[May 30, 2019, Beijing] On 29th May 2019, Cheung Kong Graduate School of Business Professor of Accounting and Finance, Associate Dean, and Director of the CKGSB Investment Research Center, Liu Jing revealed his 2019 Q1 CKGSB Investor Sentiment Survey results and commented on the repercussions of the US-China trade war to members of the Foreign Correspondents’ Club of China at the CKGSB Beijing campus.

Internationally recognized for his expertise on capital markets and investment analysis, Professor Liu’s research is based on a tight connection between theory and practice. The quarterly CKGSB Investor Sentiment Survey produced by the CKGSB Investment Research Center collects 2,500 respondent’s sentiment on China’s equity market, of which 1,900 are regular retail investors and 600 are financial industry investors.

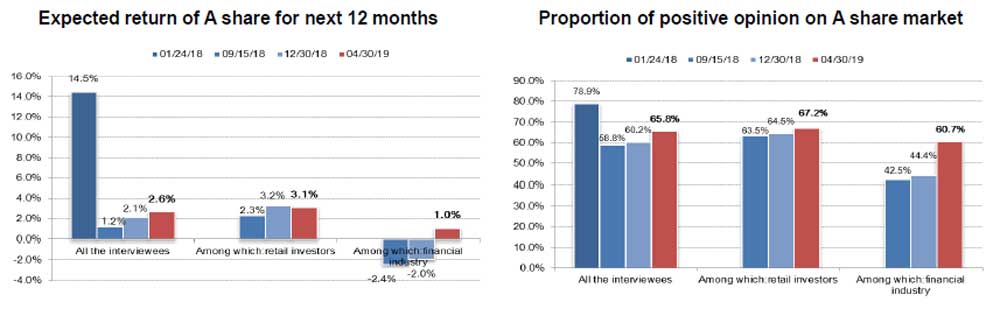

According to Professor Liu, in early 2019, Chinese A-shares experienced a reversal from the fall in 2018, when the Shanghai-Shenzhen CSI 300 Index plummeted by 25%. From January to the end of April 2019, when the survey was conducted, global stock markets experienced a rebound. A-shares came back strongest, and the CSI 300 rose by 30%. During the first quarter of 2019, pessimism was somewhat abandoned and investors were cautiously optimistic. The market expected A-share returns over the next 12 months of 2.6%, compared to forecasts at the beginning of 2019 of 2.1%.

A-share market expected return and opinions

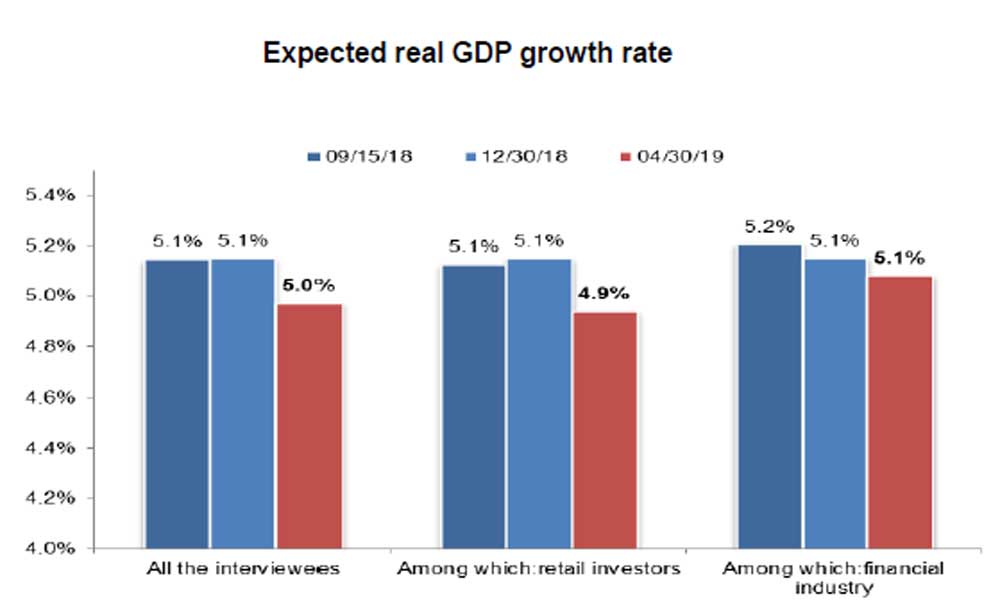

Professor Liu believes investors’ “cautiously optimistic” attitude towards the stock market may not be based on optimism over fundamental macroeconomic growth. On the contrary, investors’ level of optimism about the next five years’ GDP had fallen from 5.1% to 4.9% in the first quarter of 2019, while expectations regarding inflation fell from 3.4% to 2.8%. The change in investment sentiment was more likely due to greater confidence in macro-economic stability, explained Dr. Liu. In addition to the expected stabilization of the real estate market, investors had gradually shifted from a bearish stance on the RMB exchange rate to a more stable position. At the time of this survey, only 4.9% believed that the RMB would fall by more than 5% in the next 12 months.

