ByteDance was at one point considered the most successful Chinese Internet company in the world in terms of global users before its signature product, TikTok, was blocked in India and scrutinized by authorities in the United States.

ByteDance, a Chinese Internet company founded in 2012 and now valued at USD $180, has created phenomenal brands such as TouTiao, Douyin, and TikTok. This case study will focus on Bytedance’s most successful products, TouTiao, Douyin, and TikTok, and look at its past and future development process.

TouTiao: The Beginning of ByteDance

In August 2012, Zhang Yiming, the founder of ByteDance, started to create an app that would use big data to analyze a user’s news preferences and offer users curated content. For a long time, traditional print media was an important channel for the public to obtain information.

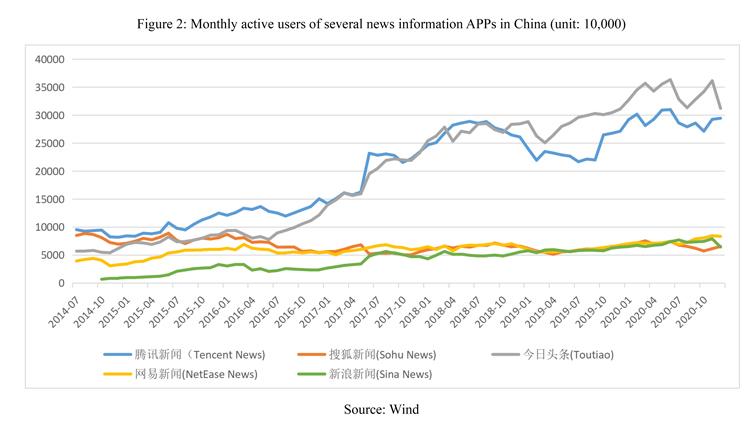

With the development and widespread use of smartphones, people no longer needed to subscribe to journals and magazines, nor browse traditional news websites. They can easily obtain information from mobile phones. The competition for mobile information culminated in 2013 when China had more than 1,300 applications focused on news information.

Even though TouTiao has no content of its own, it was still successful in the early stages. This was due to a better product design and a successful marketing strategy:

- First, the name of “TouTiao” is simple and easy to understand. In Chinese, it contains the key words of both “today” and “headline”, hence telling users that this app is the most important news of the day.

- Second, the contents of TouTiao are refreshed whenever users open the application. When the app operates under Wi-Fi environment, it will preload the content that the user may browse, and load the following five or six articles in advance.

- Third, personalized recommendation has become a key factor for TouTiao. It is TouTiao’s strategic positioning to distribute information efficiently in a personalized way.

- Fourth, TouTiao carried out effective marketing in the early stages by cooperating with mobile phone brands to pre-install the APP on the mobile phone. After purchasing a mobile phone, users can use TouTiao without downloading the app.

Operation Mode: Algorithm + Content

TouTiao uses content, user profile and environmental characteristics to recommend content. The algorithm infers whether the recommended content is suitable for a user in a certain scenario by using these 3 sources. Its ultimate goal is to match the content with the needs of individual users, and accurately distribute relevant content.

While TouTiao’s technological advantages and Internet product methodology helped it to stand out from traditional media, its use of machines and algorithms to capture content has also led to multiply lawsuits for copyright infringement. To fix the situation, TouTiao launched an extensive content cooperation with traditional media, and by 2019 had established partnerships with more than 10,000 media outlets.

The most critical step to improving TouTiao’s product offering was “TouTiaohao” – an open content creation and distribution platform similar to WeChat’s official accounts in September 2014. Account holders can publish various contents, such as text, pictures, videos, voting, etc. These contents are distributed to relevant target audience through algorithms.

Profit Model: Personalized Recommendation of Ads on News Feed

TouTiao’s advertising operations has three main aspects:

- Making advertisement informative and similar to content pieces.

- Automatic distribution of advertisement. Considering different user preferences, TouTiao may make dozens of versions of an advertisement. The system will form interest tags according to users’ browsing history, likes and favorites, and push different contents.

- Making video advertisements. The volume of videos on the TouTiao platform has increased rapidly. In May 2016, the total time spent on TouTiao’s videos surpassed that of text and picture. So, TouTiao added video as an option to its ad operation.

