Beijing has made efforts to tackle China’s long-standing issue of water scarcity, but will it be enough?

If you visit the city of Taiyuan on the dry north China plain, don’t be shocked if your hotel tells you that running water is available for only one hour a day. Such is the state of affairs in this city of 3.7 million inhabitants that taps sometimes run dry. The situation in Taiyuan is just one indicator of a dire situation confronting China. Over 28,000 rivers have disappeared from the country’s landscape in the past three decades and groundwater levels are plummeting in most regions of the country. The writing is on the wall: China has a water crisis that’s worsening by the day.

If further evidence was needed of just how valuable water is in China today, one needs to look no further than the bottled water empire Nongfu Spring, whose CEO Zhong Shanshan is now the wealthiest person in the country, with a net worth of $68.9 billion, making him the 14th richest person in the world (see “Jumping Above” on pp 44-47).

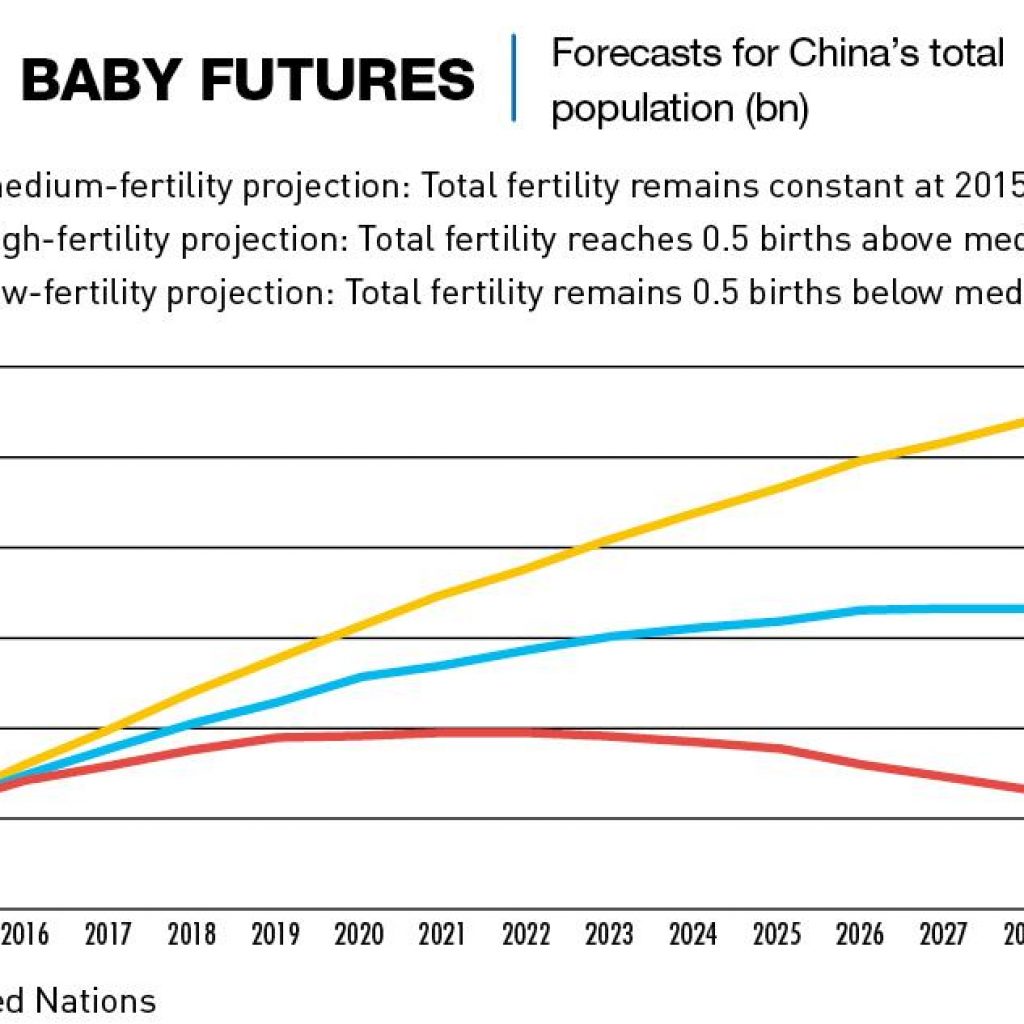

China has been facing growing water shortages in many parts of the country since the 1980s, and its leaders have for years recognized it as a serious issue. But solving the problem of how to ensure sufficient water supplies for 1.4 billion people as well as huge requirements for agriculture and industry is getting more and more urgent.

“China’s water crisis is very acute,” says Martin Tillotson, Chair in Water Management at the University of Leeds. “Not just because of the situation that it is in at the moment, but because we expect the situation to deteriorate further in the coming years, as a result of climate change, but also rising or migrating populations and increased industrialization.”

In 2005, the Ministry of Water Resources declared that it was necessary “to fight for every drop of water or die, that is the challenge facing China,” while the Premier at the time, Wen Jiabao, identified water shortages as a threat to “the very survival of the Chinese nation.” Many officials including China’s current leader Xi Jinping have echoed these concerns in the years since, but China’s water usage continues to grow, climate change continues to alter weather patterns, and the specter of ‘not a drop to drink’ is becoming ever more real.

Too much or too little?

With nearly 20% of the global population, China only possesses about 7% of the world’s fresh water. But there is a problem in distribution as well as volume. Simply put, there is too much water where too few people live, and too little water where too many live.

Around 80% of fresh water resources are in the south of China, while huge expanses of the north—where Taiyuan is—regularly suffer from water shortages. The 12 provinces and regions that make up northern China account for 38% of China’s agriculture, 46% of its industry and 41% of its population.

