By Li Haitao, Dean’s Distinguished Chair, Professor of Finance and Associate Dean, Cheung Kong Graduate School of Business

Inflation has become a global problem. In May, the US’s year-on-year (YoY) CPI was 8.6% whereas its Core Personal Consumption Expenditure (PCE) Price Index was 4.9% on a YoY basis, both recorded at the highest level in the past four decades. The Euro zone and Germany both experienced a high inflation of 7.4% in April. The inflation in the world’s major economies are due to a multiple of factors – the persistent COVID-19 pandemic, flooding liquidity in Europe and the United States, the supply chain crisis and labor shortage, the Russia-Ukraine war and China’s strict pandemic control. The global economy is now facing the possibility of a depression.

The volatility in the market shows that interest rate hikes might be too late to help the situation. Coupled with geographical conflicts and strained energy and food supply, global inflation may get out of control. Some experts say that it is possible the world may degenerate back to the Great Inflation in the 1970s. There are also concerns that the Fed’s increase of interest rates may send shockwaves through the US capital market and add to the risk of a hard landing.

Will that be the case? Will rising interest rate burst the bubble and trigger the next financial crisis? How does the Fed’s interest rate rise affect China?

The US inflation may not get out of control as it did in the 1970s.

We will need to reexamine the risks in the US’s inflation system. According to the equation of exchange, MV=PQ, the price of goods and services is determined by the demand and supply. As the Fed has been tightening its monetary policy, people may lower their demand, easing the pressure on the recovering supply chain. The development of energy technologies also prevents the US from facing the hyperinflation seen in the 1970s.

1) While the Fed could have acted sooner to increase the rate, unlike the 1970s, they have been keeping a close watch on inflation this time.

Biden shares Powell’s emphasis in curbing inflation. In one of his speeches in late-May, Biden referred to fighting inflation as his top economic priority. Powell also said recently that “inflation is much too high” and it needs to decelerate.

The pain of this year-long inflation hasn’t been felt by most people, which gives the government enough time to deal with it, whereas in August 1979 when Paul Adolph Volcker, Jr., the 12th chair of the Federal Reserve (1979-1987) took office, the US had been struggling with an inflation of over 5% for six years. Powell faces a much less tricky situation in front of him.

2) Many signs show that demand has started to decline.

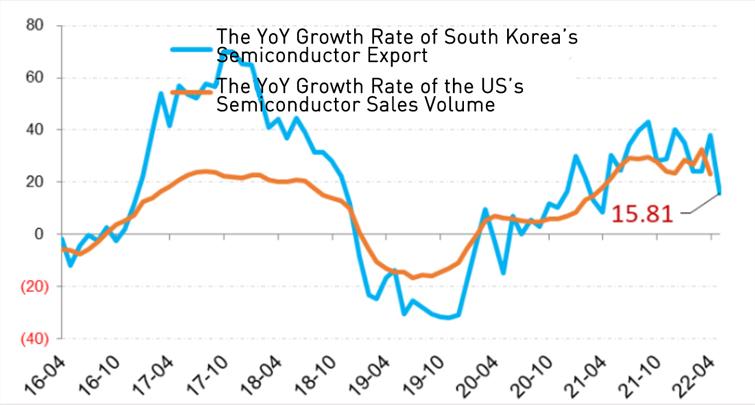

The US’s consumption of products such as semi-conductors has drifted downward. As a result, South Korea’s semiconductor export, the country’s largest foreign exchange earner, climbed only 15.8% in April at USD $1.8 billion. The downward trend was prominent, which is correlated to the US’s declining consumption. The slowing growth rate of consumption of semiconductors, one of the essential consumer goods other than energy, indicates the overall cooling off of consumption in the US.

