Anbang Insurance’s purchase of New York’s iconic Waldorf Astoria Hotel stunned many, but it’s only the tip of the Chinese outbound investment iceberg. In the first of our series on Chinese outbound investment, we take a look at the biggest real estate purchases made by Chinese companies.

In 1999 China launched its ambitious Go Out Policy (also known as the Going Global Strategy) to encourage local enterprises to play a stronger role in the international stage. Fifteen years have gone by since and the results are there for all to see. China’s outward investment has increased from $68.81 billion to $107.84 billion from 2010 to 2013. And the number of Chinese companies that have invested in overseas markets has skyrocketed from merely 510 in 2003 to 15,300 in 2013, as per the Chinese Ministry of Commerce’s annual reports. An important consequence of this policy is that several Chinese companies like Lenovo, Huawei and Haier have become significant global players.

It seems that the government intends to further encourage Chinese enterprises to invest abroad. In a recent State Council conference, Chinese Premier Li Keqiang stated that “if not specifically stipulated, outbound investments will not need the approval from the government”. So from now on, if Chinese companies want to invest abroad, the process will be much simpler. Traditional industries such as real estate, energy and natural resources rank high in the list of priorities of Chinese investors, but their appetite is growing.

In this new series, we’ll look at Chinese outbound investment in different sectors. Today, we take a look at real estate.

New York’s Waldorf Astoria Hotel is known for many things: luxury, the now world-famous Waldorf salad, and illustrious guests including the likes of Nikola Tesla, Herbert Hoover and Marilyn Monroe. Now the hotel is known for another thing: its Chinese ownership.

