The internet economy is changing the contours of business, and organizations are fast-changing from rigid hierarchy-driven structures to networks.

Two decades ago, the rapid growth of the internet was hailed as an invention that changed everything. Although that proposition seemed oversold when the bubble burst in 1999, today it is easy to see that over the long haul, the optimists were right.

One aspect that is still not quite clear, however, is just how digitalization has transformed business. Part of the reason may be because the revolution is still underway. Even as some industries, such as newspapers, have had to cope with wrenching changes, others carry on much as they did on October 12, 1994, the day before Netscape released the first commercial internet browser.

In this series, we look at how digitalization has affected the way companies compete and grow, at how those changes have affected the structure of the company, employment and management. Finally, we ask what happens next—will big companies continue to grow more powerful than they already are today or will it be a golden age for small business? Or will network economics lead to another kind of organization altogether? Does the future belong more to Wikipedia than to Google?

The Networked Company

Canadian economic historian Harold Innis once divided communications technologies between those that made it easier to move across time, such as the ability to record information on clay tablets, and those that make it easier to move across space, such as papyrus.

Each technological advance in communications, Innis said, had an impact on the political structures of the time. At the time he was writing in the early 1950s, for example, he saw the US as a dangerous country because he felt the development of mass media and instantaneous communications encouraged rapid reactions but discouraged reflection.

The form and character of companies have also evolved as the means of communications and the ability to record data changed. Double-entry bookkeeping, printing presses and punch cards all extended the corporate ability to learn from experience, even as postal systems, the telegraph and the telephone extended managers’ span of control.

Initially, many boosters saw in digitalization the possibility of what Bill Gates at Microsoft called “friction-free commerce”— highly efficient sales in which the customer received exactly what she wanted at precisely the amount she wanted to pay. Companies vying for her business would evaluate her needs and then compete to develop a customized offering that delighted her. It might also lead to the formation of many more companies too, as the costs of serving specialized niches declined. Big companies—the GMs and US Steels that dominated the post-war era—would go the way of the blacksmith’s shop, in favor of what Google chief economist Hal Varian dubbed the micro-multinational.

The reality has proven much more complex. “One can’t help but note that start-ups are getting to big valuations with much smaller teams than a generation ago, driven by the ability to tap into things like cloud computing and freelance markets,” says Scott Anthony, the Singapore-based Managing Partner of Innosight, a consultancy focused on growth and innovation.

Even by Silicon Valley standards, some of the recent numbers are extraordinary: Airbnb, the eight-year-old roomsharing service, has around 600 employees and is valued at $10 billion; Uber, the six-year-old, 550-employee taxi app company, is now valued at $40 billion.

Overall, companies hire workers much more slowly than they ever did. A 2012 survey by the US Bureau of Labor Statistics noted that although the average size of US companies rose in each expansionary year of the 1990s, it fell every year in the 2000s, regardless of whether the economy was growing or shrinking—and regardless of the economic sector.

This is especially true at start-ups: in the 1990s, the average start-up had 7.6 employees. By 2001, the average size had fallen to 6.8, and in 2011, it had declined to 4.7.

But the shrinkage is not in all sectors of the economy. “At the same time, there paradoxically are more people working for big companies than ever before,” Anthony adds.

Although some of the old-line giants have collapsed, unable to keep up with the pace of change, employment at the largest companies actually grew over the past decade: US companies with more than 1,000 employees saw their payrolls grow by 30% between 2003 and 2013, according to Bureau of Labor Statistics figures.

One reason may be that the margins of the largest companies are rising. Even as the average small company’s profitability has stayed flat, profits at the top of the heap have skyrocketed. In 2013, the US Bureau of Economic Analysis figures found that corporate profits amounted to about 12% of GDP, even as proprietors’ share remained stuck at about 8%.

Why the discrepancy, given that big and small companies alike are presumably profiting from technologies that were supposed to undermine the advantages of scale?

