Overcapacity and cost increases have firms on their heels

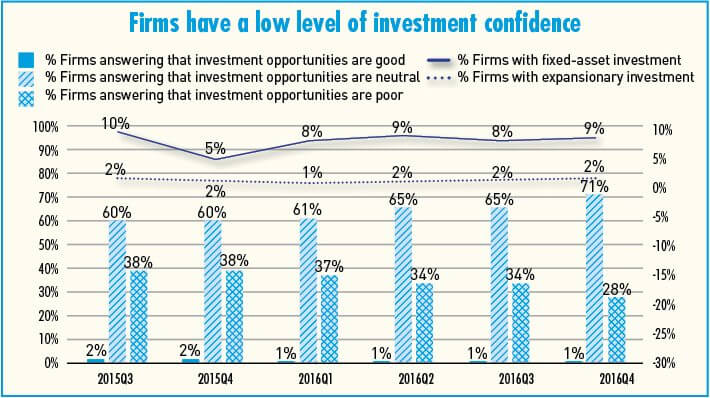

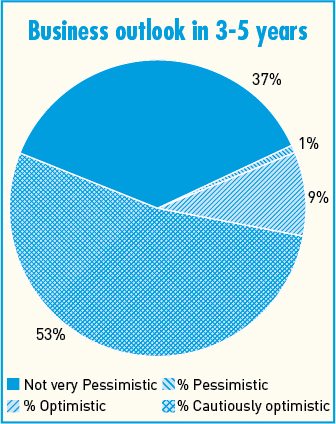

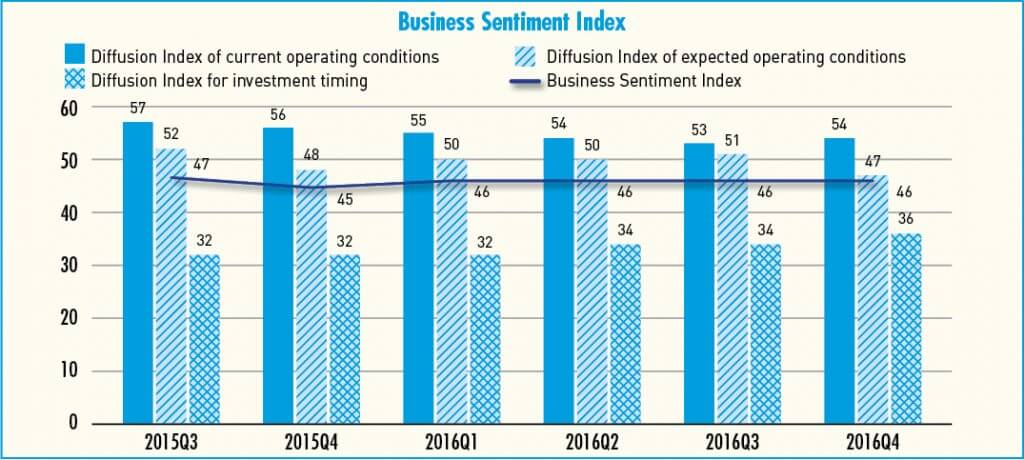

The CKGSB Business Sentiment Index stood at 46 in the fourth quarter of 2016, the same as the previous quarter, indicating a slight contraction. The low BSI is, again, a result of weak investment. Only 1% of the firms considered it a “good” time to make fixed investments, with an index of 36, far below the turning point of 50. Only 9% of firms made fixed investments in Q4 and a mere 2% made expansionary investments. Additionally, the most prominent change seen in Q4 was a significant rise in product prices, with the index rising from 50 to 66. But despite current difficulties, the majority of firms remain optimistic (9%) or causally optimistic (53%) about the economic outlook of the next three to five years. Given the government’s strong commitment to economic development, the BSI team remains optimistic about the long-term outlook of the Chinese economy.

