From Assembly to Innovation: TCL’s Rise in the Global Market

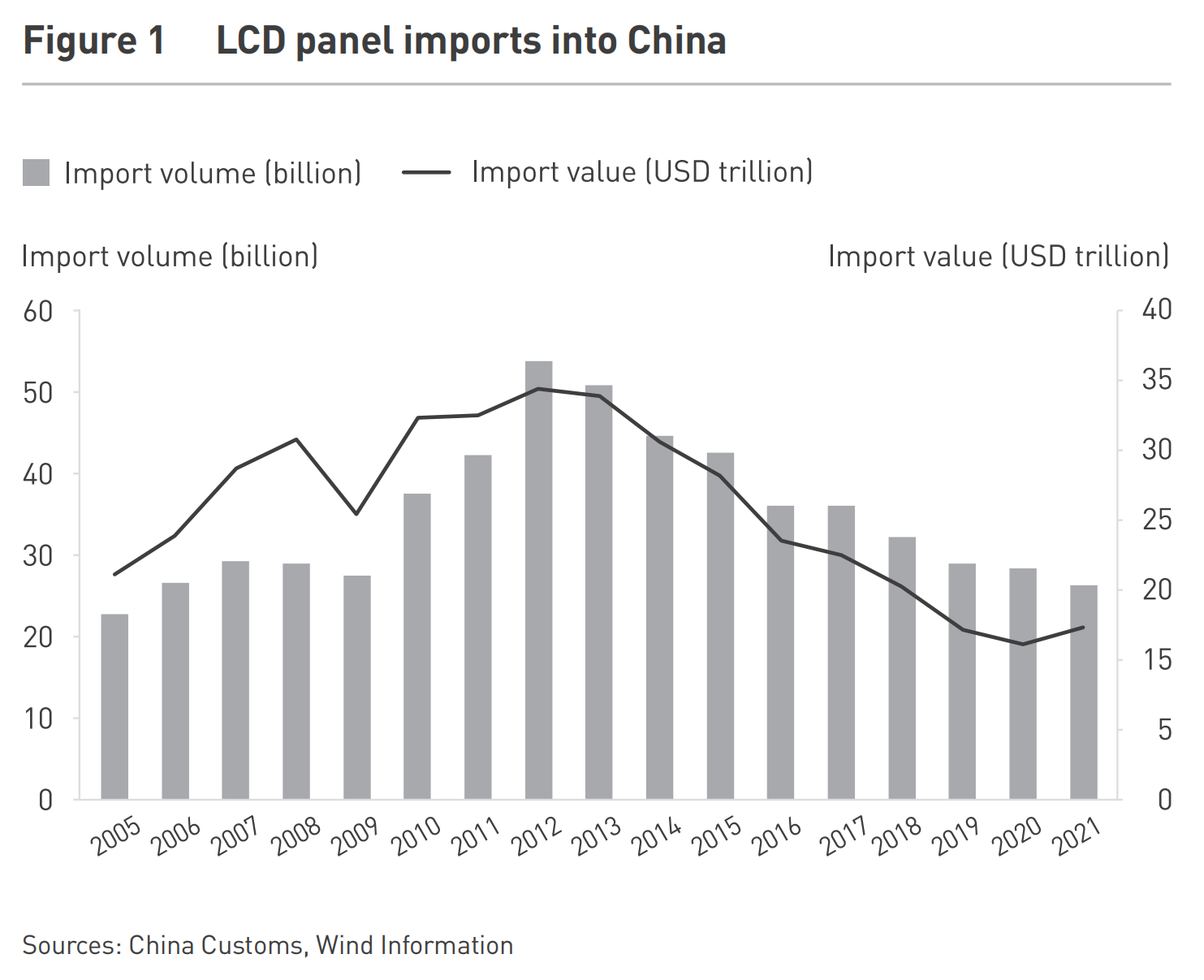

At the turn of the millennium, China’s television manufacturers were still heavily reliant on imported LCD screens, leaving them with little bargaining power against global suppliers like Samsung. At the time, an LCD TV set cost more than RMB 10,000 (USD 1,490), making it a luxury product for most Chinese households.

