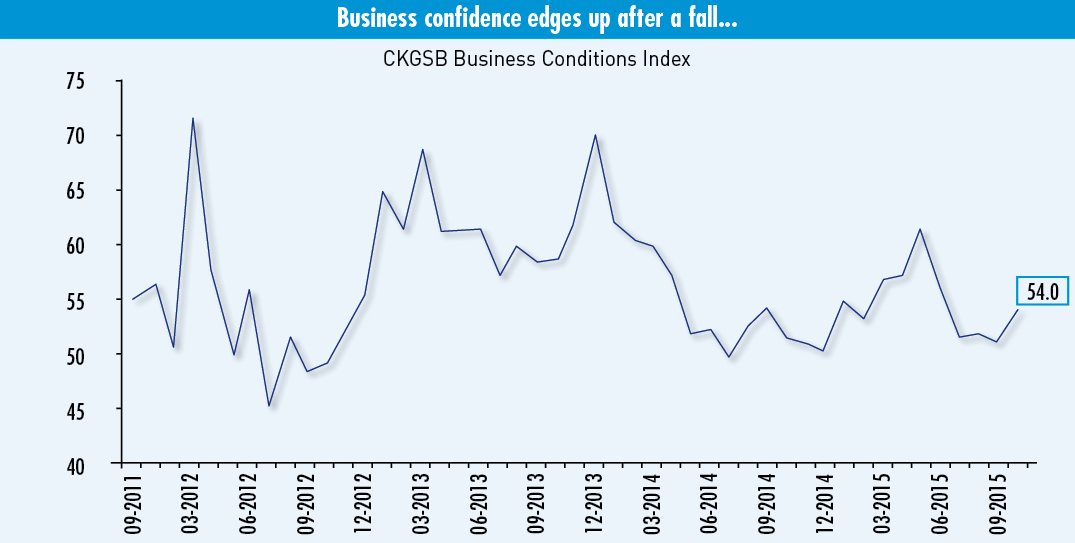

The CKGSB Business Conditions Index shows that businesses in China remain confident, but it remains unclear if they will continue to.

In October 2015, the CKGSB Business Conditions Index (BCI) posted a figure of 54.0, a mild rise over the previous monthly reading of 51.1 and slightly above the confidence threshold of 50. The BCI hit a 14-month high of 61.3 in May 2015 before sliding steadily, with readings from July to September hovering above 50, indicating that the sample firms became less optimistic about business conditions with regard to the following six months. Despite a moderate rally this month, it is still unclear whether or not the ongoing momentum will hold. As a result, we need to maintain cautious optimism with regard to these short-term economic trends.

The BCI, directed by Li Wei, Professor of Economics at the Cheung Kong Graduate School of Business, asks respondents to indicate whether their firm is more, the same, or less competitive than the industry average (50), and from this we derive a sample competitiveness index (see Industry Competitiveness Index). As our sample firms are in a relatively strong competitive position in their respective industries, the CKGSB BCI indices tend to be higher than government and industry PMI indices.

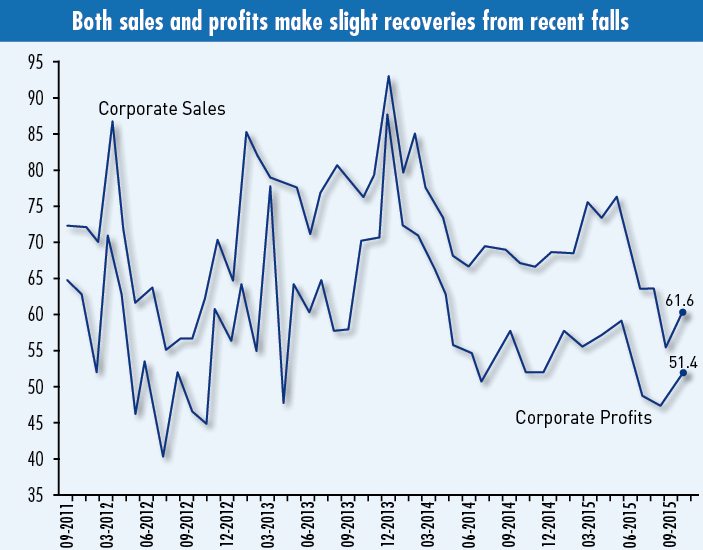

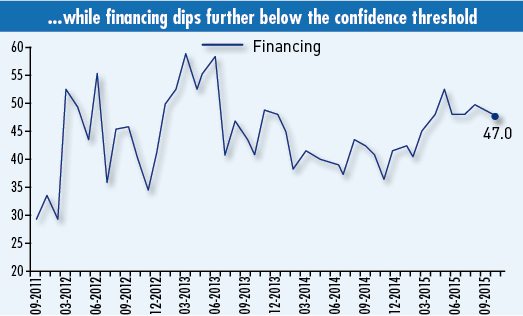

The sales index posted relatively strong growth, up to 61.6 from 56.6, while the profits index also witnessed a mild rise this month to 51.4 from 48.7, bouncing back over the mark of 50. The trend reversal isn’t that impressive, indicating that firms still have limited confidence in their profit prospects in the near future. The financing index edged down to 47.0 in October from 48.4 in the previous month—the index has long stayed below the mark of 50, suggesting a tough financing environment in which the sample firms operate.

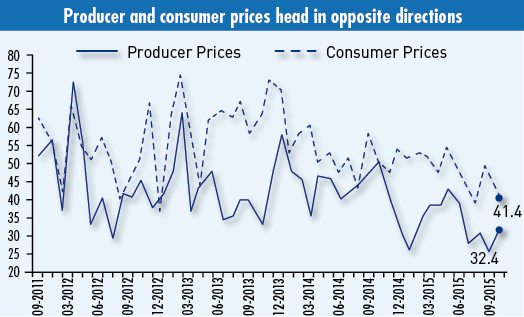

The consumer price index plummeted once again, down to 41.4 from 50.0—it has truly had a roller coaster ride over the years. Meanwhile, the product price index edged up from 27.7 to 32.4, yet remained in extremely low territory. In general, all the price-related indices have stayed weak since January 2014.