All surviving rivers in China are dammed many times along their courses, drastically damaging their ecology, and in some cases also causing foreign policy problems where the rivers stray downstream beyond China’s borders. Burma, Cambodia, India, Thailand, Kazakhstan, Laos and Vietnam have all been affected by Chinese water conservancy projects.

“On the world scale, China is the leading country in terms of dam construction,” says Olli Varis, distinguished professor at Finland’s Aalto University specializing in water resource management. “China has so many dams, no other country can compare. While benefitting agriculture, energy generation and flood protection in a big way, it has a big impact on water quality and quantity and in many ways has distorted the ecosystems and natural flow of waters. Dam construction has increased water usage, particularly for agriculture. So it has caused a lot of water shortages.”

Water security issues are widely seen as a threat to the Chinese economy and to social stability. According to a 2017 analysis in Global Risk Insights, nearly half of China’s GDP is generated “in regions that have a similar water resource per capita as the Middle East.”

“China’s economy is extremely dependent on water, not least when you think about the water requirements for agriculture and food production and the fact that China’s obviously got a huge population which needs feeding,” says Tillotson. “You also have to take into consideration the huge industrial base that China has not just to supply its own population, but in terms of global demand for Chinese products. The ‘Factory of the World’ uses a lot of water.”

More than 80% of China’s water supply comes from surface water, such as rivers and lakes, and the Ministry of Ecology and Environment reported in 2018 that nearly 26% of available water is either so polluted that it is unfit for use at all or considered only suitable for agricultural or industrial use.

China averages 2,700 cubic kilometers of renewable freshwater resources per year, which does not differ greatly from the 2,930 cubic kilometers average in the United States, according to an academic paper published by ScienceDirect. But China’s fresh water serves a population four times the size of the US and is heavily concentrated in the south of the country. Groundwater levels in populated areas, meanwhile, have been falling for decades.

“You can keep pumping ground water but eventually it’s going to run out, and when a car gets short of oil, it may continue running for several miles, but then suddenly the engine will seize up,” says former British diplomat to China Charles Parton, currently an associate fellow of the Council on Strategy and of the Royal United Services Institute, both London-based think tanks. “China’s economy is very heavily dependent on this one key resource. I’ve been saying for some time now that when I look at the Chinese future and development of the economy, the biggest long-term constraint and serious problem is the water question.”

