middle class in emerging economies, such as India, which I’m more familiar with, it has a very affluent and willing-to-spend middle class emerging, brands are becoming more popular and brands that emphasize the socially responsible dimension could, in fact, resonate with enough people to make them profitable in this emerging economies.

Q. What do you think of the future of socially responsible products? Will they go mainstream?

A. I think the answer to that, realistically, is no. The thing that still keeps them from going mainstream is the price. I’ve not seen a product that emphasizes a social responsibility dimension that is not more expensive than a standard product, and I think that is going to be a limitation.

It’s always going to be a niche product. But in some countries, a niche can be very profitable. So, the answer to the question directly is no, but I still think that they can be profitable and successful for a company. Companies can also do it to help demonstrate their commitment to social responsibility. Clorox, which does create products with chemicals, helps their corporate image by having this line called Green Works. That’s a dimension that companies can consider.