According to The Information, a subscription-based technology publication, people familiar with the matter said ByteDance’s revenue has more than doubled to around USD $37 billion in 2020.

The success of TouTiao was the biggest highlight for ByteDance between 2012-15, which helped to lay the foundation for ByteDance’s popularity. TouTiao became the top two news applications in just two years, far ahead of other competitors. It quickly became commercially profitable, further strengthening the ability of Zhang Yiming and his team.

Douyin: Redefining Short Videos

In September 2016, Zhang Yiming announced that the company would start a short video platform, and would provide RMB 1 billion to subsidize short video creators.

The rapid development of the mobile internet and the steady progress of urbanization in China have created tremendous changes in economic and social life. The fast-paced life and the disintegration of traditional social networks made cell phone a faithful companion in people’s lives.

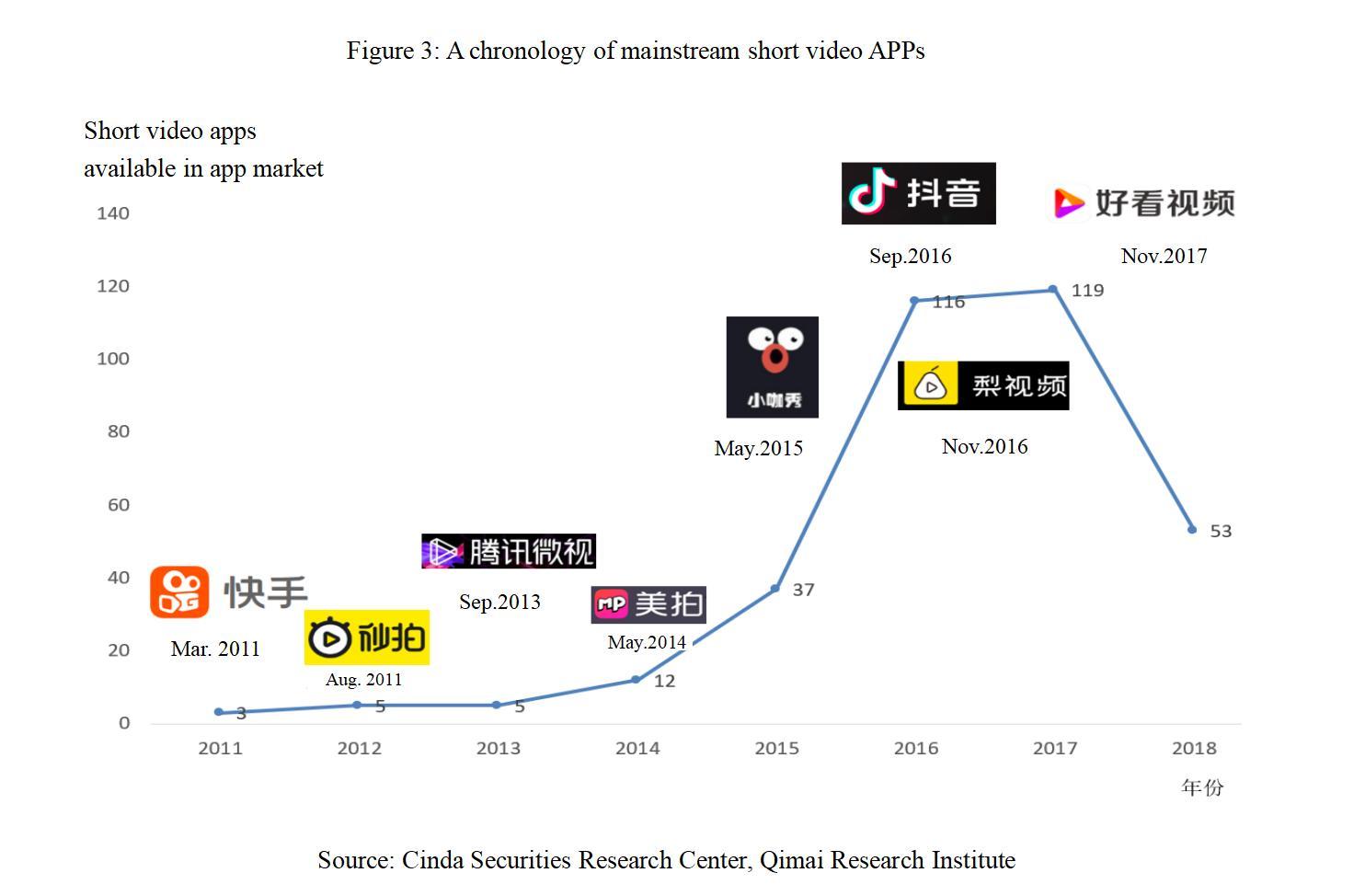

Zhang wanted to capture users’ attention within a short time and provide smart phone-based entertainment. Since 2011, short video formats have been growing in popularity. In 2016, short video applications saw a big explosion. While the short video market was flooded with newcomers, it was difficult to maintain user activity over time.