The BSI, directed by Gan Jie, Professor of Finance at the Cheung Kong Graduate School of Business, is the simple average of three diffusion indices, including current operating conditions, expected change in operating conditions and investment timing. The index ranges between 0 and 100—a larger value indicates better operating conditions, with 50 marking the turning point between expansion and contraction. Compared with other economic indices, the BSI is more forward-looking and is a reflection of the absolute level of economic activities.

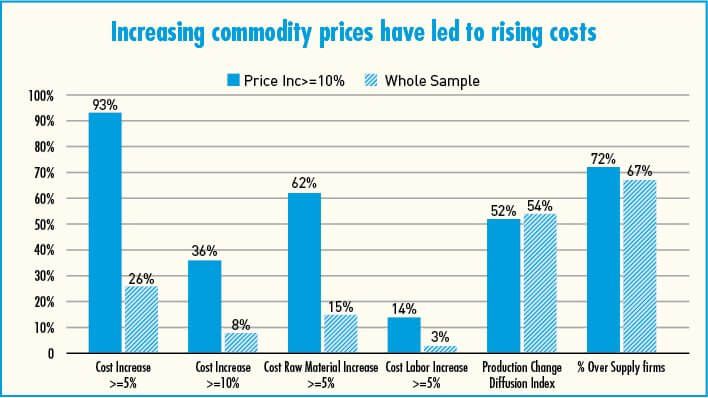

One-third of the firms surveyed reported increased product prices, with as many as a quarter reporting hikes above 10%. Production cost rises are the driving force, with about half of firms reporting unit cost increases. Unit cost increases are mostly related to raw material costs—62% of these firms reported raw material cost rises above 5%, in comparison to 15% for the whole sample. These firms were also more likely to have large labor cost increases. Meanwhile, these firms were similar to the whole sample in terms of production expansion and overcapacity. This indicates price inflation driven by cost run-ups, rather than by increased demand.

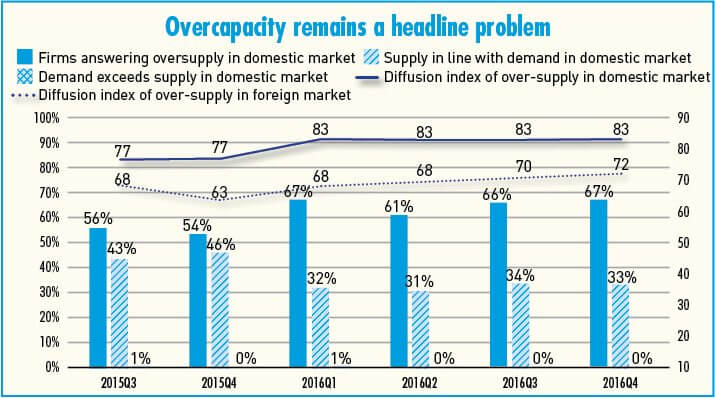

Despite stronger efforts at reduction, overcapacity remained at its historical high in 2016. Each quarter, about two-thirds of firms reported oversupply in the domestic market, with the diffusion index at 83 for four consecutive quarters. Neither was there any significant improvement in the severity of overcapacity, measured by the proportion of firms reporting supply over demand by 10% and 20%, which were 32% and 14% of firms respectively. Firms said they did not think overcapacity would improve significantly in the next quarter. The main theme of the industrial economy in 2017 will still be the reduction of overcapacity.

A mere 1-2% of firms made expansionary investments, in comparison to 2-3% in 2015. Moreover, just 17 firms, or 0.8%, said they planned to make investments in the next quarter. Recent media reports have noted that the country’s fixed investment has been dominated by government-led investment, while private investment has been contracting. Our survey shows that this trend has lasted for quite some time. The overcapacity problem, which leads to a lack of pricing power, combined with rising costs, results in low profit margins. These low margins may make it difficult for the firms to invest in R&D and industrial upgrading.