Part of the explanation may lie into the internet’s tendency to foster winner-take-all markets.

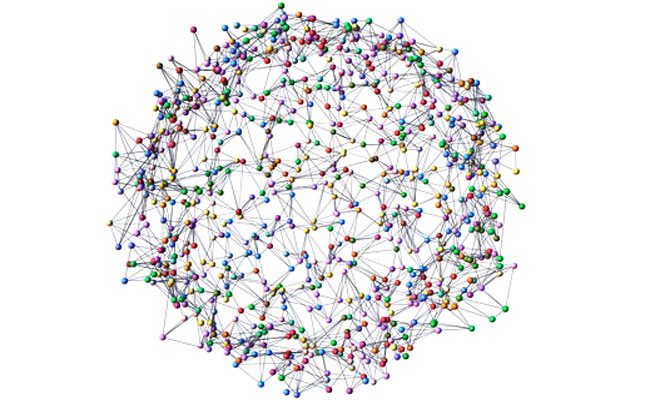

Nicholas Economides, a professor of economics at New York University’s Stern School of Business, and a leading expert in network economics, has found that for certain kinds of products and services, the popularity of the offering tends to reinforce the company’s long-term advantage. Certain kinds of software, for instance, become much more valuable once they become the standard product “everybody” uses.

His models suggest that even small network effects can help a good company realize high profits, more sales and greater profits, and the stronger the effect, the more likely that the company will be able to achieve a monopoly position. “If we have a network, we will see a lot of inequality among companies, which means that some people are going to make a lot of money,” he says.

For Andrew Odlyzko, a professor of mathematics at the University of Minnesota and a long-time observer of internet growth patterns, Apple’s Appstore may be the quintessential metaphor for how networks create value for companies.

Apple takes 30% of the revenue on all the applications uploaded by 300,000 third-party developers but the company didn’t have to invest in any of them. More importantly, the attractiveness of the Appstore to consumers has helped make Apple the dominant smartphone in terms of profitability.

It’s true that from the introduction of the iPhone in 2009 to the end of 2013, app developers earned a total of $15 billion—a fair amount of money, but for a company as profitable as Apple, roughly what they earn in profit every quarter.

For Apple, the Appstore has been a great deal. All those external developers’ contributions have helped give Apple 30%-plus margins on the iPhone, 56% of all handset profits, and a $623 billion market cap, according to company figures and analyst estimates.

Other successful companies such as Uber, Airbnb, eBay, and Alibaba all share an analogous business model—a highly visible, centralized platform that provides a global, consolidated market of offerings that were once sold locally and for the most part, as part of a telephonic or face-to-face exchange.

These networked companies have also been able to reduce their risk in another way: by learning much more about their customer than they ever knew before. The declining price of computing power and memory means that companies can gather and analyze vast quantities of information about our needs and our habits. Plus, not only can they react extremely quickly, sometimes even in nanoseconds, but they are also able to constantly monitor past experience in light of current data.

Early internet gurus imagined that consumers would also have much greater access to pricing information, but it hasn’t really worked out that way. The Information Superhighway, as politicians used to call the internet, is not necessarily running at the same speed in both directions.

Companies work hard to try to make it difficult for consumers to compare prices, Odlyzko says—or even to realize that the price you paid for a product is a lot more than your neighbor paid.

Even business customers now sometimes find themselves at a disadvantage. In his book Flash Boys, for instance, Michael Lewis characterizes the algorithmic trading industry as a group that takes advantage of tiny lags in time between different electronic stock markets to buy a stock the moment before they know an order to buy a stock will arrive.

In the end, Odlyzko fears that the success of such “confusology” could undermine capitalism generally, by making it possible to set prices so carefully that every customer pays the maximum he is willing to pay and every supplier is charged the minimum, destroying all market incentives. He argues that like the 19th century railroad owners, who found themselves the economic gatekeeper for world’s economy, today’s digital barons could undermine the functioning of the market they were intended to liberate.