Early indications show that the Chinese government’s efforts to prop up the economy might be able to steer clear of the risks of the 2009 economic stimulus.

The Purchasing Managers Index (PMI) and a slew of other macroeconomic indicators have shown that the Chinese economy hasn’t yet bottomed. Recent central government stimuli measures signal an intention to boost strong and steady growth through infrastructure development in order to counter the risk of a further macroeconomic slide.

On July 29th, Prime Minister Li Keqiang chaired a State Council meeting to push forward plans to upgrade urban utility pipelines and bundle city sewage, gas, electricity and communication lines underground. On July 31st, Vice-Minister of Housing and Urban-Rural Development Lu Kehua announced that the ministry would strive to build a good number of state-of-the-art utility pipelines by 2020.

Experts estimate that pipeline construction will attract over RMB 1 trillion in investment over the next three to five years. Ten cities including Baotou, Shenyang, Harbin, Suzhou, and Xiamen have signed up to pilot the project. Housing ministry statistics show that approximately 1,000 km of utility pipelines have already been planned for 69 cities since the beginning of 2015. Investment has totaled RMB 88 billion to date.

But the question is: where will the money come from? Housing Minister Chen Zhenggao said, “Financial institutions will lend their full support to building the utility pipelines.” Therefore, financial support from the government is destined to be the driving force behind the new scheme.

On July 30th, the National Development and Reform Commission (NDRC) held a press conference to announce new project packages in emerging industries and advanced manufacturing.. Combined with packages announced earlier this year in urban railways, modern logistics, information and gas networks, environmental sectors, clean energy, food and water efficiency projects, transportation, healthcare services, energy and mining resources, there are 11 major stimuli projects that have begun or are about to start. As of the first half of 2015, these stimuli targets have attracted RMB 3.3 trillion in investment, encompassing 228 projects.

All the signs are that the central government is accelerating its pace of involvement, as monetary easing alone cannot reverse the slowing rate of Chinese economic growth, and fiscal policy is all the more vital to reverse the trend.

Official statements are starting to show that a fear of an impending economic downturn is really settling in among China’s policymakers. The politburo’s meeting on July 30th set the tone for the second half of the year, stating that “downward economic pressures are looming” and “structural problems due to the lack of momentum in traditional sectors and the deficiency of growth impetus in new sectors are still evident.” The official stance is to “adhere to a proactive fiscal policy, keep up spending efforts and continue to reduce the burden on enterprises, guiding and leveraging private funding bodies to increase investment.” Compared with the past, the aim is to make further use of the public-private partnership model, encouraging fuller engagement of private capital.

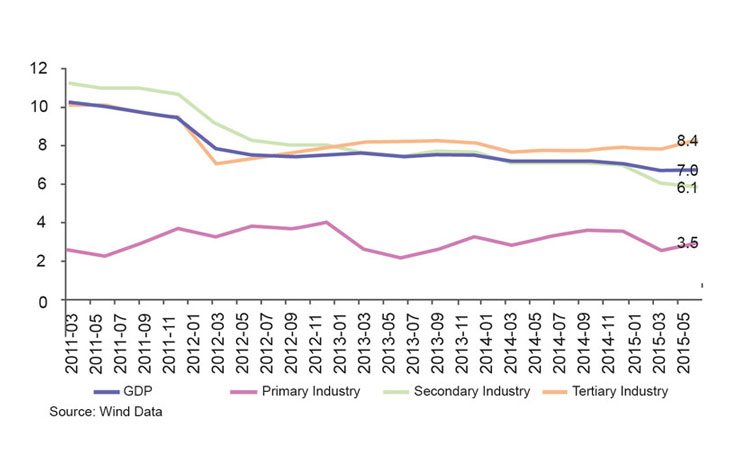

In fact, although China achieved its 7% target in the first half of the year despite sluggish domestic and global demand, secondary industry growth clearly stalled in the past two quarters. A closer inspection of GDP growth reveals that the thriving finance sector is the leading contributor to growth, which, from past experience, is closely linked to a strong performing stock market. Therefore, cooling capital markets means more pressure for growth in the second half of the year; and the waning of the wealth effect could lead to knock-on losses in consumer sectors such as automobiles and home appliances. In this context, central government enthusiasm for infrastructure investment is not hard to understand.

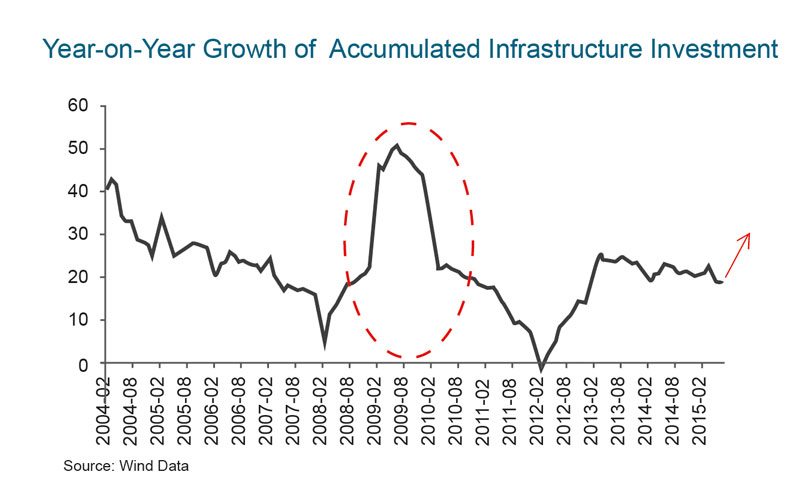

The concern is that China is going down the same path as in 2009, choosing to prop up the economy by way of infrastructure investments. Then, China acted under pressure from the global financial crisis to make massive investments in electricity, heating, water, gas, transport (mainly railway, especially high-speed rail), water conservation, environmental protection, urban utilities, affordable housing and other sectors in a number of stimulus spending plans. Complications arising from these stimuli are still being felt, notably with local governments’ non-performing loans and overcapacity in some sectors.

However, signals from the central government indicate that at the very least this round of stimuli will not be as aggressive as in 2009. The central government has repeatedly stressed upon the “triple transition” of the Chinese economy, namely a slowdown in the pace of growth, market-oriented structural adjustments and ‘digestion’ of excesses from earlier stimuli. Moreover, this round of growth will be fueled by capital from the mobilized private sector, leveraging funds through public-private partnerships (PPP) and, therefore, limiting local authorities’ credit risk.

The targets of this round of stimuli are also worthy of note. The 11 sectors targeted by Beijing are beyond just infrastructure development, they also include advanced manufacturing, clean energy, environmental protection, and health services for an aging population. Returns on investments are likely to be higher than for utilities and transportation and will, thus, be far more attractive to private investment.

Li Haitao is the Dean’s Distinguished Chair Professor of Finance and Associate Dean for the MBA Program at CKGSB.