China’s post-COVID consumer spending recovery has not happened as quickly as some predicted, but there are some sectors which are showing promise

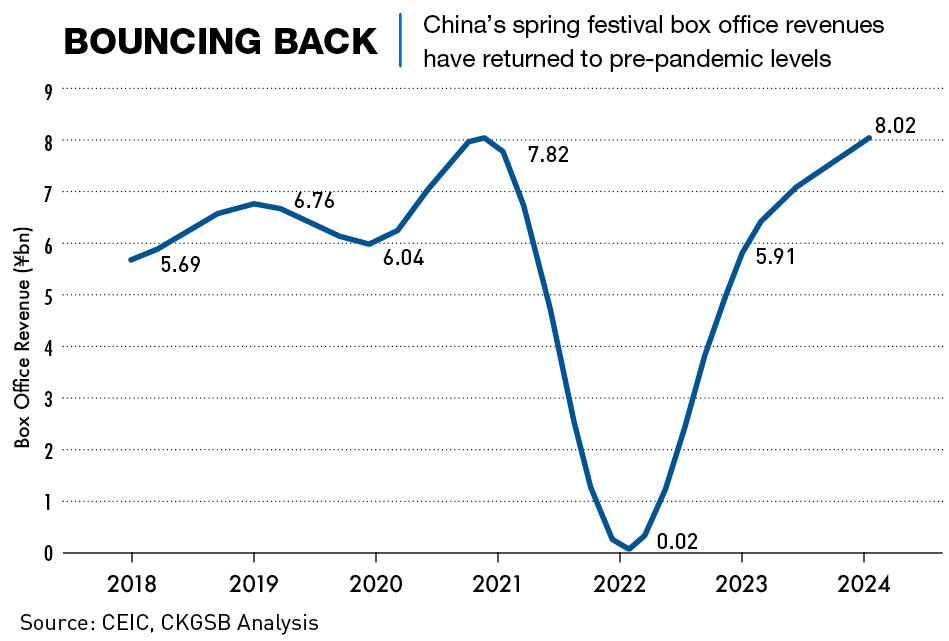

The 2024 Chinese New Year (CNY) holiday marked a notable resurgence for the film and entertainment industry in China, outpacing the performance of both the preceding year and the pre-pandemic era, demonstrating a resilience that has not yet been seen across all consumer industries in the country.

Box office revenues during the 7-day holiday reached ¥8.02 billion ($1.11 billion), a record high and an increase from ¥6.76 billion during the same time period in 2019. But, while these numbers show promise of a return to pre-pandemic spending trajectories, there remains a lack of overall momentum in the economy, underscored by faltering consumer confidence.

To understand the extent to which the resurgence seen in the film industry is an indication of a broader recovery within China’s consumption market, we need to examine the country’s historical spending patterns and their relationship to wider economic shifts. Analyzing Chinese household expenditure—the amount of final consumption expenditure made by resident households to meet their everyday needs, such as food, housing, transport, health costs, education and leisure— through a historical lens is crucial to obtaining a comprehensive understanding of the prevailing market dynamics.

Free spending

China boasts the world’s largest middle-class demographic, and there were already over 140 million middle-class households in the country by 2017, according to the definition provided by China’s National Bureau of Statistics. This typically encompasses a three-person household earning between ¥100,000 ($14,082) to ¥500,000 ($70,414) per year.

As income levels grew and property ownership rose, China’s middle-class demonstrated a growing penchant for spending. And this shift extended beyond basic necessities to encompass various entertainment-related items, mirroring consumption patterns among the middle-classes in developed Western economies.