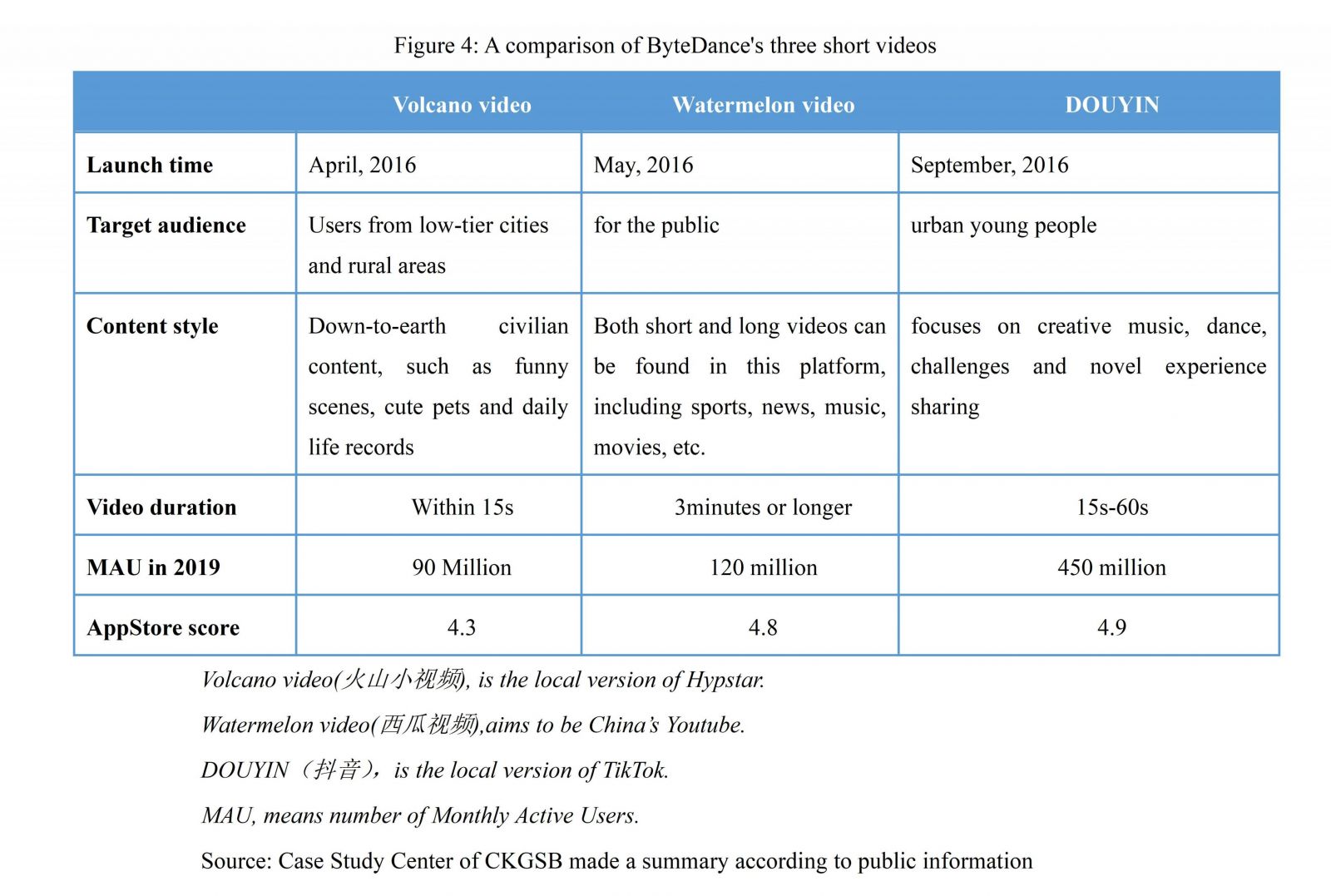

In April 2016, ByteDance officially launched its first independent short video application. In May and September, two short video applications, Xigua Video and A.me (officially renamed as Douyin three months later), were launched successively for different target groups.

Douyin, launched on September 26, 2016, is a creative short music video product focusing on young people. Based on a huge library of materials, users can create 15-second music videos shot by themselves and shared with other users on the platform.

At the same time, the Douyin team repeatedly improved the product by exploring users’ habits, and updating and optimizing the product infrastructure. For example, the team launched new features such as switching content by swiping up and down.

ByteDance also began to consciously invest more resources in Douyin from the company level. For example, during Spring Festival in 2018 when advertising is expensive, ByteDance put out advertising, subsidies, and invited celebrities to use the platform. As of January 2019, Douyin’s domestic daily active users exceeded 250 million, while the daily active users of its competitor Kuaishou were less than 200 million during the same period.

In addition to these opportunities, the reason that Douyin made remarkable achievements in the early days came down to two factors:

- One is the unique positioning and product design. The quality of videos always came first. As a music-oriented, creative short video community, Douyin attaches great importance to the development of music copyright and creative materials. The rich material available also gave users’ the opportunity to innovate on content.

- Another crucial aspect is the algorithm established by ByteDance in the early stages. Relying on the traffic base and accurate algorithm model accumulated by TouTiao, Douyin was able to use these technical advantages to identify people’s needs within a short time, accurately pushing out large amount of trending content, and adjusting the product based on feedbacks to ensure that users continue to see their favorite content.

From Attracting Traffic to Establishing Ecosystems: Douyin’s Business Model

The core of Douyin’s business model is a centralized network of the top 5% of its users and multi-channel network (MCN) organizations, in which Douyin’s algorithm system plays the role of monitoring and distributing content, while the remaining 95% are ordinary users who get served the content. Therefore, in order to pave the way for commercialization, Douyin pays special attention to embedding social features, which is a shortcoming in other short video applications.

