China’s innovation targets are centrally-driven, in contrast to more market-driven development in the rest of the world

At the key National People’s Congress (NPC) session in March, in which China’s economic priorities were laid out, “new productive forces” was named as the country’s top priority for 2024, with the slogan reflecting the growing desire of Chinese leaders for high-technology-driven development.

These new productive forces are disruptive innovations capable of propelling the country to the forefront of the global tech race. To do so requires both high-quality research and a thriving innovation environment among the country’s enterprises, and while China’s research numbers are strong, translating that into tangible products is proving difficult due to economic and geopolitical headwinds.

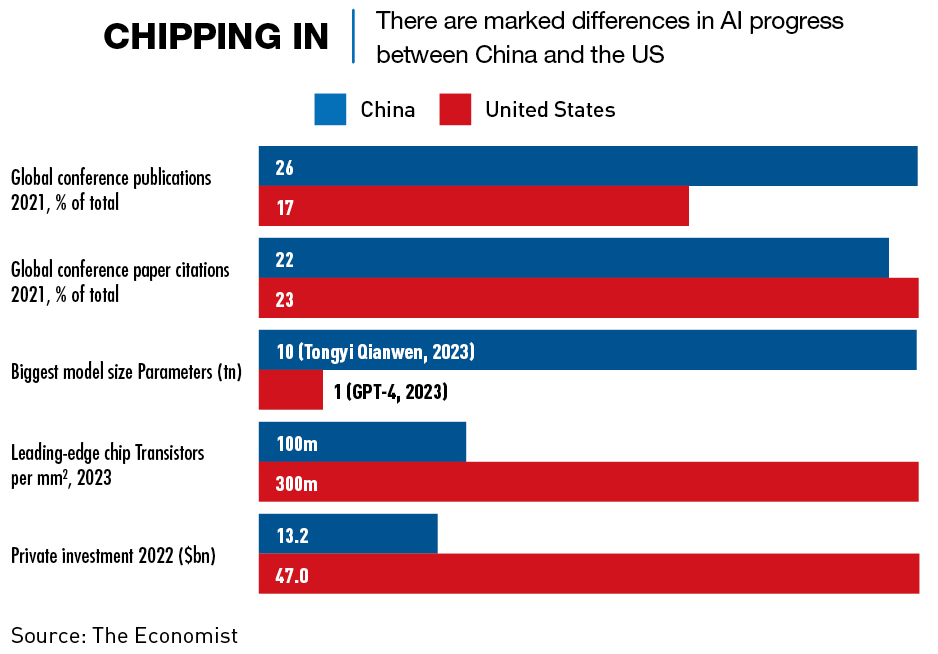

Despite an increase in R&D spending as a portion of GDP, China’s 2.64% outlay in 2023 was on par with the EU, but still far below that of 3.5% in the US. China will need to do more to close the gap, especially now that its access to externally-developed disruptive technologies is dwindling.

“There is a gap between China and the leading pack,” says Alicia García-Herrero, Chief Economist for Asia Pacific at NATIXIS. “For a long time, China has accessed disruptive innovation from the rest of the world, and that has made it easier to go through the applied innovation process. But that is getting harder to do now, and China has realized that it needs to close the gap itself. It’s going to be a tough thing to do.”

Key technologies

The technologies viewed as critical are not always the same in all countries, but there is inevitably some overlap, especially where economic and national security interests align, such as advanced telecommunications.

“China’s priorities have shifted away from engineering existing technologies to looking more towards original science innovations such as quantum computing and brain integration with computer vision,” says Tilly Zhang, China technology analyst at China macro research firm Gavekal Dragonomics. “These are areas that nobody has fully covered before, by any means, and China hopes this can help them lead the next possible industrial revolution.”

For China, a document released by the Ministry of Industry and Information Technology (MIIT) in January set out the industries of the future:

- Future manufacturing: such as humanoid robots, the industrial metaverse and biological manufacturing.

- Future information: which includes next-gen telecoms, large AI models and quantum computing.

