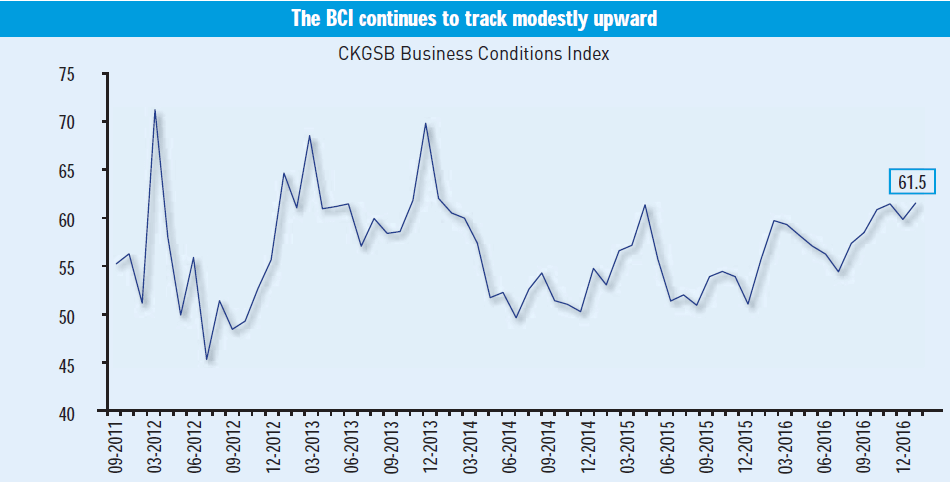

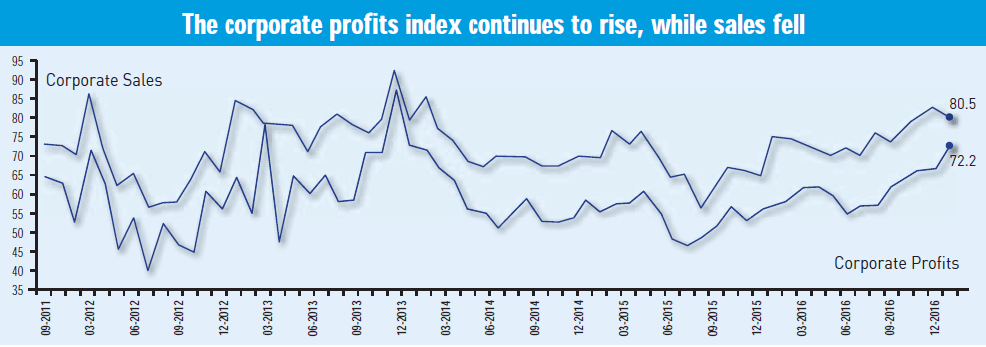

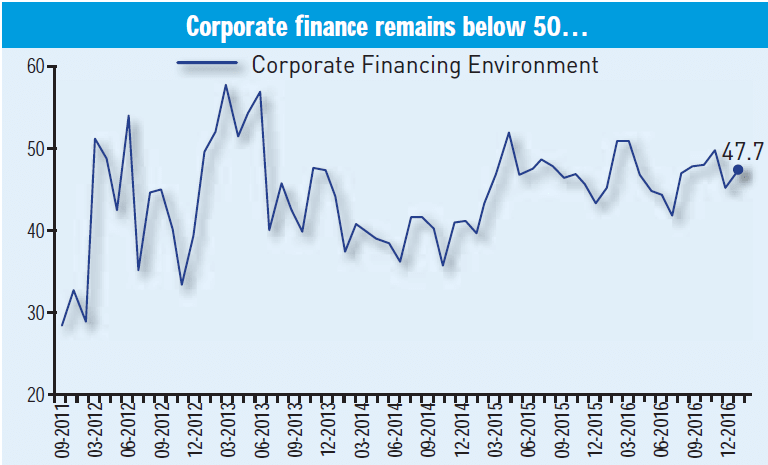

The CKGSB Business Conditions Index (BCI) registered 61.5 in February, a slight increase on Januaryʼs mark of 59.8. For CKGSBʼs sample of successful businesses operating in China, optimism about prospects over the next six months still holds for the majority of firms. The CKGSB BCI comprises four sub-indices. Of these, corporate sales fell slightly from 82.7 to 80.5, while corporate profits rose from 67.0 to 72.2. Both of these indices are well above the confidence threshold of 50. However there remain important problems in the other two sub-indices: corporate financing and inventory, both of which are currently below 50, having been near the line long-term.

