Li Haitao – Dean’s Distinguished Chair, Professor of Finance, Associate Dean for the Business Scholars Program, CKGSB

China’s economy is gradually moving away from its old growth model based on foreign exchange earnings, real estate, and infrastructure and gravitating towards a new economic model sustained by consumption and manufacturing. How does China deal with its huge amount of debt? How will local governments prosper in the absence of land finance? How should China approach credit expansion in the post-real estate era? And what will drive China’s economic growth in the future?

Since China joined the WTO in 2001, its central and commercial banks have raised capital through foreign exchange earnings via exports and currency exchange. This capital has been used as credit to fund real estate and infrastructure projects, thus driving GDP growth.

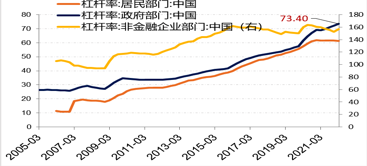

However, the sustainability of this model is now being questioned due to soaring household and corporate debt ratios.

The End of the Old Model

Leverage ratios of China’s household sector (in orange on left axis), government sector (in blue on left axis), and non-financial enterprise sector (in yellow on right axis)

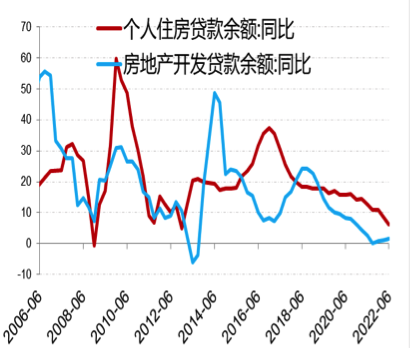

Growth rate of China’s real estate investment

Since China’s urban housing reform in 1998 property demand has soared, largely due to an increase in foreign exchange reserves at the expense of imported goods. From 2000-2021, China’s foreign exchange reserves rose from USD $150 billion to USD $3.25 trillion. Money from foreign currency reserves has flown into the economy via investment in real estate and infrastructure. This has been the basis of China’s growth model over the past 20 years.

China’s real estate loan balance has risen 18-fold from RMB 2.8 trillion in 2005 to RMB 52 trillion in 2021. Household leverage has also increased from a ratio of 10% in 2006 to 62% in 2021. Such credit expansion has driven up land prices, house prices and GDP. In cities such as Beijing, Shanghai, Shenzhen, and Guangzhou, the house price-to-income ratio have gone up 30-40-fold.

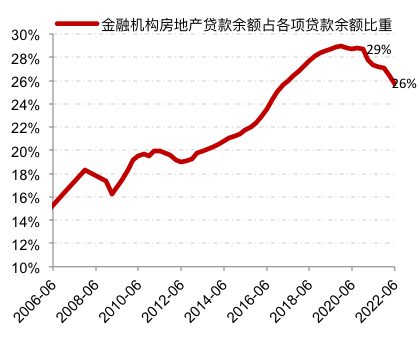

The pouring of funds into the property sector has caused many structural problems in China’s economy such as imbalances between real estate and the real economy, leading the economy to become over reliant on capital. In 2021, RMB 52 trillion of loans were directed to real estate, which made up 27% of all loans across various financial institutions in China. Moreover, real estate makes up 13% of China’s GDP (the global average is 7%) and has absorbed 30% of capital.

Growth rate of China’s personal housing loan balance (in red) vs real estate developer loan balance (in blue)

Real estate loans as a percentage of all loans provided by financial institutions

However, due to recent government interventions such as the ‘Three Red Lines’ policy introduced in August 2020 (which established guidelines for property companies to take on extra debt), and the ‘houses are for living in, not for speculation’ policy (to reduce speculative investing), have eased the situation somewhat. The ratio of real estate loans against all loans from financial institutions declined from 29% in March 2020 to 26% in June 2022. Commercial housing sales also fell in 2022 compared to 2021. Furthermore, another hard landing looks less likely now in China since the country nears the end of deleveraging. Interest rates are also on a downward cycle reducing the likelihood of default on loans.

With the era of land finance coming to an end, which path will local governments take?

The economic power of local governments in China has dwindled as they struggle to secure revenue from land sales in the post-land finance era. In the past, local governments have made revenue by leasing land to developers and homeowners.