Wells running dry

The water crisis is caused by fundamental factors including fast urbanization, booming industrial production and changes to China’s agriculture that require much higher levels of water usage than before.

“Geography is a key cause of the water shortage—there’s always been a lot more water in the south of China than in the north,” says Simon MacKinnon, Chairman of clean technology company Xeros. “Number two is very likely climate change. Number three is the rapid growth in use per person during the second half of the 20th Century, together with urbanization. When you have large concentrations of people, you then have great strain on local water supplies.”

Aalto University’s Varis says that growing population density is a major concern. China’s urbanization rate is currently at around 60.8% and is forecast to rise to 70% by 2030. “China is changing really fast and urbanizing very fast,” he says. “Many of these economic developments have a lot of negative influence on water.”

Beijing, China’s second-largest city by population, with 21 million people, has seen its water resources per capita plummet from 1,000 cubic meters in 1949 to less than 230 cubic meters in 2007, according to Probe International, an independent environmental advocacy group. Nearby reservoirs stopped meeting the requirements of Beijing’s population long ago and the central government has resorted to drastic measures, including redirecting water flows from as far away as the Yangtze River in central China in order to slake the city’s thirst.

“There’s also a lot of internal migration as the Chinese population moves evermore eastwards towards the major population centers of the coastal areas,” says Tillotson. Between 2001 and 2015 the top four recipients of internal migrants were Guangdong Province, Shanghai, Zheijang Province and Beijing, with a net inflow of around 37 million people. “And these areas tend to be quite arid with limited local water resources. You’ve got a population that’s effectively moving towards an area of water scarcity and that, in turn, then drives even greater water scarcity,” he says.

Changes in lifestyles, higher levels of meat consumption and an explosion in consumer activity have all contributed to skyrocketing water usage. “It’s a population with rising affluence and with affluence comes increased water demand,” adds Tillotson.

Data on water usage by industry is difficult to obtain, but there is no doubt that China’s role as the biggest manufacturer in the world involves the use of massive amounts of increasingly precious water. “China’s economy is very different from other economies around the world,” says Parton. “It’s much more water consumptive than service-based economies.”

Stopping the drip

Solutions to China’s great water problem have primarily focused on the kind of massive infrastructure projects which the country has proved itself to be so good at. Chief among these is the South-North Water Diversion Project, a series of canals, reservoirs, and tunnels that divert water from the Yangtze River basin northwards over 1,600 kilometers to Beijing and other centers.

The yet-to-be-completed multi-armed project, initiated in 2002, is the biggest water diversion in human history and when complete, will directly benefit more than 130 million people. But it comes at a high cost.

“I’d love to see a proper water audit of the project, because although the central arm of the two arms that are operating is largely run by gravity, the east isn’t, which means you have to pump water up 600 meters which requires an awful lot of power,” says Parton. “And generating power requires water, because a lot of water is used in geothermal and nuclear power generation, which still despite great efforts, is a large amount.”

One answer to the macro water problem would be to move large numbers of people out of the dry north down to the wetter south, but very little has been done to implement this idea. The creation of new urban centers in the north, such as the city of Xiong’an near of Beijing, now under construction, would appear to worsen the problem rather than ease it.

“Xiong’an is just crazy from a water point of view,” says Parton. “You do not set up a major water metropolis in a place which has a very acute water shortage.” The total water consumption per year of nearby Beijing, which is facing water shortage issues, is 3.95 billion cubic meters. While Xiong’an’s multiyear average volume of available water resources is only 173 million cubic meters.

Other solutions involve technology in one way or another, and desalination is one of the top long-term prospects. The current Five-Year economic development plan, covering 2021-2025, allows for investment in desalination plants to raise capacity to 2.9 million tons of water per day, and the government has announced the construction of demonstration seawater desalination facilities along the north China coast.