The BCI, directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business, asks respondents to indicate whether their firm is more, the same, or less competitive than the industry average (50), and from this we derive a sample competitiveness index. As our sample firms are in a relatively strong competitive position in their respective industries, the CKGSB BCI indices tend to be higher than government and industry PMI indices.

The Business Conditions Index (BCI) registered 61.5 in February, a slight increase on Januaryʼs mark of 59.8. For CKGSBʼs sample of successful businesses operating in China, optimism about prospects over the next six months still holds for the majority.

The CKGSB BCI comprises four sub-indices. Of these, corporate sales fell slightly from 82.7 to 80.5, while corporate profits rose from 67.0 to 72.2. Both of these indices are well above the confidence threshold of 50. However there remain important problems in the other two sub-indices: corporate financing and in inventory, both of which are currently below 50, having been near the line long-term.

The corporate financing environment index rose marginally from 46.0 to 47.7, but still remains below the confidence threshold of 50. The financing environment for the BCI sample has been consistently less than optimal, and, given that the CKGSB sample consists mainly of the leading powerhouses in the economy—small and medium-sized enterprises—this is a critical issue to address in future economic reforms.

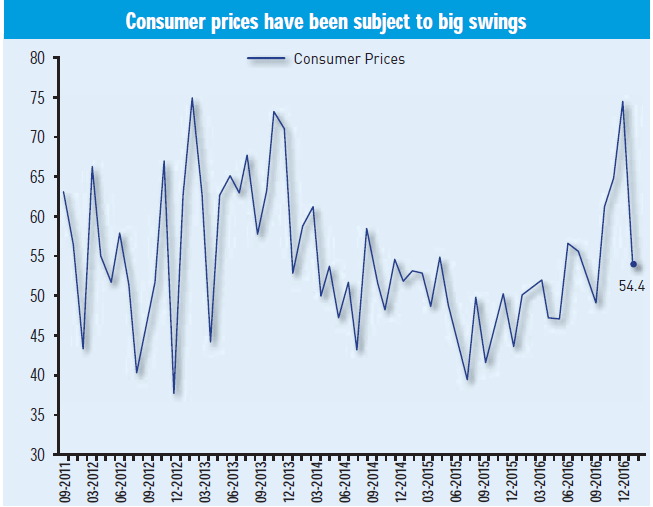

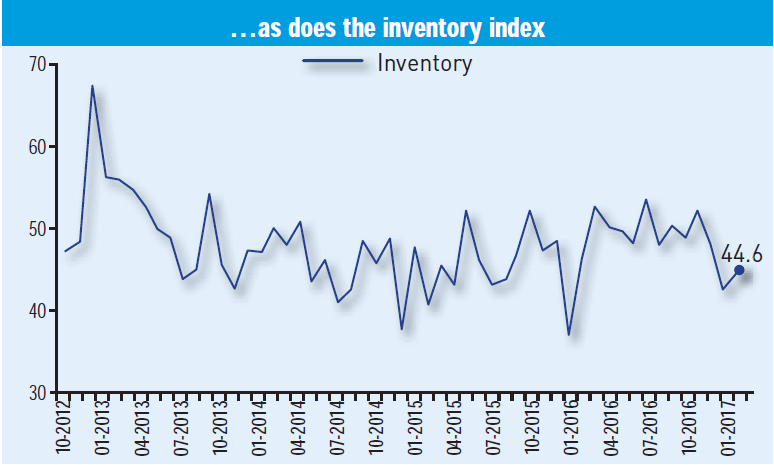

Rising from 42.6 to 44.6 in February, the inventory index has been in the doldrums for much of the history of the index, revealing an important long-term issue. The consumer prices index plummeted in February, from 74.3 to 54.4, almost 20 points. It is unclear whether the recent big swings are related to shifts in consumer product prices over the Chinese New Year period.