CKGSB Founding Dean Xiang Bing gave a keynote address at a special Knowledge Series event held in partnership with the Hua Yuan Science and Technology Association and Asia Society Northern California in Mountain View, California, on February 22, 2018.

CKGSB Americas held a special edition of its Knowledge Series on Thursday, February 22, 2018, in Mountain View, California, to discuss the effects of a rising China on investors and entrepreneurs in Silicon Valley. The event, organized in partnership with the Hua Yuan Science and Technology Association (HYSTA) and Asia Society Northern California (ASNC), featured a keynote address by Dean Xiang Bing, CKGSB’s founding dean, in addition to a fireside chat between Dean Xiang and and Ken Wilcox, the founder of Silicon Valley Bank, on the global impact of new technologies and innovation in the US and China.

Dean Xiang’s keynote address described the recent rise of the Chinese economy, the state of its current economic development, as well as the key differences between the US and Chinese economic orders. He also pointed out that despite the growing belief that China’s rise has come at America’s expense, China actually captures very little of the economic value produced in the global supply chain for popular merchandise like Apple’s iPhone. After all, Foxconn, the Chinese manufacturer of the iPhone, earns just $7.40 for each $800 sale. “I think it’s the Chinese who have made the American economy great again,” Xiang said. “To me, the Chinese are more like Filipino nannies in Hong Kong — we free American people up to have them concentrate on higher-value added activities.”

This line of thinking sparked a debate between Dean Xiang and Mr. Wilcox during their subsequent fireside chat, with Mr. Wilcox arguing that just because much of the manufacturing work that has shifted from the wealthy world to China is “low value-added” work, that doesn’t mean that America hasn’t suffered from the loss of those jobs. “The US needs some of that dirty work back,” Mr. Wilcox said. “Not all of our children are really equipped or interested in knowledge-based industries or in high value-added jobs. We have plenty of children who would really be happier in factories, and we don’t have them anymore.”

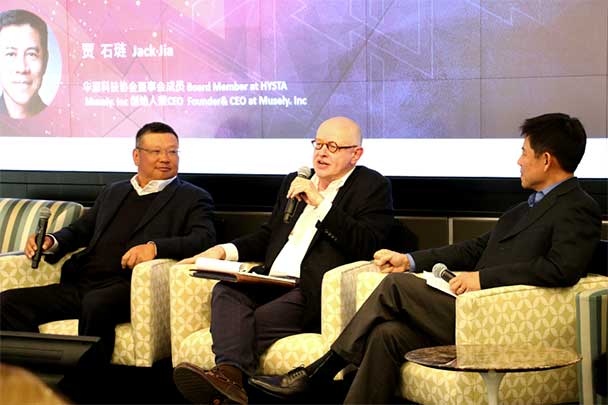

Mr. Ken Wilcox (center), founder of Silicon Valley Bank, offered his concerns on the impact the disappearance of manufacturing jobs in both the US and China could have on both societies during a “fireside chat” with CKGSB Founding Dean Xiang Bing (left).

Dean Xiang countered that with the coming wave of new automation and artificial-intelligence technologies, both the US and China are going to have to transition their workers away from manufacturing, toward either in the knowledge or service sectors. Mr. Wilcox agreed, but warned that this strategy could be a major problem for both the US and Chinese societies, because many workers in both countries are “not equipped” for such jobs.

Mr. Wilcox and Dean Xiang differed somewhat on the solution to the threat that AI and automation will create great wealth for some, but also lead to massive unemployment, because there will be too few tasks that humans can do better than machines. Dean Xiang argued that the US and China — countries he proposes are the “most capitalist” on earth — could learn to adopt “socialist” policies that better redistribute wealth, as is done in Western Europe.

While admitting that high and growing wealth and income inequality are problems that could lead to social unrest, Mr. Wilcox argued that workers want more than a check from the government to live a meaningful life. He proposed crafting policies that would lead to “a situation where everyone is working at a level that’s appropriate to their innate ability and skill set,” but where most people work far fewer hours per week than is common now in China and the US.

Mr. Wilcox and Dean Xiang also had a productive back-and-forth on the topics of the relative openness of the Chinese and US economies, and what American entrepreneurs need to do to succeed in the Chinese market. Mr. Wilcox — who spent four years in China as part of Silicon Valley Bank’s joint venture headquartered in Shanghai — argued that the Chinese government is too focused on protecting domestic companies. He said this is due in part because there is no clear delineation between government and business, as many prominent Chinese officials are also involved in various business ventures. “If your own stupidity doesn’t prevent you from doing poorly in China, there’s a fairly good chance that state capitalism will make it difficult to succeed,” Mr. Wilcox said.

While admitting that the Chinese economy could benefit from opening itself more to foreign competition, Dean Xiang countered that the perception that foreign companies aren’t successful in China is unfounded. “I think the significance of foreign companies in China may be larger than in the U.S.,” he said, pointing to firms like GM, McDonald’s and Pepsi, which have found China to be a large source of new revenues. In fact, Dean Xiang argued, foreign investment has been one of the key drivers of Chinese economic development, much more so than Japan or Korea. “Samsung does $30 billion in sales in China, but in Korea you see very few foreign companies,” Dean Xiang said.

CKGSB Founding Dean Xiang Bing (left) and Mr. Ken Wilcox, founder of Silicon Valley Bank, engaged in a thoughtful discussion exploring the global impact of new technologies and innovation in the US and China.

Despite these disagreements, both Dean Xiang and Mr. Wilcox expressed great admiration for the economies and cultures of both the US and China, and agreed that each country had much more to gain from further economic integration. One obstacle to greater success by Chinese entrepreneurs in America and vice-versa are the significant cultural differences between the two countries. Mr. Wilcox and Dean Xiang argued that this cultural distance could be bridged by more emphasis in America on Chinese language education, while the Chinese government could attract more foreign students to China by relaxing its control of the Internet and the availability of information.

Most important, they argued, is that political and business leaders in both countries see the Sino-American relationship as characterized by mutually-beneficial cooperation, rather than by zero-sum competition. “When Chinese and American companies collaborate they create great things, and there’s too much focus on competition,” Mr. Wilcox said. “I honestly don’t think that ‘who’s first’ is as important as how much we accomplish together.”