The modification of social functions not only give Douyin its identity, but also provides a platform for commercialization, helping to incubate brands and popularize merchandize.

In terms of revenue structure, Douyin mainly relies on two channels. Advertising is Douyin’s dominant business. Currently, there are two forms of Douyin’s advertising design – advertisement embedded in the video and customized challenge games. The latter invisibly completes the marketing process by driving users to compete on a certain task through giving prize incentives.

In addition to the main channel for advertisements, e-commerce has also become an emerging revenue channel for Douyin and ByteDance. Since 2019, live streaming e-commerce has been trending, and thus Douyin started to build its independent selling platform. In the livestreamed videos, information of similar products is introduced in the video through automatic pop ups. Users can directly purchase through the link or via a third-party platform, from which Douyin will take a certain percentage of commission.

In early February 2021, media reports said that Douyin’s GMV (gross merchandise turnover) for 2020 exceeded RMB 500 billion, more than tripled from 2019. At the beginning of 2020, ByteDance’s GMV target for Douyin was RMB 120-150 billion. But as the growth soon exceeded expectations, ByteDance raised the target to RMB 250 billion, and the final result still doubled.

Returning to the short video platform, Douyin and Kuaishou dominate in China. As of early 2020, the daily active users (DAU) of Douyin exceeded 400 million, and the DAU of Kuaishou exceeded 300 million, while the remaining market is divided by other smaller platforms.

With two phenomenal content products and the accumulated content ecosystem methodology (i.e. algorithm plus content), ByteDance has formed an economy of scale in many fields such as video, information, Q&A and search.

Although there seems to be no limitations to ByteDance’s business, continuous traffic growth is not endless. Bytedance faces challenges such as the lack of platform regulation and the delicate relationship with established Internet giants. It needs to upgrade its existing structure, profit model and organizational structure to stay current.

