Liu Jing – Professor of Accounting and Finance, CKGSB

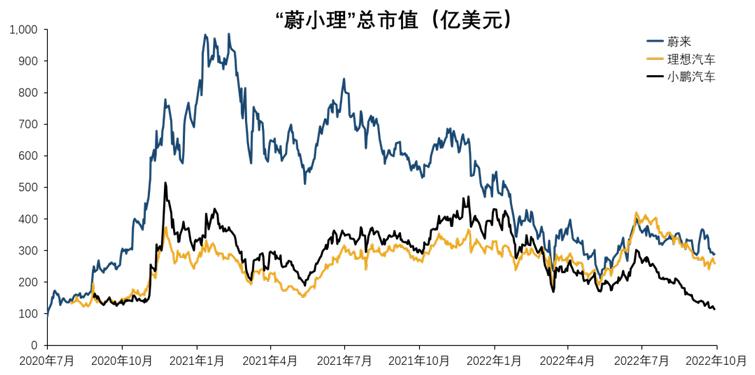

Since the beginning of this year until September 30, the market value of the new forces in China’s electric vehicle sector – NIO, Li Auto, and XPeng – has fallen by 51%, 27%, and 76% respectively. Combined with the drop in their value in 2021, the total valuations of the three car manufacturers combined have tumbled from USD $170 billion in January 2021 to USD $60 billion today. This has not only occurred in China but also in the U.S with companies such as Rivian falling from a valuation of USD $150 billion last year to around USD $30 billion today.

Market capitalization of NIO (in blue), Li Auto (in yellow), and XPeng (in black) (100 = USD 10 billion)

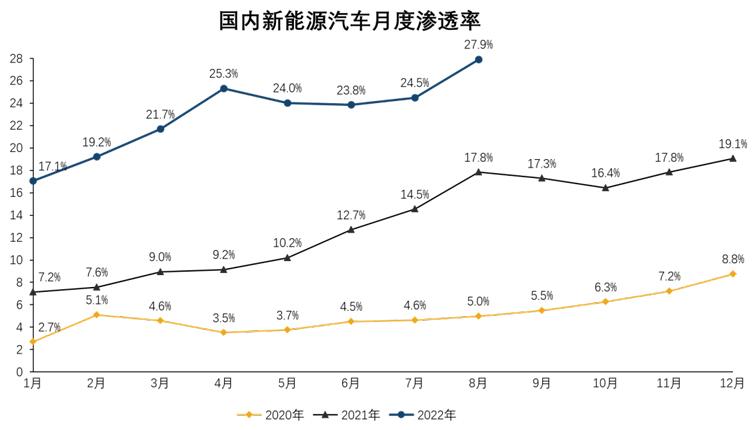

In sharp contrast, the EV industry as a whole, is booming with sales rising from 1.1 million for the whole of 2021 to 2.25 million in only the first half of 2022. According to the China Association of Automobile Manufacturers, China’s EV car sales accounted for 27.9% of total automobile sales in August 2022, which is far above the global market penetration rate of only 5.85% in 2020. China’s EV sector is the silver lining in a relatively weak broader economy.

China’s EV market penetration rates in 2020 (yellow line), 2021 (black line), & 2022 (blue line)

Will there be open competition or an oligopoly in the EV sector?

Why are stocks tumbling when the sector is performing well as a whole? We believe it is due to investors previously failing to fully understand the EV market which led them to overvalue many companies. Thus, the recent fall in their market value today is a correction of these previous overvaluations. At the beginning of 2021, we made the prediction that the price bubble in the EV market could pop within two years.

Back in 2021, the combined value of Tesla, NIO, XPeng, and Li Auto was USD $960 billion. We estimate that the combined value of all global automobile companies at that time was only USD $40 billion more at around USD $1 trillion. This led many investors to take the view that the traditional automobile industry would be replaced by the EV industry. Investors also predicted that only a few EV players such as Tesla (which at the time was valued at USD $800 billion) would hold a monopoly on the automobile market.

While our research does support the fact that EVs will replace fuel-burning automobiles within approximately 20 years, we estimate that the future of competition in the EV sector will be much more open with many companies competing for market share. This is not only because the EV sector is one in which customer retention is low but it also has lower barriers to entry.

These new EV players will bring down the market share of companies like Tesla which up to now have gained the upper hand due to a first-mover advantage and their initial product strength.

Changes in the structure and market share in the EV Market

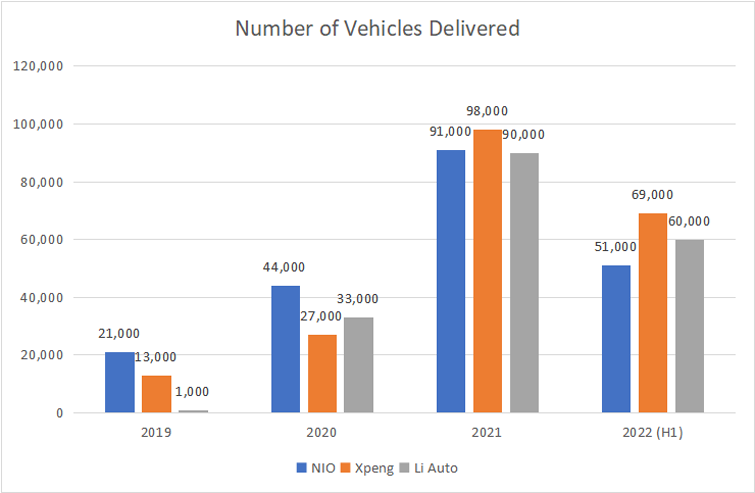

From 2019 to the first half of 2022, the market share of the top 10 global EV companies fell from 62.9% to 56.2%.

Over this period, Tesla’s global share of EV sales dropped from 16.5% to 8.8%, moving down to third place in global rankings (overtaken by the two Chinese EV giants BYD and SAIC-GM-Wuling). Tesla’s car sales grew 40%, 87%, and 46% in 2020, 2021 and the first half of 2022 respectively, which is behind the broader EV market.

A similar trend can also be seen in China where market share of the top ten EV companies fell from 75% in 2020 to 71.7% over this period. The combined market share of NIO, Li Auto, and XPeng dropped from 10.2% in 2020 to 8% in the first half of this year. Although this is not a sharp decline it reflects a broader trend of competition becoming increasingly fiercer in the sector.

In China, new players such as BYD saw sales grow 320% year-on-year (YoY) in the first half of 2022, joint ventures such as FAW Volkswagen and SAIC Volkswagen Automotive increased 76% and 99% respectively, and sales of traditional automobile manufacturers such as Geely and Chery that have crossed over into EV production have risen 360% and 220% respectively.

Moreover, the price-to-sales (P/S) ratio of NIO, XPeng, and Li Auto are far beyond what they were two years ago, falling down to 5.4, 3.0 and 4.9 respectively – which is a result of improvements in their performance and a drop in their market value. In stark contrast, Tesla’s stock price is 13.6 times its revenue. Tesla’s market capitalization has already fallen nearly 50% from as high as USD $1 trillion just over a year ago to approximately USD $600 billion today (as of November 10, 2022). We believe that its stock has been formed on a misunderstanding of the EV market and is thus a bubble that has yet to burst.

P/S ratios of Tesla (in yellow), NIO (in blue), Li Auto (black) & XPeng (in grey)