Are China’s corporate debts too heavy to bear?

Chinese corporate debt is rising fast. In most countries this would herald a wave of bankruptcies and be thought a lead indicator for an imminent correction. China, however, inspires a wide vocabulary of qualifications on the part of analysts, as the government has a high level of control and and a notably low tolerance for slow growth.

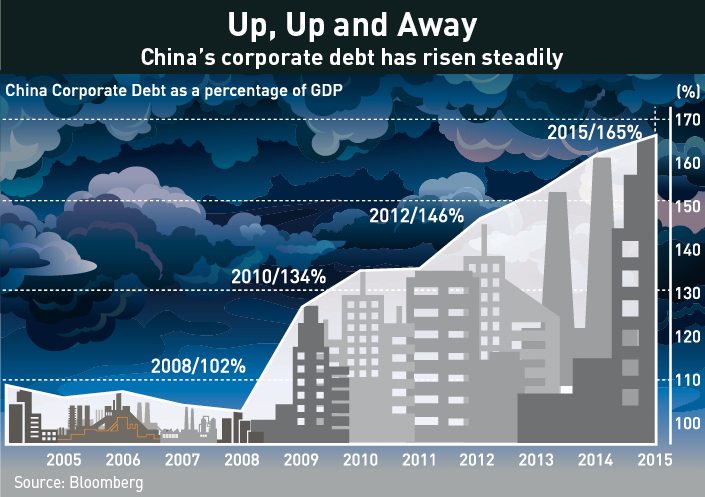

China’s debt position is in fact not out of line in total with many other developed economies, but the proportions are markedly different. China’s ‘government debt’ is relatively low, but ‘corporate debt’ is variously estimated between 145% and 170% of GDP, which is “very high by any measure,” according to the IMF.

But the problem when trying to understand the details in China is often in the definitions. Differentiating between public and private in China can be challenging, and the point at which corporate debt, even for private companies, precipitates insolvency is also highly dependent upon non-commercial factors, such as who, exactly, stands to lose out. In the state sector, a company may have lost money for years and nurse liabilities it will simply never be able to pay off, but it will still give the appearance of being a going concern.

These are the so-called ‘zombie’ companies, clearly being kept alive by the state for reasons other than economic viability—typically to maintain employment for their workers. Beyond them, however, the picture is more complex. Some sectors of ‘China Inc.’ are booming, while older industries are piling up new liabilities to meet old ones.

So is China’s corporate debt rising to support real economic growth, or merely to stave off an inevitable—and long-anticipated—moment of reckoning for inefficient, state-backed producers?

Matters of Principal

In June 2016 the IMF estimated the total amount of corporate debt in China at 145% of GDP, but Guonen Ma, Visiting Research Fellow at the Brussels-based think tank, Bruegel, and Professor James Laurenceson of the Australia-China Relations Institute (UTS), University of Technology, Sydney, used Bank for International Settlements (BIS) data and put the figure higher, at 170% of GDP for the end of 2015. This compares to a global average estimate of less than 93%, with the US and the UK in the low 70s, and even debt-mired Japan at only 100%. In other countries, government debt is typically higher, but internationally, corporate debts are usually considered private liabilities and are therefore limited by the prospect of insolvency if they get too high.

According to the IMF, State-owned Enterprises (SOEs) are responsible for 55% of all China’s corporate debt, a proportion which if applied to the BIS figures means they account for debt equivalent to 94% of GDP, while contributing only 22% of output. That also suggests that the private sector in China is not out of line with international norms, with corporate debt at about 76% of GDP.

Drilling down further reveals that among the SOEs, there is a higher debt profile in the old smokestack industries of coal, iron, steel and chemicals than the more service-oriented sectors like airlines, tourism and healthcare.

When it comes to the source of all this debt, the banking sector in China is largely state-owned, indicating that the normal distinction between government debt and corporate debt doesn’t fully apply in China, serving instead to disguise debt levels.

Patrick Chovanec, Chief Strategist at Silvercrest Asset Management, suggests the difficulty in distinguishing between public and private debt should be thought of as “intentionally ambiguous, because then everything gets the backstop of a supposedly solvent state.”

With the state seen as the ultimate underwriter of more than half of the outstanding corporate debt, this explains the general belief that a financial crisis is not imminent and could not occur unless the state itself approaches insolvency.