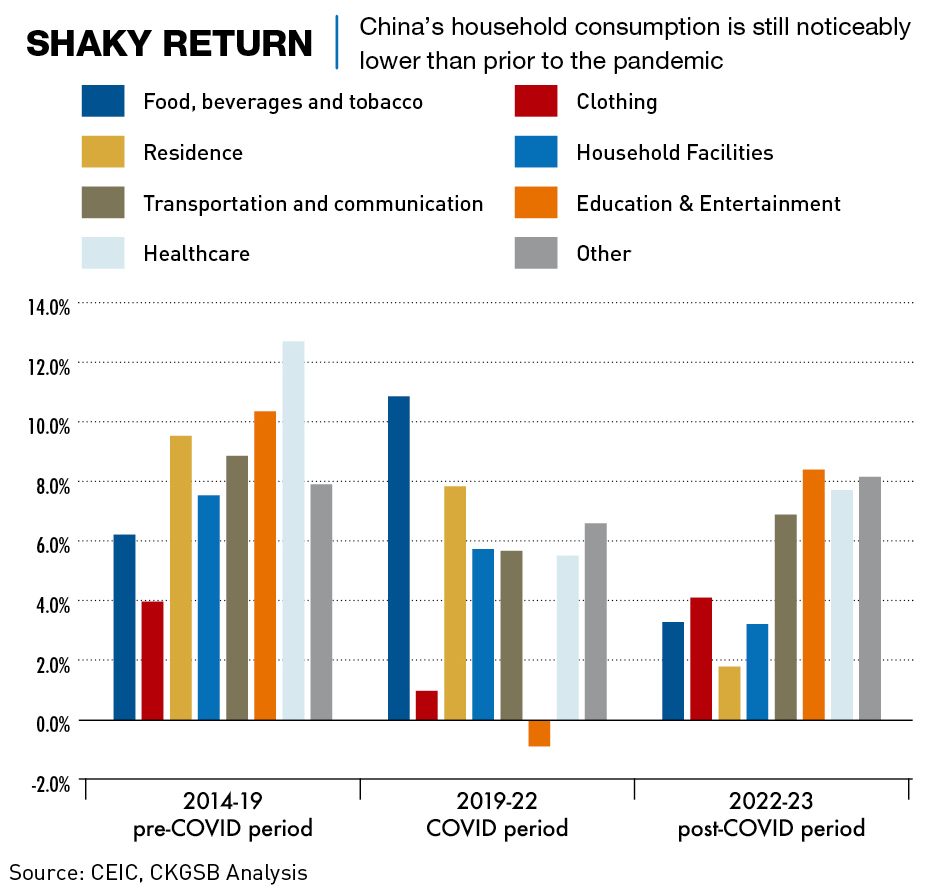

Consequently, Chinese urban households were progressively allocating more of their budget to discretionary expenditures such as healthcare, entertainment and education prior to the onset of the pandemic, trends underscored by notable annual growth rates in these categories from 2014 to 2019.

But the emergence of the COVID-19 pandemic led to significant shifts in consumer behavior, disrupting these growth patterns and, as a result, growth in discretionary spending decelerated, with expenditure increasingly favoring non-discretionary essentials.

The lockdowns and restrictions imposed due to COVID-19 then put limits on almost all in-person consumption, a persistent decline in consumer confidence, resulting in lower household spending on non-essential goods and a growing inclination towards saving.

The enduring effects of the pandemic have also prompted a reassessment of Chinese household expenditure, marked by a noticeable pivot away from discretionary expenses towards essential non-discretionary items. Notably, food emerged as the sole category exhibiting growth surpassing pre-COVID levels during the period spanning 2019 to 2022. Over the same period, spending on entertainment experienced a downturn, reflecting constraints on outdoor activities imposed by pandemic-related restrictions.

Stunted recovery

In early 2024, a year after the relaxation of COVID restrictions, there were signs of a gradual resurgence in household spending. In particular, travel activities serve as harbingers of recovery. High-frequency data associated with the Spring Festival holiday, including metrics such as subway ridership, highway congestion and railway passenger volume, all indicated a rebound in mobility levels across China.

According to statistics from the Ministry of Transport, between January 26th and February 13th, the cumulative interregional population movement within the country totalled approximately 4.16 billion person-times (the total number of individual cases of travel), with an average daily flow of about 220 million. These figures represent increases of 15.3% and 11.0% compared to 2023 and 2019, respectively.

This boost in travel statistics during the holiday reveals encouraging indicators for China’s household spending. But when looking at the wider picture of China’s consumption market, there are reasons for less optimism when it comes to a complete return to pre-pandemic trends.

On the surface, headline growth figures suggest robust retail sales performance in 2023, but a deeper examination reveals a different story. The 7.2% year-on-year growth in retail sales in 2023 was largely driven by the exceptionally low base of the previous year, which actually contracted by 0.2% compared to 2021. When considering the average growth rate for the period spanning 2022-2023 to mitigate base effects (which can occur when previous data is either unusually high or low), it becomes evident that the recovery in domestic consumption remains a prolonged endeavor.

On average, retail sales grew by a modest 3.5% during 2022-2023, notably lower than the 8.4% growth recorded during the pre-pandemic period of 2018-2019. Besides, retail sales growth moderated in the last month of 2023, standing at 7.4% year-on-year compared to the previous month’s figure of 10.1%. While some of this deceleration can be attributed to the waning impact of favorable base effects, quarterly data indicate a broader moderation in consumption growth momentum during the fourth quarter. This aligns with the persistent fragility in consumer confidence and sluggish growth in household income.