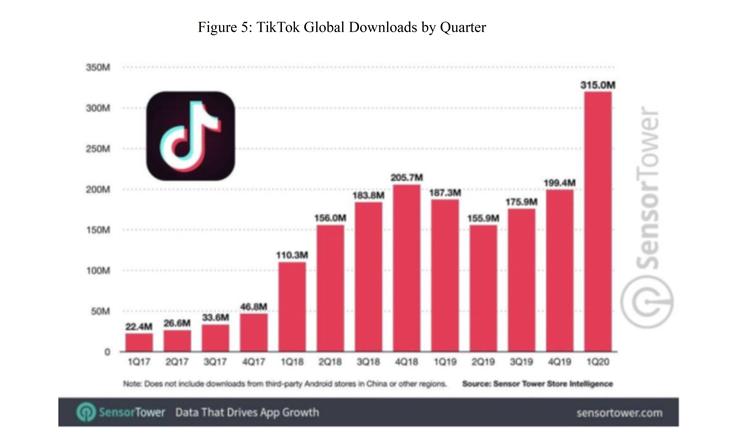

TikTok, a short video platform similar to Douyin, has achieved great success internationally. As of April 2020, it had cumulated more than 2 billion global downloads in the Apple App Store and Google App Store. In the US, TikTok was one of the most popular applications in 2020, with more than 165 million cumulative downloads.