State-owned Stimulus Tools

Before the global financial crisis (GFC) in 2008/9, China’s corporate debt position was much lower, totaling less than 100% of GDP. But the downturn following the GFC pulled down corporate earnings and reduced the ability of firms to handle problems through internal financing. According to Ma and Laurenceson, “the government responded to the crisis by implementing a stimulus in the form of corporate but government-sponsored capital expenditure … With the share of internal financing of capital expenditure declining markedly, a jump in external financing, mostly debt, was the logical consequence.”

Following this stimulus, there has been no sustained recovery in corporate earnings, and corporate debt has risen between 50% and 70%, with the biggest annual rises coinciding with the stimulus injections of credit in 2009 and 2015.

Leslie Young, Professor of Economics at the Cheung Kong Graduate School of Business in Beijing, further explains that “the government in 2015/16 decided it needed to stimulate the economy… and it ordered the state banks to lend to state enterprises.” This, combined with the continuing dearth of corporate earnings, indicates the challenging economic environment that followed the GFC had not yet abated, he says.

Mapping out the liabilities gives some additional perspective. For example the Dongbei Special Steel Group (DSSG) attracted much media attention after it defaulted on seven sets of bonds, worth $722 million, following the reported suicide of its Chairman in March. The total debt it carries is $6.7 billion, or 84% of its assets. DSSG, according to research published by Mizuho Securities Asia in August, is a group originally consolidated in 2004 from three pre-existing regional steel producers, two of which were regarded as unprofitable ‘zombies.’ Since 2008 it has borrowed heavily—along with many other steel companies—to support expansion.

Now, of course, China’s problems with overcapacity are well known, particularly in the steel sector, leaving much of this debt essentially unserviceable and weighing heavily on the finances of Liaoning Province, where it is located.

This example is reflective of problems China-wide, and the origins of this huge build-up in corporate debt can be properly understood as the consequences of poorly planned and inefficient expansion of the SOEs—a point reinforced by Chovanec, who says “a lot of fiscal spending [was] channeled through state enterprises.”

In other words, SOEs in China are not simply state-owned assets, but also conduits for expansionary economic policy. When the state needs growth, they can simply order it up, with the short-term costs falling on the deteriorating loan books of the state-run banks. The long-term costs, however, in non-performing loans (NPLs) and prolonged poor earnings then crowd out the ability of banks to loan commercially to the ‘real’ private sector.

Unintended Consequences

While the decision of the Chinese government to support growth with massive stimulus measures in the aftermath of the GFC is understandable, the quality of the actual investments is crucial. And it increasingly appears that much of China’s stimulus has simply made the need for structural reform more urgent.

“State corporate debt has been rising more quickly than among private firms,” says Andrew Collier of Orient Capital Research in Hong Kong. “The amount of money they invest in Fixed Asset Investment (FAI) skyrocketed in 2016, rising 23.7% in April.” For context, he adds that “private FAI gradually declined in 2015 and fell to a year low of 5.2% in April 2016.” Explaining this disparity, he points to two reasons: Beijing pushing state firms to invest to boost the economy, and private firms declining to make investments.

Chovanec goes further in outlining the distorted incentives produced by state-directed investment, suggesting that “there are lots of areas in the Chinese economy where there’s room for huge productivity gains. In agriculture, in logistics, in healthcare in services… and yet,” he adds, “why would you invest in those hard areas… when you can flip property and know that the government’s got your back because they can’t afford for the property sector to unravel?”

This highlights what he suggests is “the problem of bubbles. It’s not that prices go up and down and people lose their shirts, it’s that it sucks the oxygen out of the room. Signals aren’t being sent to invest in the things that need to be invested in.”

All of which points to the need to stop clogging up the banks with poor-quality loans to old smokestack industries, and allow them to lend commercially to the more dynamic and productive sectors of the economy. First, however, the banks’ loan books would need to be cleared of bad debt, and in order to do this, someone would need to take a loss. That Collier says, is something “everyone will be fighting to avoid responsibility for.”