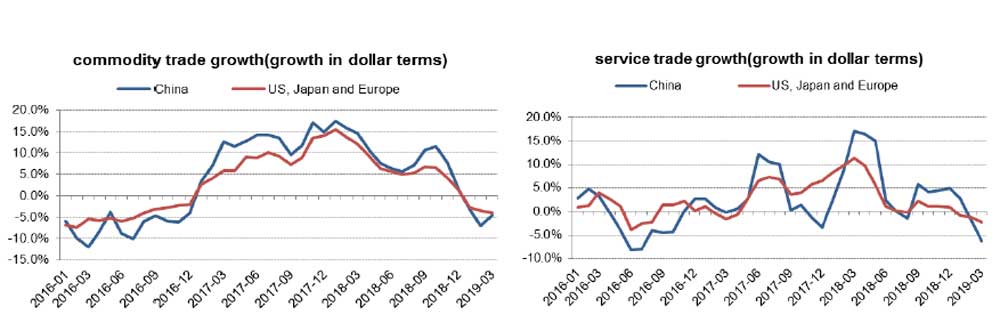

However, the survey of investor sentiment concluded on April 31, 2019. Since May 10, the rapid intensification of the US-China trade war is likely to have shifted investors’ expectations in terms of various economic indicators. As Dr. Liu explains in the Survey, the standoff has not only affected trade between China and the United States, but also major factors such as exchange rate, inflation, GDP growth, and real estate trends. The combined US and China’s economic output accounts for 40% of the world’s total today. If opposition between the two countries becomes entrenched, the structure of the global economy may be severely affected. During the event, Professor Liu expressed concerns over the geopolitical climate saying, “What is concerning about the US-China trade dispute is that it is no longer about trade. If it were just an issue of trade, there are solutions. But if it’s something else greater, that can be dangerous.”

Commodity and service trade growth rates

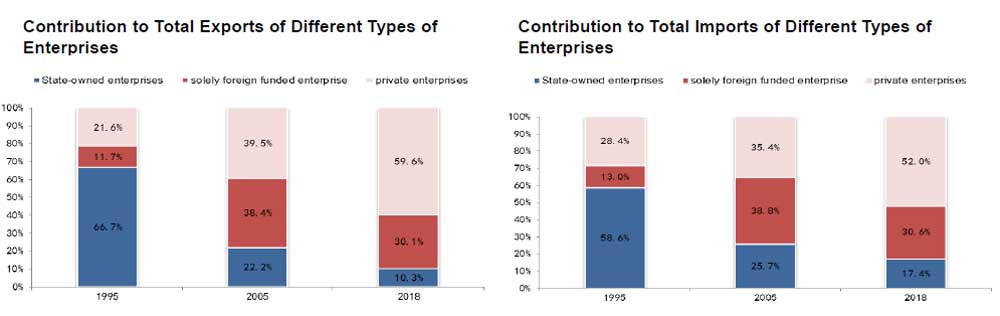

Whilst the US-China trade war claims to target the Chinese government and state-owned enterprises, its impact so far has been felt most intensely by private and foreign-invested companies. As Professor Liu details in his survey, close to 90% of total exports come from private and multinational companies.

ROE rates for listed, state-owned and private enterprises

Professor Liu elaborated on the challenges that China’s private enterprises have experienced both domestically and overseas since 2018. In China, for the purpose of deleveraging and controlling financial risks, private businesses are finding it difficult to secure financing as bank loans in China are structured to be in state-owned enterprises’ favor. As such, private companies continue to lose out in terms of investment, financing capacity and revenue, all the while, such private businesses are the engine driving China’s export manufacturing, accounting for 60%.

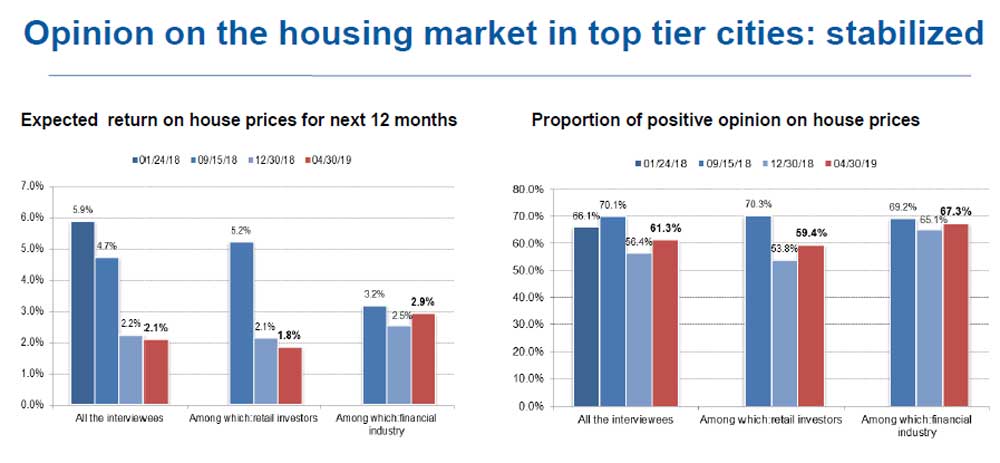

Professor Liu’s CKISS Survey also looks at investor sentiment towards China’s property markets. According to the survey results, investors in first and second tier cities were pessimistic but sentiments were beginning to stabilize. Respondents expected a 5.9% return at the beginning of 2018, but by the end of April 2019, respondents only expected a 2.1% return. However, the proportion of positive opinion towards the housing market was beginning to stabilize, with 61.3% feeling positive in April 2019, as compared to 56.4% feeling positive in December 2018.

Housing prices expected return and opinions

In conclusion, his survey revealed that investor sentiment in China bounced back at the beginning of 2019 after a pessimistic end to 2018. But the US-China trade war may be a destabilizing factor. “If it intensifies, it may shake the entire economic structure, including the international monetary system,” says Professor Liu.

About the CKGSB Investor Sentiment Survey

The CKGSB Investor Sentiment Survey is produced by the CKGSB Investment Research Center and CKGSB Business Scholars Program (DBA). The survey will be conducted quarterly to ensure an effective sample size and collection means. A goal of 2,500 respondents has been established, of which 1,900 are regular retail investors and 600 are financial industry investors. The survey was carried out by Beijing Huamei Information Co., Ltd.