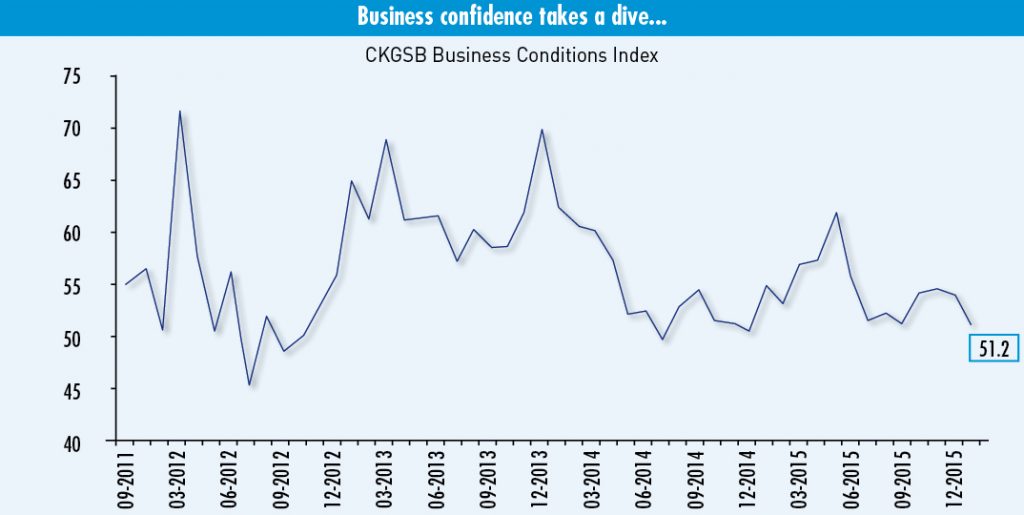

CKGSB’s Business Conditions Index shows that Chinese business executives are even less optimistic than before.

In January, the CKGSB Business Conditions Index (BCI) posted a figure of 51.2, a slightly lower overall reading than the previous monthly reading of 54.0 and slightly above the confidence threshold of 50. In May 2015, the BCI was at a considerably higher level of 61.3, but from July to September it was only just above 50. From October until December, the overall index has hovered around 54, but it has now slipped back towards the confidence threshold. This shows that for the majority of relatively successful firms in China, optimism about business conditions over the next six months is waning, and the current forecast for business operations is cautious optimism.

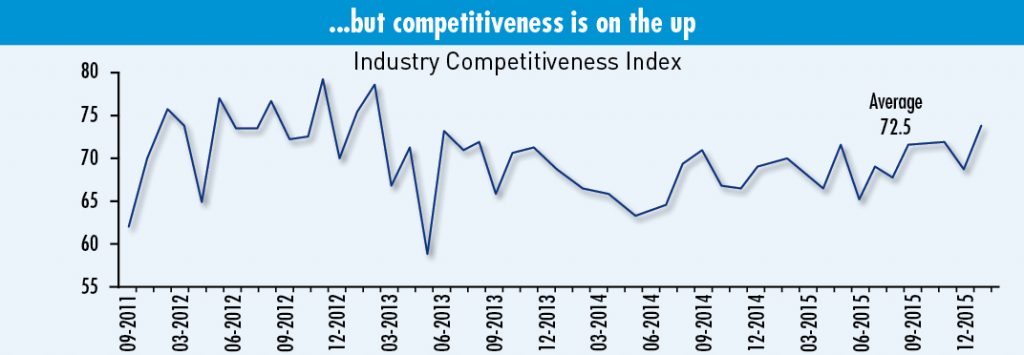

The BCI, directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business, asks respondents to indicate whether their firm is more, the same, or less competitive than the industry average (50), and from this we derive a sample competitiveness index (see Industry Competitiveness Index). As our sample firms are in a relatively strong competitive position in their respective industries, the CKGSB BCI indices tend to be higher than government and industry PMI indices.

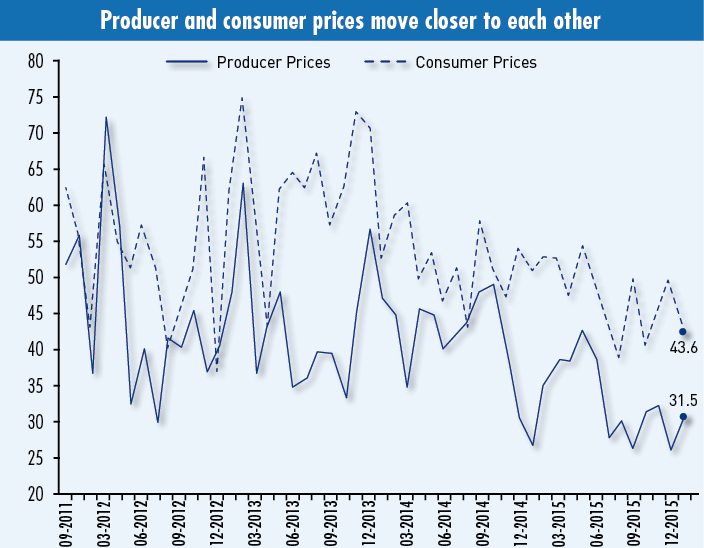

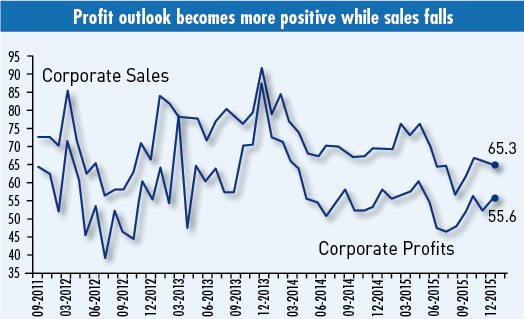

The consumer prices index fell from 50.0 to 43.6, and producer prices continued to hover at a low level, edging up from 27.8 to 31.5. Since January 2014, consumer prices have looked comparatively healthier and been mostly above 50, however the situation has deteriorated markedly, with the future trend unclear. Corporate sales fell from 66.3 to 65.3 in January, but the profit index rose, from last month’s 53.4 to this month’s 55.6. Although in recent months a sharp decline has been seen, this year profits expectations returned to over 55, showing that the profit outlook is becoming more positive for the upcoming six months. The labor demand index fell from 66.0 to 65.0—it has only been between 50 and 60 twice, and has remained above 60 for the rest of the time.