- Future materials: such as advanced semiconductors, holographic displays and superconducting materials.

- Future energy: referring to nuclear and hydrogen energy and high-efficiency solar cells, among others.

- Future space: which targets space, deep sea and deep earth development.

- Future health: advances such as brain-computer interfacing and cellular and genetic technologies.

“Many of these technologies are also frequently emphasized in the policies of the US, EU, Australia and Japan,” says Laura Gormley, research analyst with Rhodium Group’s China Practice “Ambitious national support schemes, coupled with the strong demand for disruptive technologies, will speed up indigenization and result in fiercer global competition in these sectors.”

State of play

One indicator of technology leadership is high-impact research output, and here we see a surprising dominance for China across the majority of key technologies. In 2023, the Australian Strategic Policy Institute (ASPI) published its Critical Technology Tracker, which follows research development in 64 critical and emerging technology domains, many of which align with the MIIT industries.

According to the data it released in September 2023, China currently leads the world in 53 of 64 key technologies, including advanced radio-frequency communications (5G and 6G), nanoscale materials and manufacturing, synthetic biology and supercapacitors.

In some areas the lead is by a large enough margin that it could be considered at risk of developing a technological monopoly. For example, when it comes to electric battery research, the ASPI data suggests that China publishes 65.5% of all high-impact papers on the topic, with the US in second place, publishing just 11.9%.

For the 11 key technologies where China is not in a leading position, including genetic engineering, quantum computing, and atomic clocks, it sits in second place behind the US—with varying degrees of separation in terms of percentage, including some gaps that suggest a potential US monopoly. Other than these two countries, only India and South Korea also find themselves in the top two in any of the fields.

“China used to be the student, and the US was the teacher, but that has all changed now and there is much greater parity in the relationship, and several areas where China is excelling,” says Denis Simon, Clinical Professor of Strategy and Entrepreneurship at the UNC-Kenan-Flagler Business School.

While the research statistics are impressively in China’s favor, the infancy of many of these technologies means that commercial business applications are often few and far between. “There are some sectors, such as robotaxis and the ‘low-altitude economy,̓ where commercialization is well on the way.” says Zhang. “But there are others where it will take time for products to come to market. A prominent professor in the Quantum Technology field suggested it would be at least a decade or two before anyone will be able to really commercialize those technologies.”

Currently, several Chinese companies are at the leading edge of global industry in their sectors, such as CATL for battery production and development, Huawei in the telecoms space and a number of innovative firms in the AI space, such as Alibaba, Tencent, Kuaishou and Xiaomi. There are also state-backed examples such as the surveillance tech firm, Hikvision.

But China is still behind in many key areas. For semiconductors, China is the largest producer of legacy chips—28nm chips and above—but these are now a decade-old technology and are not powerful enough to run the most up-to-date AI models or computing technologies. The country lags in the manufacture of advanced chips, which are a vital part of any cutting-edge technology.

“In terms of chip manufacturing and chip manufacturing equipment, China is at least five years behind its foreign counterparts,” says Zhang. “Some of the things that companies are trying to deliver on now are machines that [world-leading Dutch semiconductor equipment manufacturing firm] ASML had initially delivered as far back as 2003.”

According to Zhang, China is doing better in terms of chip design, where the lag is only around a year or two. In some cases domestic players such as Huawei can already compete at the same level as international powerhouses such as NVIDIA. But without proper manufacturing equipment and capabilities, the ability to design cutting-edge chips does not easily translate into real-world value.

How the system works

Turning research into technology is a complex process and requires a great number of different inputs. These include availability of state or private funding, talent availability and opportunities for international collaboration. “Right now if you look at the research collaborations around the world it’s clear that the most powerful collaborative partnerships are between US and Chinese scientists,” says Simon.

“Capabilities in upstream and downstream industries are also important,” says Gormley. “Access to critical inputs needed to produce technology, and downstream demand can determine whether research gets translated into innovation.”

China’s approach to technological development is very state-centric when compared to other global technology leaders. Government funding accounts for around 60% of financial inflows into China’s science and technology ecosystem, while of the total R&D funding in the US in 2019, 72% came from the private sector.