The YoY Growth Rate of South Korea’s Semiconductor Export and The YoY Growth Rate of the US’s Semiconductor Sales Volume

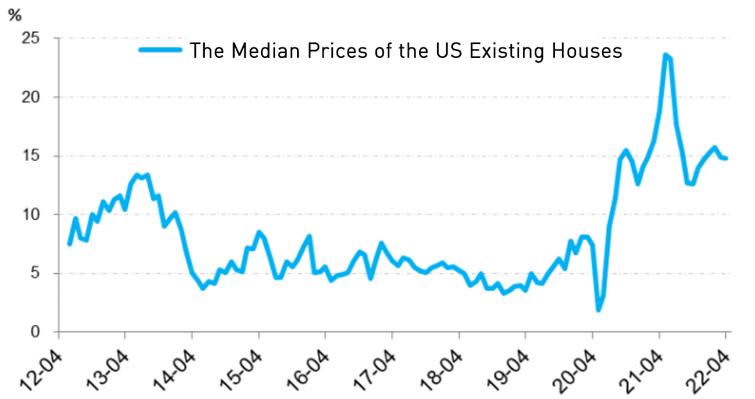

The US’s real estate sentiment has started to cool as interest rates increased. Demands on new houses and exsiting houses in the US have been suppressed by the highest 30-year fixed mortgage rate since 2010 at 5.3%. Since the Fed is expected to increase the interest rate further, the high mortgage rate may cause the prices of existing houses in the US to keep falling.

The Median House Prices of the US Existing Houses Have Fallen from its Peak

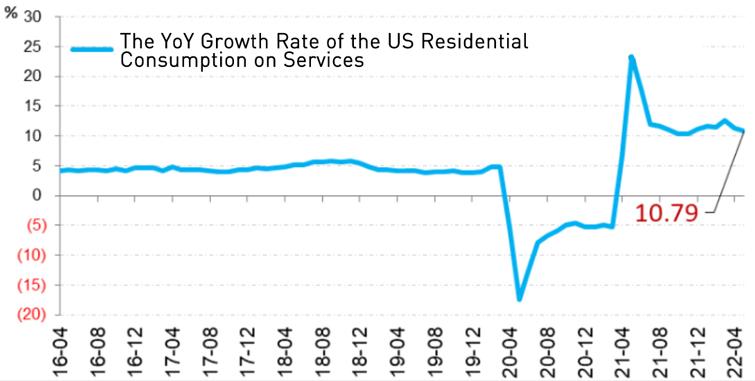

Americans’ consumption on services has slowed down compared with the same time last year. With the rising inflation, increased interest rate and drop in savings rates, Americans’ consumption on services grew by 10.8% in April YoY, down from 11.3% in March.

The YoY Growth Rate of the US Residential Consumption on Services

3) Supply-side Risks may be Alleviated

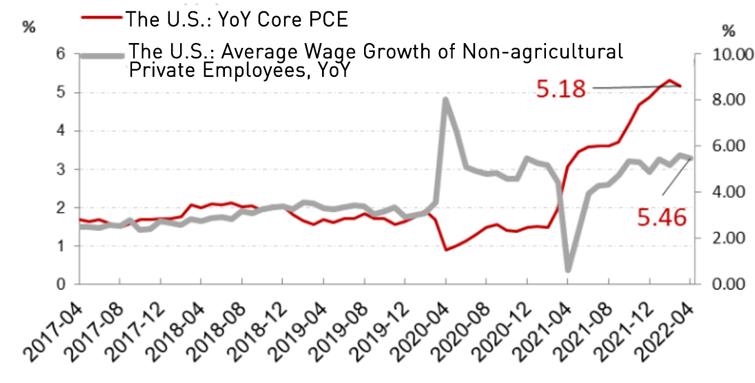

With an average wage rising by 5.5% on a YoY basis in April, the stressful labor market in the US is expected to regain its balance as interest rates increase. The Fed seems to have been ready for an unemployment rate on the rise so as to cool off the labor market. On May 12, Powell said in an interview “what we need to do is we need to get demand down, give supply a chance to recover and get those to align. Right now, in the labor market, there are two job openings for every unemployed person. It’s a historically high level.” The imbalance in the labor market also shored up the inflation. The Fed’s recent actions on interest rate cooled off the overheating labor market. The US employees lowered their expectation on wage increase.

The Fed is increasing the interest rate and tapering to lower the wage increase and to stop inflation.

