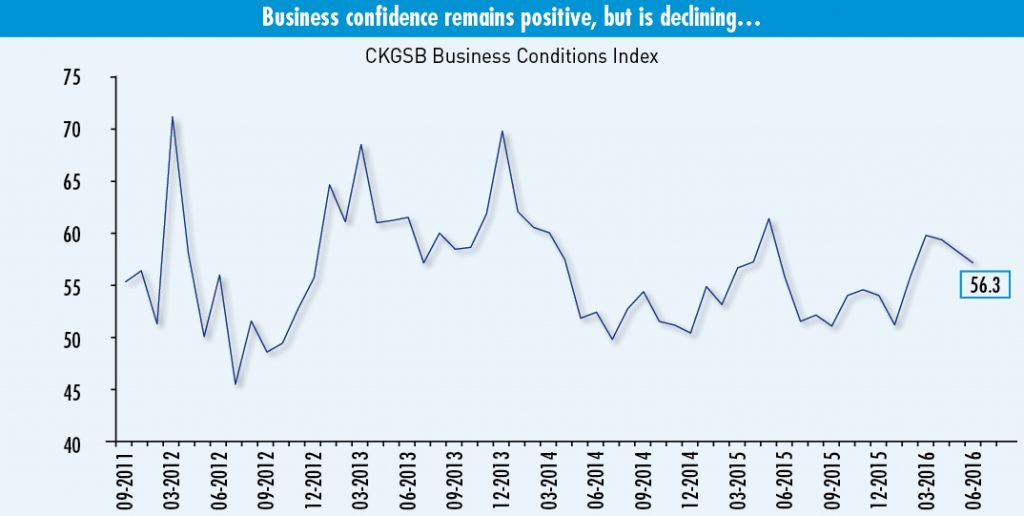

Despite a small dip, the next six months are viewed with a degree of optimism. But it is also noteworthy that the BCI has now fallen for five months in a row.

The CKGSB Business Conditions Index (BCI) registered 54.5 in August, slightly less than July’s 56.3. Despite a small dip, this shows that for CKGSB’s sample, which represents relatively successful businesses in China, the next six months are viewed with a degree of optimism. But it is also noteworthy that the BCI has now fallen for five months in a row. The BCI comprises four sub-indices: Corporate sales and inventory levels rose slightly, the latter surpassing the threshold of 50. The corporate profits index dropped by close to five points, but remains above 50, and the financing environment remained below 50.

The BCI, directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business, asks respondents to indicate whether their firm is more, the same, or less competitive than the industry average (50), and from this we derive a sample competitiveness index. As our sample firms are in a relatively strong competitive position in their respective industries, the CKGSB BCI indices tend to be higher than government and industry PMI indices.

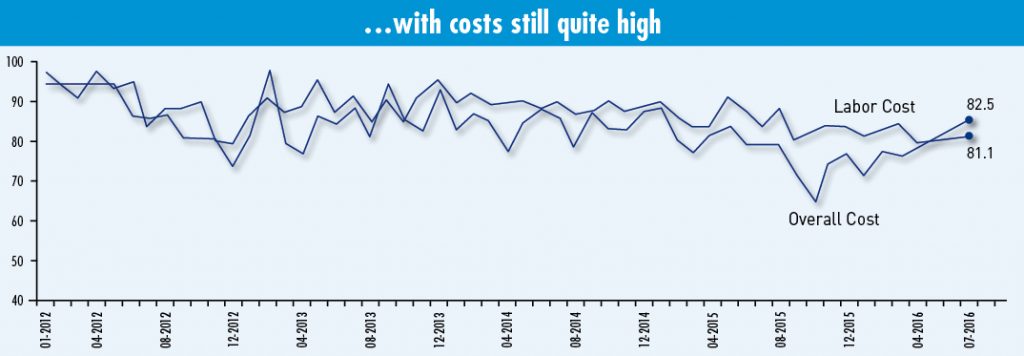

In July, labor costs fell slightly and overall costs expectations also fell slightly, but these two indices are both still over 80.

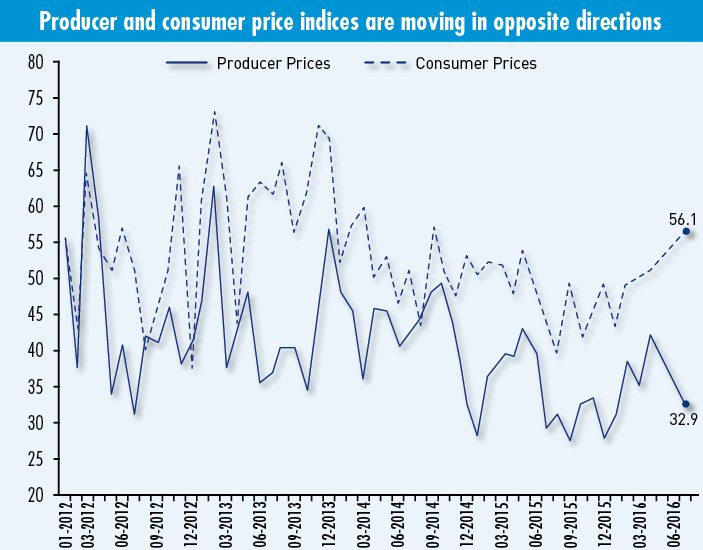

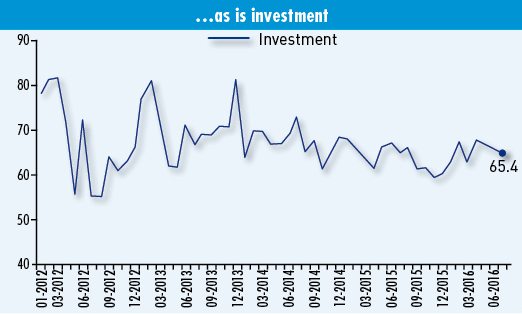

Price indices for producer and consumer goods moved in entirely different directions during the month, with the consumer goods index rising from 46.9 to 56.1, while the producer goods index fell sharply from 40.3 to 32.9. Chinese firms are facing some issues: cost inflation is growing apace and while consumer prices have recovered slightly, it is unclear whether that recovery can sustain its momentum. However, in the face of adversity, our sample firms continue to recruit and invest. Regardless of the macroeconomic conditions over the past five years of the BCI, the Chinese firms sampled have prioritized corporate investment and recruitment, providing a conundrum for observers.