Extra charges

Overall, there are several obstacles impeding the full recovery of China’s household purchasing power. Firstly, the country’s real estate market is enduring a prolonged downturn, underscored by a persistent decline in both property investment and sales. Official statistics revealed a 6.5% decrease in housing sales in 2023, while projections from Bloomberg Economics suggest that the housing sector’s contribution to China’s gross domestic product (GDP) may diminish to approximately 16% by 2026, down from its current level of around 20%. This downturn has particularly impacted China’s middle class, who heavily rely on housing as a significant portion of their assets, with around 70% tied up in property.

This situation can also be exacerbated by the wealth effect, a phenomenon whereby individuals’ perception of their wealth influences their spending behavior. When property values rise, individuals feel financially secure and are more inclined to make substantial purchases. Conversely, as housing prices fall, consumers experience a contraction in their spending power and become increasingly hesitant to engage in high-value transactions.

This intricate interplay between real estate dynamics and consumer behavior underscores the profound impact of the housing market on China’s economic landscape. As the market continues to grapple with challenges, including affordability concerns and regulatory interventions, navigating this terrain requires a nuanced understanding of the underlying dynamics shaping both household wealth and consumption patterns.

Additionally, low family incomes have been compounded by a weakened labor market and sluggish income growth during and following the pandemic period. In 2023, the nationwide per capita disposable income stood at ¥39,218, equivalent to approximately $5,300—significantly below China’s overall GDP per capita of $12,622.

Despite the lifting of restrictions, job creation remains subdued, with official data indicating a total of 12.44 million jobs created in urban areas in 2023, marking an 8% contraction compared to 2019’s figure of 13.53 million. A substantial and sustained improvement in hiring is necessary to stimulate income growth and, subsequently, household spending.

Furthermore, consumer confidence has also been dented by the pandemic and subsequent economic slowdown. The Consumer Confidence Index plummeted to 86.7 in April 2022, a stark departure from historical levels well above 100, signalling a major shift into negative sentiment. To date, the index continues to languish in negative territory.

While marginal improvements were seen towards the close of the year, concerns persist regarding the effects of this prolonged economic adversity on consumer behavior and confidence levels, particularly among a generation experiencing their first encounter with a significant economic downturn.

While we are again witnessing a positive trend in households engaging in some discretionary activities, particularly in domestic and international travel, there have been other shifts in consumer behavior. Spending per instance of travel has diminished and despite having more disposable income due to reduced spending on major investments like property, there’s a reluctance to splurge on luxury items.

Value for money and enjoyable experiences are now taking precedence, indicating a preference for mobility while maintaining frugality. This trend is anticipated to persist in the coming years.

Tightened belts

In summary, domestic private consumption recovery appears to be gradual in the near term. The absence of a favorable low base effect, alongside subdued consumer confidence, underscores the challenges ahead. The resurgence of consumption hinges on stabilizing the property sector, improving labor market conditions, and fostering income growth.

During the 2024 Two Sessions in March, China announced an annual GDP growth target of 5%, along with the creation of an additional 12 million new urban jobs. This goal aligns with that of 2023.

Thanks to a better-than-expected Q1 GDP performance of 5.3%, many entities have upgraded their forecasts for China’s 2024 overall economic growth. For example, the IMF now projects GDP growth for the year at 5%, up from its previous forecast of 4.6% made in April.

But despite overall economic growth, the consumption market still shows signs of weakness. In the first quarter of 2024, retail sales of consumer goods increased by only 4.7% year-on-year, a deceleration from the 8.4% growth seen in Q4 of 2023. Thus, achieving a significant overall improvement in China’s consumption market presents a considerable challenge.

While both central and local governments have recently tried to bolster the real estate sector by stimulating home purchases with interest rate reductions and the lifting of purchase restrictions, it is unlikely that such efforts alone will lead to a robust short-term housing market recovery. As a result, households may find themselves with discretionary cash for expenditure on tourism and entertainment due to deferred property investments. Nevertheless, they may also continue to exhibit frugality in their spending habits, opting for less spending for each outing and restaurant meal, as evidenced by heightened caution in post-COVID consumption behavior and amidst uncertain labor market conditions.

This cautious approach to expenditure may potentially become a prevailing trend in household spending patterns over the next five years.