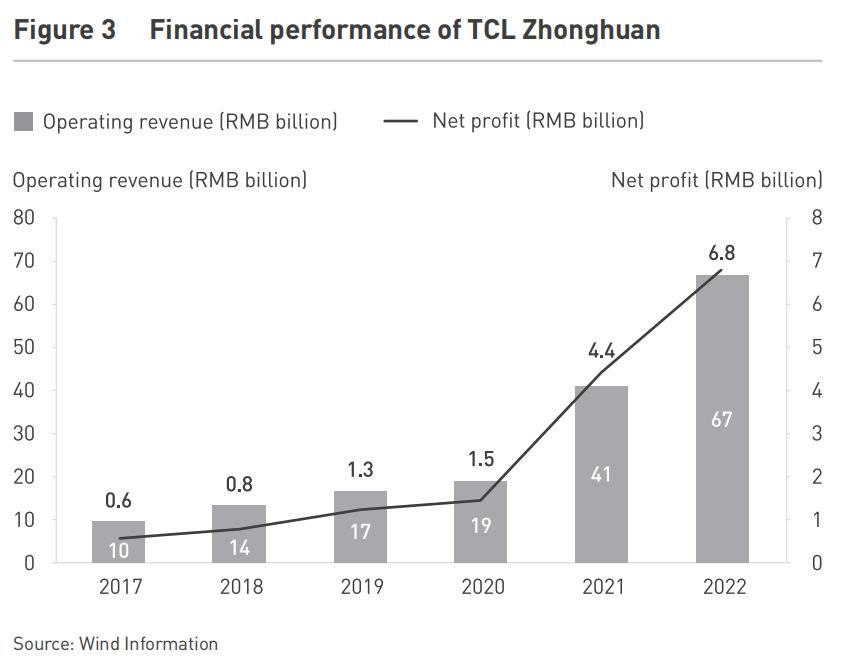

By 2017, China had overtaken South Korea as the world’s largest exporter of LCD panels. This underscored the nation’s rapid evolution from an assembler of electronics to a manufacturer of high-tech components. Among the companies leading this shift, TCL stands out as a case study in strategic transformation, evolving into a global powerhouse with total revenue exceeding RMB 260 billion (USD 38.66 billion) in 2022.

From Cassette Tapes to Global Electronics: TCL’s Early Journey

Founded in 1981 in Huizhou, Guangdong, TCL started as a cassette tape manufacturer before expanding into telephones, stereos, color TVs, mobile phones, and home appliances. By the early 2000s, it had emerged as one of China’s top consumer electronics brands.

In 2004, TCL made its first major step toward globalization by acquiring the television business of Thomson, a French multinational, securing a controlling 67% stake through a joint venture. However, the acquisition quickly turned into a financial burden as LCD and plasma displays replaced traditional cathode-ray tube (CRT) technology, rendering TCL’s new assets outdated.

Scaling Innovation and Efficiency: TCL CSOT’ s Rise

To stay competitive in the capital-intensive display industry, TCL CSOT prioritized efficiency and technological advancement:

- Cost Leadership – TCL CSOT Initially focused on lower-tier products with mature technology to achieve cost efficiency before gradually moving into high-end product development.

- Production Optimization – The company maximized equipment utilization and streamlined manufacturing processes to improve product yield and operational efficiency.