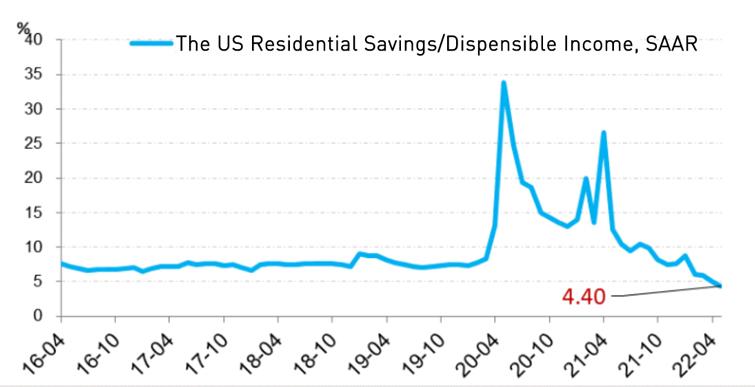

The low savings rate will force more people to return to the labor market, alleviating the stressful labor shortage. Previously, the US’ financial subsidy plans allowed many people to receive money without having to work, which additionally fueled the pressure on the labor market and contributed to inflation. In April, the US residential savings rate has dropped to 4.4%, much lower than before the pandemic. This will force many workers back to the labor force, slow the wage increase and lower inflation.

The US residential savings rate is lower than before the pandemic.

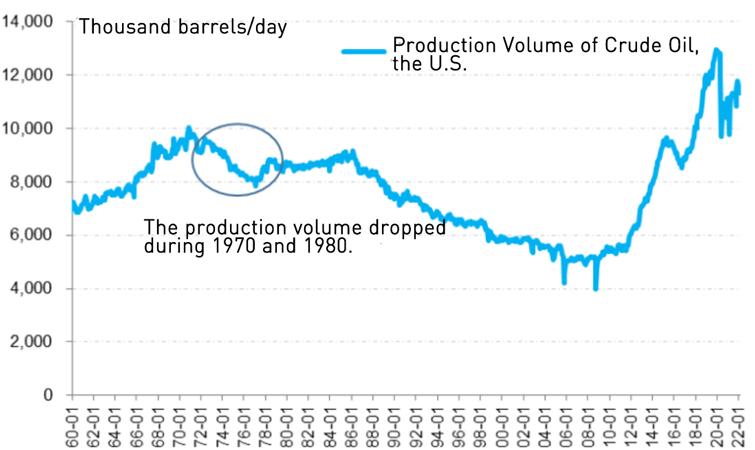

The diversification of energy supply nowadays would cushion the blow of the energy crunch. Back in the 1970s-1980s, crude oil was the US’s major energy, which made the US more prone to the shock of disruptions in oil supply from the Middle East in 1973 and 1979. Global demand for oil is cooling as we transition to other forms of energy.

Also, the U.S. can satisfy its own energy demand with its shale oil reservation and technology, which wasn’t the case back in the 1970s. It has become a net oil exporter in 2019 during Trump’s presidency. The current pressure on the U.S. energy supply is caused by short-term shortage of labors and materials, instead of by technical or reservation issues.

The U.S.’s Crude Oil Production

Making up of 13% of all American consumption, US food and their prices also played a part in the high inflation. In April, the US Consumer Price Index for food grew by 9.4% on a YoY basis, up from 8.8% from March. So far, we haven’t seen a clear downward trend in its food prices, especially with the affected food production and export in Russia and Ukraine due to the war. However, given that the U.S. is a developed country and a net food exporter, the chances of food price triggering virulent inflation are low.

The Biden administration may consider cancelling some tariffs on Chinese products to lower its domestic inflation. In his national speech in Washington D.C. on May 10, Biden said he may lift tariffs on some imported Chinese products to curb the CPI in the US.

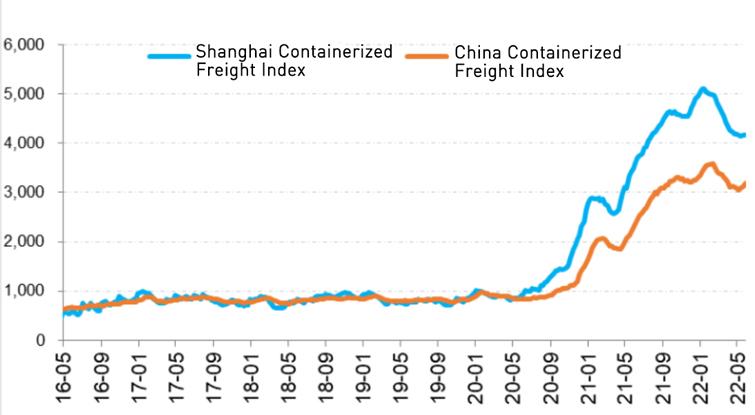

The clogged supply chain is also on the mend from the disruption of the COVID-19 pandemic. A declining demand and recovering supply chain both alleviated the strain on the supply-side. Take shipping as an example, the container shipping prices from China to the U.S. are gradually reducing.