Much of the state funding for science and technology development actually comes from the local government level, which, according to Rhodium Group statistics, accounts for around two-thirds of all state funding within the ecosystem. The funding from local governments almost exclusively follows centrally-decided targets and has generally proved fruitful in driving development, producing many leading firms, and cultivating industry clusters that play a role in driving innovation.

“China’s centralized approach enables a strategic concentration on crucial industries and technologies, accelerating the development of sectors considered vital for national interests, like AI and sustainable energy,” says Daniel Cheng, Deloitte China TMT Industry Leader.

Another state-led source of R&D funding is equity investments made through government guidance funds (GGFs), which raise capital through public and private sources. In 2022, GGFs accounted for at least $12.3 billion in funding to high-tech companies, but they have, in many cases, failed to meet investment return targets.

Enterprises themselves fund the large majority of commercial R&D in China, with around 87% of the most innovative firms reinvesting their own finances to support innovation.

“China’s general international patent output is quite competitive, but that is not the case for core disruptive technologies like AI, semiconductors or quantum,” says García-Herrero. “The US remains by far bigger than everyone else. Also very importantly, of the patents in China a big chunk of them, and perhaps even half, are from foreign companies operating in China.”

Technically correct

While it has often been thought that decentralized systems are more amenable to innovation, China’s state-capitalist approach has its benefits. The interconnectivity of the state, state-owned enterprises and banks and technology firms provide something that has been termed “the complete value package,” providing resources and support in a way that boosts Chinese firms, while at the same time making it very difficult for foreign players to operate in the market.

“The system’s positive influences manifest in various ways, including setting strategic directions, issuing supportive policies, providing active guidance, and rallying enterprise strength,” says Cheng. “By delineating clear goals and offering substantial support, the government plays a pivotal role in shaping the trajectory of technology sectors and encouraging collaboration among businesses.”

Although many GGFs have failed to reach their revenue targets, they have performed vital functions in developing strategically significant industries. The GGFs offer a way for policymakers to utilize market discipline and expertise through the provision of long-term, stable investment capital for companies trying to bridge the gap between product discovery and commercialization.

The major beneficiaries of this system have been the country’s tech-focused small- and medium-sized enterprises (SMEs), 98,000 of which have been identified by MIIT as “Specialized SMEs” and more than 12,000 as “Little Giant” SMEs, meaning that they receive government benefits as part of the acceleration system. The system is designed to promote competition between these SMEs.

“The government’s capability to mobilize extensive resources toward specific objectives facilitates rapid advancements in infrastructure, research, and technology,” says Cheng. “An example is China’s investment in quantum computing, demonstrating significant resource allocation to a cutting-edge field with the potential to transform computing and cryptography. The launch of the world’s first quantum satellite highlights China’s commitment to pioneering in this advanced technology area.”

Higher levels of educational attainment in the Chinese workforce over the past few decades have also been a positive factor in helping the country innovate, particularly the increase in the number of students studying STEM subjects abroad. Many of these students have remained overseas for their work, but a growing number have been returning to Chinese shores in recent years to work in well-resourced laboratories and high-tech companies. According to the National Bureau of Statistics, returnees outnumbered new overseas students for the first time in 2020, and 2021 saw over a million students return to China.

Wider societal support is also a strength for China, with the World Value Survey showing that China is one of the most appreciative countries when it comes to S&T. Technology has become not only a symbol of national security, but equally a driver of individual prosperity, and has been embraced with enormous enthusiasm. For instance, internet and mobile payment adoption in China has been very fast, and according to the European Chamber of Commerce, Chinese consumers demand new products and product features at a much faster rate than their European counterparts.

Coder’s block

Specific industrial targets related to national policies can show dividends in some localities, but others lack the proper expertise to do sufficient due diligence, leading to sub-par investment strategies. Another issue is that forcing a local government to prioritize a specific industry may not properly utilize existing competitive advantages in an area, as well as draw funding away from existing sectors that form a vital part of a province’s ecosystem. The heavy political priority-driven focus has also historically led to issues in the development of market-viable products, whereas the market-driven R&D approach tends to be more consistent.