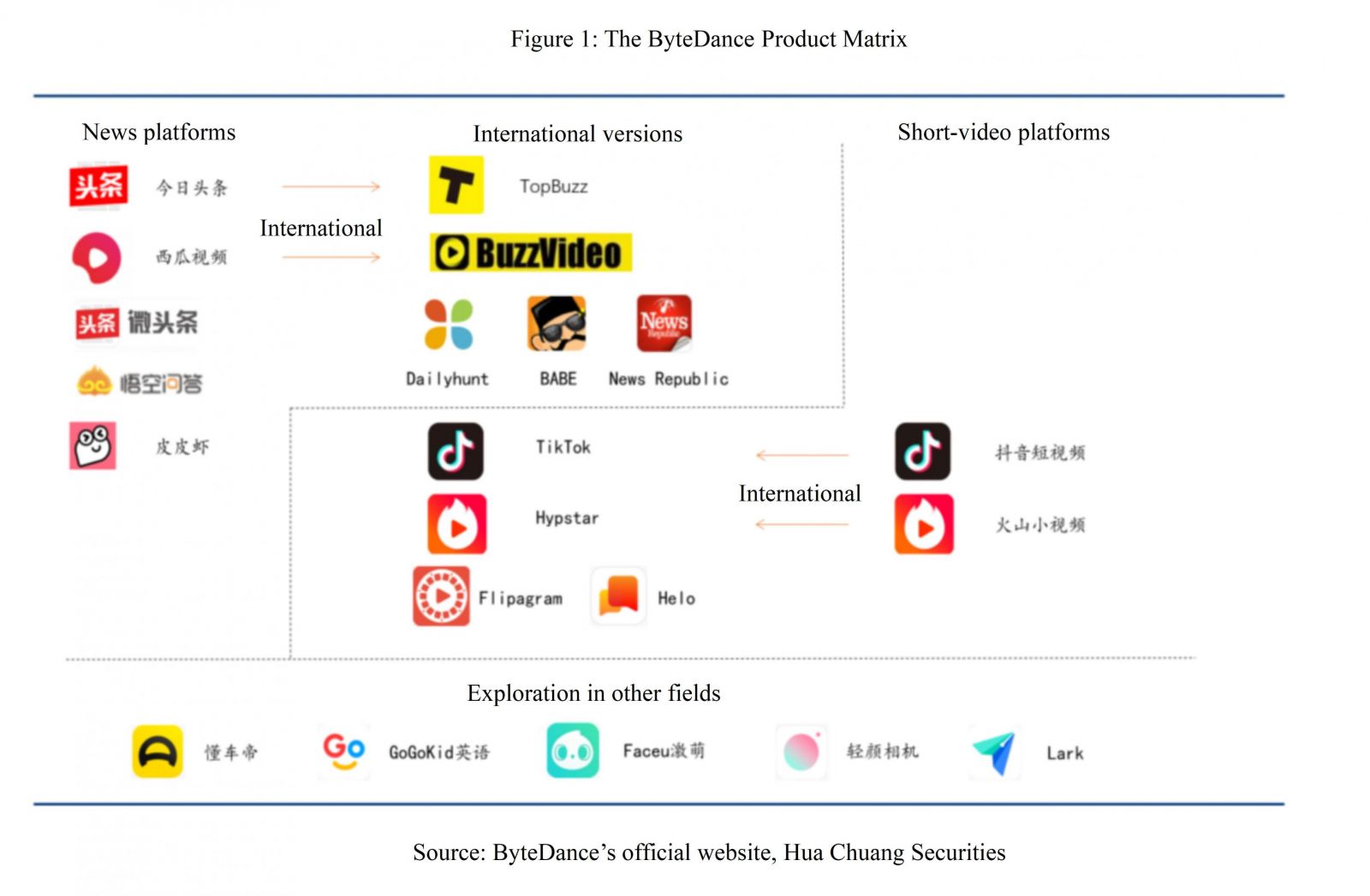

In the early stages of ByteDance in 2012, Zhang Yiming had plan to globalize his company. ByteDance’s three initial products – TouTiao, Watermelon Video and Huoshan Video – all had international versions – TopBuzz, TopBuzzVideo and Vigo Video respectively, while TikTok was similar to Douyin.

The difference between TikTok and Douyin in official publicity is that they are two independent products under ByteDance, with Douyin only operating in mainland China and TikTok covering more than 150 countries and regions around the world in 75 language. The data storage, content operation and review of the two products are independent from each other.

Growth: TikTok + Musical.ly = TikTok

There are three key points to the growth of TikTok:

- In August 2017, TikTok was launched simultaneously in more than 150 countries and regions.

- In November 2017, ByteDance acquired Musical.ly, a music video sharing and interactive social app. TikTok and Musical.ly developed in parallel.

- In August 2018, Musical.ly stopped its service and all assets of the original platform, including users and data, were merged into TikTok.

ByteDance bought Musical.ly for USD $1billion, laying a solid foundation for TikTok’s internationalization. In 2018, ByteDance made a major advertising push on Facebook, spending USD $1 million per day, which immediately led to a surge in downloads: the new TikTok was downloaded 660 million times in the whole year, a fourfold increase year-on-year.

In addition, ByteDance’s technology accumulation is also used to optimize TikTok’s recommendation mechanism. In the global market, the TikTok operation team launched marketing campaigns based on local trends and hot topics to further increase traffic and guide the direction of content.

A Crisis in the Midst of Prosperity

Despite TikTok’s global success, TikTok has encountered a number of accusations or regulatory measures in markets such as the US and India since the beginning of 2019.

- In terms of public opinion, TikTok has been criticized for its Chinese background, and has been questioned that the censorship system is “controlled by China”.

- In terms of business competition, TikTok has also been criticized by Chinese companies for its foreign identity.

- In terms of government supervision, TikTok pays fines and rectifications for protecting personal privacy.

The Dilemma of Globalization

The internationalization crisis of ByteDance broke out in mid-2020.

On June 29, 2020, the Ministry of Information Technology of India announced that it would ban 59 mobile applications developed by Chinese companies, with ByteDance’s TikTok at the top of the list.

With the ban in India TikTok and its parent company ByteDance faced two executive orders by US President Donald Trump to put TikTok under threat of being banned in the US, leaving ByteDance with extremely limited options. Meanwhile, it faced backlash from Chinese users when they learned that ByteDance had intention to sell TikTok’s US business section.

The threats to TikTok in the US are mainly the scrutiny of CFIUS and two White House executive orders from US President Donald Trump. The timeline of the key events are:

- On August 3 local time, Trump threatened to block TikTok for the first time, demanding that it reach an agreement to sell its business in the US by September 15, or else TikTok would be banned.

- On August 6, Trump signed an executive order announcing that he would ban any American individual or company from doing business with ByteDance, WeChat and their subsidiary corporations in 45 days (starting from Sept 20).

- On August 14, Trump signed an executive order again, requiring ByteDance to divest within 90 days.