The container shipping prices from China to the U.S. gradually reduce.

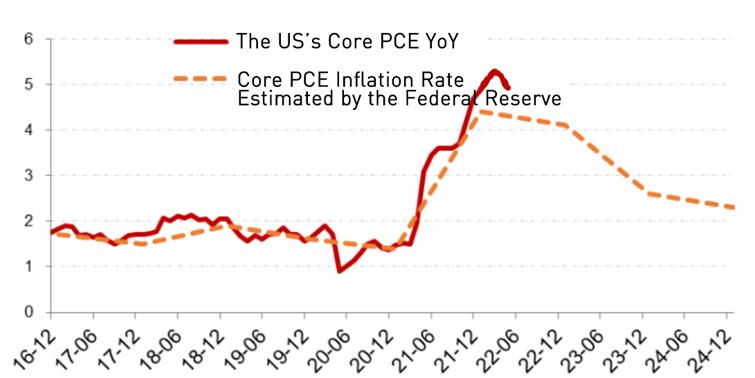

There are indeed risks in supplying products, energy and food but things so far are under control. On the one hand, to ease inflation, the U.S. can be independent in energy supply and can even expedite its energy production by invoking the Defense Production Act (DPA). On the other, the labor market will feel less pressure with the rising interest rate and the recovering economy from the pandemic. As people’s income drops, more people will return to the labor market, evidenced by the US Core PCE in April, which eased to 4.9% from the previous 2 months.

The U.S. Core PCE and the Fed’s Estimates of the Core PCE Inflation

Chances of a hard landing in the US are not high.

If the inflation drops as expected by the Fed, the U.S. economy will not likely be heading for a rapid downturn despite it facing downward risks.

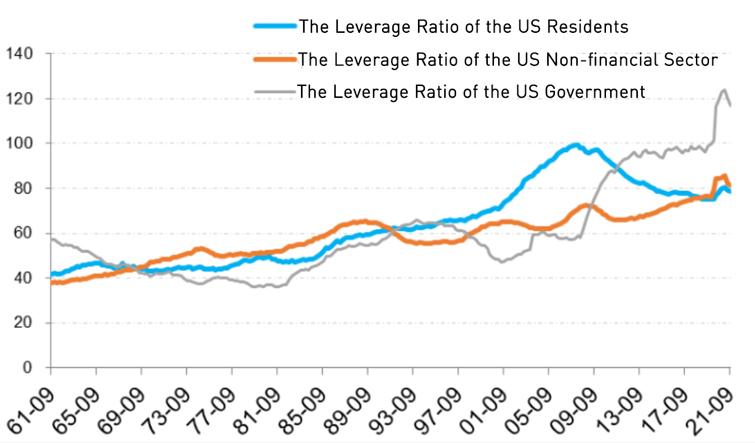

1) Amid the COVID-19 pandemic, it was mainly the U.S. government that hiked leverages. The debt level of businesses and individuals are ingeneral reasonable.

The market was mainly concerned that the increase of interest rates by the Fed may trigger debt default that leads to the tapering and an economic hard landing as in 2000 and 2008. The current situation suggests that the chances are low because it was mainly the government, instead of businesses and individuals, who borrowed heavily.

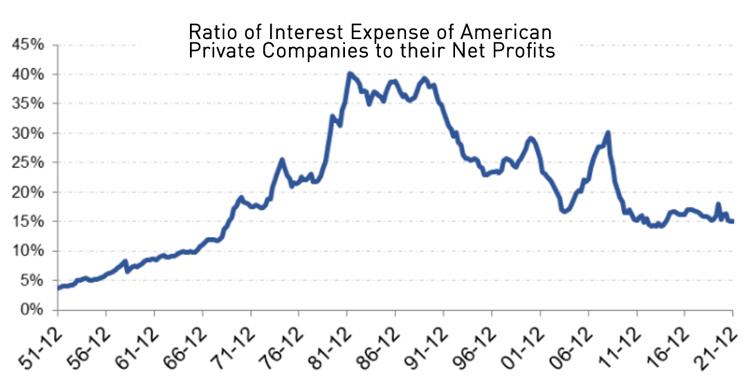

Right now U.S. companies have a reasonable level of debt, compared with that in 2000 and 2008. Interest rate expenditure of American private companies accounts for roughly 15% of their profits, which is at a low level.