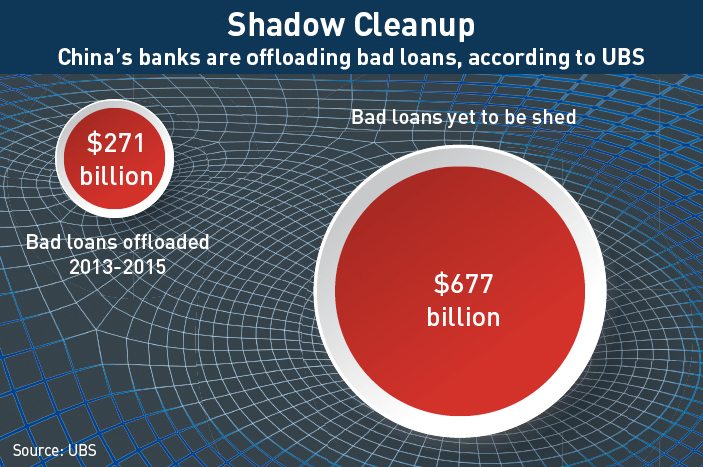

According to UBS, however, the so-called ‘cleanup’ has already begun. Their analysis of 765 banks in China showed that as much as $271 billion of impaired loans were shed between 2013 and 2015, with another $93 billion in capital raised during the same period. To attain a sustainable debt ratio, however, an additional $677 billion in bad debt needs to be offloaded, and another $300 billion in capital raised. Plans to do just that, with Beijing’s support, are underway.

But Chovanec sees a deeper correction as necessary. “If you’ve got a country which is making a lot of bad investments, then that’s going to be a problem no matter what their debt level is.” He considers the corporate debt problem part of a wider spectrum of problems rooted in uncertainty over the effects of certain policy actions, suggesting that the Chinese government “cannot pull on a thread, because [they] just don’t know what will unravel.” He further believes this uncertainty has “frozen economic reform.”

And the results of the stimulus program from 2008/9 are now plain to see in the aggregate overcapacity that China (and the world) is now facing. As Young says: “Now that they can make [all this] stuff, who wants it?”

Catch 22?

This is a problem Beijing’s leaders have been wrestling with for years, but implementation of inevitably painful solutions to overcapacity problems have mostly been postponed.

“The much-vaunted 3rd Plenum Reforms (from 2014) have not really gone anywhere,” says Chovanec. “[There has been] nibbling around the edges, but it hasn’t been entrenched because of the fear of destabilization.”

Professor Young, however, is more sanguine, believing that “it’ll be a politically, driven cleanup. The fundamental impulse of the Chinese state is to not make a million people angry.” Whatever happens, he says, “they’ll never allow a major bank to default, they’ll find some other way to deal with it.”

Chovanec thinks that eventually, “a lot of [debt] will be socialized.” The problem with this, however, is that it avoids the immediate consequences and may perpetuate bad habits.

“When companies default, at least they stop doing what they shouldn’t be doing anymore,” says Chovanec. “When you never have that and you socialize all the losses, it looks nice and neat and nobody ever goes bankrupt but at the end of the day the losses are still there.” At some point, he says, it will imperil the entire system.

Professor Young thinks that such en eventuality is a long way off, and that China still has plenty of room to maneuver. His reasoning depends on the unusual character of China’s development, featuring a large amount of “state-owned assets—principally land—to back [the accumulated debt]. And, because the money has been used in pretty sensible ways,” in Young’s view there is “at least… a pretty decent chance you’ll get the money back.”

Ma and Laurenceson conclude their research with a range of recommendations, believing that, while the immediate risk of a financial crisis is low, there is nevertheless an urgent need for “accelerating SOE reforms and bad loan disposals, dealing with both debtors and creditors while enhancing efficiency.”

Avoiding a Conclusion

There is a remarkable consensus that while China Inc. is falling deeper into the red and a correction of some sort is necessary, a financial crisis is not imminent. But the drag on growth caused by poorly-invested credit, itself pumped out to keep the aggregate growth figure looking perky, will likely worsen over time.

The deeper problems are revealed when fast-rising corporate debt is assessed against the wider context of falling growth and lower returns from investment. Beyond this, the enormity of China’s industrial overcapacity suggests that conditions for credit-fuelled growth are not likely to improve anytime soon.

“They want to have a correction without having a correction,” says Chovanec, adding, “the longer that goes on, the worse it gets.”