[Feb 21, 2023, Beijing, China] Cheung Kong Graduate School of Business (CKGSB) and the Asian Leadership Conference jointly hosted the “Global Economic Outlook” webinar. During the webinar, panellists discussed the key themes and developments that are expected to characterise China and U.S. economic development and policy in 2023, and their potential impact on the global economy.

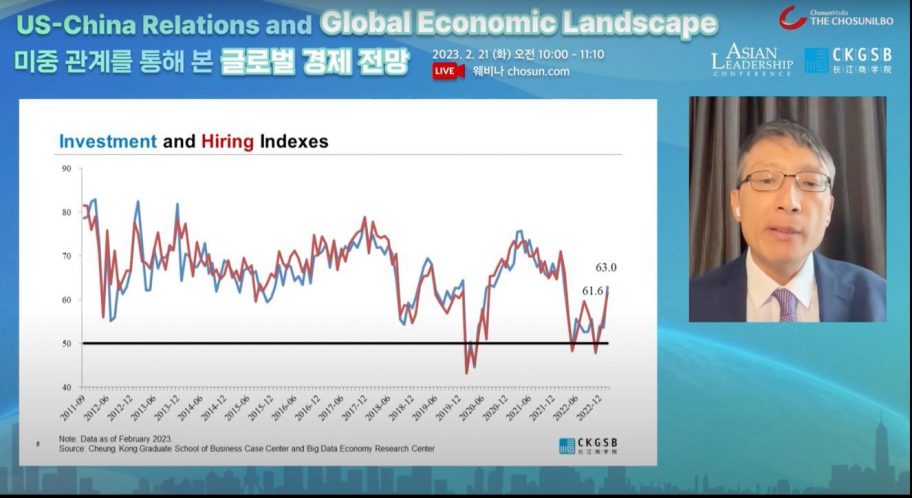

Cheung Kong Graduate School of Business Professor of Economics, Li Wei, opened the webinar by presenting his Business Conditions Index survey results showing a significant increase in sales and profits among private enterprises in China over the last two months, along with improvements in employment and investment. He explained that these developments have prompted the International Monetary Fund to revise its projections for both China and the global economy.

Mark Tokola, Vice President of the Korea Economic Institute of America in Washington DC, subsequently dived into his predictions for U.S. economic growth this year in his keynote speech. He explained that the U.S. is experiencing a decline in inflation, currently at 6.41% from a high of 8.3%. However, he noted that the current figure may not accurately reflect housing and rental prices that have yet to be factored in. With core inflation diminishing and the Fed’s tightening, there is hope that inflation will reduce to 3.5% by year-end. Tokola added that this raises the question of whether the Fed will tighten further to meet the 2% inflation target or whether it will maintain a slightly higher rate.

Michael Hart, President of AmCham, China, subsequently shared an interesting perspective on China’s development model as well as the current business sentiment in China: “One of the things that made China such a powerhouse was its development zone model. Chinese officials were very focused on FDI targets, bringing in companies that would produce and employ many people, and generate a robust tax base for local governments. The model was dependable, predictable, and had clear rules within these development zones…however, COVID Zero policies threw all of this out of balance. People started to realize that their manufacturing and supply chain models, which had worked well for the past 5, 10, or even 20 years, were breaking down due to the COVID Zero restrictions in China.”

Hart also mentioned that housing is a significant challenge in China, with around 70% of household wealth tied up in real estate. He suggested that China could alleviate its reliance on housing by building a more robust stock market, mutual fund, or bond market.

Professor Li echoed this sentiment. “The housing market is another thing that people are using primarily as an investment or savings vehicle…owner occupied housing comes close to 90% for the urban population and that’s unheard of in many other countries. That explains the housing bubble as well as why housing demand in China has been so high.”

The webinar ended with a discussion on the most significant risks facing the global economy in 2023. Li Wei drew attention to the United States’ approach to industrial policy, arguing that the U.S. has historically used industrial policy to gain a competitive edge over China. “US industrial policy did not work when they were facing the rise of Japan and is unlikely to work in the rise of China.”

Tokola also doubted the effectiveness of industrial policy. He mentioned that, in the past, trade negotiators like himself focused on addressing subsidies, tariffs, non-tariff barriers, intellectual property, and trade facilitation to open foreign markets. However, he said the current landscape has shifted, and national security and economic policy are increasingly becoming intertwined.

Overall, it was a thought-provoking discussion that shed light on some critical issues facing the global economy in 2023. We would like to thank all those who attended the webinar, the speakers, and our partner Asian Leadership Conference.