Long-term reasons for optimism about China’s economy remain, but the current challenges must be addressed. That was the conclusion of CKGSB’s 4th China Economic Symposium, held on November 21, 2017, at Cheung Kong Graduate School of Business in Beijing, just one day ahead of the school’s official 15th anniversary. Held in association with the British Chamber of Commerce and the China-Britain Business Council, the event drew 300 senior executives and economists in person, with close to 600,000 unique viewers watching online via live-streaming on the CBN, Sina, Phoenix, Tencent and Netease platforms.

Following some welcome remarks from CKGSB Assistant Dean Zhou Li, who emphasized that in the school’s 15 years of existence, CKGSB has always strived to create a new generation of business leaders in China and the world with a global vision, humanistic spirit and innovation, CKGSB Founding Dean Xiang Bing (pictured below) then delivered a speech on “China’s Transformation and Its Global Implications”.

The professor of China business and globalization added, “To further intensify global economic cooperation, Chinese entrepreneurs need to contribute their wisdom and exercise their vision amid a global economic downturn.

“China is in urgent need of the spirit of Japan’s ingenuity and the US’ innovation,” Xiang continued. Using a 260-year-old Japanese restaurant as an example, he said the time-honored brand is always improving its service and cuisine, arguing that it is the same for Chinese companies that need to concentrate on fostering creativity around their core competencies.

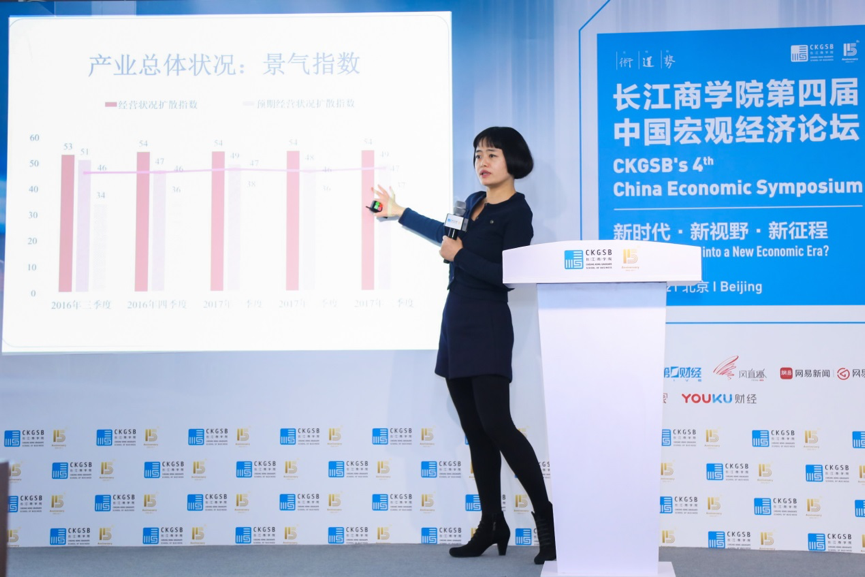

Professor of Finance Gan Jie (pictured above) then used the latest results of her quarterly survey in her keynote speech, titled “Is China’s Industrial Economy Stabilizing?” The director of the Center on Finance and Economic Growth at CKGSB noted, “The third quarter of China’s industrial economic growth was mainly driven by private enterprises. This is one of the reasons why I am optimistic about the future of the industrial economy.”

Gan added, “Although China has tried its best to eliminate capacity, there is still excess capacity. The way forward is to strengthen R&D and form core competitiveness. We need high-level talents – these will form the driving force of the future!”

In a dialogue about “Upgrading China’s Industrial Economy” with Tom Orlik, Chief Asia Economist at Bloomberg, Gan Jie said, “In today’s global economy, what counts now more than even in building and sustaining a successful enterprise is how well its innovation system can be created.”

.png)

The dialogue was followed by a keynote speech by Professor of Economics Li Wei (pictured above), who presented “An Alternative Look at China’s Growth Cycle”. “If supply-side reforms go well,” Li Said, “China’s economy will continue to grow by more than 6% over the next 10 years.”

“From an economist’s perspective, shadow banking should not be eliminated. It will continue to be an integral part of the Chinese banking system.” Li continued, “China opening up the financial sector to foreign competition is really a positive step. The government clearly realizes that a more competitive sector will lower financing costs…and is a boost for the economy overall.”

In a dialogue with Bloomberg’s Orlik on “Business Confidence in China’s Transitioning Economy”, Prof Li Wei, who is also director of the Case Center at CKGSB, said, “After the 19th CPC National Congress, the world is waiting to see China’s financial reform and for financial markets to open to the world, in particular. This can be a positive sign. The Chinese government is very likely to take more active measures in the financial sector, such as reducing financing costs to further free the potential of the Chinese economy. Compared with land costs, financing costs are easier to tackle and have fewer ripple effects.”

CKGSB Professor Li Wei (left) with Bloomberg’s Tom Orlik

Orlik responded by saying, “From 2005 through to 2014 we have witnessed steady RMB appreciation and the steady accumulation of foreign exchange reserves. The PBOC was flooding the financial system with liquidity. That’s why we saw these complex maneuvers and, ultimately, these very risky shadow banking developments. In the last two years, however, this situation has swung into reverse. We’ve seen RMB depreciation and shrinking foreign exchange reserves. The dynamic has changed.”

In the following panel discussion on “China’s Economic Outlook and Its Position in Asia”, moderator Rachel Morarjee, director at the Economist Corporate Network, noted, “Commercialization is not done by the government. But there are certain things that the state can do very well that the private sector doesn’t do in the same way.”

Kevin Kang, chief economist for KPMG China, then asked, “Will industrial policies promote innovation? From our experience over the past three decades in China, industrial policies have worked. Today, China has become a leader instead of a follower in many industries, including AI, the Internet and the digital economy. Given such circumstances, industrial policies may have less effect on economic development. It is important to remember that different eras are different, so previously useful policies may no longer be useful in the future.”

Wang Guangyu, dean at the China Academy of New Supply-side Economics and chairman at China Soft Capital, then asked, “Will debt influence Chinese economic growth or even the whole economic structure? Currently we have cut backward capacities from the supply side. But I think what matters more is deleveraging.”

With a packed afternoon consisting of the latest insights of top faculty, global economists and other experts on China, CKGSB’s 4th China Economic Symposium was a resounding success, both for those lucky enough to be in attendance as well as for the hundreds of thousands more watching online.