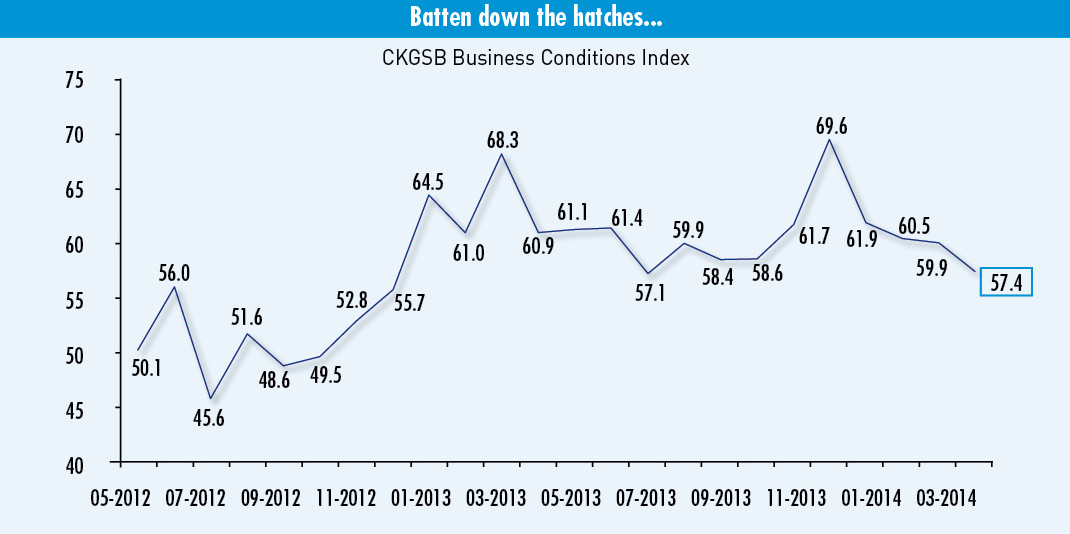

The latest CKGSB Business Conditions Index shows that entrepreneurs in China are feeling the slowdown.

Business sentiments in April have waned in light of economic data that fell short of expectations. Each month CKGSB’s Case Center and Center for Economic Research conducts a survey of leading entrepreneurs in China to gauge and track changes in their business sentiment. The result is the CKGSB Business Conditions Index (CKGSB BCI), directed by Li Wei, Professor of Economics and Emerging Markets Finance, and provides a barometer on the state of the economy as viewed by China’s entrepreneurs.

The CKGSB BCI reads 57.4 in April, and has averaged 59.9 over the last four months with 50 being the threshold between a positive and negative economic outlook (see CKGSB Business Conditions Index). Since the beginning of the year, this forecast has become cautious, resulting in the business community losing some of the winter’s bounce in expectations. China’s growth has slowed, and the effect of new policies on future forecasts remains to be seen.

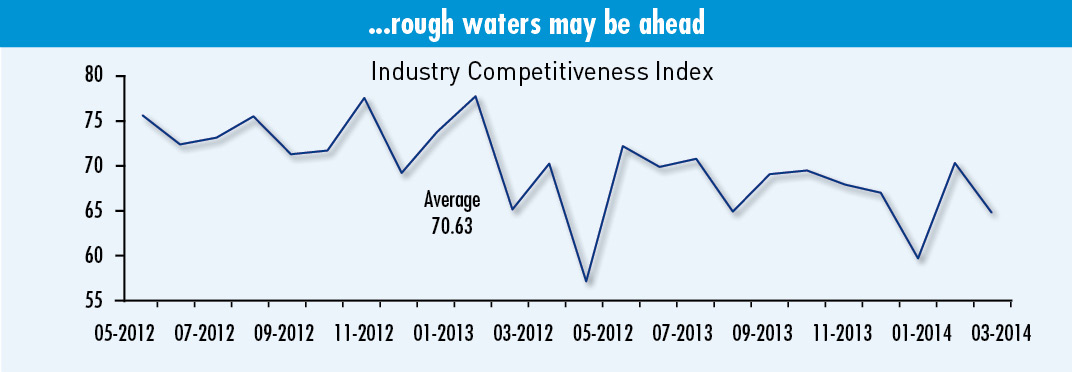

In the questionnaire respondents indicate whether their firm is more, the same, or less, competitive than the industry average (50), and from this a sample competitiveness index is derived (see Industry Competitiveness Index). Consequently, as sample firms are in a relatively strong competitive position in their respective industries, so CKGSB BCI indices are higher than government and industry PMI indices. Users of the CKGSB BCI index may thus focus on data changes over time to forecast trends in China’s economy.

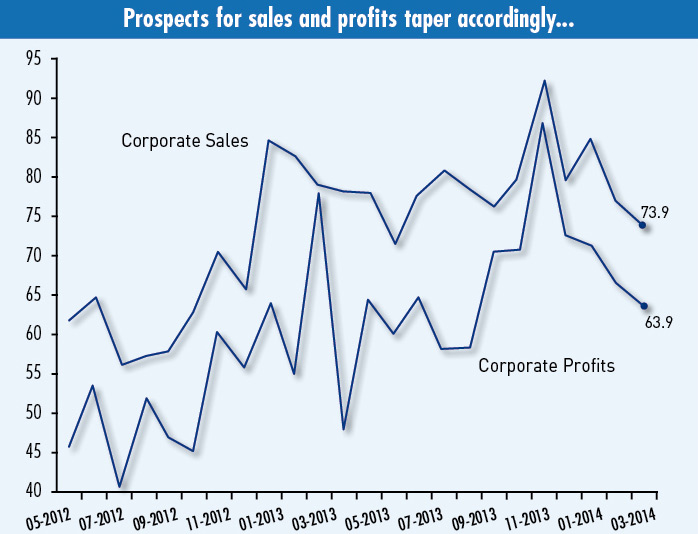

The corporate sales index registered 73.9, and the profit index registered 63.9, each lower than last month (see Corporate Sales and Corporate Profits). This quarter has seen a downward trend. Comparing these two indices with the overall BCI, we see that their downward trend is positively correlated with business operational forecasts.

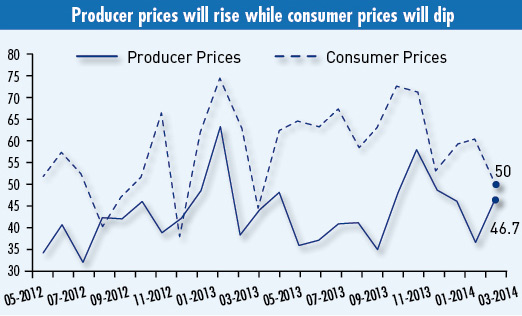

In April, labor costs and overall costs registered indices of 89 and 77.2 respectively (see Labor Costs and Overall Costs), both at a high level. These two costs indices show that the majority of sample firms expect costs to increase compared with this time last year. The consumer prices index dropped 10.9 points to 50 (see Producer Prices and Consumer Prices), showing the trend for the forthcoming period is a lowering of prices. Producer prices rose 9.8 points to 46.7, evidence of a narrowing of exposure on last month.