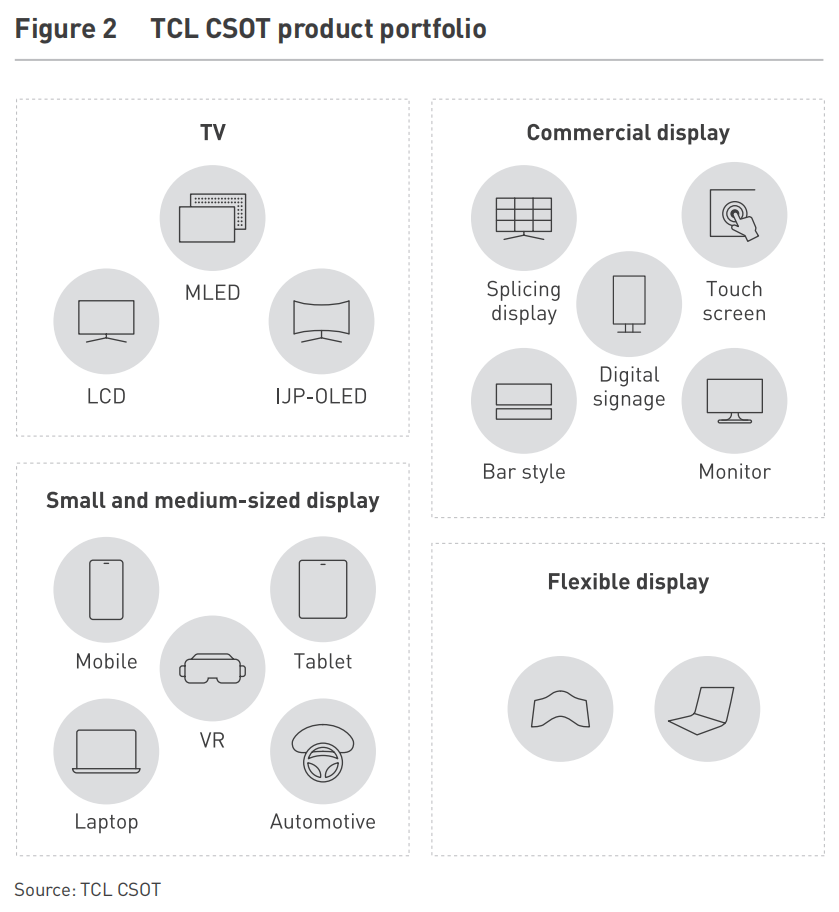

- Technology Advancement – Continuous reinvestment in R&D enabled TCL CSOT to develop next-generation display technologies such as Mini LED, printed OLED, QLED, and Micro-LED.

By 2022, TCL CSOT ranked second globally in TV panel shipments and was the world’s largest supplier of interactive whiteboard panels, e-sports panels, and low-temperature polycrystalline silicon (LTPS) tablet panels. The company also held the second-highest number of international patent applications in electroluminescence quantum dot technology. As of the end of 2022, TCL CSOT had a total of 58,942 global patent applications and 22,385 global patent authorizations.