Ratio of Interest Expense of American Private Companies to their Net Profits

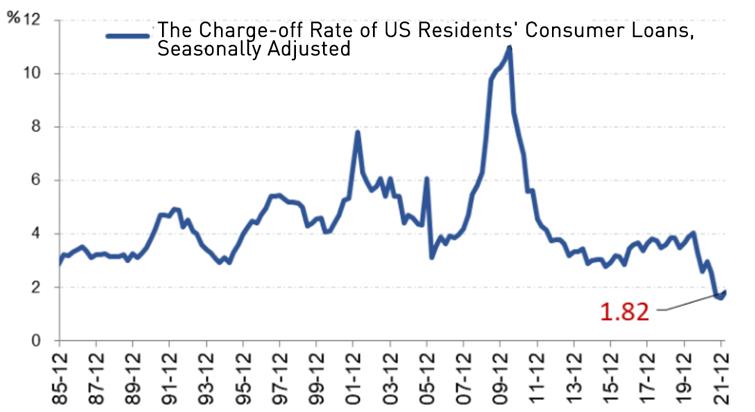

US residents are not under much debt pressure either. As of the end of 2021, the charge-off rate of US residents’ credit card consumer loans is only 1.82%, which is near a historical low, significantly different from the situation in 2000 and 2008.

The Charge-off Rate of US Residents’ Consumer Loans

This time the US government has seriously increased leverage. Generally speaking, the probability of bankruptcy and default of the US government is small, and it is more able to cope with the impact of tapering and rising interest rates than the residential and corporate sectors. In the process of fighting the COVID-19 pandemic, the US government has increased its debt by about 5 trillion, corresponding to the expansion of the Fed’s total assets from 4.2 trillion to nearly 9 trillion. The Fed’s tapering, which starts in June, is expected to reach $5.9 trillion by 2025. As long as inflation doesn’t get significantly out of control, the pace of the Fed’s tapering can be adjusted based on economic conditions. This will subjectively reduce the risk of a hard landing for the US economy.

In 2020 When the COVID-19 Pandemic Erupted, the Leverage Ratio of the US Government Rose Rapidly

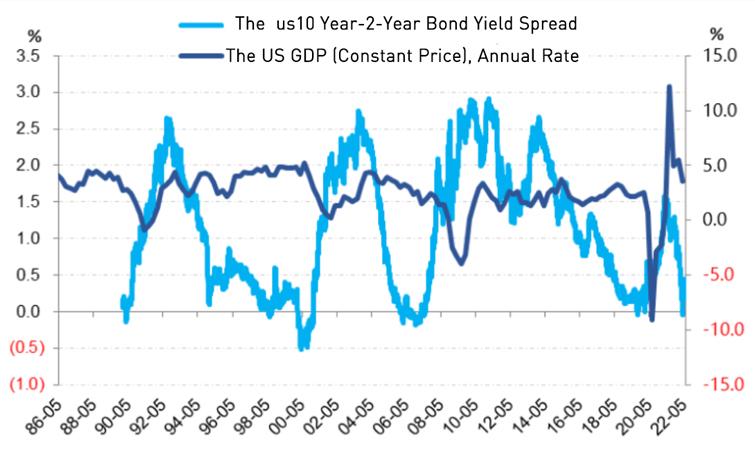

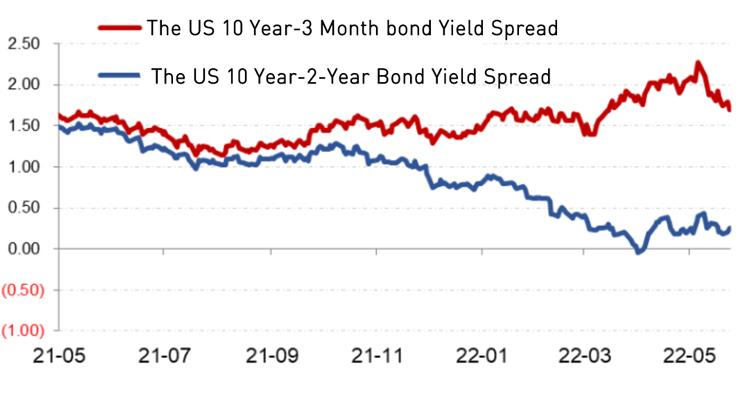

2) The interest rate spread of long-term and short-term U.S. treasuries shows that the market is not worried about a sharp economic recession at present.