China also faces some macro barriers, both internal and external, in its aim to reach pole position in the international tech race. The largest of these is the current slowdown in the Chinese economy, which has forced companies and government entities to reduce spending, especially in some areas of innovation where returns are long-term and not necessarily guaranteed.

There is also the issue of short-termism in the minds of the local government officials in charge of funding allocation and prioritization. Officials typically hold positions for five years before moving on, and they tend to maximize short-term output over long-term sustainability.

“China’s innovation system is centralized in its words, but not necessarily in its details,” says García-Herrero. “People think that the industrial policy is very clear-cut, but it can often be confusing and the different choices made by local governments can create a competitive environment. It’s a similar reason why industrial policy is a challenge for the European Market.”

There are also limits to how far some industries can go. “Investments in strategic industries linked to Made in China 2025 resulted in the build-up of production capacity from 2016 to 2020,” says Gormley. “In many industries, supply has expanded beyond what can be supported by current demand, resulting in challenges with widespread overcapacity, the effects of which will continue to manifest in coming years.”

Gormley adds that the outsized and growing role of SOEs in China’s S&T system can also be problematic due to their lower efficiency. “Though SOEs have increased their R&D spending faster than private firms in the past few years, they produce, on average, far fewer higher-quality international patents,” she says.

There are also implementation and coordination challenges, a clear example being a lack of interlinkage between AI data centers. “Local governments were encouraged to build up AI data centers at a lower level to support local AI computing power tasks,” says Zhang. “But in reality, local governments have outsourced these orders to state carriers like China Telecom and China Mobile and they are competing with big cloud computing players such as Alibaba and Tencent. They’re all now fighting over resources and local computing power is becoming increasingly fragmented.”

China’s geopolitical relationships are also having an impact, with vital technologies for innovation now under limitations leading to bottlenecks in some areas and forcing the country to try and catch up rather than work on developing something new.

The US in particular has placed limitations on China including export controls, investment and import restrictions and has bulked up its own industrial policies in certain areas.

“The export controls have had impacts here and there, but in terms of China-US differences, the real answer is that the US is running while China is still walking,” says García-Herrero. “They are spending massive amounts of money on development through the private sector that China can’t match.”

Foreign investment into Chinese tech development is also down, with overall FDI into China reaching a 23-year low in 2023. While plummeting investment is clearly exacerbating China’s economic slowdown, the lack of openness and transparency is more of an issue as it impacts talent acquisition and collaboration opportunities.

“Attracting more talent is very important to turning theoretical research into significant tech breakthroughs that are applicable to industry,” says Zhang. “This is related to having an open, rewarding and transparent environment and it seems somewhat barren in that sense in China at the moment.”

Technical progress

China’s system has its advantages, with the country boasting more state-backed funding vehicles to support innovation than probably any other country, and the goals as defined by the system are clear.

“Facing the challenges of globalization and geopolitics, China is rapidly becoming self-sufficient in its technology supply chain,” says Cheng. “This represents a major shift from being primarily a manufacturing and assembly center to one that increasingly emphasizes original design and core technology development, positioning itself at the high end of the global value chain.”

But while the quality and scope of research output put the country in a position to succeed, there are a number of barriers to turning theory into commercially viable products. Innovation is almost always driven by collaboration, transparency, and diversity, and China’s system does not lend itself well to these things. Without some changes, therefore, it will probably be difficult long term for the country to compete at the top in as many areas as it wants to.

“Changes such as overall lower S&T spending will not necessarily impede China’s ability to develop as a global leader in prioritized strategic sectors,” says Gormley. “They could, however, slow China’s development of a well-rounded innovation ecosystem—the kind that facilitates technology spill-overs, fosters the emergence of next-generation innovation, and keeps talent and resources mobilized.”

“It will be hard for China, but their mindset has changed now, so perhaps that might make it possible,” says García-Herrero.