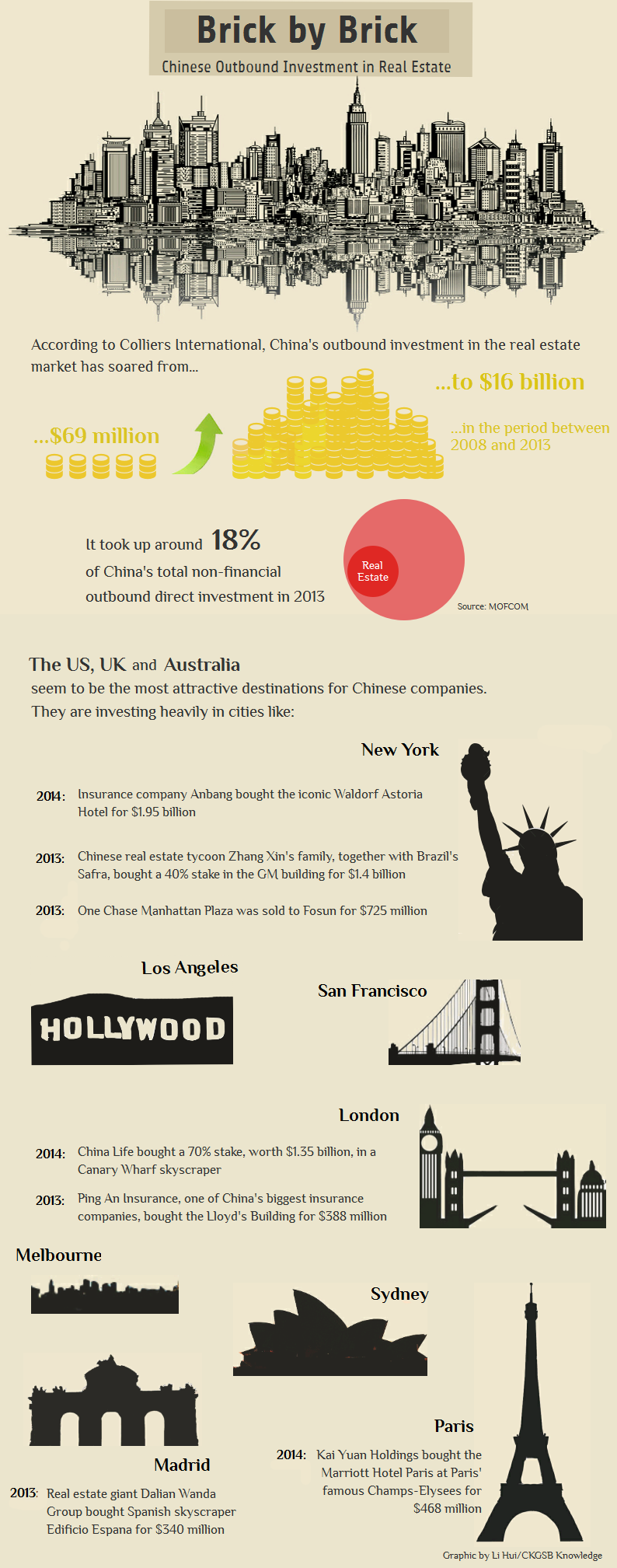

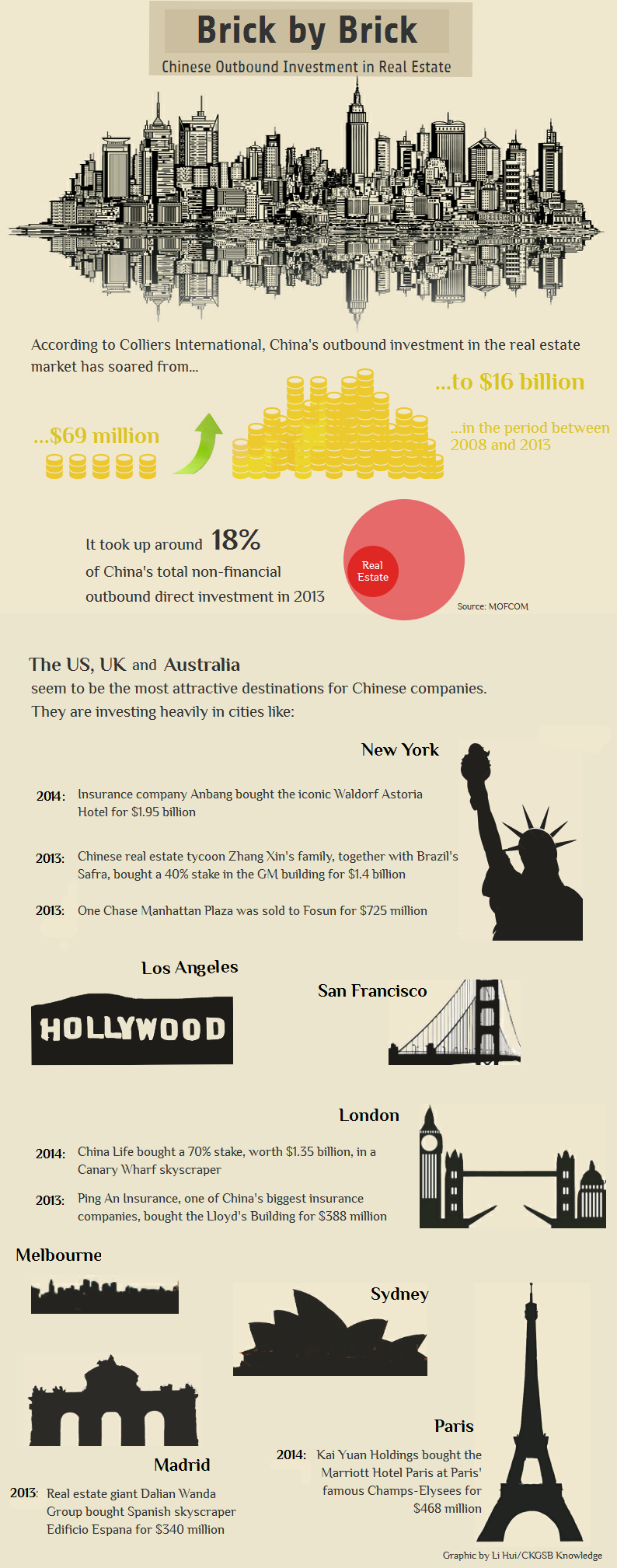

Earlier this month China’s Anbang Insurance Group bought the iconic midtown Manhattan hotel from the Hilton Group for $1.95 billion. The sale price makes Waldorf Astoria New York the world’s most expensive hotel. Last year another iconic Manhattan skyscraper—One Chase Manhattan Plaza—was bought by China’s Fosun Group, while the family of Soho China CEO Zhang Xin co-owns a stake in the General Motors Building.

According to Jones Lang LaSalle, in 2013, China’s total overseas investment reached $107.84 billion, of which $7.6 billion was in the commercial real estate market. With $3.1 billion, the US received most of this investment, while the UK got $2.3 billion. The third most alluring overseas real estate market was Australia. Chinese companies invested $700 million in the Australian real estate market. It is also forecast that the total volume of China’s overseas investment in real estate might surpass $10 billion in 2014.

Want to know more about the outbound real estate investments of Chinese companies? We put together this nifty infographic for you.