Beyond Displays: TCL’s Strategic Pivot into Solar Energy

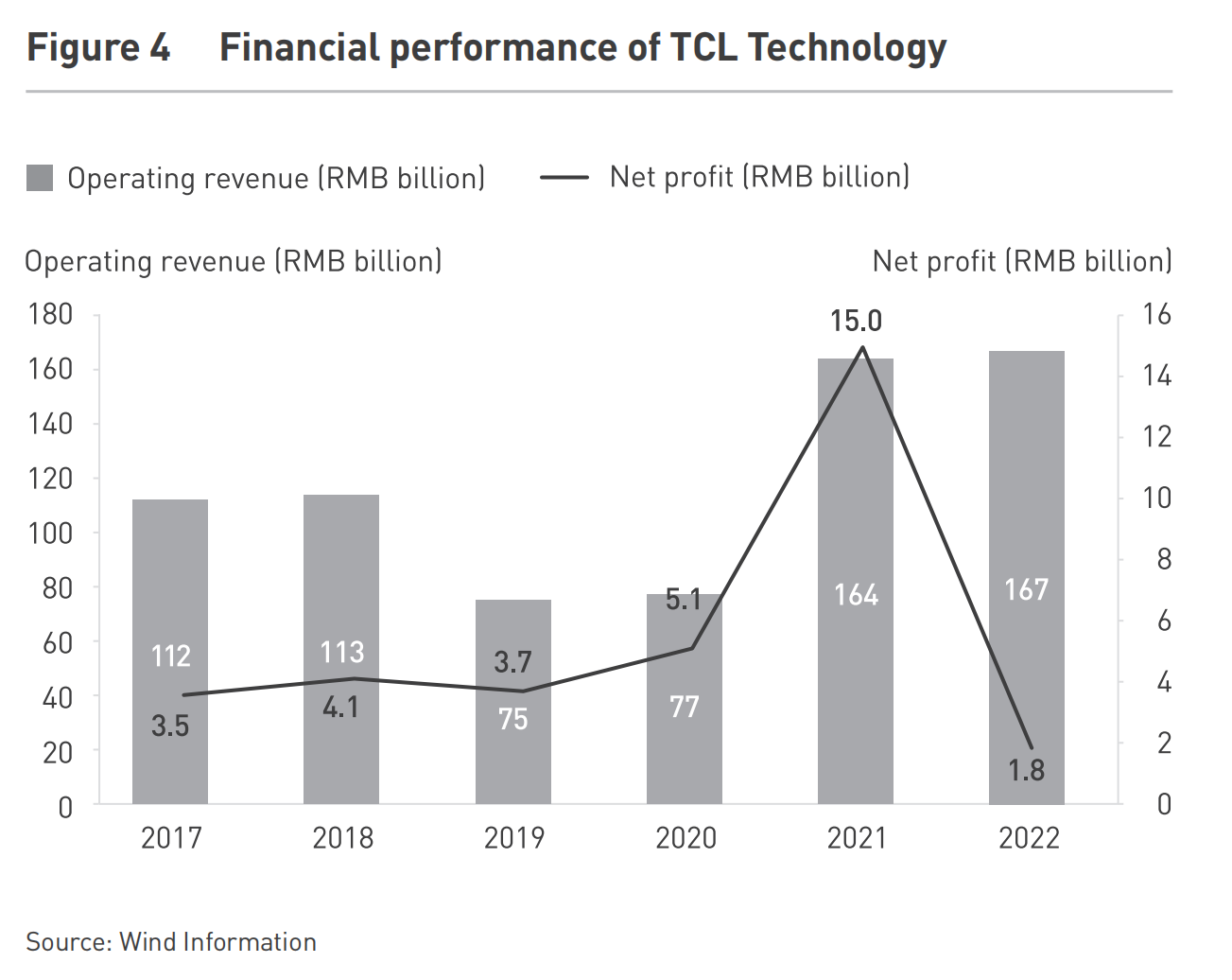

Building on its dominance in the semiconductor display, TCL set its sights on another high-tech sector: renewable energy. In 2020, the company acquired Tianjin Zhonghuan Electronic Information Group, marking its entry into the solar photovoltaic (PV) market. Today, TCL Zhonghuan specializes in the production of solar wafers, PV cells, and components, aligning with China’s broader green transition.

This move was a natural fit, as semiconductor displays and photovoltaics share similar technological foundations. By leveraging its expertise in manufacturing efficiency, TCL Zhonghuan rapidly expanded, reaching an annual production capacity of 140 GW of monocrystalline silicon wafers by 2022. The company now holds the largest market share globally in G12 silicon wafers, a next-generation solar technology.

In 2023, TCL Zhonghuan expanded further downstream in the photovoltaic industry by building a high-efficient solar battery factory. Its revenue reached RMB 34.9 billion (USD 5.19 million) in the first half of 2023.

Takeaways from TCL’s Transformation

TCL’s journey from a traditional electronics assembler to a global high-tech industrial leader offers valuable insights for Chinese manufacturers moving up the value chain:

- Vertical Integration for Supply Chain Control – By vertically integrating display panel and TV production, TCL secured long-term cost advantages and technological autonomy.

- Balancing Cost Efficiency with Innovation – TCL initially built cost leadership before investing in differentiated, high-value products.

- Diversification into Emerging Technologies – The company leveraged its core competencies to expand into high-growth areas like solar energy and semiconductor materials.

- Globalization with Purpose – Acquisitions, overseas production facilities, and international partnerships enabled TCL to compete on a global scale.

A Future Built on Technology and Sustainability

TCL continues to push boundaries, positioning itself at the intersection of smart terminals, semiconductor displays, and photovoltaic energy. As global demand for sustainable technologies rises, TCL Zhonghuan is poised to become a major driver of TCL’s future growth. Meanwhile, TCL’s commitment to display innovation remains strong, with ongoing investments in AI-powered screens, flexible displays, and next-generation OLED technologies.

Through sustained investment in R&D, global expansion, and sustainable business practices, TCL has transformed itself into one of China’s most influential high-tech enterprises. As the company navigates an increasingly competitive landscape, its ability to balance innovation with efficiency will determine its leadership in the next era of industrial transformation.

This article is part of the “Unleashing Innovation in China” series, which explores how companies are driving innovation and reshaping industries in one of the world’s most dynamic markets. For more insights, visit: Unleashing Innovation: Ten Cases from China on Digital Strategy and Market Expansion – CKGSB Knowledge