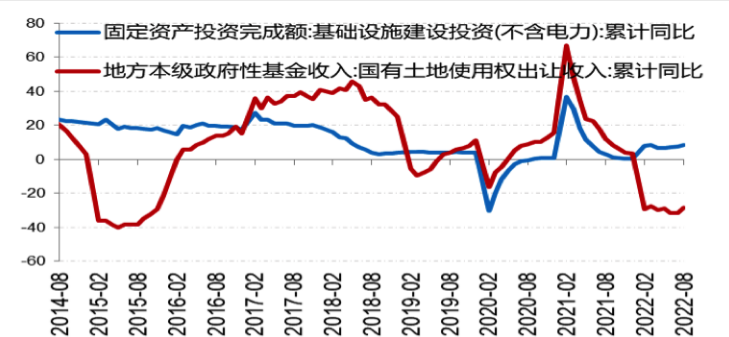

From January to August 2022, land transfer revenue accounted for 91% of total fund income and 46% of general budget revenue. This was a cumulative year-on-year (YoY) decline of 28.5%. In the same period local governments general public budgets have fallen 6.5% YoY according to China’s Ministry of Finance. Local government fiscal revenue in 2022 has also been hindered by a new policy requiring them to provide tax rebates to businesses.

Government investment in infrastructure has also been lower than expected this year. Investment in infrastructure in China only grew 8.3% YoY from January to August 2022, slower than the expected 10% rate.

Growth rate of fixed asset investment: infrastructure (excluding electricity) (in blue) vs local government income from land leases (in red)

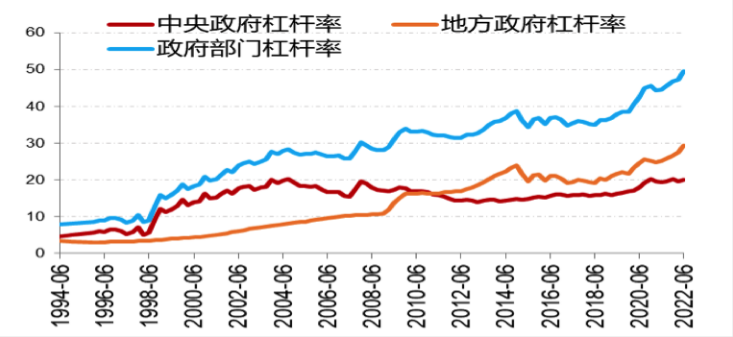

With the fall in revenue from land leases, local governments will need to raise debt to continue operating. Whereas previously this debt was taken on by households and developers it is now the local governments that need to take on the leverage to compensate for the fall in corporate and resident spending. According to China’s Ministry of Finance, as of March 2022, central government debt is RMB 23 trillion and local governments RMB 32 trillion, with leverage ratios of 20% and 28% respectively.

Growth rate of China’s central government leverage ratio (in red) vs government department leverage ratio (in blue) vs local government debt ratio (in orange)

So how can local governments reduce debt and raise revenue in the future? Using American investor Ray Dalio’s concept of managing debt default risk, local government debt could be purchased by the central government which can in turn be financed through consumer price inflation.

The role of local governments should change from productive investment-driven (investment in tangible assets) to investment in services and industry. Recently local governments have been intervening more in the economy through partnerships and funds. For example, in 2020 the Hefei government signed a strategic cooperation with NIO, one of China’s leading electric vehicle manufacturers. However, the return on state-owned assets is still only 3% (Singapore’s Temasek has a rate of return of 14%). By increasing investment in local industry, governments will both increase their revenue and promote local development.

How will China’s Economic Growth Model Change in the Future?

Against the backdrop of the Russia-Ukraine war, U.S-China trade frictions and the pandemic, China needs to find a new source of growth in the post-real estate era. As countries around the world develop their own supply chains there has been less demand for Chinese exports. China has also been affected by Biden’s CHIPS and Science Act in August 2022 which aims to boost the U.S. domestic semiconductor industry through USD $52.7 billion of subsidies.

In the future China needs to boost growth in consumption and manufacturing. China has the second largest consumer market in the world, equivalent to 96% of the United States and a middle class of 400 million consumers.

China also possesses one of the world’s most complete industrial supply chains. It is a step ahead in many industries such as smart phones, computers, electric vehicles, AR/VR displays, military equipment, and chemical manufacturing. Manufacturing companies in China are continuing to dilute costs in fixed asset investment, logistics, procurement, research. Due to economies of scale, they increasingly have an advantage over their Japanese and German competitors. Service industries in China, such as design, finance, transportation, and after-sales, will also play a fundamental role in the future. In Chinese megacities, with populations of over 10 million, service industries account for 40% of GDP. Going forward China should reduce reliance on imports and increase government investment in high-value manufacturing.

In summary, China’s economic growth structure is changing rapidly. It is shifting to one based on highly complex industries where the driver is no longer real estate but is more focused upon consumption and manufacturing.