3) In the previouscycles, the inversion of the long-term and short-term interest rates of US bonds caused by the Fed’s increase in interest rates often indicates a recession. This is mainly due to the fact that the Fed’s interest rate hikes have more influence on the rise of short-term interest rates, while long-term interest rates reflect the premium of inflation and actual economic growth, and are often higher than short-term interest rates. When the time premium of long-term interest rates is negative (that is, the long-term and short-term interest rates are inverted), it means that the market is not optimistic about the long-term economy. The market is the most sensitive, and market concerns often end up happening, such as 2000 and 2008.

The inversion of the long-term and short-term interest rates of US bonds caused by the Fed’s increase in interest rates often indicates a recession.

At present, the 10 year-2-year bond yield spread and the 10 year-3 month bond yield spread diverges, which shows that the market is not consistent with expectations for a rapid recession in the US economy. At the same time, the 10 year-2-year bond yield spread has recently rebounded from the bottom, indicating a low possibility of a rapid recession in the US economy in the near future.

The 10 Year-2 Year Bond Yield Spread and the 10 Year-3 Month Bond Yield Spread

US inflation expectations are overall under control. Its residents and companies are under reasonable debt pressure. After tracking its indicators such as employment, income, consumption, production, inventories, and inflation, we don’t think the possibility of a hard landing for the US economy is high.

Implications for China in Economic Development and Investment

The Fed’s rate hike is one of the most obvious external shocks to the Chinese economy, which will pose risks to both the Chinese economy and the capital market. In the shock caused by the Fed’s interest rate hike, we need to pay attention to the following risks and prepare for them:

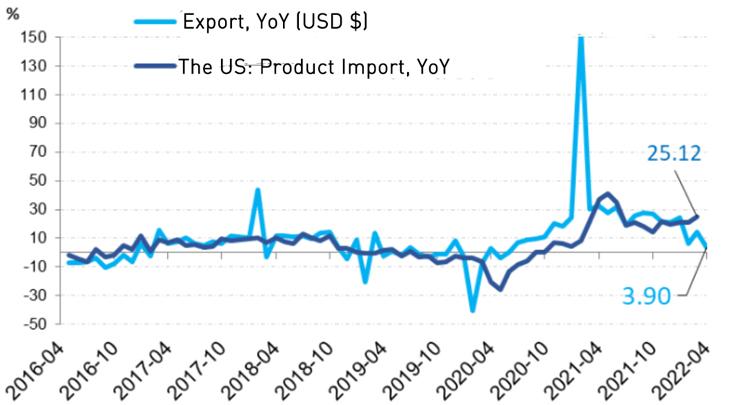

1) China’s external demand is facing downward pressure, and it must be well prepared to deal with the impact of the decline in external demand.

In 2021, China’s economy was robust, due to a strong export to a large extent. But this trend is rapidly changing. Reduced demand in Europe and the United States due to tighter monetary policies and recovering local production capacity from the pandemic will all pose challenges to China’s exports. As an export-oriented country, the decline in exports means pressure on China’s economic growth, which will bring challenges to domestic employment.

US Import Growth and China’s Export Growth

2) At present, it is a viable policy for the Chinese government to increase leverage to save the economy. During the COVID-19 pandemic, the United States adopted unconventional monetary and fiscal policies to stabilize the economy. Now China’s domestic pandemic prevention and control is at a critical moment. The Chinese government needs to consider increasing leverage to save the economy and boost market confidence to sustain a healthy economic development until after the pandemic ends. At the same time, if the US inflation is under control and the Fed does not raise interest rates, China should prioritize setting up its own monetary policy based on its own economic condition, and there is still room for interest rate cuts in China.

3) The Fed will aim to reduce its domestic inflation. At present, the priority of the Fed is to reduce the inflation, which will bring down demand and put pressure on risk assets. However, it is difficult for the US economy to have a hard landing, and the probability of inflation running out of control is low, so there is limited room for US stocks to continue to dip. In addition, the rising interest rate will put pressure on growth stocks before inflation is tamed, and energy high-dividend stocks (XOPXLEEnergy ETFs) will be favored.

This article was originally published on Financial Times in Chinese.