“It’s worth it in some coastal or urban areas, for urban use,” says Varis. “But desalination requires a lot of energy and in that sense, a lot of money. It’s an expensive solution. But, for a wealthy urban area, it can be an option.”

Tillotson agrees on the high costs involved and also points to another problem with desalination. “Desalination is a very energy intensive process,” says

Tillotson. “By solving, potentially, a problem in terms of water supply, depending on where that energy comes from, you then create another problem in terms of greenhouse gas emissions.”

Another idea is “sponge cities,” a new urban model for flood management and water retention, which requires road surfaces to be porous, so that water does not simply flow away. Following major flooding in Beijing in 2012, the Chinese government put in place a program of sponge city urban developments across China, which has now expanded to over 30 locations, including Shanghai and Beijing, according to architecture company Chapman Taylor, which has been involved in the design of a number of major sponge city projects in China.

MacKinnon says his company Xeros is marketing polymer technologies which can reduce water usage by up to 80% in major industries including laundry and textile manufacturing. “We are being encouraged and supported by Chinese partners and the government to help Chinese customers to adopt this technology,” he says. “There are many others out there addressing different areas of industry.”

“The new technologies have been improving the situation a lot, I would say,” says Varis. “But of course, the volume of water usage has been growing also. It doesn’t happen in one night, but there can be a lot of changes in a period of 10 or 15 years, changing old technologies to new ones that require less energy and are less carbon intensive.”

Water forecast

How soon China’s water problems could reach crisis point is a matter of great debate among experts, and none of the people interviewed for this article were willing to hazard a guess as to how close China is to running out on a significant scale in any region. But it seems clear that China is moving closer to that point and Greenpeace has predicted that water consumption could outstrip supply by as early as 2030.

“The current pace of development of solutions to this crisis are not keeping up with demand,” says Tillotson. “There is this looming crisis that, ultimately, will have a huge economic, environmental and social impact on China. You reach a point at which the ability of the Chinese authorities to supply people with the water that they need starts to become limited. That means then that people are starting to go without the water that they need. While there are glimmers of hope that change is starting to happen, the speed at which that change is happening is important.”

As water shortages intensify, there will be growing consequences for businesses in various regions and sectors, particularly manufacturing, says MacKinnon. “Regulations will only be enforced more strictly across the board, and technology will play a greater role in terms of monitoring each step of the manufacturing process to ensure less wastage and any excessive use will be fined heavily,” he adds.

On the other hand, Tillotson sees opportunities for business in the parched outlook. “Anything that is able to make more efficient use of water will be something that will be in high demand in China,” he says. “Anything that is able to improve the water efficiency of existing production processes, whether that be irrigation in agriculture or car production or clothing production.”

The ruling factor

Water shortages are a growing problem in many parts of the world, not just China, and it is simply a matter of who hits the brick wall first.

“Chinese policies have been ambitious and I would say they are doing a fairly good job, but there’s still a lot to do, and water needs to be seen in a bigger context than before, particularly in terms of ecosystem management and climate change,” says Varis. “The biggest unknown here is climate change. The north is very dry and the east is very crowded. If that area dries up even a little due to climate change—and there’s considerable risk that it would happen at least in some years—that would be a big unknown and big stress factor.”

MacKinnon predicts higher water prices and more careful usage of water. “Already, there are improvements,” says MacKinnon. “If you visit Baosteel (a major steel plant near Shanghai), for example, the amount of water that they are now recycling is tremendous compared to five or 10 years ago. I predict in 10 years’ time, China will be aggressively addressing water problems and that will feed through into changed behaviors, increased prices, and a lot more conservation of water by industry.”

But there are pessimistic scenarios, too. “Water is the one factor above all—beyond demographics, debt and education—that makes me wonder about the future of China,” says Parton. “If the leadership can be open and can solve it, then they’ve got a very good chance of becoming the superpower of this century. If they can’t, then I don’t see them reaching that point.”