- On August 23, ByteDance announced that it will formally prosecute Trump and the US government on August 24 local time (August 25, Beijing time). While negotiating the sale, ByteDance is preparing a “shutdown plan”, including countermeasures to avoid any impact on employee salaries.

- On August 30, ByteDance stated that the company will strictly abide by relevant Chinese laws and regulations and handle business related to technology export. The TikTok deal could be delayed until after the US elections in November, as Chinese approvals would take time.

On September 14, Oracle confirmed that ByteDance has submitted a proposal to the US Treasury Department to serve as a “Trusted Technology Provider” for TikTok. TikTok will continue to be based in the US, Oracle will be the data custodian for TikTok to ensure data security, and TikTok will not sell its core algorithms to Oracle.

However, things were not settled as expected. On September 19, Trump said he had approved the cooperation agreement among Oracle, Walmart and TikTok. Two days later, on September 21, Trump changed his mind and said he would not approve the deal between Oracle and ByteDance if the latter still controlled TikTok.

Trump’s changing attitude made it no longer feasible for TikTok to solve problems through cooperation. At this time, under the political background of the US-China trade war, suing Trump became the most realistic option for ByteDance.

Since July 6, US Secretary of State Mike Pompeo said the US would likely ban TikTok. Meanwhile in China, people compared ByteDance with Huawei, referring it as the pride of Chinese companies going abroad. While in late July to early August, when the news that ByteDance might sell TikTok came to China, public opinion on ByteDance and Zhang Yiming took a sharp turn for the worse.

Encountering a similar dilemma to Huawei, ByteDance’s response was very different from Huawei’s. Some commentators called for more tolerance for ByteDance. They believed that ByteDance’s business is different from that of Huawei, and if it encounters an overnight ban like Huawei had, all the initial investment would be wasted.

ByteDance expressed its difficulties in the form of a company account statement and Zhang Yiming’s open letter, hoping to get more support from Chinese users.

With the Oracle proposal in mid-September, the opinion field gradually recognized ByteDance’s efforts to preserve TikTok. As the lawsuit progressed, public opinion showed more recognition for TikTok.

The future of ByteDance

Despite the hurdles TikTok faced in the US, globalization is still the overall strategy of ByteDance in the long term. From the sudden emergence of TouTiao to Douyin to TikTok, ByteDance is the company with the fastest growth in the past decade. Even with TikTok’s overseas setbacks, ByteDance is still a dynamic company and will not stop its expansion.

In the short term, ByteDance’s “cash cow” business remains stable, with TouTiao and Douyin contributing more than 80% of the revenue. At the same time, the layout of ByteDance in games, education, finance, and entertainment has also achieved some initial results.

“Education is the company’s new business direction for cross-border attempts, and it is also one of the company’s three major focuses in the future,” said Zhang Yingming in an internal letter, identifying the importance of education in the company’s new business field.

On October 29, 2020, ByteDance announced the launch of a new education brand “Dali Education”. As the first independent business brand under ByteDance, Dali Education undertakes all educational products and businesses of ByteDance.

“Entering the game industry is a must for ByteDance’s content and commercialization, because a large proportion of ByteDance’s advertising revenue comes from the game industry,” a Guosen Securities analyst once commented on ByteDance’s layout in games. According to the report of GameLook, ByteDance officially established a game department in February 2020, with a team size of more than 1,000 people.

Enterprise service is a key investment area of ByteDance. With the help of consumer-side accumulation, investing in business-side enterprise services is also one of the ways for ByteDance to offer returns to shareholders and leverage the incremental volume.

Finance is an important means for Internet giants to monetize their traffic. In March 2020, ByteDance officially acquired the license of online small loan. In August, ByteDance acquired the license for consulting business of futures from Hong Kong brokerages. In September, Ulpay was officially incorporated by Bytedance, and Zhang Yiming finally obtained the payment license. In January 2021, Douyin Payment was officially launched in Douyin APP.

ByteDance is also involved in real estate, hardware, medical, catering, automobiles and other fields, but they are all in the testing stage.

In December 2020, Zhang Yiming said he would focus on three new business directions for further exploration in 2021, including cross-border e-commerce, enterprise services and office services.